Trading Pathway

Welcome to the pathway of trading success! Initiate your trading journey from the very basic steps to the most advanced lessons. We have specifically arranged the materials to help novice traders start in the right path.

Keep Tabs on Your Journey

Stay in the loop and track your progress with us. You only need to log in to see where you stand on your pathway to success and how much left to achieve.

Beginner

We believe you've likely come across a wealth of information on how forex can bring in profits with flexible time and capital.

The next question is, how do you make some profit and where do you start?

Let's explore the strategies and steps you can take to unlock the benefits and start your forex journey.

Yet, if you're keen on grasping the fundamentals of forex, feel free to explore some outdated narratives that unravel the fundamental backstory of the forex market.

Where Do I Start?

All trading activities commence on a trading platform. MetaTrader is a good example of trading platform where beginners can start learning how to trade.

-

What is MetaTrader 4 or MT4?

MetaTrader 4 or MT4, is a trading platform that was built by MetaQuotes with the purpose of trading forex, futures, and CFDs. Many believe that MT4 is the industry standard for trading.

Continue Reading at Is MetaTrader 4 (MT4) Still Relevant?

-

How to Download MetaTrader Platform?

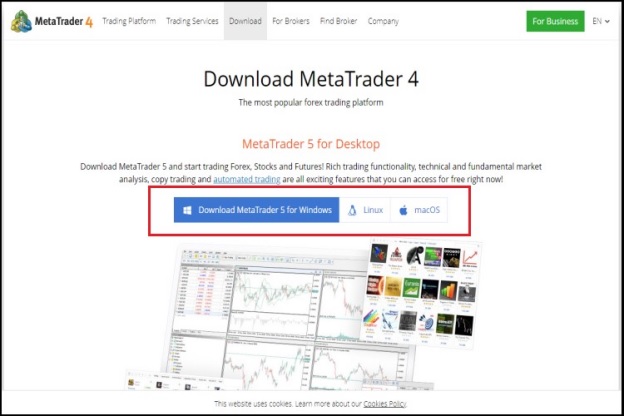

1. Visit the Metatrader download page.

2. Click on the "Download MetaTrader" button.

3. If in your download history there is already a MetaTrader setup file in .exe format like this, it means the platform has been successfully downloaded to your computer.

-

How to Install MetaTrader Platform?

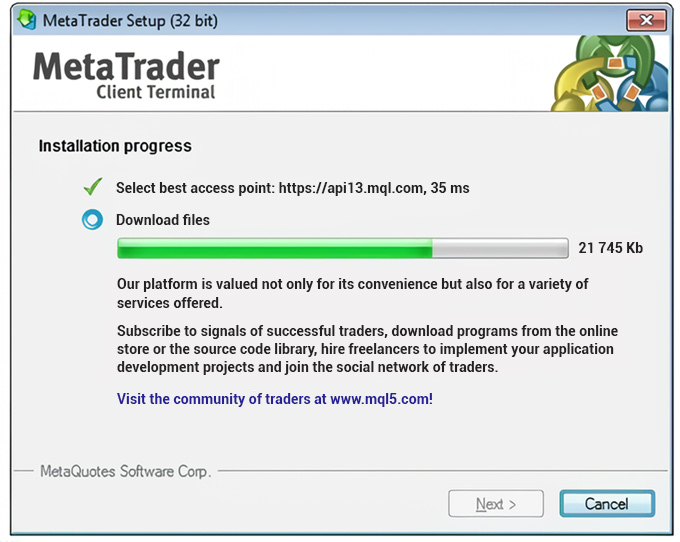

1. The first thing you’re going to to do is downloading the MetaTrader App, you can safely download the MetaTrader 4 application on their official website. After that, double click the app, a Metatrader 4 Setup window will appear, as shown in the image below. Check the box to agree to the license terms and click “Next”.

2. The next window will give you installation options, such as whether or not you want to include a desktop shortcut. Depending on your operating system, you may or may not get this dialog box. For example, my system took me straight to the “installation progress” screen, as shown below.

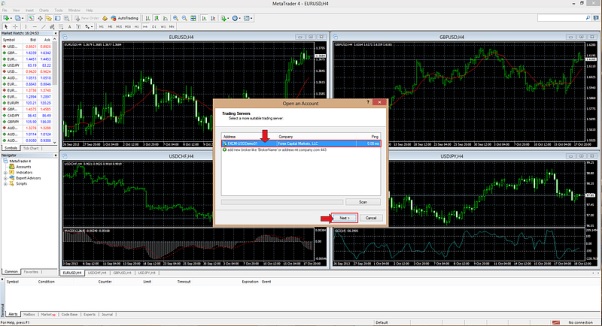

3. Select your preferred broker or choose the default setting and click “Next”. This will connect your MT4 platform with your broker’s demo feed.

4. After selecting “Next” from the screen above, you will be prompted with an option to either open a new demo account or login to an existing account. if choose “New demo account”, click “Next” as shown in the image below.

5. The very next screen will prompt you with several fields, most of which are mandatory. Here you will need to enter your name, address, phone number, email address as well as your account type and currency.

6. After you have completed all required fields, click the “Next” button. This will launch MT4 and present you with the default chart layout. You have successfully installed Metatrader 4.

-

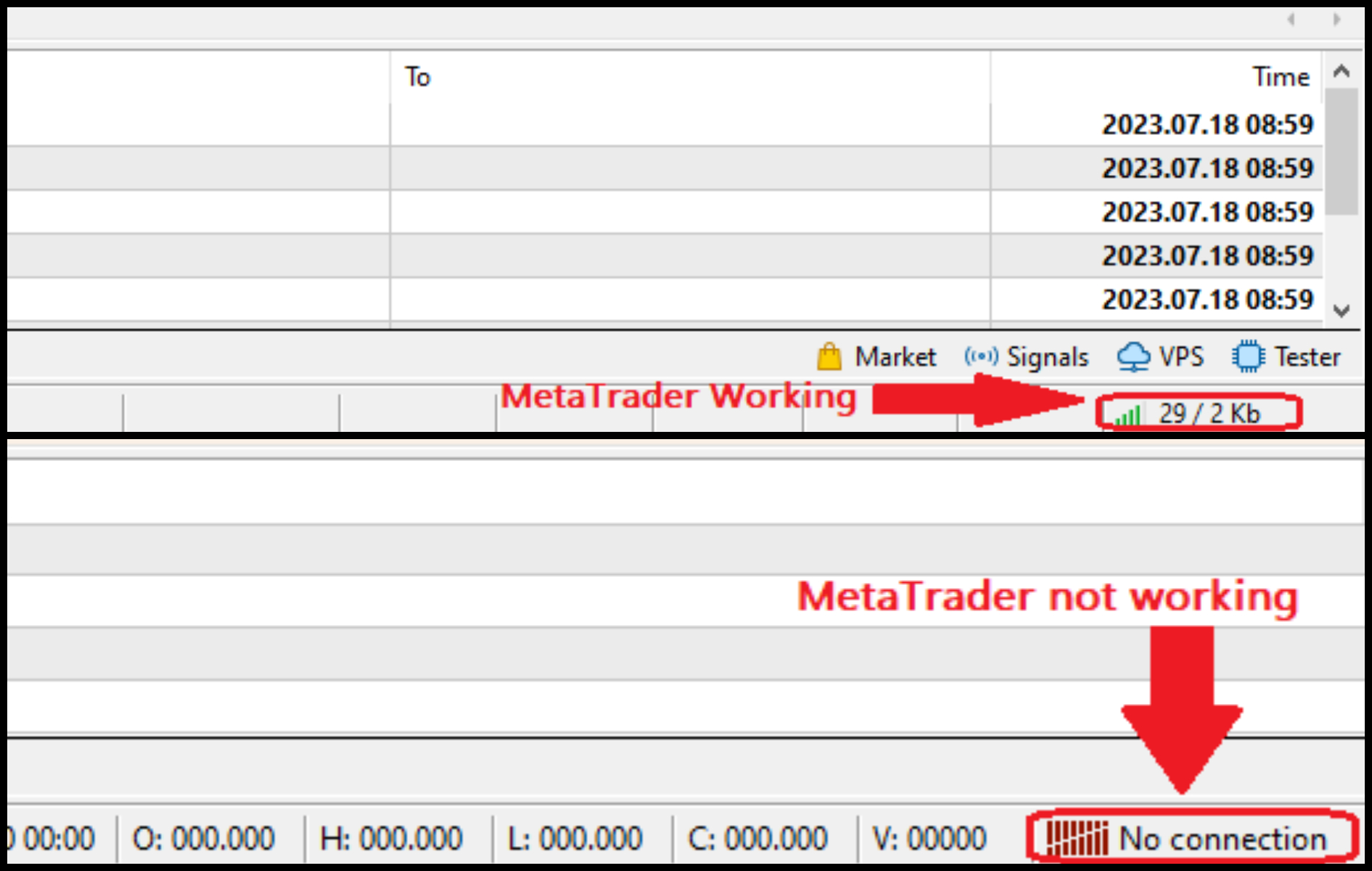

Is My MetaTrader Working?One easy way to indicate whether your MetaTrader is properly working is by checking the traffic signal at the most right bottom of the platform. If the number is active at the start of the operation and remains that way, it shows that the MetaTrader is working just fine. On the other hand, inactive traffic signal indicates there's no data update on the platform so the MetaTrader won't be able to use for any trading activity. Here's the comparison:

-

What Are the Basics of Using MetaTrader?

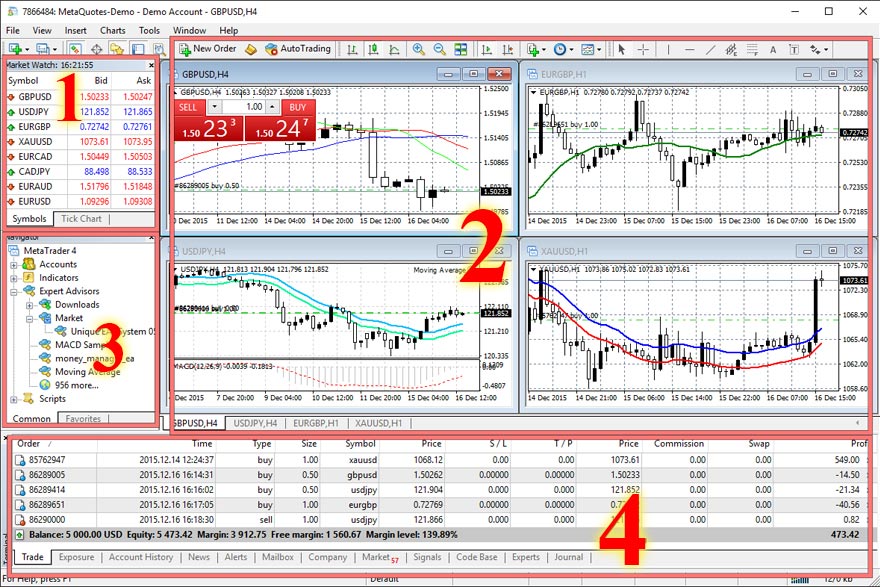

In the MT4 screen, you can see 4 main panels: 'Market Watch,' 'Navigator,' 'Chart,' and 'Terminal.' Let's dive into each and understanding each role.

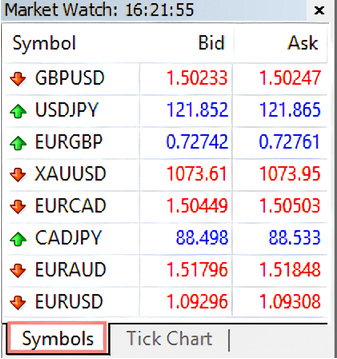

1. Market Watch

Check out the Market Watch—it's like the trading menu showing all the cool stuff you can trade, from forex pairs to metals. You'll see symbols and the current buying and selling prices.

If you right-click on the symbol tab, you get some options:

- New Order: Opens a trade for the instrument you clicked

- Chart Window: Opens a new chart for that instrument

- Tick Chart: Shows sales activity for the instrument

- Depth of Market: Displays bid and ask prices for the instrument at the best prices right now

- Specification: Gives you the details on the instrument, like spreads, contract size, and swap rates.

- Hide: Make symbols disappear from the list. Good for cleaning up and saving bandwidth. You can also use the Delete button.

- Hide All: Clears out all symbols from the list. Doesn't touch the ones with open positions or charts from this session.

- Show All: Bring back the full list of symbols. Quotes for all of them will start flowing in.

- Symbols: Opens a window listing all available symbols. You can add or remove symbols from the quotes window with "Show Symbol" and "Hide Symbol." "Properties" lets you check out symbol details.

- Sets: Go into a sub-menu for managing symbol sets. Store, delete, or pick an existing set – super handy for juggling different types of securities.

- Spread: Toggle to show or hide the column displaying the spread (the bid-ask difference).

- High/Low: Adds the highest and lowest daily prices to the displayed quotes.

- Time: Reveals the time of incoming quotes.

- Auto Arrange: Columns to arrange themselves when you resize the window. Hit 'A' to enable it.

- Grid: Flip the grid on or off, keeping things neat.

- Popup Prices: Opens an extra quotes window, matching the "Market Watch" symbols. It's info-rich, and you can even trade from here. Double-click to get things rolling. The context menu offers display tweaks, full-screen mode, and keeping the window on top.

2. Chart

The chart panel is where you see the instrument's price move. By clicking the Template icon (1), you can show this chart in different styles, like candlesticks, bars, or lines. And you can even juggle multiple charts on one screen if you're keeping tabs on different markets.

By clicking the Watch icon (2), you can switch up the view from short 1-minute moves to longer 1-month time frame. On a 1-minute chart, each tick shows a minute's worth of action. If you click monthly chart, each move covers a whole month.

3. Navigator

Hop into the navigator panel to log in to your trading. You can even create a demo account here to test your strategies before diving into the live action by clicking Accounts (1). But wait, there's more! The navigator is your go-to spot for adding indicators to your chart (2). Pick from a bunch of indicators or get fancy and create your very own using MQL5, the MT4 programming language. You can also import your custom indicator into MT4 for a more personalized trading style.

4. Terminal

- Trade: See what's happening with your open positions and pending orders.

- Account History: It's like your trading diary, showing all the trades you've made: profit, loss.

- Exposure: This tab gives you the lowdown on how all your open positions are doing.

- News: Get the scoop on important trading headlines.

- Alerts: Set alarms here for price hits or when crossing indicator trend lines.

- Mailbox: Check out all the electronic messages Metaquotes has sent you.

- Company: This tab may display a useful web page for a trader, for example, the technical support page.

- Market: Market is a store of MQL4 applications at MQL5.community.

- Signals: Signals tab of Terminal window displays trading signals available for subscription.

- Code Base: This is where you can download any app you like from the "Code Base" on the MQL5.community website.

- Experts: Peek at the active Expert Advisors (EAs) in your account and see what they've been up to.

- Journal: It's like your account's diary, recording login times, filled orders, edited orders, and closed positions.

-

Why do most brokers choose to offer MT4?

MetaTrader 4's simplicity and ease of use make it a preferred choice for brokers. It offers a range of customization options, settings, and data management features, ensuring that traders' needs are easily met and brokers can tailor the platform to their preferences.

Continue Reading at Is MetaTrader Still Relevant for Professionals?

-

Is MT4 suitable for beginners?

Yes, there are several reasons why MT4 is good for beginners.

- It has a simple design that is easy to understand

- Requires very little RAM compared to most trading platforms.

- It is also equipped with a wide array of indicators that can be customized.

Continue Reading at Is MetaTrader 4 (MT4) Still Relevant?

- What Problems Should Be Looked Out for on MT4?

- Common error

- Crash or freeze

- Waiting for update

- No internet connection

- Invalid account

- EA is not working

- Slow execution of orders

- Lagging performance

- Trade is disabled

- Off quotes

- Not enough money

- Can't login

For further details and solutions to each problem, continue reading at MetaTrader 4 Platform Common Problems and Solutions Reveal

Installing MetaTrader platform is a straightforward process. Here's a general step-by-step to get you started:

- Head to the official MetaQuotes website

- Choose your operating system (Windows, Mac, Linux, Android, iOS).

- Click on the "Download" button for the platform.

- Double-click on your downloaded file to launch the installation.

- Read and accept the license agreement.

- Choose where you want to save the platform data on your device.

- Click "Next" to continue through each step.

- Once the installation is done, click "Finish".

- You can now launch MetaTrader on your device.

Well done! You've successfully installed MetaTrader and are ready to run the platform. Make sure you download the platform from the official MetaQuotes website to avoid potential malware risks. If you encounter any issues during the installation, consult the MetaQuotes' support team.

Other than MetaTrader, you also need to prepare a trading account if you want to get serious as a forex trader. Such an account is typically hosted by forex brokers.

DO NOT carelessly choose any forex broker to open your first trading account. Pay attention to these factors instead:

a. Regulation

- Do You Have to Trade with Regulated Brokers?

- 6 Best Forex Broker Regulators in the World

- List of Brokers with FCA Regulation

- List of Brokers with ASIC Regulation

- List of Brokers with CySEC Regulation

b. Experience

Your broker is your partner in the forex market. Choosing one with a proven track record can make a significant difference in your trading journey and potential success. The higher your broker's experience, the more likely you trade in a safe broker.

It's essential to choose a broker with a solid reputation and a history of providing excellent service to ensure a positive trading experience.

- Forex Brokers with 10+ Years of Experience

- Forex Brokers with Up to 5 Years of Experience

- Forex Brokers with Up to 2 Years of Experience

c. Features

Selecting an appropriate forex broker tailored to your requirements is crucial. Take into account your trading preferences, level of experience, and financial constraints when assessing various brokers. Keep in mind that a platform equipped with rich features, competitive fees, and dependable support has the potential to greatly enhance your trading experience and possibly improve your outcomes.

- Forex Brokers with the Lowest Deposits

- Forex Brokers with the Lowest Spreads

- Forex Brokers with Free Education for Beginners

- Forex Brokers with High Leverages

- Forex Brokers with Mobile Trading

d. Promotion

Forex broker promotions can prove advantageous, serving as a means for traders to get additional funds, extra margin for trading, and various other types of rewards.

In a way, beginners can use such rewards to boost their initial deposits. Here are some tips in regard with forex broker promotions and bonuses:

- Forex Deposit Bonus: 5 Things Every Trader Should Know

- How to Successfully Use a Forex Broker Bonus

- How to Maximize Your Forex No Deposit Bonus

Interested? You can choose from these updated promotions and bonuses from forex brokers:

- List of Broker Promotions: Your Gateway to Winning Opportunities!

- List of Broker Bonus: All the Forex Rewards You Can Get

e. Special Consideration: Offshore brokers

Did you know that most well-regulated brokers are so restricted that they can freely offer all of the requirements above? In recent years, it has become such a dilemma for traders.

Although offshore regulations are not as highly regarded as their onshore counterparts, they're nonetheless built with an aim to protect clients and regulate forex brokers. As such, offshore brokers can offer a more flexible condition within a regulated environment.

To ensure higher reliability and security, traders tend to choose offshore brokers that are more than 5 years old. That way, theya are able to safely gain some advantages that are not available in other strictly regulated bokers, such as simple registration process, various features and promotions, higher leverage, as well as unlimited use of trading strategy.

Learn further:

The essence of forex trading is to earn profit from the market. As such, you will need all the important skill, knowledge, strategy, and tenacity of a successful forex trader.

To acquire them, you might first learn how to understand the market movement from FAQs below:

a. How to Choose Currency Pair?

Selecting the right currency pair in forex trading is an ongoing process that requires continuous evaluationbased on changing market conditions and your evolving trading experience. There are several factors to consider in this matter:

1. Risk Tolerance

It deals with your level of comfort with risk and potential losses. Major currency pairs like EUR/USD and GBP/USD generally offer lower volatility and higher liquidity, but also smaller potential rewards. On the other hand, exotic currency pairs like USD/ZAR and USD/TRY offer higher volatility and potentially larger profits, but also carry greater risk.

2. Trading Style

If you prefer short-term, high-frequency trades, choose pairs with high liquidity and tight spreads like EUR/USD or GBP/USD. For day traders, pairs with moderate volatility and decent spreads like AUD/USD or USD/CHF, are suitable.

If you prefer longer-term trades, you could consider pairs with strong trends and lower volatility.

3. Market Conditions

Choose strong currencies that are supported by strong economies. Analyze the economic performance and outlook of the countries associated with the currency pair. In addition, you can compare interest rates between the two countries. Higher interest rates can make a currency more attractive. Political stability and potential events that could impact market sentiment and currency movements are also of importance.

4. Technical Outlook

To enter a trade at the best position, currencies with good technical outlooks are more preferred. Such currencies should have clear strong movement - whether it's uptrend, downtrend, or sideways consolidation; display potential reversal or continuation patterns; and are easy to be combined with technical indicators.

It;'s best to trade the USD pair since it usually has the best liquidity. Some of them are:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- USD/CAD

- AUD/USD

Continue Reading at Guides to Forex Trading as a Side Job

The EUR/USD pair is well-known for its high volatility. To this day, the EUR/USD remains the most volatile pair in forex history. This fact has attracted the attention of many traders in the market.

As the single currency of several countries, the Euro is greatly influenced by the political and economic developments of these countries. In just one day, there are many different data releases from its 16 member countries. On the other hand, news throughout the day related to the US economy and its major trading partners will also affect the value of the Dollar. Thus, it is clear that there are many opportunities to take advantage of the EUR/USD, even with small price movements.

Continue Reading at 5 EUR/USD Facts Every Beginner Should Know

The overlap session of London and New York is a favorite time for short-term traders. This is because major pairs involving the Euro, US Dollar, Pound, and others are experiencing significant range increases during this session.

If you are using a news trading strategy, the best time to trade the EUR/USD is during the overlap session. But if you want to apply breakout trading, then you can take advantage of the rapid movements at the beginning of the London session.

Continue Reading at 5 EUR/USD Facts Every Beginner Should Know

It;'s best to trade the USD pair since it usually has the best liquidity. Some of them are:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- USD/CAD

- AUD/USD

Continue Reading at Guides to Forex Trading as a Side Job

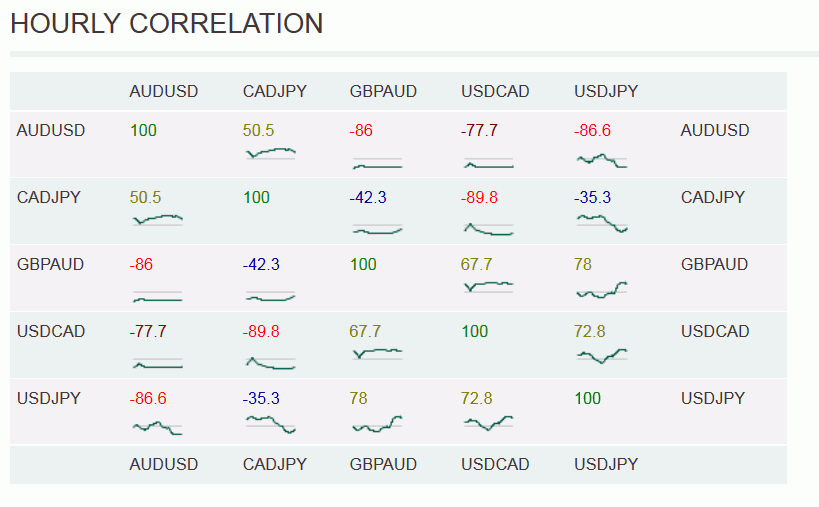

Some pairs often move in different directions or, conversely, move in the same direction up to a certain degree. In the following graph, several pairs have more than -80 hourly correlations. That means they are negatively correlated; when one pair moves upward, the other one tends to move downward.

Continue Reading at Introduction to Forex Hedging Strategy

b. What Indicators Do I Use?

In forex trading, there are two major types of indicators, namely economic indicators and technical indicators. Economic indicators are mainly related with fundamental analysis and published by official departments to indicate the economic condition of a acountry, while technical indicators are the essence of technical analysis based on the price movement.

Economic indicators are data released by the government or private organizations which can be used to see the economic performance of a particular country. After the release, there will be either a positive sentiment (optimistic) or a negative one (pessimistic) about the policy or economic condition of the country. This sentiment influences market player decisions and affects the country's exchange rate.

Continue Reading at The Economic Indicators That Affect Forex Trading

Some important economic indicators that affect the forex market are:

- Unemployment Report: Reports about a country's unemployment.

- Gross Domestic Product (GDP): Consists of the total market value of a country's goods and services.

- Retail Sales: Measures the total sales of goods and services by retail establishments over a specific period.

- Production Reports: Shows fluctuation in industrial productivity.

- Trade Balance: A measure of a country's exports minus its imports.

- Consumer Price Index (CPI): Measures the changes in the consumer's goods price in 200 categories.

Continue Reading at The Economic Indicators That Affect Forex Trading

Economic indicators play a crucial role in understanding and evaluating the health of an economy. These indicators provide valuable insights into various aspects of economic activity, such as employment, inflation, trade, and overall growth. They help policymakers, investors, businesses, and individuals make informed decisions and formulate strategies. Economic indicators allow us to assess the current state of the economy, identify trends, and anticipate potential changes or risks.

They provide a foundation for economic forecasting and planning, enabling policymakers to implement appropriate measures to stimulate growth or manage downturns. Additionally, economic indicators help investors gauge market conditions and make informed investment decisions. These indicators are essential for monitoring and analyzing the economic landscape, contributing to informed decision-making, and fostering stability and growth in local and global economies.

Continue Reading at The Economic Indicators That Affect Forex Trading

Technical analysis tools like charts and indicators can help you identify potential entry and exit points, making informed trading decisions based on historical price movements and market trends. Technical analysis can provide useful insights into market trends, price movements, and potential price levels, helping you to identify patterns and trends that may influence your trading decisions.

By analyzing technical indicators like moving averages, oscillators, and candlestick charts, you can identify potential entry and exit points that maximize your profits while minimizing risks.

Continue Reading at How to Trade and Make Profit on Binance Leveraged Token

Generally, you can use any kinds of indicators you want. But ideally, it is best not to use more than 2 technical indicators. The reason is that the signal it produces might be confusing for you. Also, analyzing too m any indicators might make you lose momentum.

Continue Reading at 17 Common Trading Mistakes That Result in Great Loss

Technical indicators can be a great way to support your traders. But, solely relying on technical indicators might not be wise. It would be best if you also considered news and other economic events.

Continue Reading at Seven Don'ts Of Forex Trading To Avoid Losses

c. How to Use Fundamental Analysis?

The fundamental aspect of forex trading is economic data or events that cause the flow of cash in currency transactions. Since traders try to find the strongest currency to be paired with the weaker one, fundamental analysis in forex trading is used for learning the economic factors which cause the dynamic transaction of traders of a currency pair.

Fundamental and important data affect the demand for a currency, especially the Gross Domestic Product (GDP), the Consumer Price Index (CPI), and the Employment Figure. Those three indicators reflect the economic condition of a country and they directly affect the exchange rate of the currency.

Whatever strategy you use in trading, you must monitor the three data mentioned for determining the tendency of currency's price movement based on the capital inflow and outflow in the country. The country with a strong economic condition will attract more investors so more money supply will flow into the country, and vice versa.

Continue Reading at Everything You Need to Know About Fundamental Analysis

The fundamental analysis in forex trading is used for learning the economic factors which cause the dynamic transaction of traders of a currency pair. In other words, applying the fundamental strategy uses some data and important events as the fundamentals of analyzing market outlook to determine the ideal trade. The data or the events are generally mentioned as high-impact factors.

If there are economic data that performs better than expected and affects the economic situation in a country, we then can find another currency from a country that experiences a weaker economic situation. For instance, if the economic data of the Euro area or Germany is in a good condition while the United States' situation is weaker, it means we can buy EUR/USD.

Continue Reading at Everything You Need to Know About Fundamental Analysis

A specific economic report (like NFP or GDP) is only a single piece of a jigsaw puzzle. When they are pieced together, only by then you can get an insight into "the big picture".

If you only narrow down on a single piece while ignoring the other pieces, you are prone to be misled. That's why you can't only rely on a single so-called high-impact data release all the time without considering other economic data releases.

Continue Reading at The Key to Approach Fundamental Analysis

There are three rules to remember in applying fundamental analysis:

- Not all high-impact news is a game-changer

- Understand concepts about currency data

- Don't leave technicals behind

Continue Reading at Three Reasons Why Your Fundamental Analysis Does Not Work

For example, USD seems to be going strong because of some economic data are better than ever. However, you later found out that instead of going downward, GBP/USD holds out and then moves upward! Well, it might be that the GBP is fundamentally stronger than the USD.

A strong currency does not mean that the currency will emerge as the overall champion in the forex market. Remember that currencies are traded in pairs within a globalized forex market, which mean: influential fundamentals come from both sides and more.

You should not only observe fundamental dynamics of one or two currencies but also global market dynamics. Prices are determined by supply and demand in that market, so you should think about market sentiments too.

Continue Reading at Three Reasons Why Your Fundamental Analysis Does Not Work

The right moment to enter the market naturally is around news releases, particularly high-impact news releases with average movements of 30 pips or more. That may include:

- Non-Farm Payroll USA (100 – 200 pips).

- Trade Balance USA (70 – 120 pips).

- Interest Rate Statements (approx. 100 pips).

- Durable Goods (50 – 100 pips).

- Producer Price Index (50 – 60 pips)

- PPI excl. Food and Energy (50 – 60 pips)

- Consumer Price Index (50 – 60 pips).

- CPI excl. Food and Energy (50 – 60 pips).

- The Fed Chief Speaks (30 – 100 pips).

- Unemployment Rate (30 – 50 pips).

Continue Reading at Trade US Dollar At The Right Moments

All investors, speculators, as well as traders, always consider interest rates to get the biggest and increase their investment portfolios. Therefore, countries with higher interest and better economic fundamentals will tend to attract capital flow.

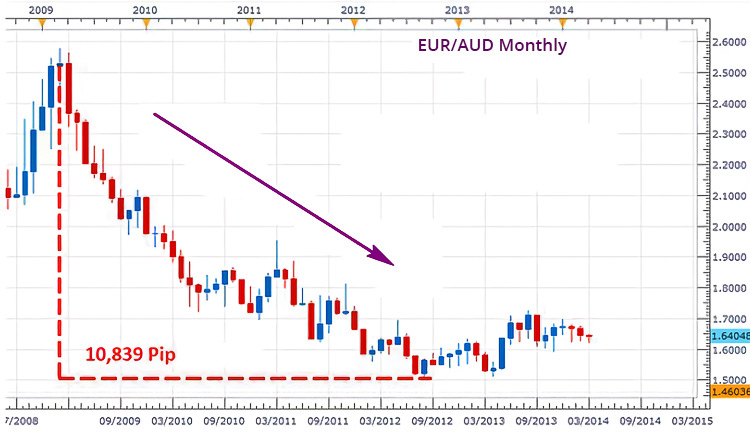

As indicated on the monthly chart below, EUR/AUD experienced a decrease of 10,839 pips between 2009 and 2014. At the time it had been happening, the interest rate of the Australian central bank was 4.75%. On the other hand, the Euro central bank only put a 1.50% rate. Traders and investors then used the difference in interest rates for getting profit by selling EUR to buy AUD.

Continue Reading at Everything You Need to Know About Fundamental Analysis

d. How to Use Technical Analysis?

Technical analysis in forex trading refers to attempts to analyze the patterns of price movement in order to predict the subsequent price movement. Traders who like to use technical analysis are commonly called technicalist or chartist. A technicalist tends to ignore the driving force behind price movement, and focuses on the most recent movements. The opposite of a technicalist is a fundamentalist who tries to predict price movement by analyzing news on several economic indicators.

Technical analysis refers to an analysis method that is based on market statistics. This includes the use of chart patterns, trends, support and resistance levels, volume data, and so on.

The goal is to predict how the market might act in the future based on the patterns found in past market behavior. Technical traders believe that the market's future performance can be determined by analyzing the past performance data.

Continue Reading at Stop Using Fundamental Analysis in Day Trading, Here's Why

Because of its unpredictable nature, traders relying only upon technical analysis in decision-making often avoid news releases with short-term impacts.

They consider the movements around news releases too random and out of the ongoing trend, so the swings are temporary. Traders chose to monitor currency pair movements and not open any position when the market blows.

Continue Reading at How to Take Advantage of Market Euphoria on News Releases

Yes, you can also use technical analysis for CFD trading. This strategy involves studying historical data as well as charts in order to make predictions on future price movements. You can also use the help of technical indicators to analyze the market better. The problem with this strategy is that it requires you to study how to use indicators, how to read the charts, and many more.

Continue Reading at Top 5 CFD Trading Strategies You Should Try

A scalping method is generally applied in a 1-minute to 1-hour time frame with certain indicators. Besides the technical indicators, the reading and interpreting abilities on the price movement are very helpful and necessary. The example below is taken in a 5-minute chart.

Continue Reading at The Secrets of Successful Scalping Strategy

Learn further:

- Forex Technical Analysis: A Comprehensive Guide for Beginners

- Introduction to Forex Technical Analysis with Chart Patterns

- 7 Myths of Technical Analysis

e. How to Combine Fundamental and Technical Analysis?

In general, fundamental and technical analysis can work together if you use them properly. You can use fundamental analysis to get the market sentiment of a currency you're about to trade, and apply technical analysis to identify the best entry and exit points. That way, you would avoid trading against the market and know where to open and close positions to get maximum profits.

Yes, it is. The fundamental analysis makes it possible for traders to understand the growing sentiment for a certain pair and where prices are going to go, but that needs to be supported by technical analysis to identify the best entry and exit points.

There are many other advantages of mastering the basics of both analyses. For instance, technical indicators could give an early warning when market sentiment changes or when the market has stretched tight (which means you should get out of there quickly).

Continue Reading at Three Reasons Why Your Fundamental Analysis Does Not Work

If price movements is a human, then fundamental analysis and technical analysis are the two feet. Learning one without the other is like trying to walk with only one foot.

For a short time, you might be able to do that, but sooner or later, you will stumble and fall.

Continue Reading at Three Reasons Why Your Fundamental Analysis Does Not Work

Yes, we can. Although not the main focus, technical analysis and trends will still be studied by macro traders. Financial markets go up and down very quickly, so it's impossible for macro traders to identify the best location to enter and exit the market without performing some technical analysis.

Instead of focusing on different types of indicators to combine, macro traders would apply simple technical analysis that mostly involves price action, support and resistance, as well as 1-2 trend indicators.

Continue Reading at Macro Trading: A Fundamental Approach to Your Strategy

A forex demo account is a practice account on a real trading platform. You do not need to deposit funds as brokers fund demo accounts with virtual money. In other words, demo accounts allow you to practice in the live market environments with real-time market price.

One of the reasons why beginner traders tend to lose is because they rushed to use live accounts. They might be surprised and not ready to face the real market conditions. It is best to start from a demo account since it allows traders to 'feel' the real market situations without actually facing the risk.

Continue Reading at Lost Before Trading: Three Reasons Why Novice Accounts Collapsed

Installing a demo account is easy. That's because you can get it free from your Forex broker.

- Look for the "open demo account" button somewhere on your broker registration page. From there, brokers may offer more than one type of demo account, like; MetaTrader4 or 5 (MT4 or MT5), cTrader, etc. If you're pretty clueless, just pick MetaTrader4 because it's one of the most popular trading terminals.

- Alternatively, you can download MT4 from the MetaQuote website. Once you start pressing the download button, the client file should stay on your computer folder. Step two, locate that mt4setup.exe file on your download folder.

- Fill the checkbox to confirm your installation agreements. After then, click next. Additionally, you can change the MT4 installation directory by clicking the Setting button.

- Wait until the installer finished downloading all the required files. When it's done, click the Finish button.

Voila, now you're done with the basic installation!

Continue Reading at Demo Account For Foreign Exchange Beginner: Simple How To's

Each broker has various types of services that they can offer to clients. Below is a list of questions to determine the most suitable broker based on its demo platform:

- How can I place a stop or limit order?

- Can the orders be set automatically or at the time of entry?

- How do the spreads on the platform vary over time?

- What is the typical spread?

- What is the lot size I can trade (0.01, 0.1, or 1 lot)?

- Can I mix and match the lot sizes?

- Is customer service reliable even if my internet connection is down?

Generally, good brokers for demo trading have notable regulatory licenses, good reputation among clients, long-time experience in the business, and a wide choice of tradable assets.

Continue Reading at Forex Demo Account: The Good, the Bad, and the Brokers

- The speed of execution: If the trades are executed quickly and without any, this is a good sign of the quality of the brokerage services.

- The spreads: Lower spreads are generally better, meaning traders will pay less in trade fees.

- The commissions: Lower commissions are generally better as traders will keep more profits

- The platform: The platform should be easy to use and navigate and offer all the features traders need to trade effectively.

- Customer support: If traders have any questions or problems during their demo trading, they should be able to get help from the broker's customer support team quickly and easily.

Continue Reading at How Long Should You Trade on Demo Account?

The foreign exchange market basically works like other traditional markets. Simply put, to make a profit out of it, you have to offer something at a higher price than its original value. Well, that's easier said than done. To better illustrate it, we'll make a demonstration.

Take a look at the picture above. It's a chart depicting the Forex rate change in EUR/USD pair. As you can see, the forex rate went down from the end of September to November. During that time, you can make a profit by pressing the sell button to open a position. Let's say you open the position at 1.12500 by one full lot on 26th September. If you manage to hold your position from that day to 18th November 2016, you'll successfully close a deal that's worth about USD6,720!

But remember, simulation is the keyword. Whatever you're going to do here can't reflect 100% actual live account trading conditions. That's because there are some things that one can only experience in live trading sessions.

Continue Reading at Demo Account For Foreign Exchange Beginner: Simple How To's

Most forex brokers provide demo accounts for free to their clients. Below are some forex brokers with the best demo accounts:

- IC Markets: Available in all account types, platforms, and all instruments.

- OANDA: Allows CFD trading account and test trading strategies under real market conditions.

- Exness: Offers vast opportunities for different types of traders.

- XM: Avaliable for all XM Real Account holders.

- Tickmill: Allow traders to try low spreads, fast execution & great trading conditions risk free.

- OctaFX: Allow trader to open as many demo accounts as they want.

- Pepperstone: Provide real market pricing and can be offered with up to 50,000 virtual funds.

- FBS: Available for all account types and instruments.

- eToro: Get a free $100,000 Practice Account upon joining.

Continue Reading at Forex Demo Account: The Good, the Bad, and the Brokers

Honestly, that's a hard subject to answer. Why? Because each individual is different from one another.

Let's say on rare occasions, you had randomly opened a position and somehow scored handsome profit. But in another, you had wished for the same thing, only to found that you have lost more. In that case, a better-educated trader will learn and adapt faster to improve his trades.

Alternatively, a better-motivated trader may persevere harder in the face of many difficulties. So, which one are you? Are you that smart guy who learns fast? If that's so, it may only take some weeks before you discover a consistent trading system that suits your strategy. Or, are you that motivated trader who persists against many bad trades? Well then, you may have to keep trading on a demo account until you know what to do with trade signals.

Continue Reading at Demo Account For Foreign Exchange Beginner: Simple How To's