Brokers With the Highest Volume for GBP/USD

High volume usually refers to the number of lots traded in currency pairs. There is some advantage of trading in high volume. For example, it minimizes volatility, reduces liquidity risk, and tends to have a smaller spread. Trading with high volume also offers more opportunities for traders. That is why a lot of experienced traders choose forex broker with the highest volume .

Choosing the right broker is very important. A different broker might have different rules and this might affect your trading activities. If you trade on GBP/USD, you can refer to this list of brokers with the highest volume for GBP/USD.

Scroll for more details

What are the most important US news for GBP/USD traders?

As in any other currencies traded directly with US Dollar, economic reports from the US will influence GBP/USD as well. This is especially notable for Federal Reserve (the Fed) decisions. The UK's central bank, the Bank of England (BoE) has a relatively lower influence than the Fed.

In this sense, here are some high-impact US news you should note if you want to trade GBP/USD successfully:

- FOMC Meeting and the subsequent Fed's interest rate statement.

- FOMC Meeting Minutes release (two weeks after the meeting).

- The Fed/FOMC Chairperson speeches.

- US GDP

- US Nonfarm Payrolls report which also includes wages and unemployment rate.

- US Retail Sales

Continue Reading at Tips on How to Trade GBP/USD

How does GBP/USD correlate to EUR/USD?

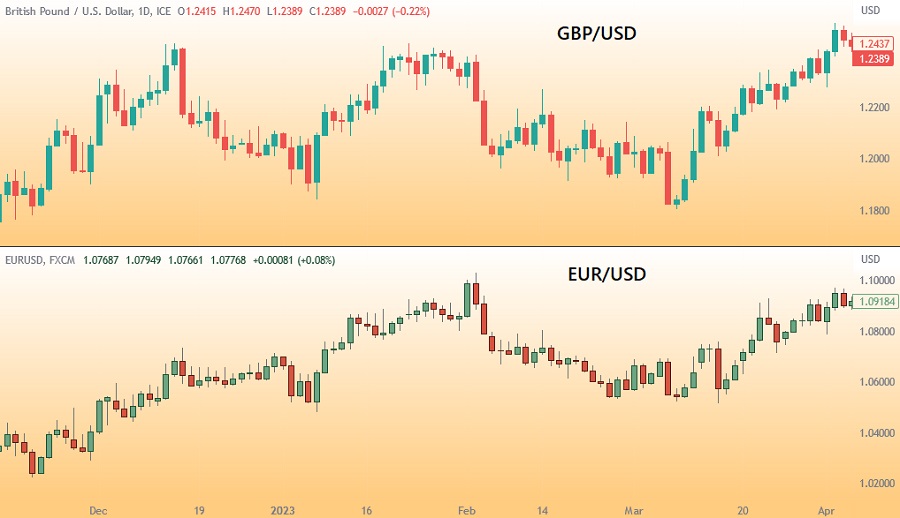

The GBP/USD is often recognized as having a positive correlation with the EUR/USD pair. Here's a chart that shows the positive dynamic between GBP/USD and EUR/USD on a daily chart:

Many traders use this correlation to hedge both pairs. The strategy involves opening positions in GBP/USD and EUR/USD at the same time. If the hedging strategy is applied to offset the losses, traders tend to trade GBP/USD and EUR/USD oppositely. But, if the hedging's purpose is to optimize the potential profit, traders would trade GBP/USD and EUR/USD in the same direction.

Continue Reading at Tips on How to Trade GBP/USD

What happened to GBP/USD during Brexit?

The Brexit vote caused GBP reach its lowest point in 30 years of forex historical data. In fact, it is the weakest GBP/USD exchange rate since 1985. The main difference is that in the 1980s, it was more about the Dollar's strength, while in 2016, it was all about the Sterling weakness.

Another historical moment called "the Sterling flash crash" happened in late 2016. During this time, the Pound moved 6% lower against the Dollar in just a matter of minutes. While the exact cause is still debatable, such an event was enough to shake the currency market for a while.

Continue Reading at An Admirals' Guide to Trade GBP/USD Successfully

When is the best time to trade GBP/USD?

In the forex market, London and New York sessions are the two busiest markets every day. These circumstances boost GBP/USD volatility, particularly during London and New York trading sessions (3-10 AM EST).

As such, the best time to trade GBP/USD is the overlap session between Europe and US trading hours, although you can technically trade the pair anytime from the market opening on Monday to the market closing on Friday (24/5).

Continue Reading at Tips on How to Trade GBP/USD