eToro is a well-known company that offers many interesting features including copy trading for crypto and other assets. Here's a full review of how crypto trading works in eToro.

As an investor, one should understand that every investment has its own risks and there are several factors that should be considered before taking the next step and putting your hard-earned money into this.

For one, it's important to choose the right exchange to buy, sell, and hold your crypto assets. Surely, not all exchanges are equally trusted and reliable, so you must make sure that you take enough time to review each exchange carefully before you trust them with your cash. One of the leading companies that offer cryptocurrency trading opportunities as well as other assets is eToro. This article will provide you a complete guide to crypto trading in eToro and all of the advantages that you can get.

Introduction to eToro

eToro is a well-known CFD broker that was founded in 2007 by David Ring and the Assia Brothers. Back in 2007, eToro was originally called RetailFX by the founders. Over more than a decade later, the company has grown into one of the world's largest online trading platforms and multi-asset brokers. eToro is fully regulated by several top-tier regulatory bodies including the FCA, CySEC, MiFID, and ASIC.

With more than 20 million users worldwide, eToro is undoubtedly famous for its social and copy trading features. Copy trading is where investors can copy other investors' strategies and use them as their own. Through the platform, users can browse through thousands of successful traders and find the one that matches their trading needs and preferences.

This opens a huge opportunity for beginners who are still lacking in knowledge and trading strategy to earn money. On the other hand, professional traders can share their knowledge and earn commission by letting others copy their strategy.

What's great about it is that copy trading is not only available for trading with stock and forex, but also for other financial assets including cryptocurrencies. So, trading cryptocurrencies is not the only service in eToro. The platform also enables you to earn profit by copying other crypto traders' strategies.

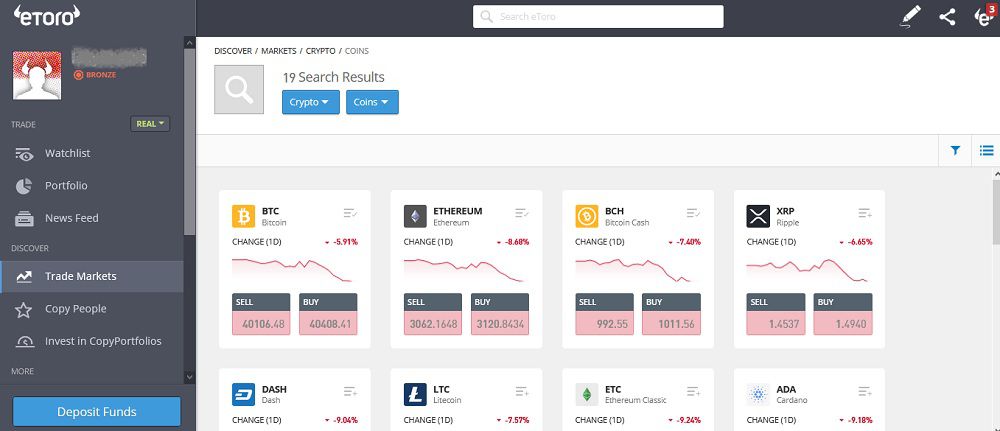

At the time of this writing, eToro supports 19 of the most well-known digital currencies in the market:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- Dash (DASH)

- Litecoin (LTC)

- Ethereum Classic (ETC)

- Cardano (ADA)

- MIOTA (IOTA)

- Stellar Lumens (XLM)

- EOS (EOS)

- NEO (NEO)

- TRON coin (TRX)

- Zcash (ZEC)

- BNB (Binance Coin)

- Tezos (XTZ)

- LINK (Chainlink)

- UNI (Uniswap)

- DOGE (Dogecoin)

In addition to that, eToro also accepts crypto payments for its clients.

Why Crypto Trading in eToro?

Why should you invest in eToro and what makes it better than other platforms? eToro offers various benefits for its traders, including:

- Good track record: eToro has maintained its reputation for more than 14 years and has gained more than 20 million users ever since, making it one of the largest trading communities in the industry.

- Unique trading opportunities: eToro offers the copy trading feature that lets you follow other traders, copy their strategy, and add it straight to your portfolio. This is actually a win-win situation for both copiers and professionals.

- More than 2,000 tradable assets including 15 cryptocurrencies, stocks, forex, indices, forex, etc.

- Beginner-friendly platform: eToro's trading platform has a clean and easy-to-navigate interface with various features suitable for beginners. The platform is capable of covering all the basics and helping you complete tasks quickly, such as creating watchlists and placing a trade directly from the watchlist.

- Good customer support: you can contact eToro via eToro Friends, Facebook, and email. You can also chat with a live agent on the website and even gets a dedicated account manager once you reach a certain level on the eToro's Club.

- Insurance: balances on eToro are covered by the Financial Service Compensation Scheme, so your balances are insured for up to €50,000.

- Deposit methods: the minimum deposit limit ranges from $200-$500 depending on the payment method. There are several methods offered by eToro, namely credit/debit card, China Union Pay, Giropay, WebMoney, Yandex, wire transfer, and crypto payments.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

Navigating the Platform

Before we discuss how to actually trade crypto in eToro, we would like to help you navigate through the platform. The following is the dashboard screen that you would see once your account is active. Read further to better understand each section and feature of the platform.

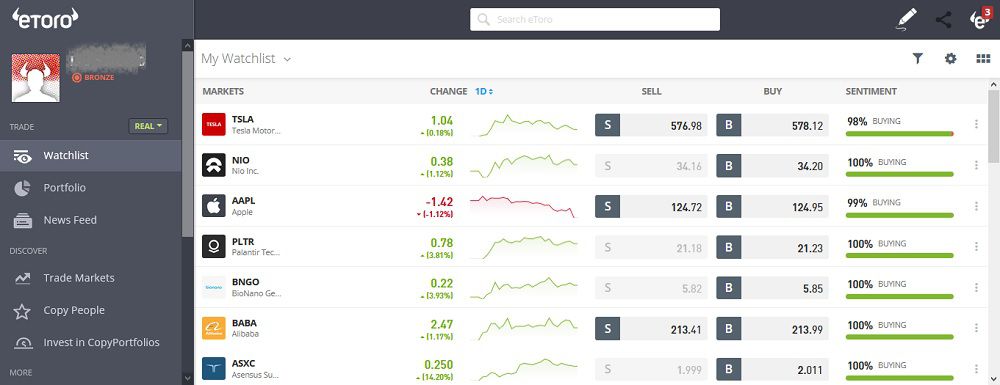

Watchlist

The default display screen of your dashboard is called "Watchlist". It contains a selection of markets you keep track of on regular basis. By default, your list will only contain two cryptos (Bitcoin and Ethereum) and other tradable assets such as several stocks, commodities, currencies, etc. You can remove these markets from the list by clicking the one that you want to remove and then press the checkmark dropdown on the top-right corner and click "My Watchlist".

Furthermore, you can also add more markets by scrolling down the list and click the "+ADD MARKETS" button. A pop-up window then will show up where you can choose to add "Crypto". You will then see a list of tradable cryptocurrencies that can be added to your Watchlist in eToro.

Apart from that, you can also add another list by pressing the "Add to new list" button. This feature is great if you trade with multiple asset and you want to manage your lists accordingly. Not only for markets (trading instruments), your Watchlist can also be filled with people that you are interested to follow or copy.

Portfolio

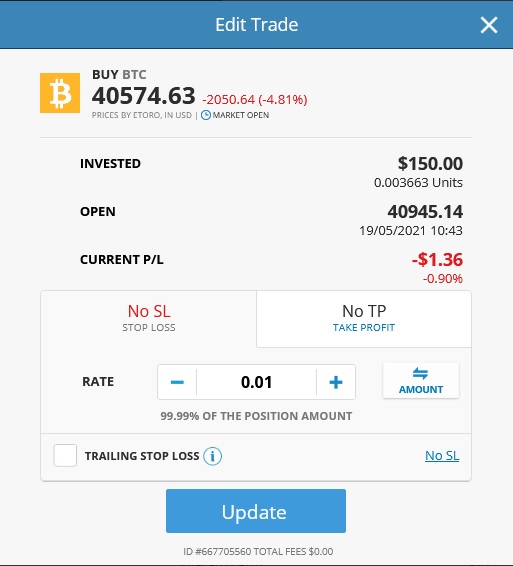

This is where you manage all of your open positions, whether it is a copied trade or a manually opened position. To be able to trade, you must complete your profile and make your first deposit. Here you can view the markets that you're trading, units purchased/sold, amount invested, net profit, profit/loss percentage, and the current value of your trade.

Other than that, there are various other things that you can see including your trade history, pending orders, share through social media, etc. If you're a popular investor in eToro, your portfolio can be seen and copied by other traders.

News Feed

News Feed is basically a social media timeline on the platform. Here you can post your thoughts as well as share your trading experience with other users. You can also search for specific cryptocurrencies to see people's posts related to them. While it's not wise to rely on people's analysis, it can be useful to find people with the same interest as you and discuss various trading ideas. This feature is particularly what makes eToro a great social trading platform because it can serve as the common ground for many traders with various backgrounds to build a big trading community.

Trade Markets

This is where you can see all the different markets available in eToro. It will display all the information you need about every instrument including the price and spread. Therefore, you can use the details as an analytical tool before you look for a trading opportunity.

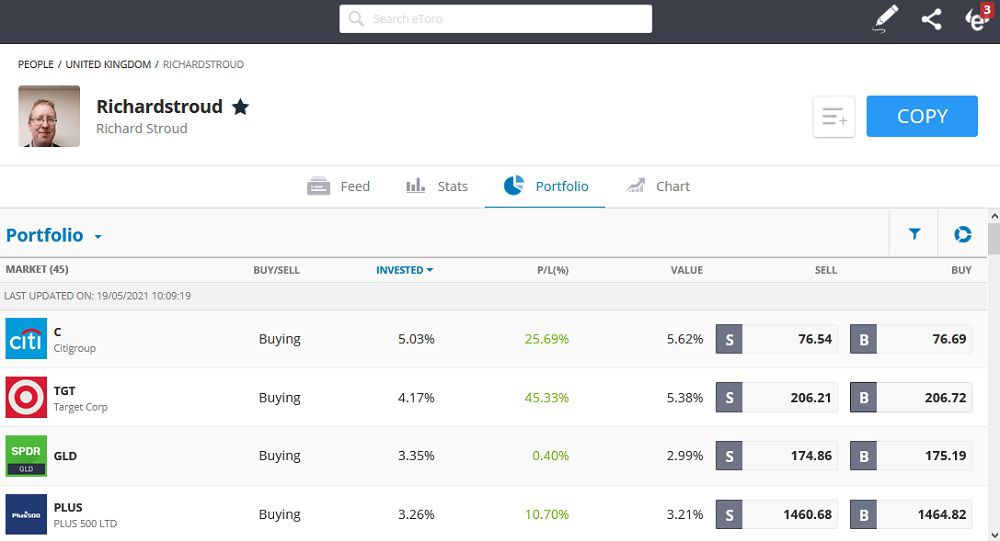

Copy People

Here you can find people with successful trading experience and copy them. Press the "WHO INVEST IN" button on the upper menu and pick "CRYPTO" to access the library of crypto traders on eToro that you can copy. For better results, we suggest you change the "GAINED AT LEAST" setting to "100" because cryptocurrency is an extremely high-risk high-return market. This will then filter your search to only traders with ROIs of 100% or more. For further safety, change the minimum copier count to HIGH (over 500) so you only find people with good credibility and testimonies from other traders.

People

This section contains the profiles of public eToro traders. When you click on one of them, you will see their news feed, bio, and follower count. You can also check their trading performance by month or year in the "Stats" section. Under the "Portfolio" tab, you can see their trading strategy in detail, which includes their open positions, entry points, etc. Lastly, the "Chart" tab will show you a chart that simulates the performance if you decide to copy the trader with a $10,000 investment.

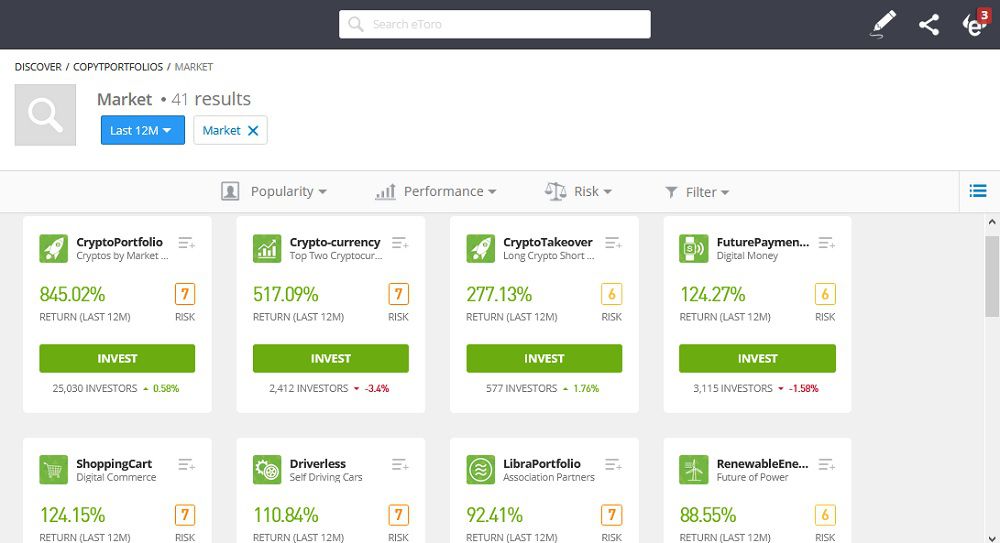

CopyPortfolios

CopyPortfolios is a collection of thematic portfolio management products that gives you the power to act as your own "hedge fund" in eToro. These portfolios will give you greater diversity in choosing trading assets. In a way, it serves as a simple way to give yourself complete exposure to the crypto industry should you specifically choose portfolios that focus on crypto coins.

The big advantage that you can get from this is the lack of personal management required. These portfolios are managed by top traders and you can participate here without having to pay any additional fees regardless of your holding time.

How to Trade Crypto in eToro

To trade crypto in eToro, you can do these following step by step:

- Start from either the Trade Markets or Watchlist section on your dashboard.

- Under the Trade Markets, click the "Buy" or "Sell" button to open a position on a particular cryptocurrency of your choice.

- Whereas from the Watchlist section, press "S" for a short trade or "B" for a long position.

- Apart from those two options, you can also go to the cryptocurrency's info page and press the "Trade" button to either buy or sell the crypto.

You can also hover over the "Trade" dropdown menu and select "Order". By doing so, you can set a pending position at a level that you can choose on your own. This feature would be extremely useful to maximize your profit in day trading.

Next, these two steps should be ensured to execute your position:

- Enter the amount you wish to invest.

- Press "Open Trade".

Once you submit all the required data, eToro will then place your order to activate your position. Now that you have an open position, make sure to regularly check its progress on your Portfolio page.

From there, you can click the gear symbol and manage your position in various different ways. This is where you can set the stop loss and take profit, close your trade, and activate the trailing stop. You should also do the following things:

See Also:

Crypto Trading in eToro is More Than Just Trading

Overall, eToro is a great trading platform for cryptocurrency, especially with its unique copy trading feature. Being the best social trading platform in the industry, it is unsurprising that eToro provides many interesting features that are easy to use and definitely useful for many traders, even for beginners. Here you can follow successful crypto traders and then copy their strategies directly to your portfolio or you can manually trade cryptocurrency with your own strategy.

However, keep in mind that it is extremely crucial to understand what you're doing before you invest with real money. eToro may provide several features that could help you trade better, but it still won't eliminate the risk of losing the trade. Things can go wrong anytime, especially in the highly volatile market of cryptocurrency. That is why you should only invest with money that you can afford to lose, never overtrade, don't make clumsy decisions based on greed or impulsiveness, and more importantly, learn how to work with eToro's crypto trading feature in the demo account first.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano