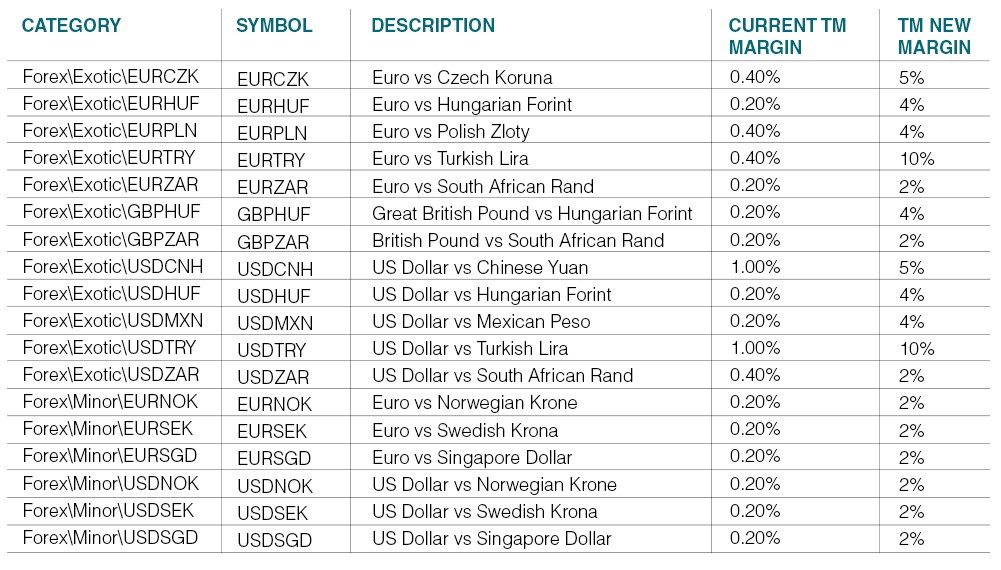

ThinkMarkets has raised margin requirements for some of its forex products including exotic pairs of EUR/CZK, GBP/HUF, USD/NOK, and more to protect clients from volatility.

The online broker ThinkMarkets has made changes to the trading conditions for certain foreign currency pairs which have been effective since April 2, 2022.

ThinkMarkets is an international company that positions itself as a multi-regulated broker with favorable trading conditions under the supervision of FCA, ASIC, FSA, and FSCA. So it's no wonder that ThinkMarkets broker always wants to offer the best trading conditions for its clients, one of which is by increasing margins.

The broker increases margins for 18 foreign currency pairs, mostly exotics and minors which you can read below:

ThinkMarkets relates margin changes to current market conditions to accommodate and protect clients from any possible volatile environment. In fact, increasing the margin is a common thing that brokers do. Many brokers determine how much money clients have to spend to trade using leverage, citing increased volatility in the market ahead of or during major events, such as the US election and the current geopolitical crisis.

Leverage can amplify market movements in volatile times but can cause heavy losses for clients and force a margin call to be triggered. The broker obviously doesn't want to be stuck in the position if the market swings rapidly during that period.

Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance