Looking for opportunities in the forex is practically doable at any time during working days. But the profitability may not be the same. So, when is the best time to trade forex?

The forex market is open 24 hours a day, five days a week, so it basically opens at all times during business days. For traders, surely this is a huge advantage as it offers a chance of generating profits at any time. This also offers flexibility because then traders can decide their own time for trading so that it doesn't clash with their working time or family quality time. However, every trader should know that forex trading time is divided into several sessions and not all of them are equally active.

There are times when the market is extremely bursting with activities, but there are also times when the market is rather quiet even during open hours. The busier the market, the higher the chance to earn profit. On the contrary, it's harder to get profits when the market is quiet and less active. Therefore, it's necessary to understand when the best time and hour for forex trading. You can then adjust your trading strategy in accordance with the characteristic of each trading session in order to get maximum profit from your trades.

Forex Market Hours

First things first, we need to understand that forex market hours are divided into four main sessions: Sydney (Australia), Tokyo (Asia), London (Europe), and New York (The United States). Overlapping time zones between the four are the reason why the forex market never s. As one region's market closes, another opens, and so on.

To get a better understanding of how it works, let's take a look at the picture below.

You can use the chart above as a guide for your trades, except when the US and other countries apply the Daylight Saving Time (DST). During DST, the forex market hours can be shifted forward one hour, along with the rest of the important schedules on the economic calendar. DST typically lasts from March to November with different dates every year, so brokers usually make an announcement of when the DST starts and ends.

When the markets do overlap, it's only natural that the trading volume increases and the price movements become more dynamic, especially when the European and the US markets overlap. How so? Let's learn the characteristics of each session below:

The Asian Session

The trading volume in Asian markets (Tokyo and Sydney) comprises 20% of the total global forex trading volume. Transaction centers are located in several major areas, including Tokyo (8%), Singapore (5%), Hong Kong (4%), and Australia (3%). Here are some of the characteristics of Asian markets:

- In addition to Japan, other countries with rather big economic powers like Hong Kong, Singapore, Australia, and Korea are also actively conducting transactions in the forex market. Note that China and Japan are main exporters so other than central banks, the market is also filled with many commercial entrepreneurs (export/import).

- At certain times, the market liquidity can be very low. This is shown in the small price movements that last for a relatively long time, creating a consolidation phase in the market.

- Most of the market movements happen during the early part of the session when fundamental economic news is announced or released.

- Trading activities that happen in the Tokyo market can more or less have an impact on the next trading sessions because traders in Europe and America would see and consider what happened in the Tokyo market to get a general outlook of what could happen next.

- Currency pairs that may be profitable to be traded during the Asian session are JPY and AUD pairs. However, keep in mind that not all impactful news comes from Japan and Australia only. News releases from China may also affect the movements of those two currencies.

The European Session

Europe, particularly London, has been one of the most significant trading centers since the Industrial Revolution era. The European market has the biggest portion of the total global forex trading volume, which is around 36%. About 31% of that number is from London, while the remaining 5% occurs in Germany. With that being said, this session is typically the busiest compared to others.

Here are some notable characteristics of the European markets:

- The London session is the time when forex trading is at its peak. As a result, the liquidity and volatility are usually very high and the spread can be very small.

- Oftentimes, the trend that occurs during the European session extends until the beginning of the New York session.

- During the day in, volatility typically dies down due to lunch break and the wait for the American session to open.

- Crucial news in the Eurozone can greatly influence price movements.

- All currency pairs are generally attractive due to the highly active forex market. However, the most lucrative movements usually come from major pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF. Several cross pairs like EUR/JPY and GBP/JPY may be attractive too.

The American Session

New York is the center of business and trading in the United States, so it is often referred to as the "city that never s". Today, New York is even considered the financial center of America and even the world. New York alone can account for about 19% of the total global forex trading volume, which is pretty unsurprising.

Moreover, it is important to know that the US dollar is currently considered the world's most-used currency. At least 90% of global trades in goods and services use the US dollar as a medium of payment.

Therefore, the American session is definitely crucial for forex traders. The following are some characteristics of the New York market:

- The liquidity tends to be high during the morning time in New York because it overlaps with the European session.

- Economic news released in the US certainly has a very huge impact to move the prices on the market. Remember that 90% of trades involve US dollars.

- When the European market closes, the volatility and liquidity will fall accordingly. This period also coincides with the lunch break time in the US.

- On Friday afternoon New York time, trading activities will drop drastically because most Asian and European traders have stopped working and going into the weekend.

- Trend reversals often happen at certain periods after the American afternoon session, so you need to be careful during this time. Some traders prefer not to leave any position open by the end of Friday to avoid getting trapped in some events or news that might happen over the weekend.

- Similar to the European market, all currencies can be profitable during the American session. However, it's important to pay attention to the fundamental news that's already or is about to be released.

See Also:

Measuring the Forex Market Volume

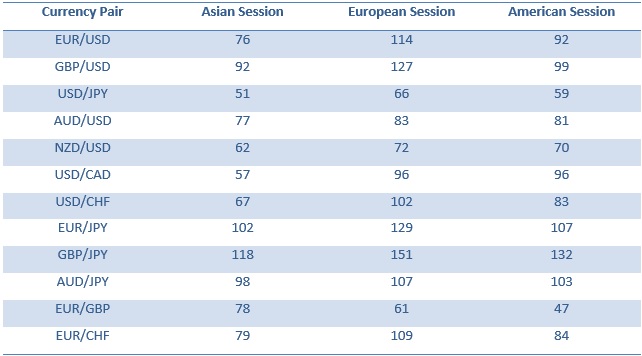

In order to figure out how busy a market currently is, you can refer to the difference in price movements of each currency pair. The results are usually calculated by using pips as the unit of measurement. Let's take a look at the price movements of some of the most popular currency pairs in each trading session.

It's pretty clear that the price movements during the European and American sessions are larger compared to the Asian session. The volume of a certain currency trading is related to the high concentration of transactions in those regions (Europe, America, and Asia). Meanwhile, the rest of the world only accounts for 25% of global forex trading. Their working hours also have no effect on forex trading sessions.

See also: Real-time Forex Volume Comparison

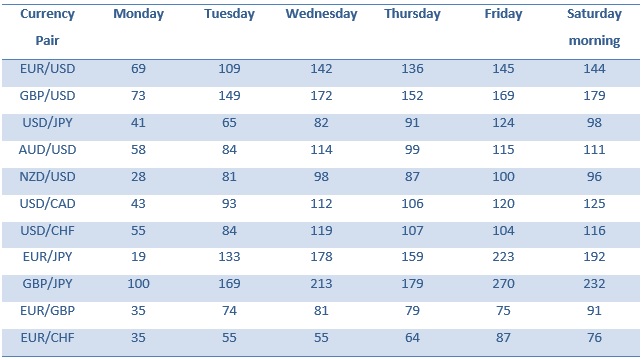

Let's take a closer look at the characteristics of daily price movements in currency pairs so that you can get a complete picture of how it works so you're able to decide when is the best day and hour to trade.

Based on the table above, we can see that the busiest forex trading times are on Wednesday, Thursday, and Friday. We can then consider that these periods have the highest trading opportunities for our trades.

See Also:

The Best Time to Trade Forex

From the explanation above, we can conclude that the best time for forex trading is during the European session as it is the busiest of all. Furthermore, the overlap with the American session creates a profitable trading hour with high volatility as well as liquidity. This presents an opportunity for retail traders to enter the market and make profits. Also, the busiest days of the week are Wednesday, Thursday, and Friday, so it's a great idea to look for trading opportunities during those times.

Moreover, we can now map out ideal times to trade forex based on our trading styles. For aggressive traders, the Asian session may be less exciting because of the low liquidity and volatility. Price movements tend to be slow during this time. Other than that, Saturday mornings are also usually quiet because the market is about to close and most traders have closed their transactions for the day.

It is worth noting that when there's a huge global event like the World Cup, for instance, the market can become less active because people are distracted from the market. Also, make sure to take enough rest because it can affect your trading performance in general.

Now that you've learned about the best and most profitable time to trade, the next step is to learn the basics of technical analysis and fundamental analysis. Technical analysis refers to a trading approach that sees the price movements from a mathematical point of view, whereas fundamental analysis perceives the market through economic, social, and political conditions that could influence the market's supply and demand. Both methods might be your greatest weapon to be a successful forex trader.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance