About us

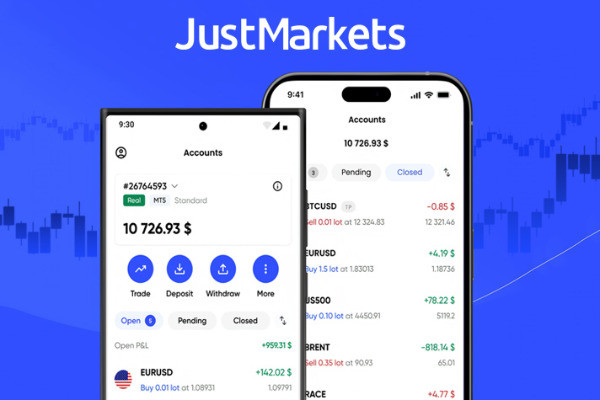

JustMarkets is a well-established broker since 2012. JustMarkets has headquarters in Seychelles, Cyprus, Mauritius and South Africa. JustMarkets provides their Forex/CFD trading services to over 4 million clients.

This broker has also been regulated by FSA (Seychelles) SD088, CySEC 401/21, FSC (Mauritius) GB22200881 and FSCA 51114.

Bonus:

Scroll for more details

JustMarkets News

JustMarkets Articles

JustMarkets Testimonials

What are bond classes in the US?

Here are several notable classes of bonds in the US:

- US Treasury: Bonds issued by the US Department of Treasury.

- Corporate Bonds: Bonds issued by investment-grade corporations.

- Junk Bonds: Bonds below investment-grade, also known as high-yield bonds.

- Mortgage-Backed Securities (MBS): Bonds backed by principal and interest payments from a pool of single-family residential mortgages.

- Asset-Backed Securities (ABS): Bonds backed by underlying pool of assets like auto loans, credit card receivables, aircraft leases, among others. There are unlimited list of assets that can be pooled into ABS.

- Municipal Bonds: Bonds issued by a state, city, or local goverment agencies.

Continue Reading at How to Analyze Market with Bond Spreads

How does the US benefit from shale fracking?

Fracking enables exploration on deeper earth and pumps out oil and gas in a way that other methods can not. As a result, shale fracking is responsible for boosting US energy output, leading to the decrease in US gas imports.

Due to the success, the US defeated Russia by becoming the world's number one gas producer and is expected to be a net gas exporter by 2020. At the same time, shale oil has pushed down US oil imports and placed it as the world's third-largest oil producer after Saudi Arabia. The International Energy Agency even predicts that US oil shale will continue to grow.

Continue Reading at How World Oil Prices Affect Forex, Before And After US Shale Fracking

How did shale fracking contribute to US oil imports?

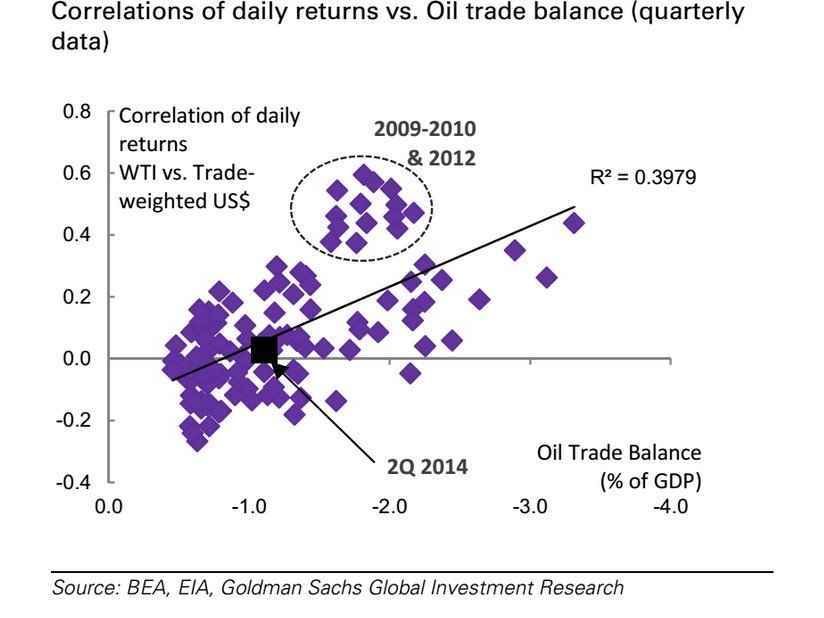

The US imported approximately 12 million barrels a day of oil in 2008; but the figure has skydived, and today US oil imports is less than 5 million barrels a day due to the US shale technology. Around 2.6 millions of it is imported from Canada and Mexico. That means, US oil imports has fallen more than 60% since 2008, and this significantly decreased the commodities correlation with the US Dollar.

Along with the post-crisis financial market normalization, (the drop in oil imports) has dramatically reduced the correlation between oil and the USD, to around 0% (i.e. uncorrelated) today from historical highs near 60% in 2008/2009.

Continue Reading at How World Oil Prices Affect Forex, Before And After US Shale Fracking

What are the most important US news for GBP/USD traders?

As in any other currencies traded directly with US Dollar, economic reports from the US will influence GBP/USD as well. This is especially notable for Federal Reserve (the Fed) decisions. The UK's central bank, the Bank of England (BoE) has a relatively lower influence than the Fed.

In this sense, here are some high-impact US news you should note if you want to trade GBP/USD successfully:

- FOMC Meeting and the subsequent Fed's interest rate statement.

- FOMC Meeting Minutes release (two weeks after the meeting).

- The Fed/FOMC Chairperson speeches.

- US GDP

- US Nonfarm Payrolls report which also includes wages and unemployment rate.

- US Retail Sales

Continue Reading at Tips on How to Trade GBP/USD