In this article, we have summarized everything you need to know about eToro's Smart Portfolios, including how to access it, how to choose the right portfolio, and the pros and cons.

Building a well-diversified long-term investment portfolio is not an easy job. It requires a lot of research and considerations of whether the assets could balance each other and yield a higher return in the future. To make things easier for you, eToro offers a very useful feature called Smart Portfolios.

Throughout the years, eToro broker has introduced many exciting features to help traders maximize their gains. eToro's Smart Portfolios is a brand-new investment product that allows traders to diversify their portfolios in the simplest way. Let's find out more about this exciting feature in this article.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

Intro to eToro's Smart Portfolios, a New Type of Thematic Investing

Formerly known as CopyPortfolio, eToro's Smart Portfolios are long-term investment portfolios curated by eToro analysts, experts, and partners. Each portfolio has a unique strategy and comprises various assets under a specific theme.

This form of investment is often referred to as thematic investing. It is generally similar to sector investing, but wider in range. Basically, thematic investing aims to identify macro-level trends that are expected to evolve over time.

While the assets have a theme in common, they actually span across diversified sub-sectors, regions, and even asset classes. For instance, the Europe Economy eToro's Smart Portfolio may consist of leading stocks of companies in various sectors within the European continent like banks, automobile, pharmaceuticals, luxury goods, and more.

Unlike other investment programs that focus on "past winners", thematic investing looks forward to a future world that may be different from the past. For this reason, the assets must be thoroughly researched and considered based on various aspects such as the balance, exposure, expected returns, and risk level.

Thematic Investing in eToro

To ensure its success, eToro's analyst team is constantly keeping an eye on the most popular trends that are predicted to make a big impact in the upcoming future.

At the time of writing, there are over 70 portfolios available. With eToro's Smart Portfolios, you can easily diversify your holdings without paying enormous management fees.

Types of eToro's Portfolios

In eToro, there are three types of portfolios that you can choose, namely:

🔝 Top TradersThese portfolios are curated by the best-performing traders based on their pre-defined strategies. Currently, there are three Top Trader Portfolios on the platform, such as ActiveTraders, SharpTraders, and GainersQtr.

🌈 ThematicAs the name suggests, Thematic Portfolios are focused on specific themes, sectors, regions, or trends. The theme itself ranges from traditional industries to advanced technology. One of the examples is InTheGame, which consists of various top gaming companies and businesses around the world, providing diversified exposure to the gaming industry.

👨👩👦👦 PartnersThese portfolios are developed in collaboration with some of the most innovative partners, money managers, and experts in various areas, including AI, crypto, sentiment analysis, and more. |

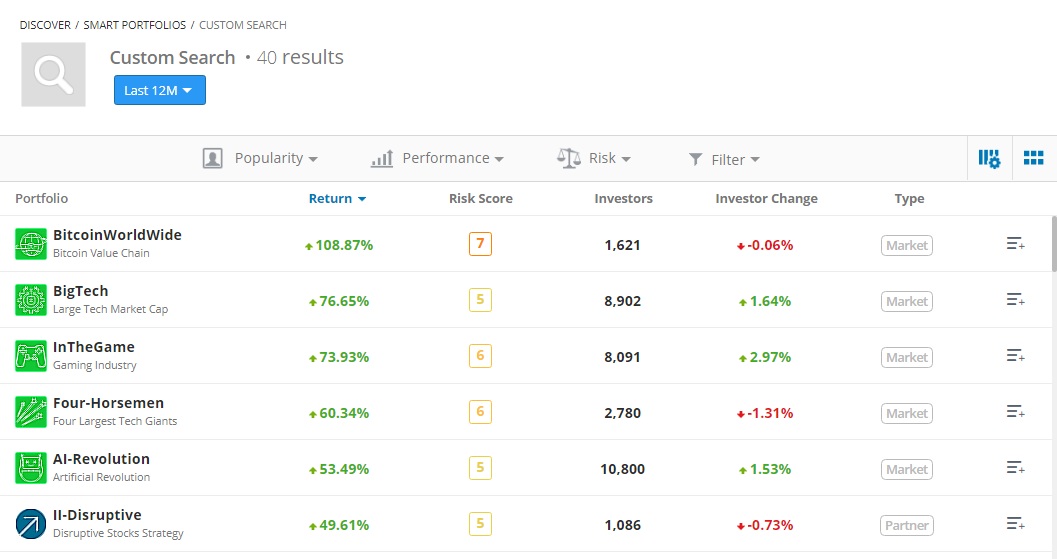

Aside from the portfolio type, eToro broker also allows you to filter the options based on other parameters like popularity, performance, risk score, and time. This obviously will help you narrow down the options to find the one that best aligns with your investment goals.

How to Invest in eToro's Smart Portfolios

Investing in eToro's Smart Portfolios is actually very easy and can be done in a few clicks. Simply follow the tutorial below:

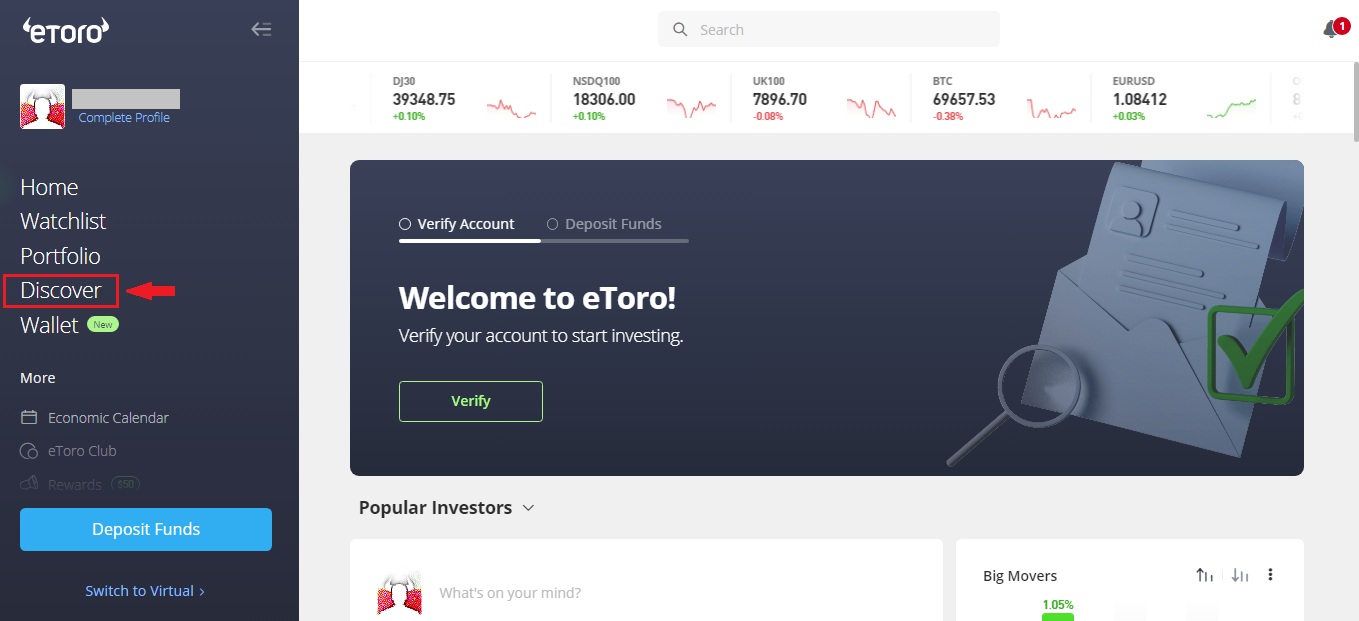

- Open eToro's official website and login to your account.

- Click "Discover" from the left-side menu on your dashboard.

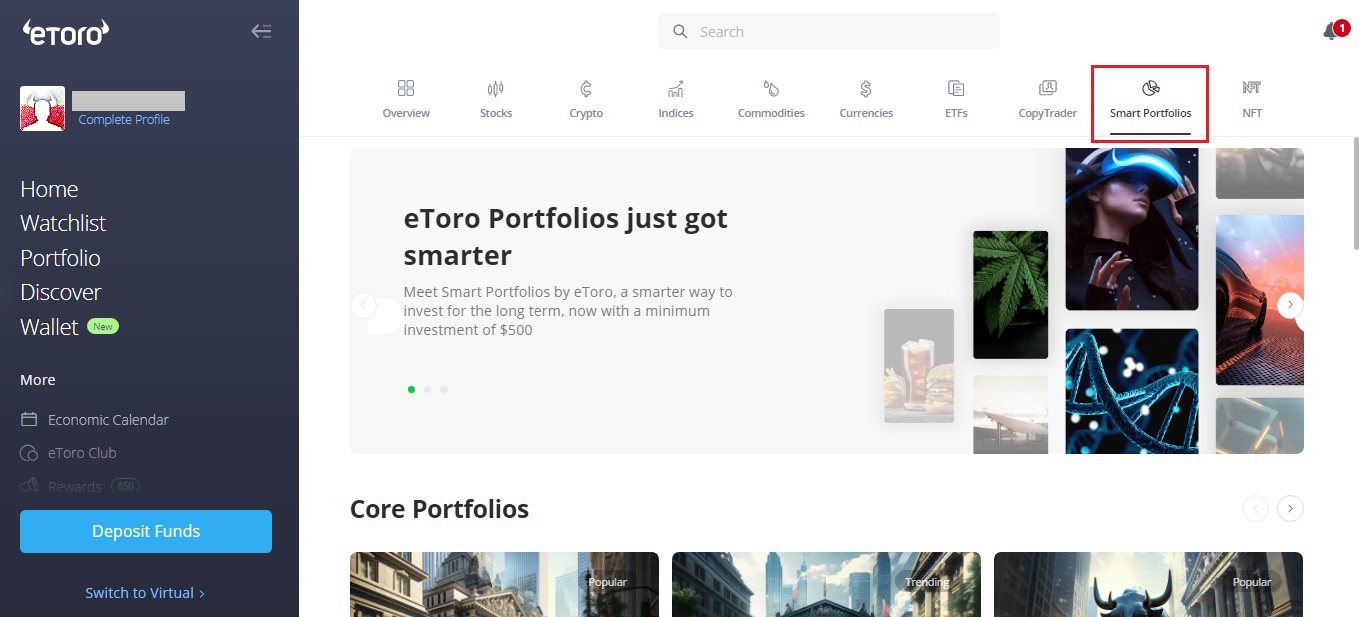

- Select "Smart Portfolios" to enter the eToro Smart Portfolio page and view all the available investments in various categories.

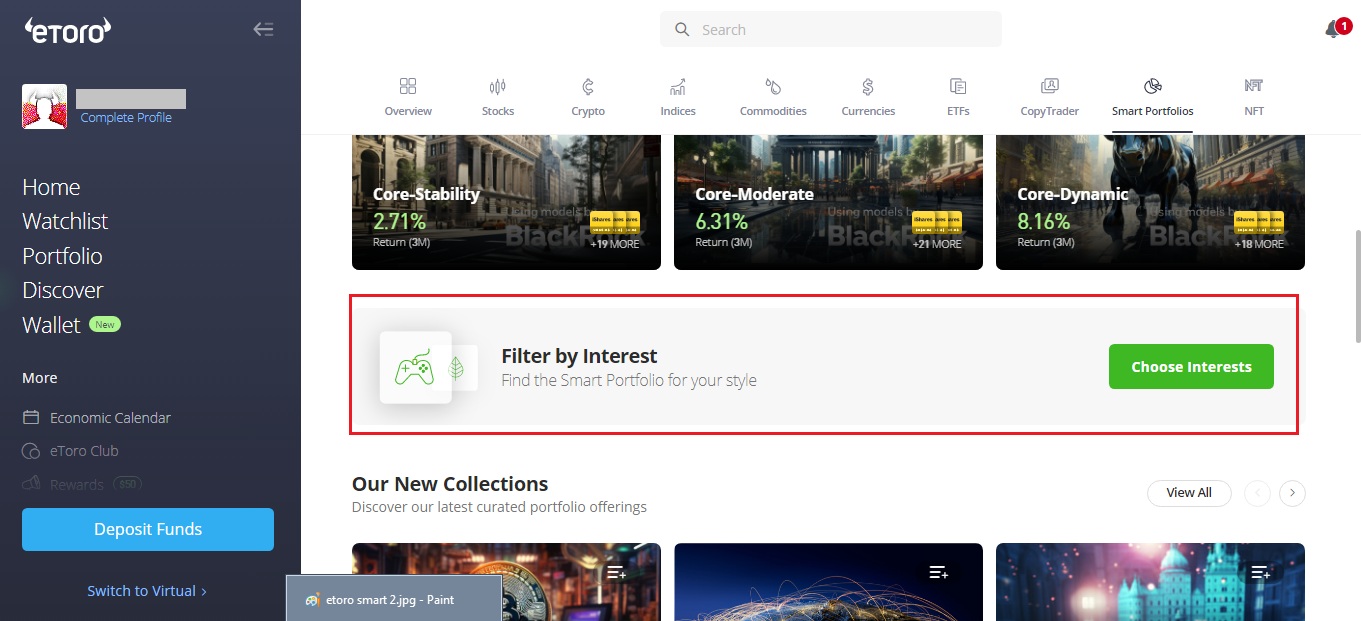

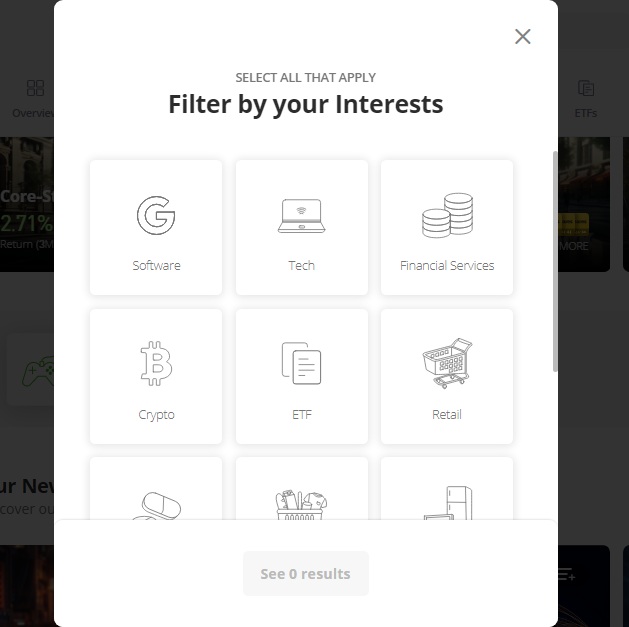

- Further down the official website page you'll find the filter feature. You can use this to narrow down the options based on your interests.

- Choose the portfolio that you'd like to invest in.

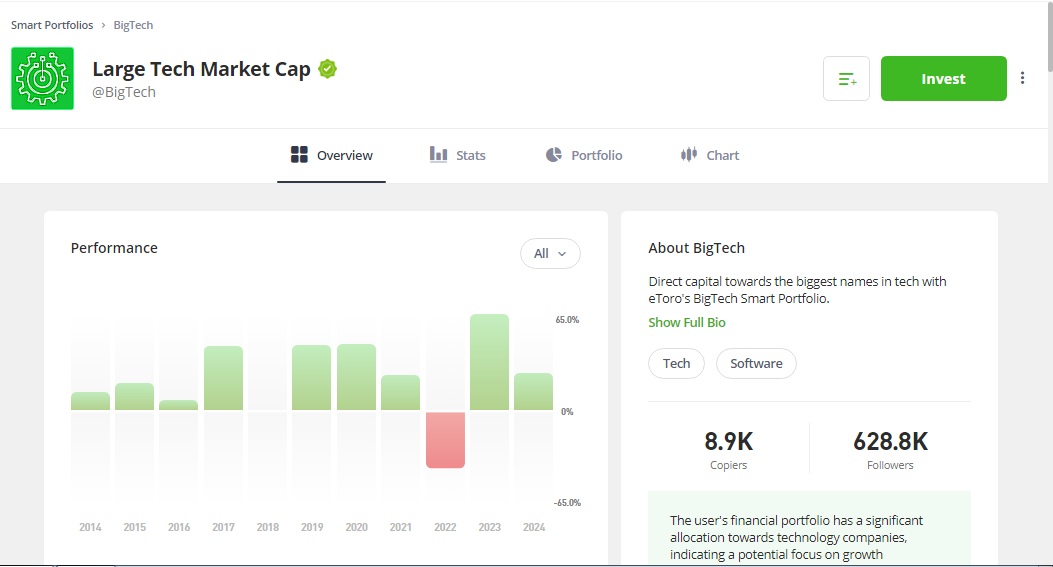

- You'll enter the eToro portfolio page where you can see the offer in more details. Once you're ready to make the investment, click the green "Invest" button.

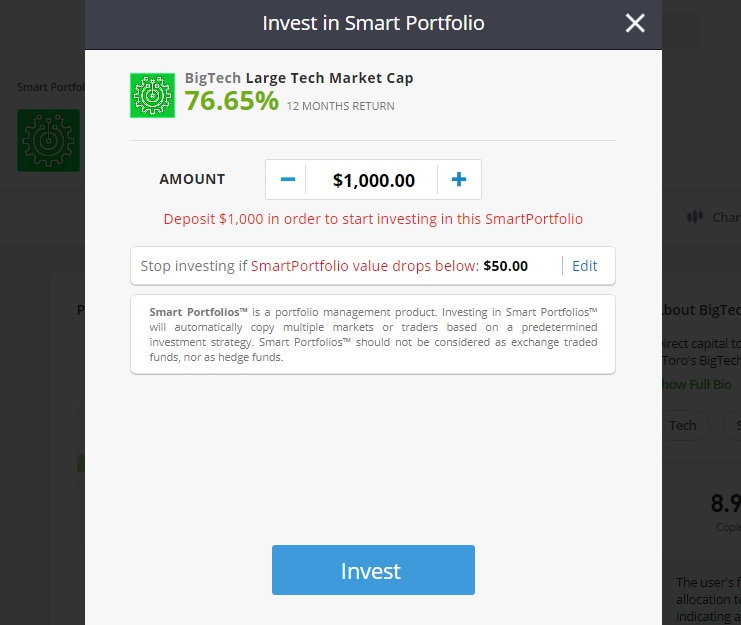

- Specify the amount that you wish to invest. eToro sets the minimum amount is $500. After that, set up your stop loss figure and click "Invest" to complete the process.

- Your active portfolio will appear on the Portfolio page, which can be accessed from your dashboard. Here, you can easily manage all your portfolios and even check your transaction history.

See Also:

How to Pick the Right Portfolios

To ensure maximum gains in eToro, you need to pick your investments carefully. There are lists of portfolios in various categories, from which you need to have a good understanding to pick the most suitable one.

If you don't know how the products in your portfolio work, how can you ensure the investment will succeed? So, in this case, start by choosing the thematic category based on your interests.

Next, inspect the portfolios closer. On the details page, you'll see the portfolio's past performance as well as the risk score, and the number of copiers and followers. Make sure that the numbers match your investment goals and risk tolerance. Remember that a good investment portfolio is the one that can provide you with a peace of mind.

Another tip is to manage your stop loss effectively. If you don't know how stop loss works, it will close your investment and return the remaining funds to your account once it reaches a certain point. We advise not to set the number too high as it might trigger the stop loss early. Instead, calculate your risk tolerance and use market analysis to find the right figure.

The Pros and Cons of eToro's Smart Portfolios

eToro's Smart Portfolio is an innovative offer that you may not find anywhere else. Here are the pros and cons that you should consider.

| ✔️ Pros | ❌ Cons |

| eToro's Smart Portfolios are curated and monitored by a group of experts and analysts, offering a level of professional oversight and advanced strategy. | eToro's Smart Portfolios don't come with lots of customization options, which might be a drawback for traders who prefer specialized strategies. There's no option to modify trades for long-term or short-term, and the asset allocations are not adjustable either. The success entirely depends on the trader's capability in choosing which eToro's Smart Portfolios could bring the best overall return. Once they choose the portfolio, the investment would follow the portfolio's performance in the market without any chance to adjust the strategy. |

| Allows you to diversify your investment across various assets, thus lowering the overall risks. | Investing in eToro's Smart Portfolios means less control over your investment portfolio because you're relying on decisions made by the analyst team. |

| You can save time as there's no need to do the research yourself. | eToro's Smart Portfolios are not free of risk. Human or algorithmic error might occur and impact the portfolio's performance. |

| eToro's Smart Portfolios are highly flexible and manageable. You can enter and close your holding at any time, allowing you to shift smoothly between products as needed. | Some portfolios are not available in certain countries, so you need to check the availability before making the investment. |

| The entry barrier is relatively low. You can invest with only $500. | |

| No management fees. |

Final Thoughts

eToro's Smart Portfolios offer a unique combination of automated investment and professional management, allowing investors to make hands-off investments with ease. To minimize the risks, the analyst team has to rebalance every once in a while by reassessing the market conditions and managing positions.

Of course, like any other investment, there is never a guarantee that you will gain profit over time. Therefore, diversification is always important. Take your time to build your long-term investment portfolio according to your investment goals and risk tolerance.

FAQs on eToro's Smart Portfolios

- What makes diversification so important for investors?

Financial markets can be really hard to predict, so there's always a chance that the price moves drastically and ruin your well-planned strategy. To avoid such risk, it's highly suggested to never put your eggs in one basket.

Instead, spread the risk and increase your gains by investing in various sectors, asset classes, and regions. This is what diversification is all about and how it can save you from getting too much loss.

- What is the best way to diversify?

The goal of diversification is to find balance in your investments. You need to spread your wealth in different sectors that are more likely to move in opposite directions.

So, when one of them is at loss, you can rely on the rest to give you profits. This is also why you should stay ahead of market updates and news. By doing so, you'll be able to tell if it's the right time to cut your losses and move on to the next investment.

- Are eToro's Smart Portfolios managed actively or passively?

According to eToro, it uses dynamic asset allocation, which is a mixture of both active and passive approaches. eToro's Smart Portfolios are not monitored daily, but they are regularly balanced by the experts to adapt to market conditions.

This can mean closing existing positions or opening new ones to maintain the strategy. The rebalancing period differs from one portfolio to another, so it's optimized based on the condition of each investment.

- How do I realize the profits made from eToro's Smart Portfolios?

The only way to enjoy the profits you gained is by closing the eToro's Smart Portfolios. You can do this by opening the eToro's Smart Portfolios page and select "Close Investment", then click "Stop Investing". This way, all of your positions in the eToro's Smart Portfolios will be closed and the funds will be transferred to your account balance.

- Does eToro offer other features in investing and strategies?

Aside from eToro's Smart Portfolio, you might also want to try eToro's CopyTrader feature, which allows you to copy other traders' strategy. In fact, this is one of eToro's most popular features on the platform.

eToro also provides TipRanks that reveal a lot of valuable market info for stock traders.

Connect & trade with millions!

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Jared

Mar 29 2024

This article makes me want to try smart portfolio, although I'm still not sure if it's right for me. The thing is, I started trading about a few years ago, but then one of my plans failed me, so I had to stop my trading career to focus on my 9-to-5 job. Now I'm back on my feet and ready to enter the markets once again. I was thinking of using the copytrading system as it is easy and not too risky while I'm preparing myself for manual trading. But after reading this article, smart portfolio actually sounds really good right now.

I've heard of eToro a couple of times from my friends, so I know it's legit. But even so, I'm still worried about the risks. Can you explain how the risk score works on this platform and what is the safe number to invest in? Thanks

Antonio

Mar 31 2024

Hey dude, welcome back! I know how it feels like to lose money (we all do at some point) and somewhat forced to step away for a while cause you don't have any more balance to spare.

Anyway, about the risk score. It is actually a very smart and helpful feature offered by eToro. So, the score ranges from 1 (low risk) to 10 (high risk). You can see the score in each portfolio page.

The risk score is influenced by a number of factors:

By considering these factors, the system provides a weighted measure of portfolio's performance over the years. While the risk score doesn't predict the future, it may help you calculate the risk based on the portfolio's track record.

Stephie

Apr 1 2024

1 indicates extremely low risk and 10 indicates extremely high risk. In eToro, the maximum risk score of a top investor is 7, but I suggest you go for investments with lower risk score. If you're a beginner, don't choose investments with a risk score of higher than 5. Don't worry, the platform is practically packed with many good investments, so you won't run out of options. If your risk tolerance is pretty high, then you may go for investments with higher risk scores. Also, don't forget to diversify. Do not put all your trades in one place and risk losing it all in a blink of an eye.

Tara S.

Mar 30 2024

Hi there, just a quick question. Are smart portfolios different from copy trading? Sorry, I'm a complete beginner here, so I don't know much about how these platforms work and I'm pretty nervous to open my first trade. I figure that passive investment might be the way to go, at least until I'm confident enough to trade on my own. Oh and also, are these smart portfolios made for short-term or long-term investors? Can I remove my funds and withdraw at any time, in case the investment doesn't go as planned?

Shawn

Mar 31 2024

No worries! I'm happy to help.

So, yes, copy trading and smart portfolios are different. As the name suggests, copy trading allows you to copy other trader's strategy and put it in your own portfolio. In other words, you are basically copying a specific person's strategy. Meanwhile, smart portfolios are a collection of assets curated by professional analysts.

Each portfolio consists of several assets, taking into account various factors like exposure, balance, etc. Smart portfolios are made with long-term strategy in mind, so it's suitable for investors looking for a hands-free investment.

Unlike copy trader, you won't be able to remove funds from an open smart portfolio. You can however close your smart portfolio holding at any time.