The Swiss National Bank (SNB) statement regarding Credit Suisse helped improve market sentiment ahead of the European Central Bank (ECB) policy announcement later tonight.

Yesterday, the exchange rates of European currencies plummeted due to negative rumors about the financial condition of Credit Suisse, one of the largest banks in the region. However, the situation started to improve at the beginning of Thursday's (March 16) European trading session thanks to a supportive statement from the Swiss National Bank (SNB).

EUR/USD rose 0.4% to around 1.0620, and GBP/USD was up 0.3% to around 1.2090. USD/CHF also retreated by almost 1% as market demand for the US dollar as a safe haven in this turmoil decreased. Each movement has not fully recovered from yesterday's decline, but there are signs of recovery.

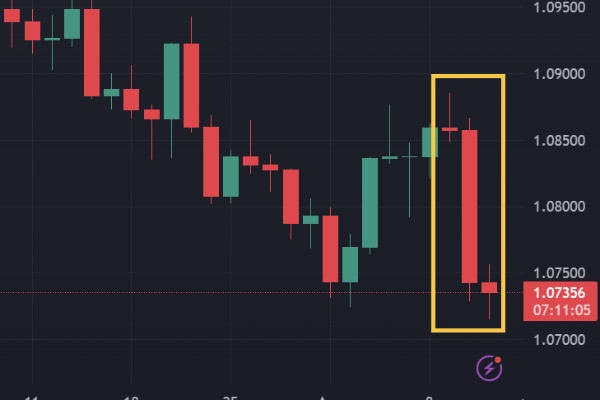

USD/CHF Daily chart via TradingView

USD/CHF Daily chart via TradingView

Earlier this morning, SNB announced that the Swiss financial market remains healthy. They emphasized that all banks in Switzerland must "meet or exceed minimum Basel standards", which means that the negative effects of crises or shocks can be absorbed well. SNB also denied rumors about Credit Suisse while expressing readiness to support Credit Suisse through additional liquidity if necessary.

"The SNB and FINMA are pointing out in this joint statement that there are no indications of a direct risk of contagion for Swiss institutions due to the current turmoil in the US banking market." The Swiss National Bank (SNB) and the Swiss Financial Market Supervisory Authority (FINMA) released a statement. "Against this background, FINMA confirms that Credit Suisse meets the higher capital and liquidity requirements applicable to systemically important banks."

Market participants await the announcement of the European Central Bank's (ECB) policy meeting results later tonight. Two important points in the announcement will be the focus of the global spotlight, namely the issue of interest rates and the ECB's view of the current condition of European banks and financial markets.

The European currencies risk slipping again if the ECB does not raise interest rates by 50 bps as promised. There is also a bearish risk if the ECB signals the prospect of smaller interest rate hikes due to the worsening condition of banks and financial markets.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance