Donchian channels can be a powerful trend indicator for finding potential entry and exit signals. The following guide will outline how to use it.

Many indicators are available to help forex traders make decisions while trading. One of them is an indicator that can find the direction of trends and price reversals, such as Donchian Channels.

The main concept of this indicator is to identify significant dynamic support and resistance levels and determine when prices will experience a breakout. This allows traders to measure market volatility and identify trends more easily.

So, how to use and optimize Donchian Channels for forex trading?

What Are Donchian Channels?

Donchian Channels are a technical indicator to help identify trend direction and potential entry-exit points. This indicator was discovered by Richard Donchian in 1960 and has remained popular among traders and investors.

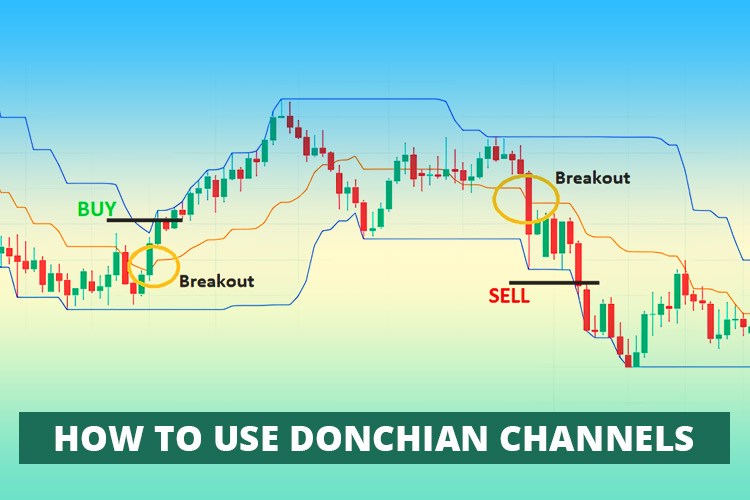

Donchian Channels consist of three lines that surround the price:

- The upper band shows the highest price for a certain period.

- The lower band shows the lowest price for the same period.

- The middle band is the average of the upper and lower bands.

One of the main advantages of Donchian Channels is their ability to show a relatively stable price range. This makes it very helpful for traders in managing risk by generating potential trading signals.

What Do Donchian Channels Show?

Donchian Channels can show a pair's highest and lowest price range over a certain period. In general, this indicator can provide two important pieces of information:

- Volatility: When the channel is narrow, it indicates relatively low volatility. Conversely, a widening channel indicates that volatility is high.

- Potential Breakout: When the price touches the upper or lower band, it can be a potential breakout signal to open Buy or Sell positions. In this case, the upper band can be used as a Buy signal and the lower band as a Sell signal.

How to Install Donchian Channels?

Installing Donchian Channels usually depends on the trading platform being used. Here are the general steps to install Donchian Channels on the MetaTrader 4 trading platform:

- Open the price chart of the pair to be analyzed.

- Look for the "Indicator" or "Add Indicator" option on the trading platform.

- Find Donchian Channels among the available indicator options and the indicator.

- After ing Donchian Channels, traders may need to adjust the default indicator settings such as periods and line colors.

- After adjusting the settings, click "Apply" or "OK" to add Donchian Channels to the price chart.

- How to Trade with Donchian Channels?

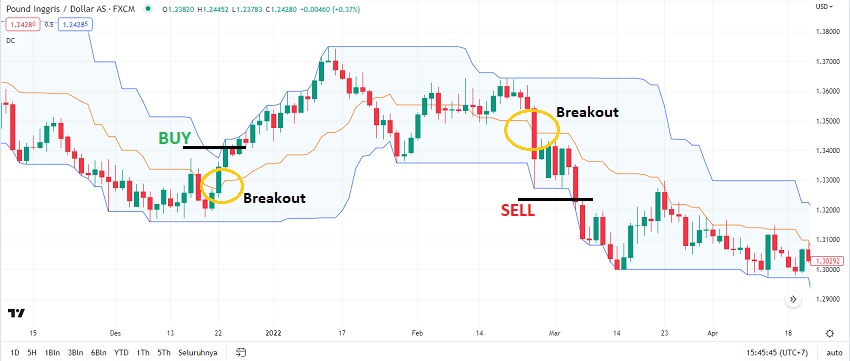

As explained above, this indicator can detect volatility and breakout signals. Traders must look for a candlestick breakout from the middle line and confirm it through the price movement that touches the upper or lower band. Touching the upper band indicates a Buy signal, while the lower band indicates Sell.

For a clearer picture, please see the image below.

How to Trade with Donchian Channels?

As mentioned above, this indicator can detect volatility and breakout signals. Traders need to look for a candlestick breakout from the middle line and confirm it through price movements that touch the upper or lower line. A touch on the upper line indicates a Buy signal, while the lower line indicates Sell.

For more clarity, please refer to the image below.

When Should You Exit a Trade?

Some traders will use the middle line as a reference point to exit in the opposite direction of their entry.

For example, if the price touches the upper line and the trader opens a Buy position. The position is safe if the price moves above the middle line. But if the price drops below the middle line, it could signal that the trend is about to reverse. So, the trader can exit at this point.

Key point: Traders can use touches on the upper and lower lines as signals to buy and sell, respectively. When the price crosses the middle band, it can be a reversal signal between bullish and bearish conditions.

Tips for Using Donchian Channels for Forex Trading

Donchian Channels are one of the technical indicators that are easy to use. However, to get maximum results, also consider the following tips:

- Identify the trend: Donchian Channels can be used to identify the trend in the market. If the price moves above the upper Donchian Channel line, then the market is in an uptrend, while if the price moves below the lower Donchian Channel line, then the market is in a downtrend.

- Identify support and resistance levels: Donchian Channels can also be used to identify support and resistance levels. The upper Donchian Channel line can be considered resistance, while the lower Donchian Channel line functions as support.

- Combine Donchian Channels with other indicators: Donchian Channels can be used with other technical indicators, such as RSI or MACD, to confirm the trend direction and potential reversal.

- Choose the right time frame: It is important to use the appropriate time frame when using Donchian Channels. A larger time frame can provide more accurate signals but also requires patience for confirmation.

- Pay attention to volatility: Remember that Donchian Channels tend to give false signals during periods of high volatility. Therefore, pay attention to market volatility and avoid trading during highly volatile periods.

- Set a stop loss: As with all technical analysis tools, it is important to use a stop loss when using Donchian Channels. Stop loss can help protect positions from large losses if the signals provided by Donchian Channels are wrong.

- Perform backtesting and demo testing: Whatever trading system is created, testing it before using it live is very important. Perform backtesting first to understand what may work, then perform demo testing to practice it without risk. After proving profitable, traders can consider using it on a real account.

Conclusion

In conclusion, Donchian Channels can be a useful tool to help traders identify potential trading opportunities. This indicator can also help traders identify trends and market reversals earlier.

However, traders should always remember that Donchian Channels are just one indicator and insufficient to be used alone. Pairing Donchian Channels with other indicators are recommended for more accurate results. Moreover, it is important to remember that Donchian Channels are just one of many indicators, and their use should be tailored to each individual's trading strategy and style. Backtesting strategies with Donchian Channels are highly recommended before trading with real accounts.

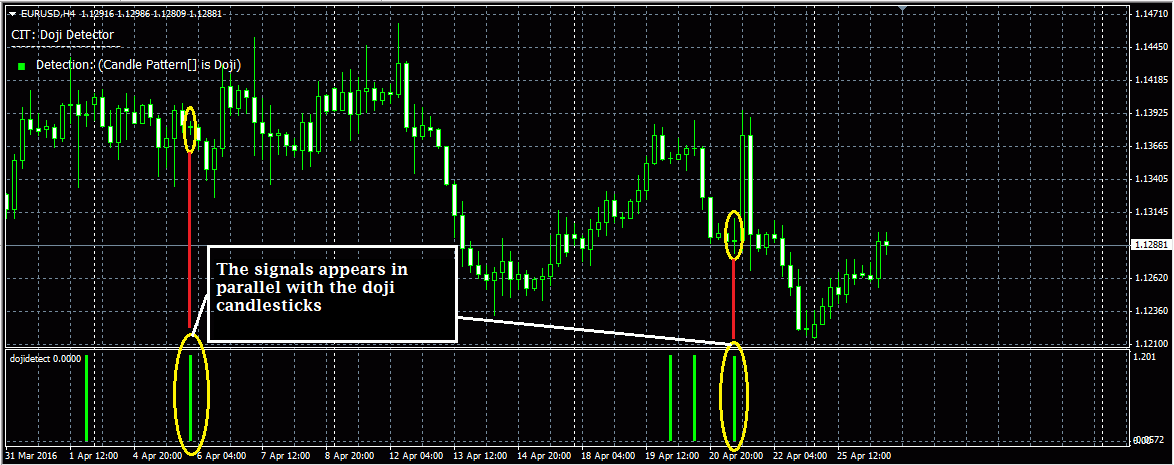

Using only one indicator might give traders less accurate signals. In addition to other indicators, traders can also combine indicators with candlestick patterns.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance