The leading exchange Binance offers liquidity farming in its service, which is one of the greatest alternatives to earn passive income in the crypto world.

There is no doubt that decentralized finance (DeFi) is growing bigger and faster these days. The blockchain-powered ecosystem has attracted many investors and enterprises in the past few years to join the community and capitalize on the benefits of the new emerging solution. Long story short, decentralized finance has opened up endless possibilities for using and managing digital assets in our everyday lives, including banking, loans, mortgages, asset trading, and more.

DeFi can be used in many different ways and is able to handle both simple and complex transactions. One of the most interesting approaches in DeFi projects is called liquidity farming. It is a pretty popular solution within the DeFi space to obtain passive income in crypto assets. If you want to learn more about it, the leading crypto exchange Binance actually offers a liquidity farming service for its users and it's definitely worth checking out.

Contents

What is Binance Liquidity Farming?

Liquidity farming basically offers a way to earn passive returns simply by depositing your crypto assets in liquidity pools. It is based on the Automated Market Maker (AMM) principle, which is a type of protocol that's responsible to maintain consistent liquidity as the transactions don't include any counterparties in it. Just like any other DeFi swap, it consists of several liquidity pools and each pool contains two or more digital tokens or fiat assets.

There are two main components in liquidity farming, namely liquidity pools and liquidity providers. Liquidity pools are essentially the smart contracts that drive the DeFi ecosystem. Meanwhile, liquidity providers are the users or investors who have locked their assets into the pool in exchange for flexible interest and transaction fees. The pools include digital tokens which can be utilized by users to purchase, sell, borrow, lend, or swap. The usage of these assets incurs fees, which are then given to the liquidity providers according to their shares in the pool.

Types of Liquidity Farming

The following are two types of liquidity farming offered by Binance:

- Stable: Uses a hybrid constant function of the AMM model to facilitate the transaction and pricing between two stable tokens. It can also provide a low slippage trading experience as the prices of the two tokens in the pool are determined by the exchange rate fluctuations of the stablecoins. In addition, the rewards are more stable than the other type.

- Innovative: This type uses a constant mean value AMM model to facilitate the transaction and pricing between two digital tokens or fiat assets. The prices are determined by the exchange rate fluctuations of the tokens, so the rewards for liquidity providers can fluctuate more greatly.

Important Terms in Liquidity Farming

- Price: The price swap between the pair in the pool. The final price is based on the proportion of the pair in the liquidity pool.

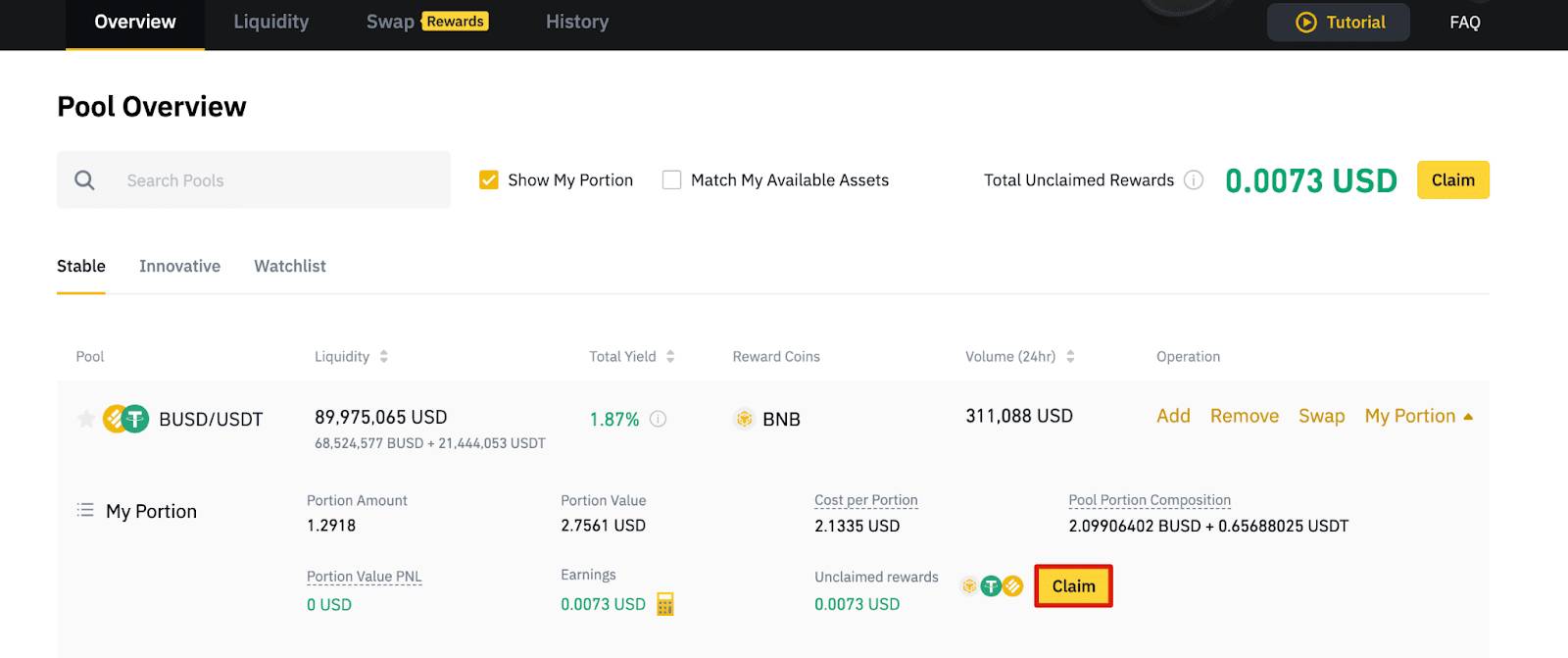

- Current Pool Size: The composition of the tokens in the pool. When you add assets, you will add them in the proportion to the composition.

- Portion: The pool portion that you're expected to get after adding liquidity.

- Portion value: the total value of the portion acquired after adding liquidity. Portion value = the number of two tokens in the portion composition at real-time exchange rates (in USD).

- Portion of the pool: The estimated shares of the pool after you add liquidity. The portion fluctuates depending on the pool's liquidity at the time of your order.

- Pool Portion Composition: The current composites of your portion. The number of the assets will change in real-time based on the current pool condition.

- Cost per Portion: Calculated after you add some tokens into the pool (priced in USD).

- Portion Value PNL: Calculated based on the current portion value minus the total cost price of the portion. Portion value can be influenced by a number of factors, such as exchange rates, token price fluctuations, and impermanent losses.

- Total Yield: The APY that depends on 24-hour volume annualized. The total return is basically the sum of the liquidity rewards and trading fees. The liquidity rewards are calculated hourly and the fees are based on the 24-hour trading volume. Total yield = 365 (rewards in the past 24 hours + trading fees in the past 24 hours) / total pool value in the past 24 hours.

How to Use Binance Liquidity Farming

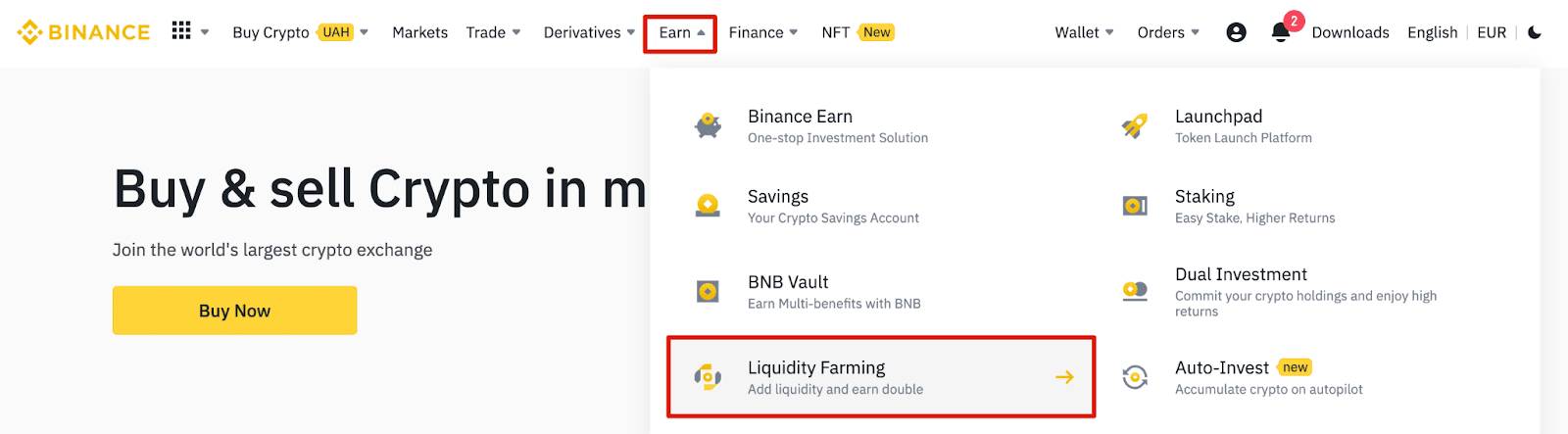

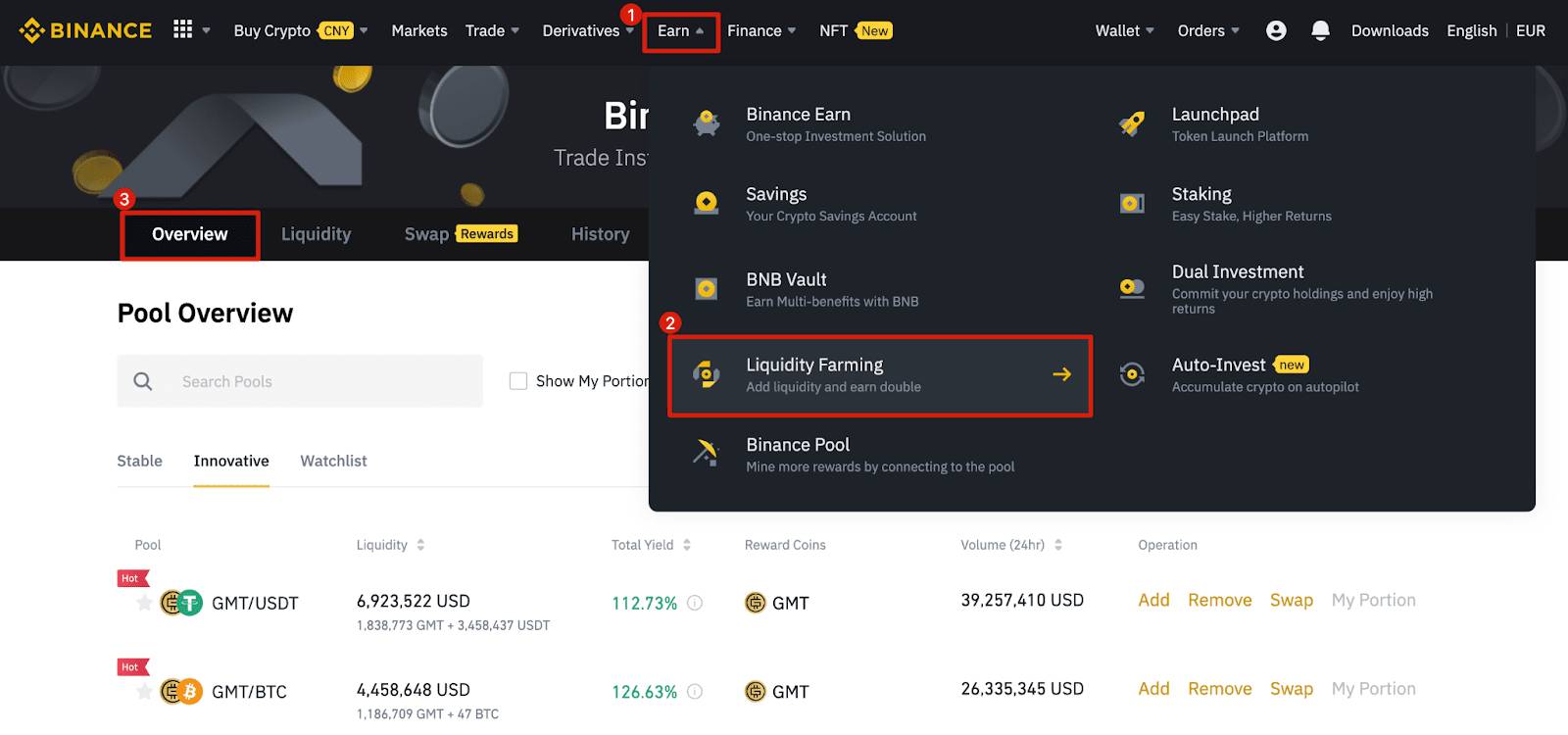

1. Open the Binance official website and log in to your Binance account. On the homepage, click "Earn" and choose "Liquidity Farming".

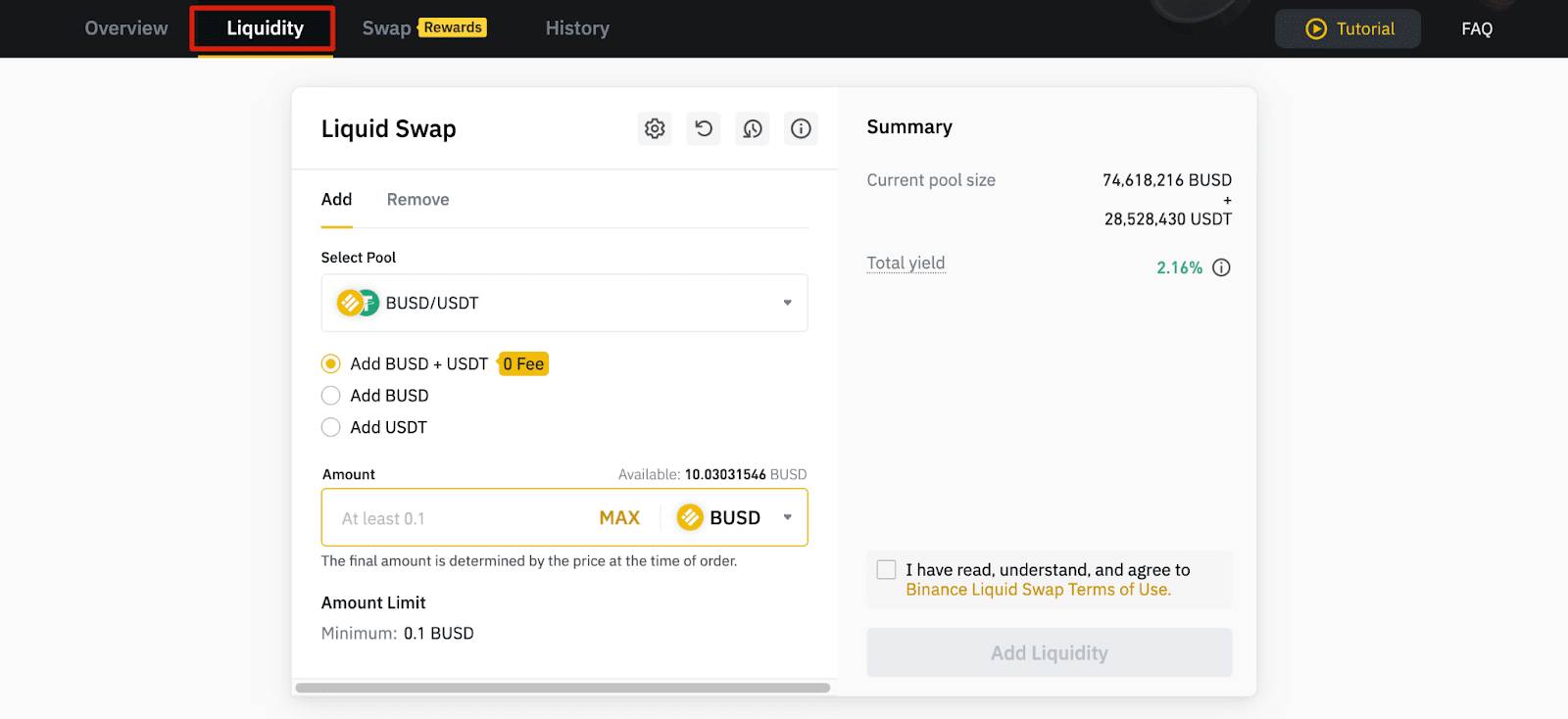

2. Click "Liquidity" to enter the liquidity farming page.

How to Add Liquidity

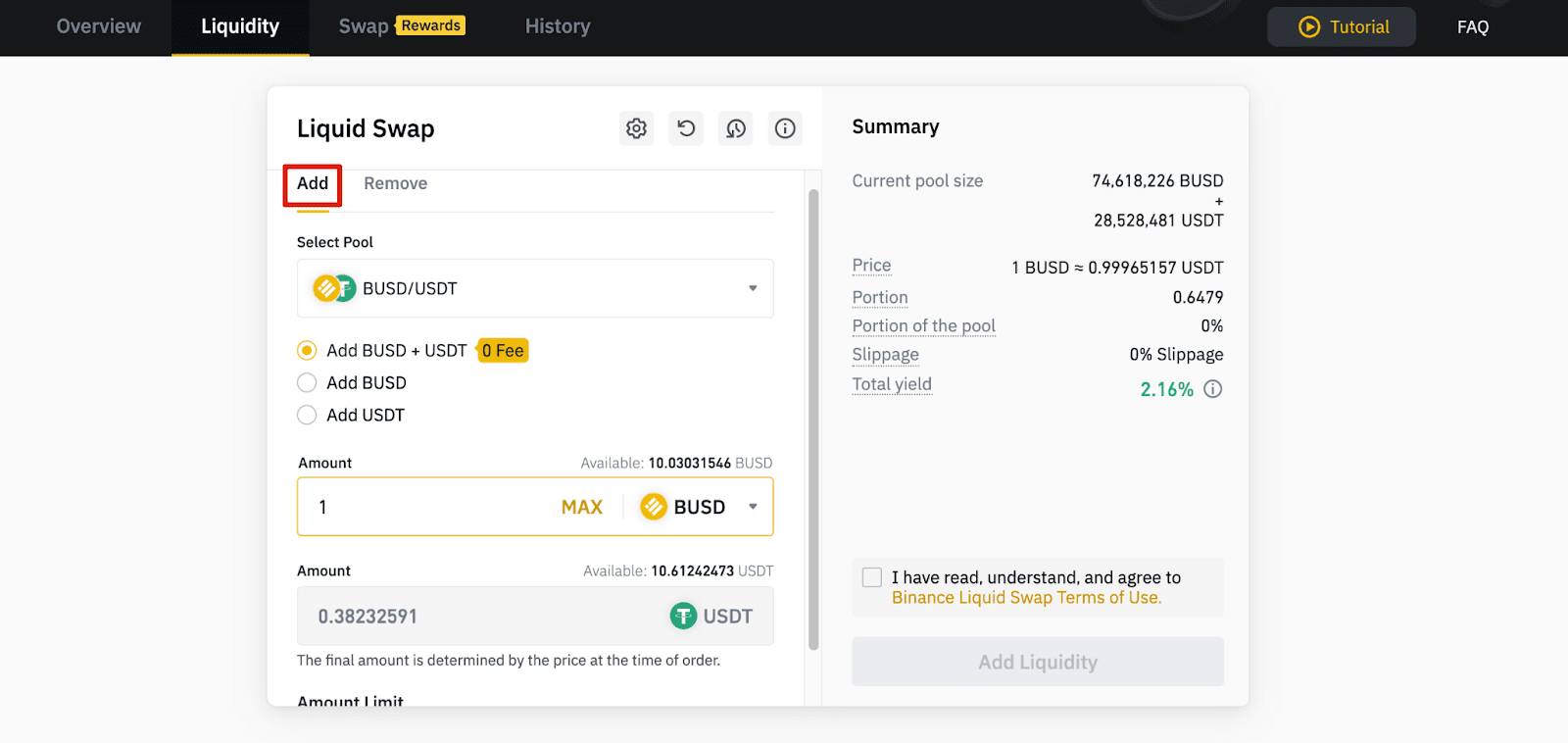

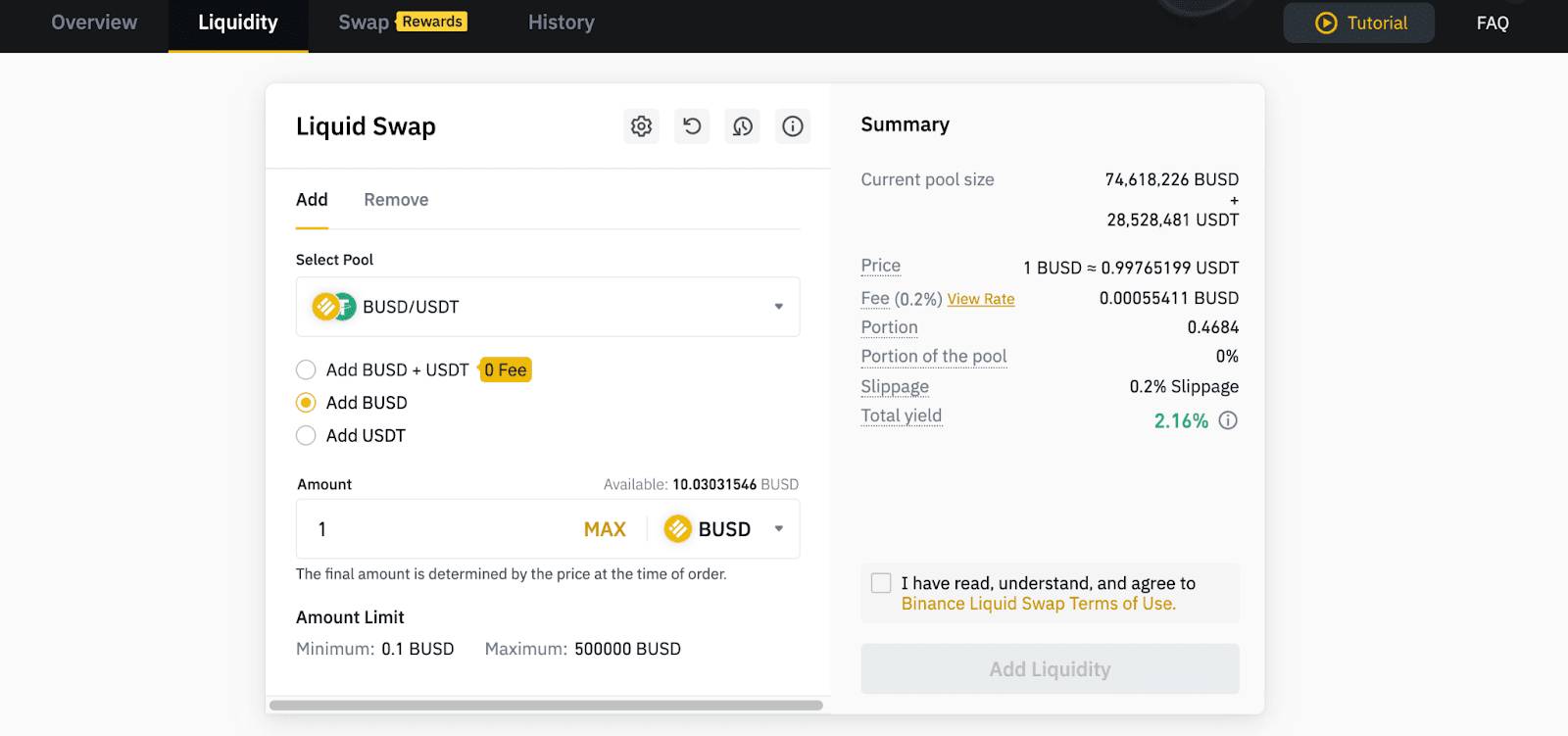

1. Click "Add" on the Liquidity box, choose the liquidity pool, and choose the pool type (dual or single token).

If you choose to add liquidity to a dual token pool, you simply have to enter the amount of the first token and the system will automatically display the number you need for the second token. Note that the final number is determined by the token price at the time of your order.

On the other hand, if you choose to add liquidity to a single token pool, you should just enter the amount of the token and the system will automatically convert it to the underlying token based on the current portion composition ratio in the pool. Keep in mind that there are going to be transaction fees during the conversion. Also, large transactions might have a higher chance of getting slippage and loss.

2. Make sure to read and agree to the terms and conditions, then click "Add Liquidity" to confirm your request.

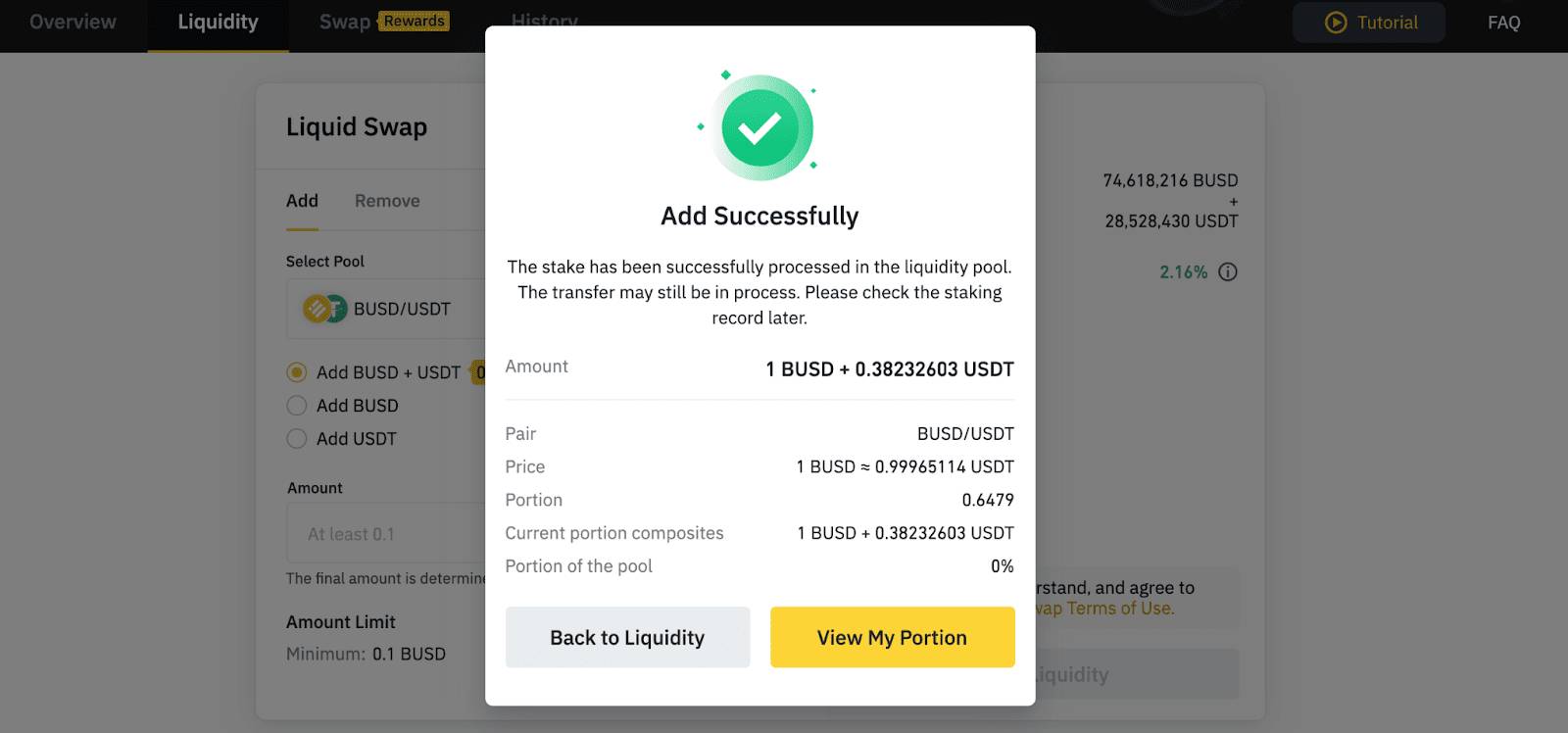

3. Once your tokens are added, you'll see a pop-up message that shows detailed information about your order, including the token amount, the pair, the price, your portion, your current portion composition, and your portion of the pool.

4. You can click "View My Portion" to see the total portion that you have as well as your liquidity history.

How to Remove Liquidity

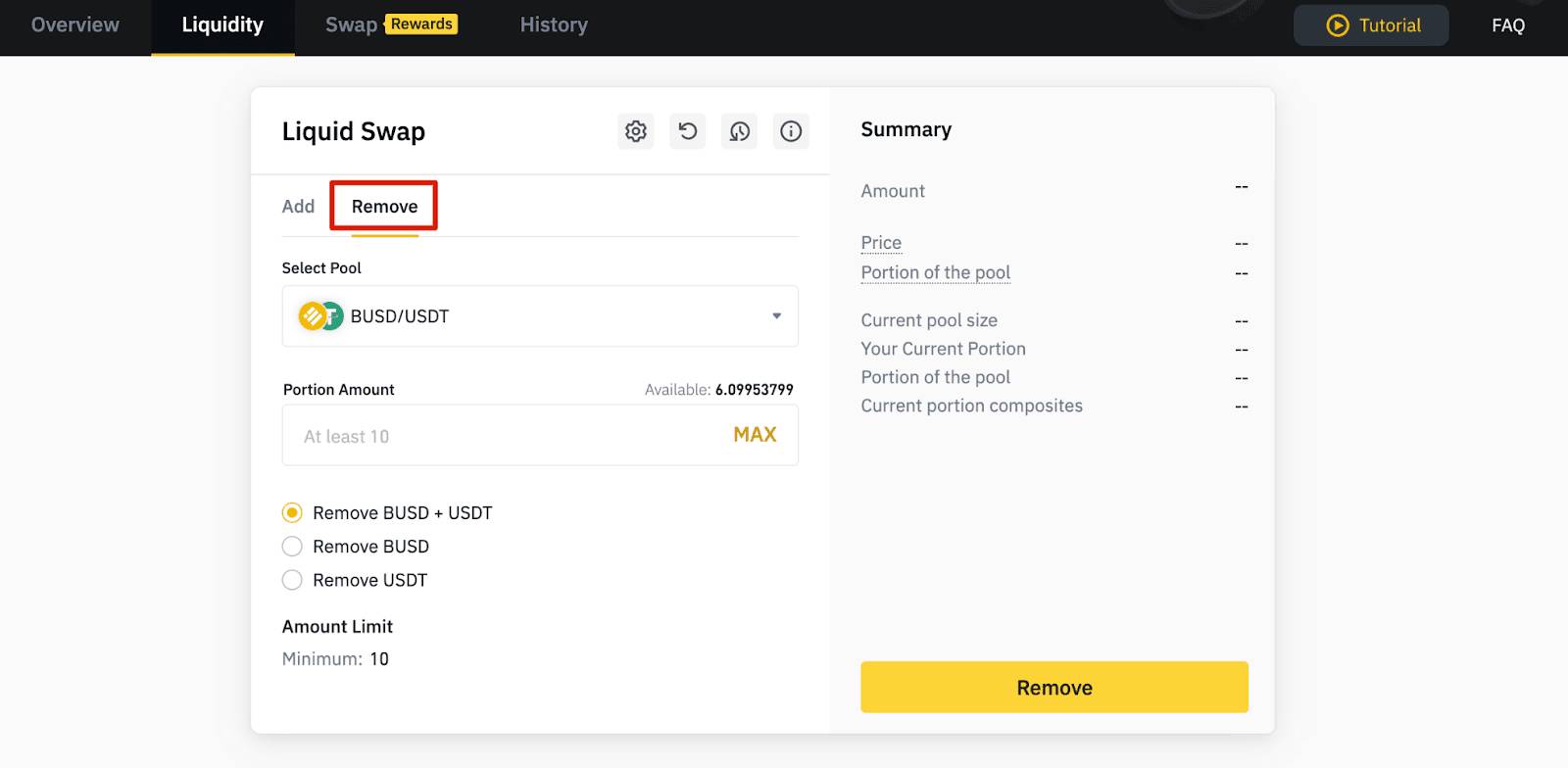

1. On the liquidity page, click "Remove".

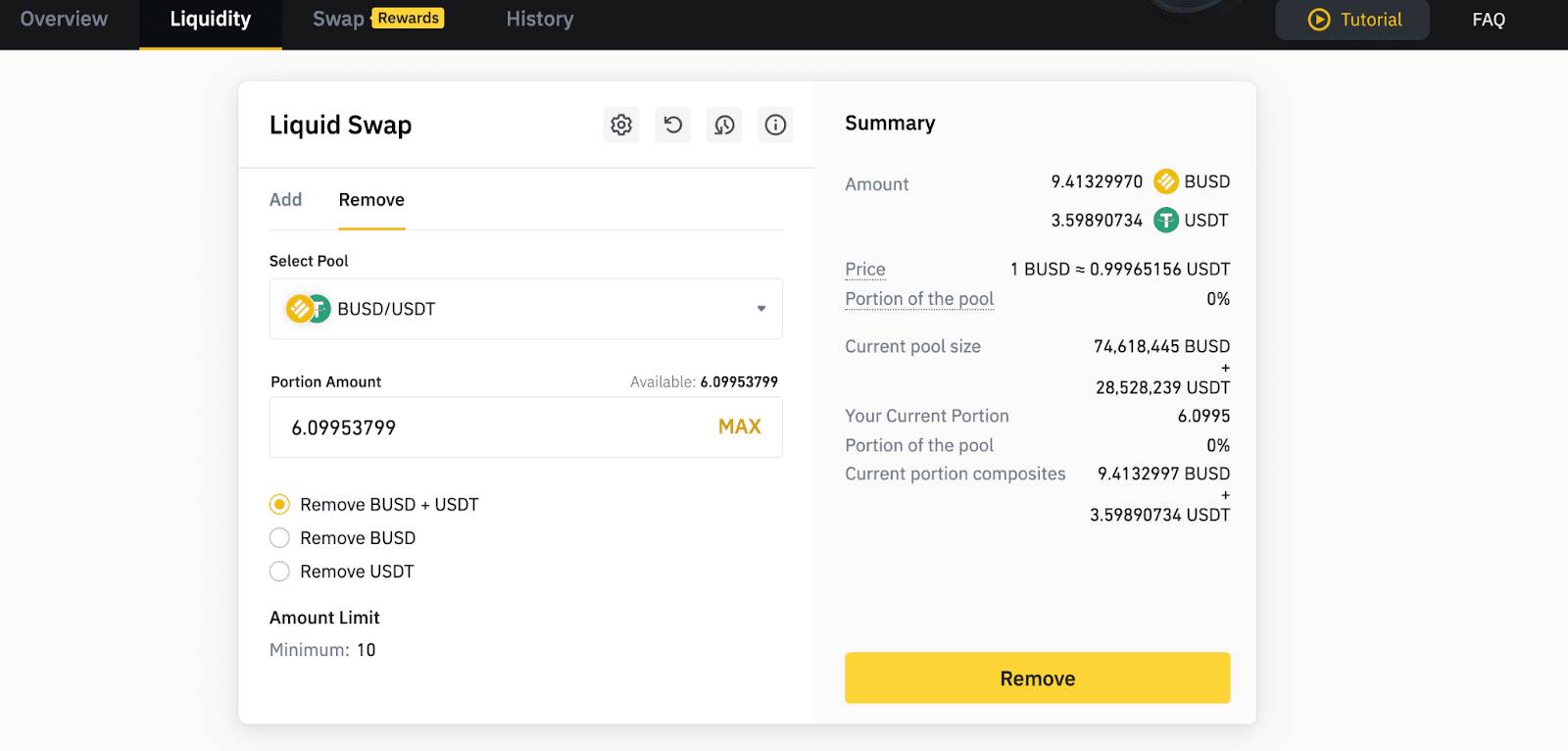

2. Choose the liquidity pool that you wish to remove and then enter the amount along with the type of token that you want to redeem. The system will then automatically calculate the result based on the current price, portion of the pool, the pool size, and your current portion. Before you confirm the order, make sure to read the details carefully and then click "Remove".

Please note that if you choose to remove two tokens, the system will automatically send the tokens back to your spot wallet based on the pool portion and portion composition. But if you choose to remove a single token, the system will convert the two tokens to the one you chose and the fee will be calculated during the conversion process.

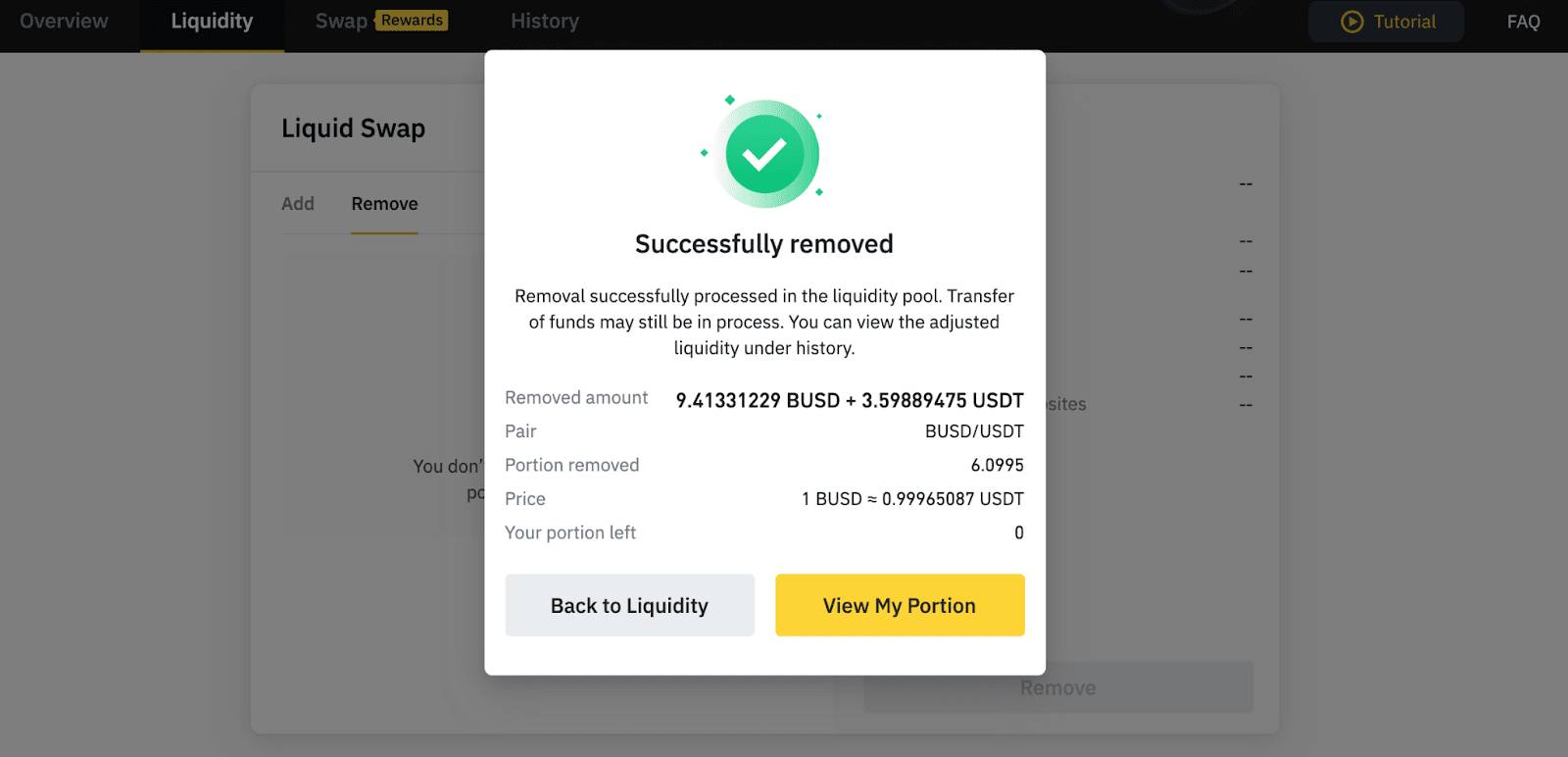

3. Once you remove the tokens, you'll see a pop-up message about the details of your order, including the amount removed, the pair, the portion, the price, and the remaining portion (if there's any).

The Risk of Slippage

It's important to understand that liquidity farming is not free of risk. You may get losses because of several reasons, such as the fluctuations in the token prices that could affect the value of portions, the frequent adding or redeeming of tokens, and the possibility of getting slippage.

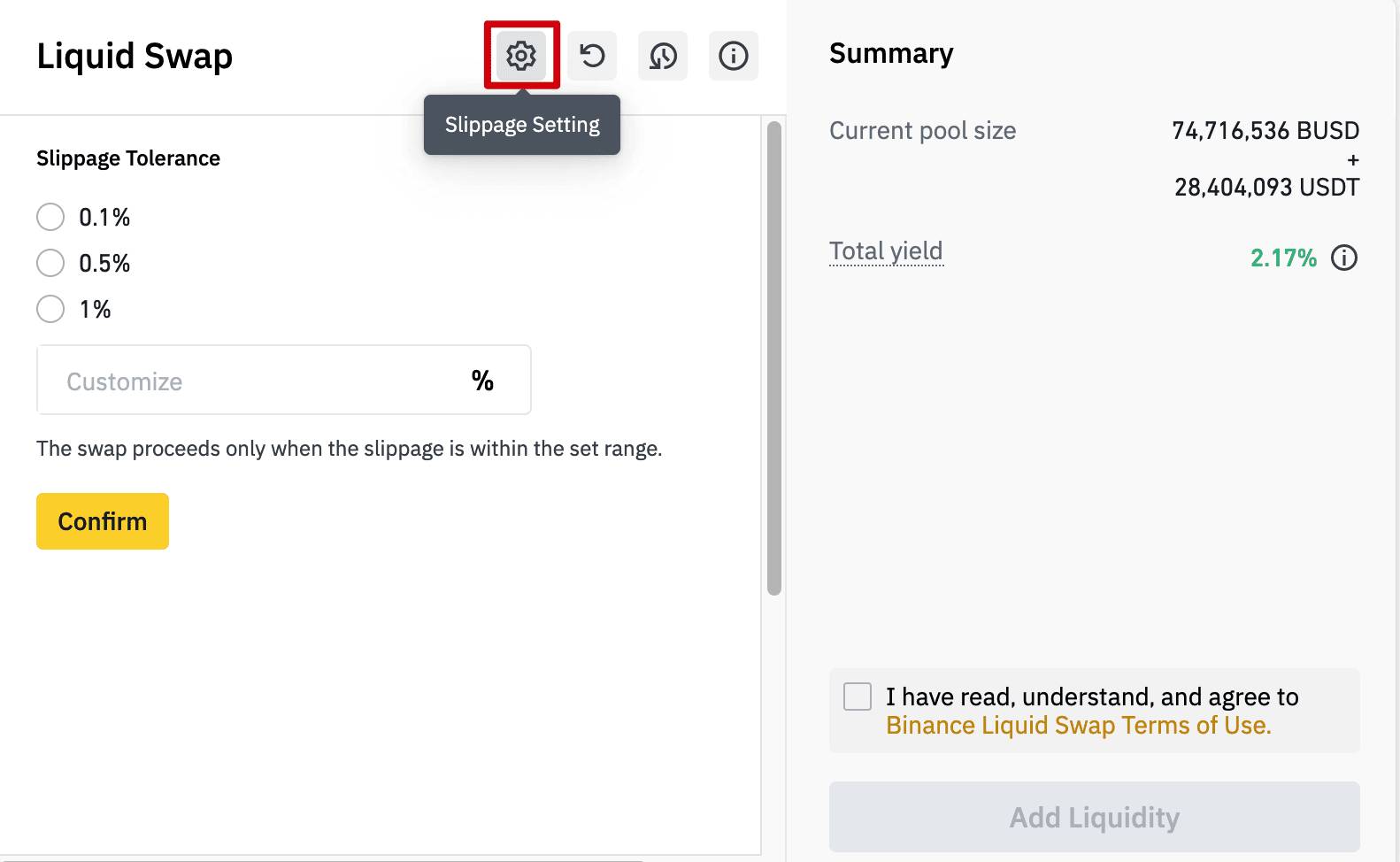

Slippage is the difference between the order price and the actual trading price. On Binance, you can set your slippage tolerance on the Liquidity Farming page. Once you define your setting, you will only be allowed to swap when the slippage is within your tolerance range. In other cases, if you make a huge transaction and the slippage is considered too big, the system will send you a warning before you confirm the swap.

How to Claim Liquidity Rewards on Binance

By putting your tokens in liquidity pools, you'll get rewards that are updated hourly. With just a few clicks, you can redeem your earned tokens and send them to your spot wallet at any time you want.

To claim your rewards, here are the steps that you should follow:

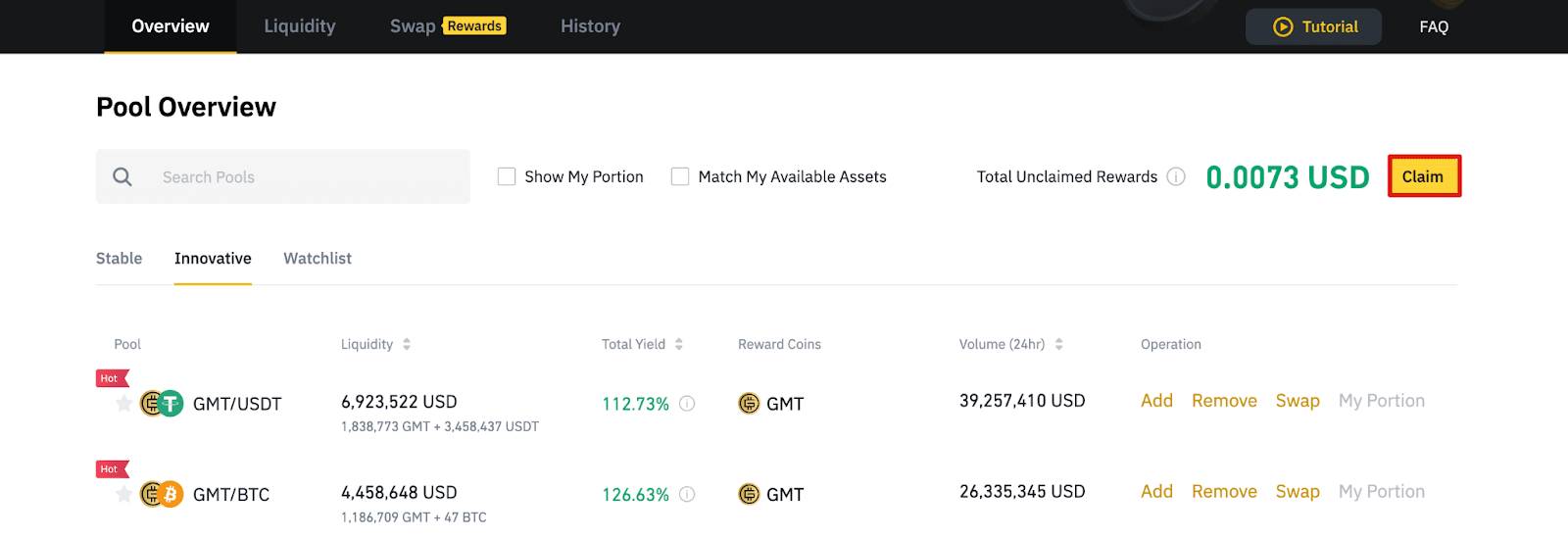

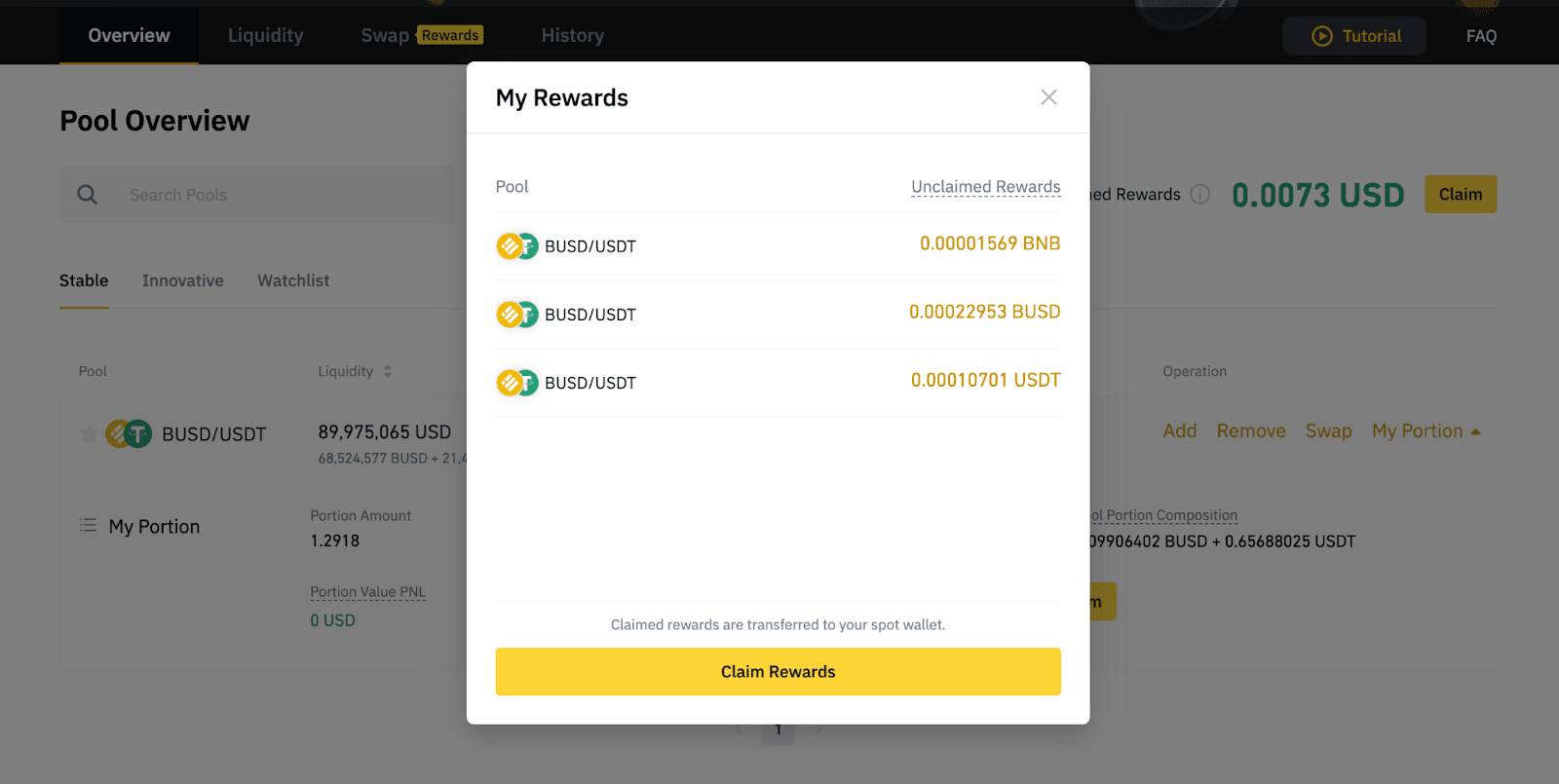

1. Log in to your Binance account and enter the liquidity page. Click "Overview".

2. You'll see the "Total Unclaimed Rewards" on the screen, and then click "Claim" to claim your rewards.

3. Confirm your order by clicking "Claim Rewards".

In a nutshell, liquidity farming is a great alternative to earn crypto passive income. Just by locking your assets in liquidity pools and becoming a liquidity provider, you can get significant rewards every now and then. However, you should also be aware that this type of investment is not guaranteed to always be profitable. Liquidity farming can make you lose money from getting slippage and is also vulnerable to crypto hacks, so you need to be extra careful and manage your risks well. Remember that cryptocurrency is a volatile asset and drastic changes can heavily affect your investments.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano

11 Comments

Choo Juri

May 18 2022

Is there a minimum token requirement for liquidity farming?

Divany

May 18 2022

Choo Juri: Most of the time the answer is yes, but the amount depends on the exchange and currency pair that you're using. For instance, you'll need to invest at least 0.1 BUSD on Binance in order to participate in liquidity farming for the BUSD/USDT pair.

Miranda Bells

Jul 2 2022

What’s the difference between staking, yield farming, and liquidity farming?

Divany

Jul 18 2022

Miranda Bells: Staking means pledging your digital assets to blockchain networks that use Proof-of-Stake algorithm. The purpose is to support the blockchain and validate transactions in exchange for interest.

Yield farming allows crypto holders to earn passive income by depositing your crypto coins to a liquidity pool. The aim is to provide lending services for other users and to get as much yield as possible.

Liquidity farming focuses on providing liquidity to DeFi protocols. To participate, users need to provide their crypto assets into the liquidity pool of DeFi protocols for crypto trading.

Maribeth

Jul 22 2022

Is Binance safe for liquidity farming?

Divany

Aug 15 2022

Maribeth: Don't worry, Binance liquidity farming is safe and very easy to do. It opens the opportunity for users to earn passive income simply by depositing their assets in liquidity pools.

Federico

Jul 31 2022

How many liquidity pools that Binance provides?

Divany

Aug 15 2022

Federico: According to the website, currently there are at least 97 liquidity pools available on Binance and more projects are already lined up in the future.

Gareth

Aug 1 2022

Which liquidity pool or protocol is the best for liquidity farming?

Divany

Aug 15 2022

Gareth: Some of the top and stable liquidity pools available on Binance are BTC/WBTC, BUSD/USDT, and BUSD/DAI. Check Binance's website for further details.

N

Aug 23 2022

I'm curious about the claim rewards from liquidity farming. Do I have to claim them out and re-submit into liquidity farming? Or I can just leave it there for a long term?