Global trading broker ThinkMarkets introduces a new PAMM available to all partners and customers. Traders can allocate funds to money managers to earn profits.

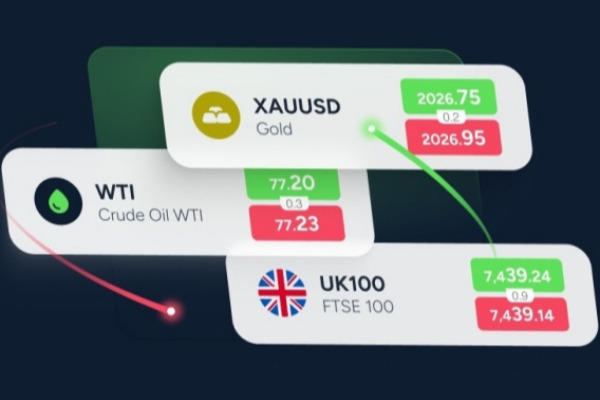

As trading on the forex market developed, traders were allowed to allocate funds according to their individual preferences, including the possibility of passive profits using a PAMM account. To meet the growing needs of traders and investors, Australia-based multi-asset online broker ThinkMarkets has launched a new PAMM (Percentage Allocation Module Management) available to all partners and customers.

The platform offers innovative and intuitive advanced reporting capabilities, flexible pricing options, and 100% asset allocation accuracy. This feature allows traders to allocate funds to money managers who trade through the new customizable platform.

Clients can also select a money manager from a dynamic leaderboard and view real-time performance data on each performance. Money managers also get access to trader funding and invest to earn better profits.

ThinkMarkets Co-founder, Faizan Anees, commented, "ThinkMarkets is committed to leading by offering attractive products backed by a reliable technology infrastructure and strong customer service. We have grown ThinkMarkets business significantly in emerging markets. The new PAMM product is the latest in a series of exciting initiatives over the next 12 months to improve the product."

Since its founding in 2010, ThinkMarkets has grown to become an internationally regulated online FX and CFD trading broker serving 450k global customers. The broker provides a professional platform on over 4000 trading instruments with 14 offices in several countries.

Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance