IG broker sees a change in its clients' trading habits due to several risk-off sentiments including high inflation, rising interest rates, and the Russia-Ukraine war.

IG broker started to see a change in investment habits among its clients this year due to a lot of risk-off sentiment lately, such as rising interest rates, rising inflation rates, and geopolitical conflicts between Russia and Ukraine.

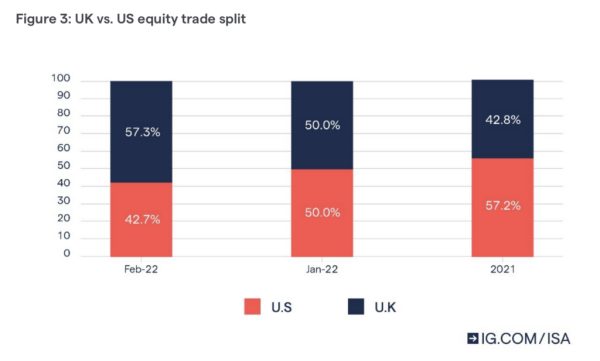

One of the main changes in the company was seen in the increasing popularity of UK stocks compared to US equities. In February, UK equities accounted for the bulk of new trading. While on the other hand, the trade split versus US stocks continues to increase in favor of UK stocks. Evidently, last month's trade split registered a figure of 57.3% for UK stocks across 2021, while US equities shortly follow at 57.2%.

The rising popularity of UK stocks is supported by their recent better performance compared to US stocks. Since the start of the year, the FTSE 100 is up 8.4% from the S&P 500. In recent months IG has started to see a shift to share value more broadly as IG investors have started to move away from riskier assets.

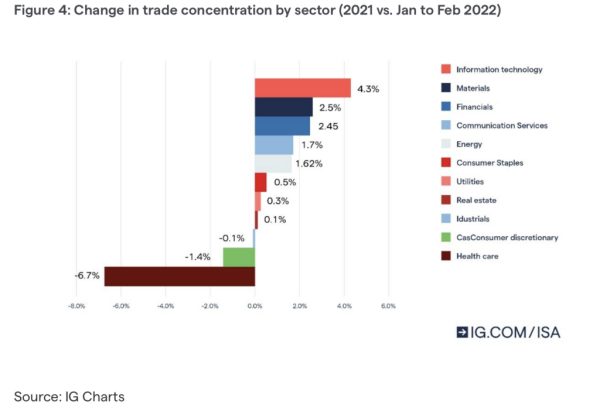

The brokerage clients appear to be investing less in shares of healthcare companies during the first two months of 2022, while investments in traditional value sectors such as materials and finance grew by 2.5% and 2.4%, respectively.

Tech stocks, widely recognized as a promising sector, rose 4.3% during the period. However, this can be explained by several major tech companies reported earnings in the first two months of 2022.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance