Tickmill adjusts its account types based on trading experience. Therefore, you could choose the right account type in this broker by your skills and style of trading.

Tickmill is a forex and CFD broker that offers competitive pricing to its clients. It offers a wide range of products that traders can choose from which include forex, indices, cryptocurrencies, CFDs, metals, and bonds. As a trader, you might be wondering if Tickmill is even appropriate for you and what's the right account type to choose.

Tickmill is a safe broker that is regulated by well-known financial bodies which ensures that the trading funds of its clients are protected. The broker currently offers three major account types to cater to the needs of its clients according to their expectations and level of trading experience. Let's get to know each.

Tickmill is an award-winning global ECN broker, authorized and regulated by the Financial Conduct Authority (FCA) in the UK, CySEC in Cyprus, and the FSA of Seychelles. Founded in 2014, it offers its retail and institutional clients various trading services with a prime focus on forex, stock, commodities, CFDs, and metals.

For traders who prioritize the value of spreads in broker selection, Tickmill provides excellent services with low spreads, starting from 0.0 pips.

The London-based company has a mission to provide clients with the best possible trading environment, so clients can focus on trading and become successful traders. One way to reach its mission is to offer a fast-execution of 0.15s. With this facility, it's no wonder that Tickmill gets the 2019 Best Forex Execution Broker award by the CFI.co Awards. Also, Tickmill received the achievement as Best CFD Broker Asia 2019 by International Business Magazine, the Best Forex Broker Asia, and the Most Transparent Broker 2019 by Forex Awards.

After registering in Tickmill, traders can choose the most ideal asset among 60 currency pairs that they can trade. If traders aren't sure yet to open a real account, Tickmill recommends learning to trade through a demo account.

There are also educational features such as Webinars, Seminars, Ebooks, and Video Tutorials. All of these facilities can be used by traders to increase knowledge about trading and the financial market as a whole. If traders already have enough knowledge, they have a greater opportunity for earning profit consistently.

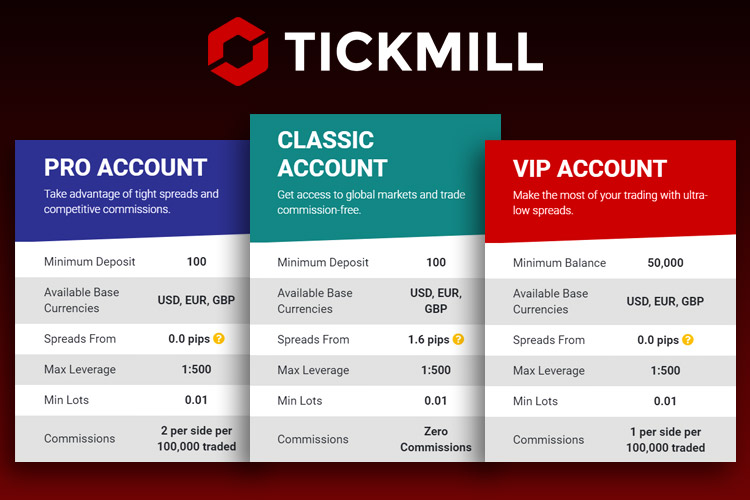

For traders registered in real accounts, they can choose between provides three types of accounts, including Pro Account, Classic Account, and VIP Account. Traders can open positions with a minimum order of 0.01 Lots. This applies to all types of accounts.

The company provides recommendations for traders who are still confused when choosing an account. For example, for novice traders, Tickmill encourages clients to choose a Classic Account. It offers optimal conditions with fast order execution while enabling traders to use virtually any trading strategy. Additionally, the account is trade commission-free so traders only pay the bid/ask spread. Other than the 3 main accounts above, Tickmill also provides an Islamic account (swap-free).

The downside is, trading with Tickmill will only enable traders to use MetaTrader 4 as their offered trading platform. Although not much if compared to other brokers, the Tickmill platform provides a user-friendly and highly customizable interface, accompanied by sophisticated order management tools to help traders control positions quickly and efficiently.

The convenience of trading on Tickmill is enhanced by the existence of One-Click EA integrated on MT4. Traders will get Stop Loss and Take Profit calculations automatically. On top of that, Tickmill provides a VPS hosting for automated traders that can't be bothered with technical problems such as troublesome internet connection.

They offer several third-party research solutions, including Autochartist, which is a popular pattern-recognition software that uses automated technical analysis to make forecasts and generate trading signals. Autochartist is available both in Tickmill's web portal and as a platform plugin for MetaTrader 4.

As a Tickmill client, a trader can deposit and withdraw with a variety of payment methods, including Visa, Mastercard, bank transfer, and Skrill. Tickmill accepts deposits and withdrawals in 4 currencies, which include USD, EUR, GBP, and PLN.

Overall, Tickmill is a competitive broker in spreads and provides a safe trading environment with its regulated entities in three different jurisdictions. Although their trading platform is not outstanding, the analytical tools they present to equip traders' needs are considered by retail broker standards.

Tickmill Classic Account

This is aimed at traders with little to no experience as well as those with sufficient experience. It is the simplest account for accessing any of the financial markets offered. The account provides traders with optimal trading conditions and order execution that is ultra-fast and allows them to utilize any kind of trading strategy.

The Classic Account allows CFD trading on 62 currency pairs, stock indices, oil, bonds, major stocks, precious metals, and cryptocurrencies without commissions, while variable spreads start from 1.6 pips. The minimum balance is 100 USD and the maximum leverage is 1:500.

Tickmill Pro Account

This account type is suitable for experienced traders that are looking for advanced features to go along with optimal trading conditions. Similar to the Classic account, the minimum balance for the Pro account is also 100 USD. A maximum leverage of 1:500 is provided, and traders can enjoy spreads starting from 0.0 pips in this account.

However, unlike the Classic account, there is a commission involved in which traders are required to pay a fee of 2 currency units per side per lot in the base currency of the instrument being traded. For instance, if 1 lot of EUR/USD with a contract size of 100,000 EUR is being traded, then the expected commission per side will be 2 EUR or 4 EUR round turn (for both sides).

On this account type, Tickmill allows traders to place stop and limit orders close to market prices which is something that is not permitted by many brokers.

Where to Find the Information on the Official Broker Site?

- This information is reported per Apr 17 2024.

- We can not ensure if this offering is still available or remain the same in future.

- The broker announcement page may or may not exist anymore, You may explore Tickmill homepage and try to find "Promotion" section on the menu, footer, etc, to ensure the availability and validity of this promotion.

Tickmill VIP Account

This account type is exclusive as it is aimed at high-volume traders that are searching for competitive pricing and extra benefits. In contrast to the Classic and Pro accounts, the minimum balance for this account is 50,000 USD with spreads starting from 0.0 pips and a maximum leverage of 1:500.

There is also a commission involved for every trade with traders paying a fee of 1 currency unit per side per lot in the base currency of the instrument being traded. This is lesser than the commission for the Pro account. For instance, trading 1 lot of USD/GBP with a contract size of 100,000 USD, then the expected commission will be 1 USD or 2 USD round turn.

Which One is the Best?

Overall, the three account types share similar features in terms of leverage, base currencies (USD, EUR, GBP), an average execution speed of 0.20 seconds, market execution, and margin call/stop-out at 100%/30%. The same range of financial instruments offered by Tickmill is available across the three account types. All these similarities might make it difficult for you to make a choice among the three account types, but the most important factor to consider is your level of experience as a trader and your expectations from a broker.

Here's an easier comparison between Tickmill's account types:

| Features | Classic | Pro | VIP |

| 💰Minimum deposit | 100 USD | 100 USD | 50,000 USD |

| ⚖Leverage | 1:500 | 1:500 | 1:500 |

| 🔢Spreads | 1.6 pips | 0.0 pips | 0.0 pips |

| 💸Commissions | ❌ | 2 currency unit per side per lot | 1 currency unit per side per lot |

| 👨💼Suitable for | All traders | Experienced traders | High-volume traders |

See Also:

Conclusion

If you are a novice, then the Classic account type might be the best since there are no commissions and all you have to deal with are spreads which might be more straightforward. If you are an experienced trader and want some advanced features to go along with your trading while not having to fork out so much money to open an account, then the Pro account is for you. However, if you are a high-volume trader that wants competitive pricing and do not mind the relatively high minimum deposit requirement, then Tickmill's VIP account might just be the most suitable.

Tickmill is the brand name of Tickmill Ltd. which offers trading services with premium products and innovative technology. Superior trading conditions, ultra-fast execution, safety of client funds, and dedicated support are at the forefront of their offering.

20% Discount on Forex VPS

20% Discount on Forex VPS Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise

23 Comments

Jorge Mendes

Feb 1 2023

No, forget about the VIP account, because very few traders can trade with $50,000

Let's focus on Classic and Pro accounts for now. With the same minimum deposit, many traders can cover this minimum deposit. BUT, there is a big difference between the spread. Classic starts from 1.6 pips and requires no commission, while professional account starts from 0.0 pips but commissions are based on each side.

What is the best beginner account? I mean, I strongly disagree with the author who said that classic account is only for an inexperienced trader because the spreads are much higher. Why the author said that? And while the pro account is less expensive because the spread starts from 0.0. I mean by reading the article above, I think the trading fee to the classic account seems more expensive.

Rues

Feb 1 2023

Jorge Mendes: I disagree if you say the pro account can be used by a novice trader. As you have seen, the commission on the Pro account is based on lots. And these are actually cheaper fees as they only charge you $0.04 per trade with 0.01 lots. But what makes the difference are other factors.

Yes, advanced tools are required for trading. Basically, trading on a professional account is different from a classic account. The functionality in there is more important and I bet the novice trader will be confused when using these tools. I think you just need to follow the author's suggestion, because many traders have failed on the Pro account just because the trading conditions seem very cheap, but because of that, they overtrading and loss everything. .

Larry

Feb 1 2023

Jorge Mendes: Have you ever heard of many indicators and tools that will confuse traders and so they cannot trade with maximum effort? Imagine this, the pro account is like oatmeal while the classic account is a mix. If you have small children, of course you will give your 6-month-old baby solids first, right? Although the nutritional value of Puree is much less than oatmeal, it's okay if your baby can't eat it, right?

So just like novice traders, if they open a professional account, they will have a hard time trading because of many tools, fees and some conditions that you won't even see in the classic account. DOM for example if Tickmill is an ECN broker.

Enzo

Feb 1 2023

The tickmill account for me is very concise. I mean there are only 3 accounts available and for me that would make a quick decision to choose one. For example, if you are a beginner or an advanced trader, choose a mini account. If you want to enjoy 0.0 and you have experience, choose a pro account. And if you are a professional trader and have capital, choose VIP. Even a novice like me can figure out which account is right for me.

My only question is how to deposit to Tickmill? Is it fast and what is the payment option available. I had a bad experience with some payment options and brokers because they didn't process my deposits and withdrawals quickly. I prefer to send money faster because when we are asked for a deposit, we can send money immediately without waiting. If I wait, the margin that I can keep is gone and it stops. So, I really need fast deposit broker.

Does anyone have experience with deposit at tickmill?

Eddie

Feb 1 2023

Enzo: Depositing at Tickmill is easy as there are many payment options you can choose from. In my experience, if you want to deposit, the estimated time is instantaneous if you deposit from e-wallets like Skrill, Netteller and Fasapay. Meanwhile, if you have a local bank like Tickmill, then you can just do a wire transfer, but that is not recommended if you are not the same one that Tickmill uses because it took 5 days to process. Another deposit option that may not be available is crypto payments (BTC, ETH and USDT), but availability is limited to certain regions.

One thing I know for sure and feel is that Tickmill is committed to processing all withdrawal requests within one business day. If you want to know more, just read the Tickmill Deposit and Withdrawal FAQ articles : Tickmill Deposit and Withdrawal FAQ

Licha

Feb 17 2023

Enzo: Deposits can become a hurtbutt if the process is slow, as withdrawals too. In my experience, payment cards like debit and credit cards come out very fast but with low fees when depositing with brokers. It's not like a bank transfer which requires a very long process, the debit and credit card process requires your CVV and second verification. As soon as possible, the deposit funds will arrive immediately. But if you use a credit card to deposit, sometimes the used credit line will be charged next month at a higher rate.

Other payment methods you can use are electronic payments, including Skrill, Neteller, PayPal or Fasapay. But what you need to be aware of is that most brokers will implement a paid options policy. So if you deposit with a cash card, you can also only withdraw with a cash card. So think carefully before choosing a payment option

Gredinho

Feb 17 2023

As suggested by the author on the tickmill account, maybe I could choose to be a newbie. As far as I can read, the author has chosen the classic account as an account suitable for all traders, including beginners. Meanwhile, with the same conditions, the pro account is for professional traders.

Although I disagree with the author as the spreads offered in the pro account are much lower than in the classic, but this time I will follow the author's choice.

If I have opened an account, a regular account, at Tickmill, what style of trading can match the trading conditions offered by Tickmill? Of course, with spreads starting from 1.8 pips

Sonja

Feb 17 2023

Gredinho: In my opinion, day trading can be very suitable for classic account as it has 1.8 pips (meaning you need minimum profit of 2 pips to avoid loss, and above 2 pips to get profit).

Meanwhile, it is very disadvantageous to use scalping in the classic account because the spreads are higher. although no commission happens, spread in pro can be 0.0 pips and with commissions as little as $4/lot. If you are trading 0.01 lots, your minimum trading fee will be 0.01 x 100 = 1 pip, 1 pip in 0.01 lots = 0.1 USD + 4 USD = 4.1 USD

And if you are scalping on a classic account, it will be 1.8 pips x 100 = 180 pips with 0.01 lots = $18.

So it is better to use day trading, with target pips maybe 50 pips to make a profit. And you can learn about trading more comfortably and can watch and learn all the movements of candlesticks

Read the day trading steps here :

Upamecano

Feb 17 2023

Based on the reading, all three accounts have similar margin calls and stops at 100%/30%. I've always been curious about margin calls and stop rates. I mean, when do I know I'm going to enter a margin call and stop before the margin call alert alarms me? I mean, there must be a number of factors that can influence a trade to become a margin call.

And next question is is there any trick to avoid margin call in trading and what should i do for my trade if i get margin call and what is the example function of d' stop level? Thanks!

Marcel

Feb 17 2023

Upamecano: I will answer your last question first.

There is only two ways to avoid margin call. Either using Money Management (read here : 5 key tips on Money Mangement) or you can add more funds to avoid it.

It is better for you to practice the money management, right? Since you will not added more funds from your wallet, the money management can be the best choice.

next question is how you can know if you will get margin call or not. Just see the free margin level; which is you can see beside the equity and margin at Metatrader. If your free margin level is above 100% you will not getting margin call. The more margin level drop, the more you will get the margin call. And if you get margin call and still not deposit more funds, when your margin free level hit the stop out level, which is 30% or below.

All the trades will automatically closed.

Gary

Apr 18 2023

In the world of finance, high-volume traders are known for their ability to make significant profits through their trading activities. It's fascinating to think about how they manage to achieve this level of success. I mean the pro trader, in this case high volume trader will trade with higher volume also higher risk but the return, you will get higher profit and it seems tempting to become professional traders although it is not easy. Have you ever wondered about the strategies and techniques they use to make profitable trades consistently?

Koth

Apr 18 2023

You bet! So, high-volume traders use a bunch of strategies and techniques to make bank on their trades. They're pretty much experts on the markets they're trading in and use analysis tools to find patterns and opportunities for profitable trades.

One popular technique is called technical analysis. Basically, it involves looking at historical price and volume data to spot trends and patterns. They might use fancy stuff like moving averages or momentum indicators to figure out the best time to buy or sell.

Aside from that, they might also use fundamental analysis to evaluate the financial health of companies they're trading with. This involves looking at things like earnings, market share, and revenue growth to determine whether a company is worth investing in. And finally, high-volume traders are all about risk management. They've got strict rules in place to minimize risk, like limiting the size of their trades or using stop-loss orders to keep their losses in check. By being smart about risk, they can keep making money consistently.

Those strategies are basic strategies. SO, it means you can also become pro trader too if you know about all the strategies deeply

Aston

Jun 2 2023

What is the significance and impact of the margin call/stop-out levels set at 100%/30% in Tickmill's three account types? The article suggests that these levels are shared across all three account types. Can you provide a more detailed explanation of the implications of these levels and how they can influence traders' positions and overall trading experience?

Understanding the intricacies of margin call and stop-out levels is essential for traders to effectively manage their positions and mitigate potential risks. Could you elaborate on the specific implications of these levels and shed light on how they can affect traders' decision-making processes, risk exposure, and overall trading strategies?

Furthermore, in the context of Tickmill's three account types, do these shared margin call/stop-out levels indicate a consistent approach to risk management and position monitoring? How do these levels align with Tickmill's overall philosophy and commitment to providing a secure and transparent trading environment for its clients?

Harry

Jul 2 2023

@Aston: The margin call and stop-out levels set by Tickmill have a significant impact on traders' positions and overall trading experience. The margin call level, set at 100%, warns traders when their account balance approaches the required margin for open positions. The stop-out level, set at 30%, automatically closes positions to prevent further losses when the account equity falls below this level. These levels help traders manage risk, make informed decisions, and prevent excessive losses. Tickmill's consistent approach to these levels across all account types reflects their commitment to risk management and a secure trading environment. Traders should understand these levels to effectively manage their positions and align their trading strategies with their risk tolerance.

You can learn more about margin call and stop-out in this article : Forex Margin Call Vs Stop Out

Shota

Jul 4 2023

If you are a novice, then the Classic account type might be the best since there are no commissions and all you have to deal with are spreads which might be more straightforward. If you are an experienced trader and want some advanced features to go along with your trading while not having to fork out so much money to open an account, then the Pro account is for you. However, if you are a high-volume trader that wants competitive pricing and do not mind the relatively high minimum deposit requirement, then Tickmill's VIP account might just be the most suitable.

Sammuel

Sep 7 2023

Dude, I don't think Tickmill is that bad, but it's also not that good for beginners. That means you can get a demo account, but it lacks other useful resources. However, since I was aiming to do forex with the least amount of problems, I don't think that matters too much to me. The author also said that in Tickmill, problems seldom occur and the Tickmill can be my best partner for trading.

But before going to open an account there, I have a question about opening an account there. Because Tickmill offered multiple accounts such as Calssic, ECN Pro and VIP Account. Also, both the Classic account and his ECN account require $100 to start, but ECN Pro offers fixed spreads and Classic offers variable spreads. Which Tickmill account is best for a beginner like me?

Finraly

Sep 9 2023

It depends on your needs dude. I am a trader at Tickmill and I opened an account at The Classic account. The classic account in Tickmill offered variable spreads and no commission fees, which for me, might be more suitable for beginners who are still learning about trading and want to start with a lower risk. Since it has no commission, you can trade without the need to pay for the total volume that you trade. Meanwhile, based on the Tickmill website, This ECN Pro account offers fixed spreads, which can be beneficial for traders who want to know exactly what they'll be paying for each trade, but require a higher deposit amount. However, fixed spreads can sometimes be wider than variable spreads, so it's important to consider this when choosing an account. account might be more suitable for traders who have more experience and are looking for a more advanced trading environment.

Immanuel

Sep 10 2023

When it comes to choosing the best account type for a beginner on Tickmill, it depends on your trading style and preferences. The Classic account offers variable spreads, which means that the spread can change based on market conditions, while the ECN Pro account offers fixed spreads, which means that the spread remains the same regardless of market conditions. The VIP account requires a larger deposit and offers additional features, such as a dedicated account manager and lower commission fees.

For beginners, the Classic account may be a good option as it allows you to start with a smaller deposit and provides the opportunity to learn and practice trading with variable spreads, which can help you develop your trading strategy. On the other hand, the ECN Pro account may be more suitable if you prefer the certainty of fixed spreads and are willing to start with a larger deposit.

It's important to note that different account types may have different trading conditions and fees, so make sure to carefully review the details of each account before making a decision. Additionally, Tickmill offers a demo account that you can use to practice trading and test out different account types before committing to a live account. This can be a great way to gain experience and confidence in your trading abilities before risking real money.

JK Damian

Sep 12 2023

Hey, I have to say that I really dig Tickmill as a trading platform. I mean, they have some killer features that I'm really tempted to, especially in terms of their leverage, which is actually higher than what's allowed in my own country, the US.

So after reading this article, I decided to give their demo account a try. I trained with him for several months and finally felt ready to open a live account. I followed all the steps outlined in the article, but when I tried to open a live account, it was rejected. I was disappointed and finally contacted Tickmill customer support.

They explained to me that they do not accept US traders. I was a bit confused because they let me open a demo account in the first place, but didn't let me open a live account. Do you know why this is? What's the problem with Tickmill not accepting US traders?

Vanessa

Sep 13 2023

Actually, here I just want to explain the reason why forex brokers don't accept US clients is because of the higher costs associated with doing business in the US. The US is known to have a higher cost of living and wages than many other countries, meaning forex brokers have to pay their employees more, resulting in higher operating costs.

In addition, forex brokers also have to pay higher taxes and fees to operate in the US, which can be a significant burden for smaller companies. As a result, many forex brokers choose to focus on other markets where the costs of doing business are lower.

Apart from these reasons, In the US, forex brokers are only allowed to offer a maximum leverage of 50:1 on major currency pairs and 20:1 on minor currency pairs. This is much lower than the leverage that is offered by brokers in other countries, such as Australia and Europe, where leverage of up to 500:1 is available. The restrictions on leverage in the US can make it difficult for traders to make a profit, as they are not able to take advantage of the same level of leverage that is available in other countries. As a result, many traders choose to use offshore forex brokers that offer higher leverage, which is why many US forex brokers do not accept US clients.

This is all done to protect traders from fraud and cyber crimes.

Siegfried

Sep 14 2023

Not many brokers accept US traders. One of the main reasons why forex brokers do not accept US clients is because of the strict regulations imposed by the US government. The US government has implemented a number of regulations regarding forex brokers, including the Dodd-Frank Act which was introduced in 2010. This law requires forex brokers to register with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). , which can be a lengthy and expensive process.

In addition, forex brokers are also required to meet a number of other requirements, including maintaining minimum capital requirements and submitting periodic financial reports to the authorities. These regulations can be difficult for forex brokers to comply with, which is why many prefer not to accept US clients.

Well despite the many rules in the US, it is important to remember that these regulations are designed to protect traders and ensure that the forex market operates fairly and transparently. As a result, it is important to choose a regulated and trustworthy forex broker, even if they do not accept US clients.

Fendi

Oct 25 2023

Hey there! Just beginner here and dont understand at all about it so called Margin Call! Alright, so let's dive into the nitty-gritty of Tickmill's account options - Classic, Pro, and VIP. These guys seem to have a lot in common, like leverage, base currencies (USD, EUR, GBP), quick execution (0.20 seconds), market execution, and they all hit the margin call/stop-out button at the same numbers - 100%/30%. But, here's the real deal: Can you spill the beans on the actual cash amount, in good ol' US dollars, that would trigger a margin call for these accounts? This number is like your trading safety net, and knowing it can be a game-changer. It helps you figure out which account type suits your trading style and risk appetite. So, what's the scoop?

Bellingham

Oct 29 2023

@Fendi: Hey there, beginner trader! Understanding margin calls is essential. The margin call level for Tickmill's Classic, Pro, and VIP accounts is indeed set at 100%, which means when your account equity drops to the same value as your used margin, you'll get a margin call. However, the actual cash amount that triggers a margin call can vary. It depends on your open positions and the size of your trades. It's not a fixed dollar amount, as it's influenced by the leverage you use and the value of your positions. To stay safe, always monitor your account balance and avoid getting too close to the margin call level to protect your investments and maintain your trading positions. Happy trading!