Forex requotes can be pretty annoying, but it's actually not that hard to manage. Here's what you need to do to avoid forex requotes.

Whether you're a newbie or an expert trader in the field, forex broker requote is something you would most likely prefer to avoid since it can your success or even destroy your trade.

It can be more damaging, particularly to scalpers or day traders who trade in shorter time frames. Some even suggest that requote is an indication of a fraudulent broker. This is why some trading companies proclaim themselves as no-requote brokers to attract new clients.

To avoid undesirable situations, protect yourself from forex broker requotes by implementing these methods:

- Avoid volatile market hours

- Set SL/TP properly

- Enable maximum deviation in MT4

What does that mean? Before that, let's understand forex broker requotes first.

Forex Broker Requote in a Nutshell

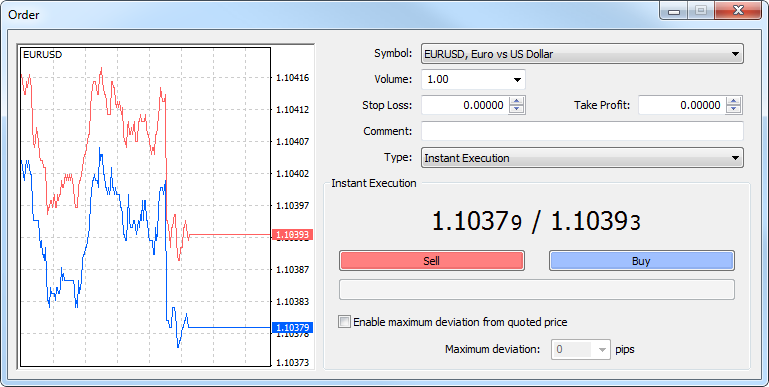

A forex requote refers to a broker's offer to execute a trade at a different price than your initial price. Say you plan to open a buy position of GBP/USD when the bid/ask price is at 1.3810/1.3826. Supposedly, the trade will immediately be executed at that exact price. But you get a requote so your order will beed and the broker will give you a new offer. Here's an example of how it looks like if you get a requote:

Requote basically indicates that the market price has changed, so you won't be able to execute your order at the price you want. Technically, the new price can either be higher or lower than your requested one.

However, in reality, the requoted price is almost bad for your trade, so requotes are generally bad for traders. It can ruin your trading plan and prevent you from getting the profits that you've expected.

Here's one possible scenario. You wish to open a buy position at 1.3810 but get requoted. The trade ends up executed at 1.3820, so if the price moves up but only reaches 1.3825, then you can only get 5 pips profit (1.3825-1.3820) instead of the supposedly 15 pips (1.3825-1.3810).

Protecting Yourself from Forex Broker Requotes

When trading with a reputable broker, it seems rather easy to dodge requotes. You can choose a broker that offers no requote trading conditions. As this is a huge feature that brokers are often most proud of, it won't be difficult to find the claim on some brokers' websites.

However, the truth is that forex requotes are not that simple to get rid of. When the broker's server is overloaded with too many orders, requotes will still occur. But does that mean the broker lies for giving no requotes? Not necessarily. These brokers can set specific software to avoid requotes, but the order execution time is usually longer. Therefore, choosing a no requote broker comes with its own consequences that you need to think about.

Apart from that, there are several other things that you can do to avoid forex requotes, such as:

1. Don't Trade during Volatile Market Hours

Trading during volatile hours or after a massive news announcement is risky and definitely more complicated. Unless you're an experienced news trader with enough skill and experience to avoid requote, it's best to avoid entering the market during important news releases or major fundamental events that may cause extreme spikes in price movements.

2. Set Stop Loss and Take Profit

In addition to the entry level, exit positions can also be subject to forex broker requotes. It can be pretty impactful for the trade, considering that the closing position could be executed at different prices than expected. Therefore, it's important to set the stop loss and take profit beforehand and not modify or change them once a trade is already executed.

3. Enable Maximum Deviation in MT4

If your MT4 broker offers a maximum deviation feature, you can use it to avoid forex requotes. Maximum deviation is the limit you're willing to take when the trade doesn't go as planned. If your broker allows it, you can check the "Enable maximum deviation..." option and set the maximum price deviation limit for each trading position.

Let's say you set the maximum deviation limit at 3 pips, it means that the maximum difference in the requoted price will be 3 pips from the actual real-time price. An open sell at a price of 1.4165, for instance, will not be offered a requoted price lower than 1.4162.

It is clear that maximum deviation does not necessarily eliminate requotes. Nevertheless, it somewhat limits the maximum difference of price that you can tolerate. Traders who actively trade in high market volatility usually use this feature. They understand that requotes are sometimes unavoidable, so they try to manage them with this particular tool.

How does Requote Happen?

Essentially, when you place an order, you set a particular price and press the button to execute the trade. The order won't be executed instantly but instead sent to the broker. This is why there's always a difference between the order and execution times even if you place a market order.

Since the forex market is fast-moving, there's always a chance that the prices will move in the time gap between your order and execution time. By the time the broker receives the order request, the market could have moved so fast that the price has moved from its initial point. Requotes let you know that the price has moved and allows you to decide whether or not you are willing to accept the price. As the requoted price is mostly worse than the one you ordered, brokers would ask you first before executing it.

What Causes Forex Requote?

If you wonder why requotes happen, it's important to understand that when you place an order in a broker, you ask them to execute the order at a certain price. The broker will then try to exceed that, but it may not always be possible for a variety of reasons such as:

1. High Volatility

You can get requotes almost at any time of the day, but not all the time. Requotes usually happens when the market is extremely busy and fast-moving due to huge news announcement or other events. The forex market normally moves pretty smoothly, but it can move in drastic ways during certain times. This makes it very difficult for the brokerage to place an order at the price that you've requested. If the broker finds that the price you've asked for is not available, they would adjust the numbers and warn you through requote.

2. Slow Internet Connection or Other Technical Issues

In order to be able to send the order immediately to the broker, you need a fast and stable internet connection. Using slow internet will increase the chance of getting requotes since there will be a after you click the order button versus the time when the broker receives this order. In forex trading, prices can move even in the slightest of time. The same goes for any technical issue you have that can the process.

3. Broker's Execution Delay

Depending on the broker's execution method, there could be a higher probability of requotes. In this case, the best brokers to are ECN brokers as they are generally considered to be capable of providing fast execution. Also, it's best to a broker that tends to support their clients with advanced trading technology, especially in regards to trading execution so they can reduce the time lag that may cause requotes.

The Bottom Line

Requotes may be damaging for the trades, but it is actually more common than you think. If you bump into a requote at some point, don't panic. Every platform shows hectic price movements during a high volatility market anyway, and you can always reject the offer if the requoted price is too unacceptable for you. It's also worth noting that requotes don't occur all the time and usually only happen to big trades.

However, too many requote, especially those without clear reasons, should alert you to consider changing your broker. The best option would be to choose a broker that offers no requote, has a good reputation and uses sophisticated technology. In the meantime, you can try following the tips that we have provided in this article. Hopefully, it can help you avoid requotes more effectively and make you trade better.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance