The US jobless claims data has raised market concerns before the NFP release tonight, causing the forex market to be sluggish in the Asian session.

The US dollar index (DXY) recorded a significant decline in the New York session following the disappointing release of US unemployment claims data. Its position was then pressured into 105.20 in the Asian session on Friday (March 10th), while the movement of major currency pairs was constrained in a very narrow range, almost flat.

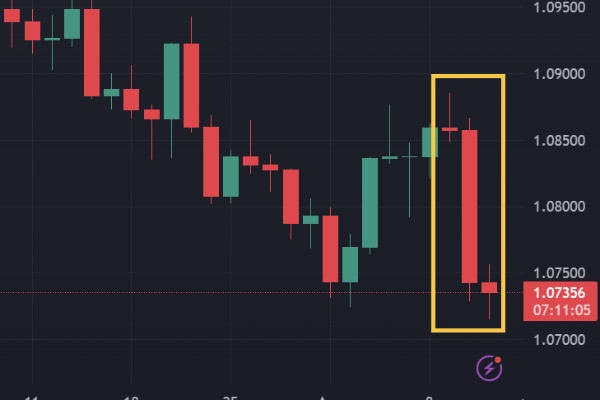

DXY Daily chart via TradingView

DXY Daily chart via TradingView

The number of jobless claims in the United States increased by 21k, reaching 211k for the week ending on March 4, 2023. The increase is larger than the consensus estimate and the largest in the last five months.

This surge in jobless claims has led some traders to question the speculation of a more aggressive Fed rate hike. Fed Funds Futures yesterday showed a nearly 70% chance of a 50 bps rate hike by The Fed in the FOMC meeting on March 21-22, but the chances have now dropped to only 54%.

Market participants will look at other US employment data releases tonight, including Non-farm Payroll (NFP), wage growth, and the unemployment rate. The consensus is that payroll will only rise by 205k in February after skyrocketing to 517k in January. Average hourly earnings are expected to grow by 0.3% (Month-over-Month), the same as the previous month. Meanwhile, the unemployment rate is expected to remain stagnant at 3.4%. Any actual data surprises that are far beyond estimates can have explosive impacts.

Nick Cawley, Senior Strategist at DailyFX, noted in his latest column, "Market forecasts for new jobs have been exceeded in the last 10 reports, and some by a fair margin. In July 22, the actual number of 372k was over 100k higher than the market forecast, on August 22 the 528k actual was over double expectations, while last month's 517k was 330k above market expectations. A further heavy beat will send the US dollar higher going into the weekend."

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance