A Handbook for Indian Traders

Forex Trading in India

India is a country in South Asia with a population of more than 1.4 billion people, making it the most populous country in the world since April 2023, surpassing the population of China.

It's difficult to determine the exact number of forex traders in India due to the rapid population growth and technological advancements. Based on the latest available data, approximately 2% of the total population in India is actively trading forex. If calculated, this means there are around 26 million forex traders in India.

India has one of the world's largest economies, with rapid growth and huge market potential. According to the latest data, India's annual GDP has been growing steadily from 7.2% to 7.3%, and then to 7.6%. Quarterly GDP also grew impressively to 8.4%, proving its economic resilience amidst global changes.

The Reserve Bank of India (RBI) stimulates economic growth by implementing tight monetary policy. Policy changes by the RBI will affect the value of the Indian Rupee (INR) exchange rate.

USD/INR is one of the exotic currency pairs that is traded quite frequently. Indian traders typically trade forex with brokers regulated by SEBI (Securities and Exchange Board of India). SEBI is the regulatory authority responsible for overseeing the securities and commodity markets in India.

There are specific regulations governing forex trading in India. Trading is permitted only in currency pairs approved by the RBI and SEBI, and these can be traded exclusively on the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and MCX-SX.

As per the Foreign Exchange Management Act (FEMA) of 1999, trading in the offshore forex market through unapproved brokers is illegal. If detected trading from an Indian bank account with unauthorized brokers, your account may be seized, and your bank balance forfeited.

The currency pairs allowed for trading in India include USD/INR, EUR/INR, GBP/INR, and JPY/INR. Additionally, there are extensions of these main pairs, such as EUR/USD, GBP/USD, and USD/JPY.

In addition to trading forex with SEBI-regulated brokers, many traders in India also use the services of foreign brokers to access more flexible trading conditions or a wider range of currency pairs. The requirement remains the same; they must have clear authorization following FEMA 1999. Typically, brokers regulated by FCA, CySEC, ASIC, or FSA are favored by Indian traders. Here are some popular regulated brokers in India:

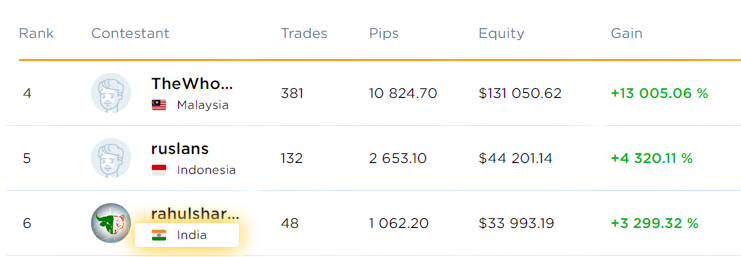

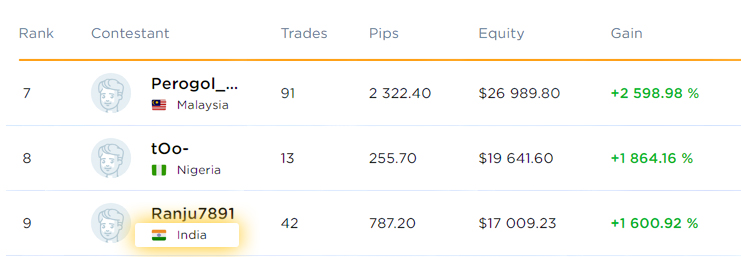

Top Rankers in Broker Contest

Moreover, Indian traders often dominate the top rankings of winners in the Octa Champion demo contest. This event is a highly popular trading contest on demo accounts. Indian traders are almost always among the top 5 traders who manage to win big. This indicates the high level of enthusiasm among the Indian community for forex trading.

Below is one example of the top 10 ranking of winners in the Octa demo contest where 4 Indian traders made the list.