ThinkMarkets revenue sank 38% in 2021 to £2.74 million along with the declining client asset by £3.72 million.

FCA-regulated global branch of TF Markets, ThinkMarkets, saw a drastic drop in revenue in 2021. In fact, in 2020, the Australian broker experienced a 13% increase to £4.39 million. In 2021, ThinkMarkets UK revenue fell 38% to £2.74 million. On the profit side, it edged up from £279,000 last year to £305,000. Client assets also slumped for the second year in a row, by £3.72 million at the end of 2021 compared to £4.68m in 2020.

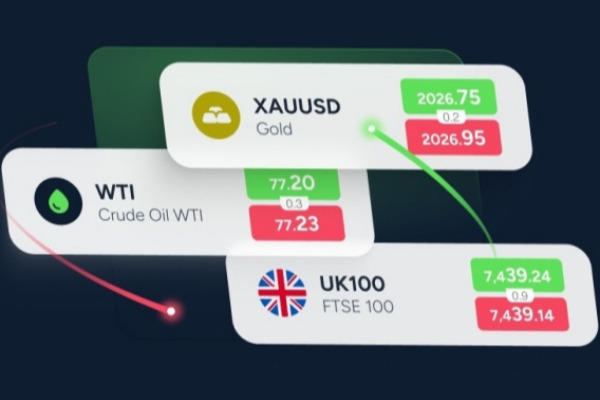

Apart from having 2 dual headquarters in Melbourne and London, the multi-asset company also has a licensed subsidiary in South Africa, which was established in 2019. ThinkMarkets is regulated by three tier-1L authorities FCA, JFSA, and ASIC to offer traders access to Forex, Indices, Cryptos, ETFs, Futures, Metals, Stocks, and Commodities markets.

Since 2010, the online broker has expanded its trading operations to successfully claim 550,000 users in 180 countries, including Indonesia, Egypt, UAE, and Bulgaria. In 2018, ThinkMarkets made headlines for allowing Australian investors to invest in the emerging financial technology market by conducting a £100 million IPO on ASX.

Last year, ThinkMarkets UK established an institutional service and a liquidity arm called Liquidity.net under the license of TF Global Markets (UK) Limited. However, it seems the company has experienced somes in going full business.

Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance