Ultimate Guidebooks for Asian Traders

Highest Population: India 1,438 million (Mar/2024)

Highest Population: India 1,438 million (Mar/2024) Lowest Population: Maldives 345 thousand (Mar/2024)

Lowest Population: Maldives 345 thousand (Mar/2024) Highest GDP: China $19.3 million (2023)

Highest GDP: China $19.3 million (2023) Lowest GDP: East Timor $1,988 (2023)

Lowest GDP: East Timor $1,988 (2023) Highest Inflation Rate: Syria 140% (Dec/2023)

Highest Inflation Rate: Syria 140% (Dec/2023) Lowest Inflation Rate: Afghanistan -9.7% (Feb/2024)

Lowest Inflation Rate: Afghanistan -9.7% (Feb/2024) Japan (BoJ): 0.00% (Mar/2024)

Japan (BoJ): 0.00% (Mar/2024) China (PBoC): 3.45% (Mar/2024)

China (PBoC): 3.45% (Mar/2024) India (RBI): 6.50% (Feb/2024)

India (RBI): 6.50% (Feb/2024) Indonesia (BI): 6.00% (Mar/2024)

Indonesia (BI): 6.00% (Mar/2024)

Forex Trading in Asia

Asia is the largest continent among others with an area of approximately 44.8 million square kilometers. Of the 4.7 billion population in Asia, as many as 3.2 million are engaged in forex trading.

One of the major central banks on this continent is the Bank of Japan, often abbreviated as BoJ. BoJ is renowned for its unconventional negative interest rate policy, where it sets interest rates below zero to spur economic growth and inflation. The Japanese yen, particularly paired with the USD (USD/JPY), stands as one of the major currency pairs frequently traded.

What You Need to Know About the Regulatory in Asia

In terms of regulation, forex trading in Asia is subject to stringent oversight by official regulatory bodies. Some renowned regulatory authorities in the region include the Monetary Authority of Singapore (MAS) and the Japan Financial Services Agency (JFSA).

Additionally, smaller regulatory bodies such as the Securities and Exchange Commission (SEC) in Thailand, the China Securities Regulatory Commission (CSRC), and the Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI) in Indonesia also play crucial roles in ensuring market integrity and investor protection.

The requirements set by Asian regulators for forex brokers are more or less the same, some of which are as follows:

- They must provide segregated accounts to separate client funds from broker operations.

- They must offer trading education services so that beginners can understand that trading is risky and cannot be done haphazardly.

- They limit the use of high leverage to protect clients from large losses. For example, MAS sets the maximum leverage for forex trading at 1:20, while BAPPEBTI limits it to 1:100.

- Detailed verification processes to ensure no money laundering or other scam activities are occurring.

If traders want to obtain more flexible trading conditions, usually the best choice will fall on forex brokers regulated by FCA, ASIC, CySEC , or offshore brokers. Here are popular regulated brokers in Asia.

Participation in Trading competitions is High

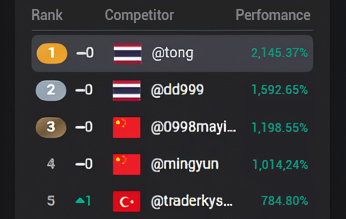

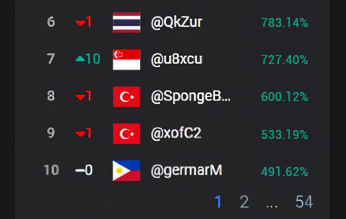

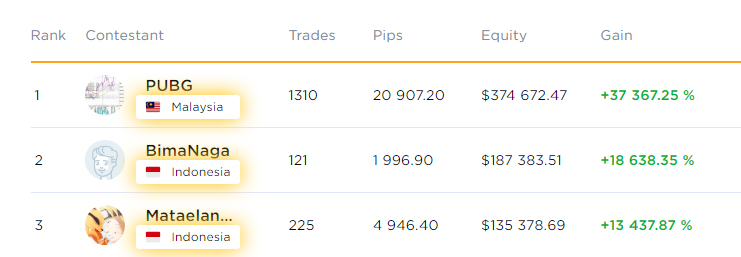

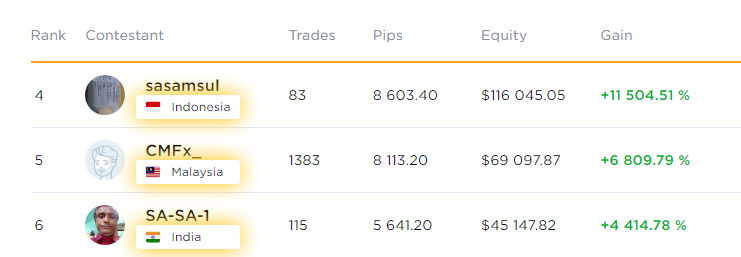

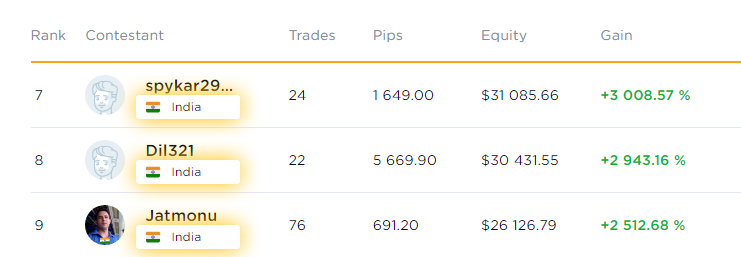

Despite being restricted in certain Asian countries, forex trading remains a widely embraced activity among the populace. This is evidenced by the substantial number of forex traders hailing from Indonesia, Malaysia, the Philippines, and India, who often dominate broker trading contests, such as the Octa Demo Contest and XM Social Trading Competition.

In terms of copy trading or social trading, traders from China typically boast large followings due to their superior win rates compared to their counterparts. Below is one of the rankings of XM social competitions dominated by traders from China and other Asian countries.