ThinkMarkets expands more than 4000 ETFs and shares on its ThinkTrader platform as the demand for more trading instruments increase lately.

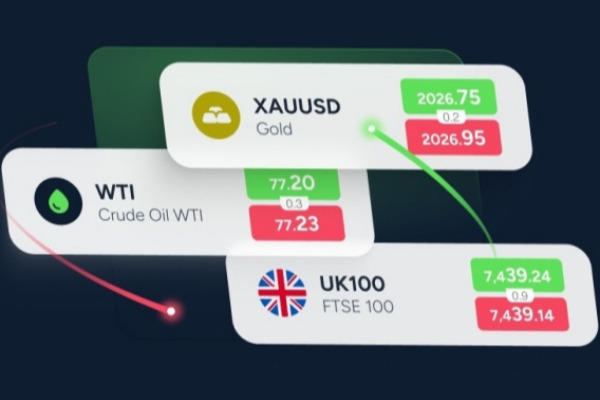

Now CFDs on ETFs have become one of the popular investment tools because they are considered cheaper than futures trading. CFDs allow traders to trade a basket of assets in a single transaction. This gives traders much better control over their exposure to margin risk. Therefore, ThinkMarkets is also expanding its service offering by including 2500 new CFDs on its ThinkTrader platform.

ThinkMarkets is a multi-licensed online forex brokerage firm regulated by the UK Financial Conduct Authority (FCA) and the Australian Investment and Security Commission (ASIC).

In a press release, the Melbourne-based broker said it had significantly added to its line of derivatives to the liquid stocks traded on the NYSE and NASDAQ. Over 4000 listed stocks and ETFs are now accessible to ThinkMarkets clients.

"Our primary mission has always been to satisfy our clients and offer them a wide variety of choices when it comes to the assets they want to trade. Moreover, we’ve strived to stay ahead and maintain a best-in-class offering which is constantly updated with more instruments that clients can choose from," the company said.

ThinkMarkets' goal of expanding its product line is closely related to meeting the client's need for exposure to regulated markets. The inclusion of new EFT CFDs not only helps expand clients' trading capabilities but also attracts more new traders who are looking for a wider range of trading options to diversify their portfolios. Not only ThinkMarkets, but many brokers have also added more assets in recent years with clients interested in actively trading new instruments.

Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance