Exness published their Own Funds report on April 26th 2016, in accordance to factual findings conducted by Deloitte. As stated, Exness as cyprus regulated broker, recorded their Own Funds at US$83.78

Exness published their Own Funds report on April 26th 2016, in accordance to factual findings conducted by Deloitte. As stated, Exness as Cyprus-regulated broker, recorded their Own Funds at US$83.78.

Since January 2014, Exness manifested themselves as the only retail broker with their trading volume to be audited by independent firm, Deloitte, reiteirating their public image of transparency in forex industry.

On Behalf of Transparency

Exness Group's CEO, Petr Valov, said, Every client and partner of Exness Group should have access to factual information about the Group's financial indicators. When we announce our leading positions in the industry, we support it with figures confirmed by independent experts.

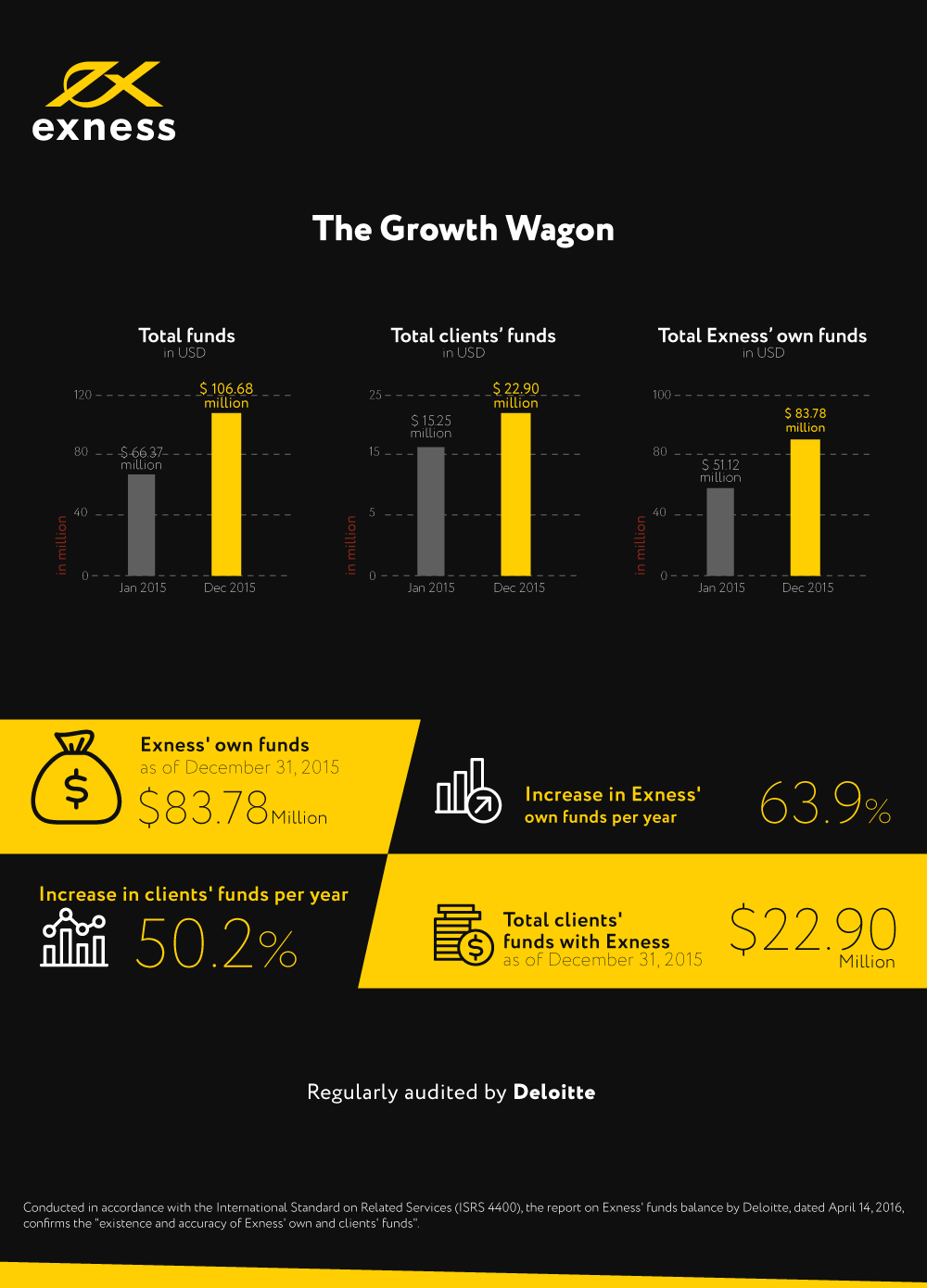

In less than a year (from January 20 to December 31, 2015), Exness' combined funds grew by 60.7% to US$106.68 million, with a 63.9% and 50.2% increase in own and clients' funds respectively. Summarized, Exness Own Funds at US$83.78 milllion as the majority (78.5% of combined funds) to client's fund at US$22.90 million.

The details are shown to graphic table below:

Since established in 2008, Exness has been facilitating trades on forex, CFD, and futures for clients from all around the world. The Russian-based broker has spread its wings to the Europe with licenses from Cyprus CySEC, and slowly extends its market to China and Southeast Asia. Aside of that, Exness is also registered in German BaFin, Spain CNMV, Italian CONSOB, New Zealand FSPR, and others. Further information about Exness could be accessed in the following page.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance