Pivot Point Calculator - Key Levels for Technical Analysis

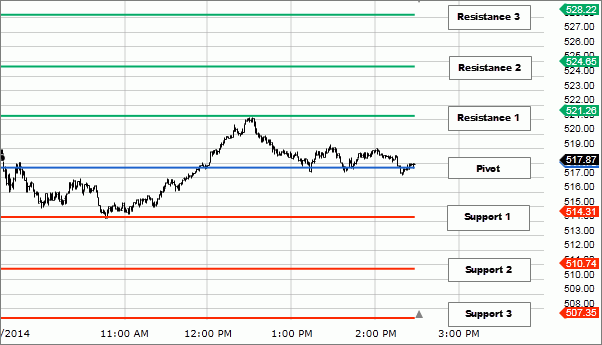

The Pivot Point Calculator will show you support and resistance levels based on the pivot point formula.

Guide to use the Pivot Point Calculator

- Decide on the type of Pivot Point that you want t o calculate. You can choose between Classic, Woodie's, Camarilla, and De Mark. When in doubt, just go for Classic.

- Enter the highest price level, lowest price, and closing price in the columns provided. This price level corresponds to the time frame you choose. If you use a daily chart, then enter the highest price, lowest price, and closing price of the previous day.

- For De Mark Pivot Point, you need to add an opening price.

- Click "Calculate".

How to measure pivot points accuracy?

In order to measure the accuracy of pivot points in the span of x number of days, here's what we can do:

Subtract the actual Low on that day with the support level based on pivot points. You'll get these formulas: Low – S1, Low – S2, and Low – S3.

Subtract the actual High on that day with the resistance level based on the pivot points. You'll get these formulas: High – R1, High – R2, and High – R3.

Find the average value of each result.

Continue Reading at Your Definitive Guide to Pivot Points in Forex Trading

How to calculate woodie pivot point?

The common practice is using prices from the previous trading days to find a pivot. However, Woodie incorporates the opening price too. For example, you want to calculate the pivot for 23 January 2014. If you count it using the usual way, you calculate prices from 22 January only. But in Woodie, you discard the closing price of 22 January and enter an opening price of 23 January instead. The calculation formula is as follows:

Pivot = (High+Low+Opening+Opening)/4

By doubling the opening price, Woodie accentuates the role of the opening price in predicting market movements. What you do next is find support and resistance levels, mark those levels, and then you are set to go.

Continue Reading at Predicting Trends Using Pivot Points In Forex Trading

How to calculate pivot point levels?

Pivot point levels are generated by a specific formula that calculates the past price levels to determine potential turning points in the chart. Pivot points use the previous day's Open, High, and Low to calculate the points for the current day. Traders often see these pivots as markers for support and resistance levels. In forex trading, pivot points are often used by day traders who prefer shorter time frames.

Pivot points can be accurate and objective, but compared to psychological levels or price swings, the accuracy of pivot points as support and resistance levels is relatively low. When the market experiences high volatility and the price moves very fast, pivot points are usually incapable of indicating the right key levels.

Continue Reading at Support and Resistance Levels: The Complete Guide

The pivot is the main key here. The common practice is using prices from the previous trading day. However, you could opt for smaller time frames, as in H1, or any other time frame that suits your trading plan.

After finding the pivot level, some traders are immediately using it to predict the trend and combine it with some other indicators to complete their strategy. If the price opens under that level, then it means the trend is bearish. If the price opens over that level, then the upcoming trend will be bullish.

Continue Reading at Predicting Trends Using Pivot Points In Forex Trading

Pivot Point Articles

-

Best Trading Strategy with Double EMA (DEMA)

-

All About Forex Trading in the UK

-

5 Ways You Can Step Up to Advanced Trading with Tickmill

-

Predicting Trends Using Moving Averages In Forex Trading

-

The Main Enemies of a Forex Trader

-

How to Combine Forex Indicators Like A Pro

-

Your Simple Guide to MACD in Forex Trading

-

MT5 Brokers with Low Spread to Try

-

Guide to Trade in Sideways Markets

-

Beginner's Guide to HF Markets' Trading Tools

- More