Brokers For Scalping Strategy

Many Forex brokers offer their traders a feature called scalping. Scalping is a trading style that specializes in profiting off small price changes, generally after a trade is executed and becomes profitable. It requires a trader to have a strict exit strategy because one large loss could eliminate the many small gains the trader worked to obtain. In short, scalping is a rapid trading style where trader looks for small profits, between 2-5 pips by opening and closing trades that last less than a minute over and over again.

The best scalping Forex brokers offer an opportunity to hold positions for mere seconds and use tight stop-loss orders on them. Some brokers allow scalping in general, but impose some restrictions on scalpers in form of additional commissions, spreads or trade number limits. A list below will show you some brokers allowing scalping for the clients.

Scroll for more details

Additional FAQ

How could volatility work for scalpers?

Most scalpers focus on an extreme price movement in the forex market. They do not pay much attention to the actual market condition, because it only capitalizes on the price volatility. The main target is to benefit from the unbalanced demand and supply of the market caused by the lack of liquidity that may happen temporarily.

For example, when some important fundamental news causes the market liquidity to decrease and creates a significant gap between the bid and ask prices, a scalper would take advantage of the situation to gain profit. In this case, a scalper profits from the emotional reaction against the market condition.

Continue Reading at The Secrets of Successful Scalping Strategy

Why is one click trading beneficial for scalpers?

If you are a scalper, you always need to open and close positions in a matter of minutes. Now, let's think of placing a trade but there are too many details and options to fill on your platform.

You'll spend time setting up the requirements and by the time you're finished the price would move from your initial entry target. This might lead to missed opportunities that can be very frustrating.

Continue Reading at All You Need to Know About One Click Trading

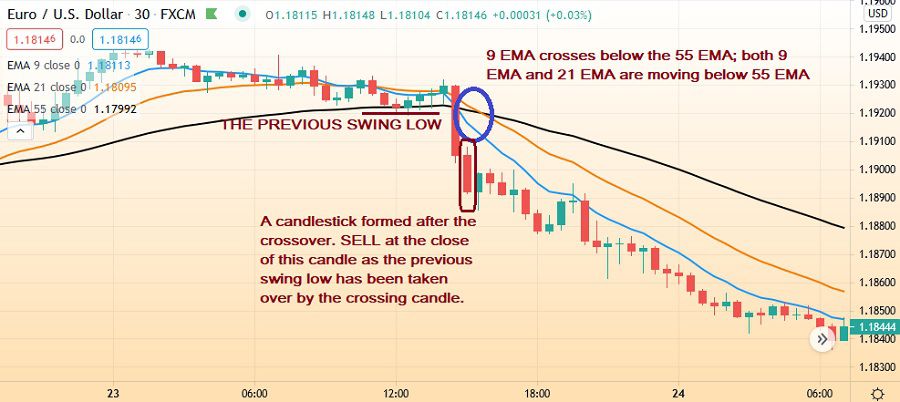

How to open a sell trade with 3 EMA scalping strategy?

- In this setup, we would be paying attention to the lowest swing low of the range because it needs to be broken to consider opening a short position.

- Make sure that the 9 EMA has crossed below the 55 EMA and that both 9 and 21 EMAs are below the 55 EMA.

- Sell the close of the candlestick following the moving average crossover.

- Watch for the swing low on the left side; we should only sell from the close of the candlestick that takes out the previous swing low.

Continue Reading at How to Use 3 EMA Lines for Scalping

How to take profit in triple EMA scalping strategy?

- The previous swing low levels can be used as the profit target for a trade that prioritizes selling while the previous swing high levels should be used as the profit target for a trade that prioritizes buying.

- The trader may decide to not use the option of a profit target but instead uses a trailing stop by placing it behind every price swing. As the trade moves in your favor, you can keep riding that trend as long as the possibility of extracting maximum pips out of the price swing remains. Using this option allows you to lock in your profits in case of sudden reversals.

Continue Reading at Simple to Follow: Triple EMA Scalping Strategy

Related Articles

- Which Indicator is Best for Scalping?

- Simple Scalping Strategy with EMA

- The Best EMA Crossover for Scalping

- Is ECN Account Good for Scalping?

- 5 Minute Scalping Strategies for Quick Profits

- Bitcoin Scalping Strategy for Quick Profit

- Simple to Follow: Triple EMA Scalping Strategy

- Best Forex Brokers For Scalping

Broker Categories

Minimun Deposit

Payment

License

Country

Established

Instruments Traded

Features