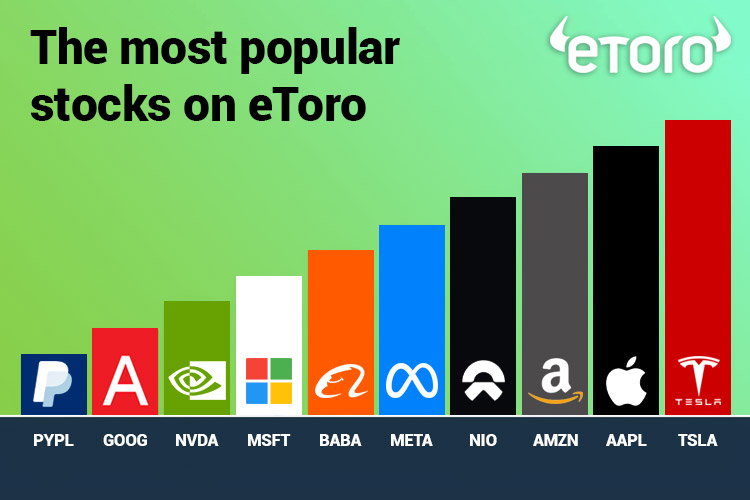

Between 2021 and 2022, there is little change across the 20 most popular stocks on eToro. Tesla, Amazon, and Apple were among the top.

The latest quarterly stock data from the social investing network eToro shows that retail investors appear to be keeping faith in big tech stocks despite the 2022 sell-off erasing hundreds of billions from their market value.

During the past year, two new firms have entered the top 20 list: Intel, one of the world's largest semiconductor chip manufacturers, and Coca-Cola, a popular defensive stock. Meanwhile, Virgin Galactic and Asenus, down heavily this year, dropped out of the top 20.

According to eToro's Global Market Strategist Ben Laidler, 2022 was an abysmal year for investments, and for some of our users, it was the biggest bear market they had ever encountered.

"However, we know from our latest Retail Investor Beat that the vast majority of retail investors have long-term time horizons, making them resilient to market cycles.

From what we can see, a lot of retail investors took a 'wait and see' position in 2022 rather than change their investment approach. The most popular stocks are still dominated by big tech despite this year's sell-off, but when we look at these names – Apple, Microsoft, Meta, Alphabet – we are talking about giants with fortress balance sheets, structural growth outlooks, and now cheaper valuations, which could have encouraged more to buy in. Certainly, companies which still deserve a place within a diversified portfolio," he added.

See Also: eToro Review

The meme stock Gamestop fell to 11th place after eToro users dropped its holdings by 17%. Also on the list, Netflix rose from 19th to 14th after posting a 59% share price increase in 2022, following a dismal H1.

Laidler adds: "The two additions to the top 20 list make sense. As an industry leader and now at a much cheaper valuation, Intel is well-positioned to benefit from any easing of the semiconductor downturn, while Coca-Cola can benefit from its dominance in the global soft drinks market. It might surprise some that Netflix is at the top of the list now. We are likely seeing the results of bottom fishing, with retail investors who bought during the summer months enjoying fairly significant gains. The company is trying to survive the current cost of living crisis with new programming, ad-supported subscriptions, and a crackdown on password sharing."

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance