Copy Trading, What Is It?

A strategy that allows individuals to automatically copy positions from other traders. This approach enables less experienced traders to benefit from the knowledge and trading strategies of more seasoned traders. On the other hand, experienced traders can benefit from extra commissions paid by other traders who copy their positions.

How Popular Is Copy Trading?

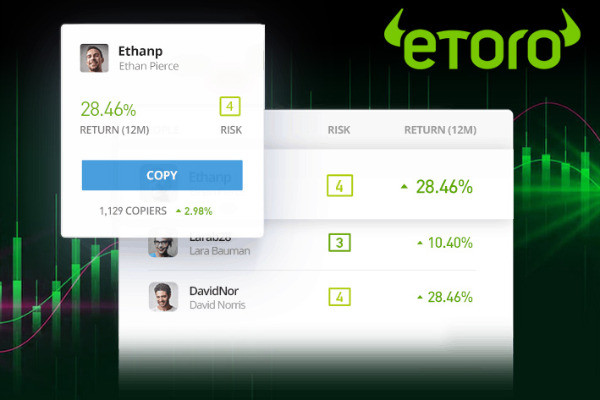

Since its initial introduction in the early 2010s, copy trading has become a hit among forex traders. eToro alone has more than 2000 investors to copy from, where 12 of them have managed to gather more than $10 million copy value. A report by The Insight Partners estimated that the compounded annual rate of copy trading is expected to grow 7.8 percent, reaching a market size of $3.77 billion by 2028. More insights about copy trading prospects can be found here.

Pros

- It makes the financial markets more accessible to beginners.

- It saves time as it requires less market research and ongoing trade management.

- It helps you build portfolio diversification by copying multiple traders who employ different strategies or trade different assets.

- It offers a learning experience by observing the trading decisions of experienced traders.

Cons

- The success of your investment depends on the performance of the traders you copy.

- Some platforms may charge additional fees for using their copy trading services.

- While you control whom you copy and the amount invested, you do not have direct control over individual trade decisions.

- Strategies that were successful in the past may not necessarily continue to be so in the future.

Most Notable Copy Trading Platforms to Try

Other Category

Brokers Category

Score Category