Reflation trade usually looks for opportunities at a time when the economy is recovering from recent slumps. How to carry out the strategy?

Every economy experiences a continuous cycle of growth and decline. When the economy is slowing down, usually there's a steady decrease in economic activities and employment rates. This is called an economic contraction and it may lead to a recession. As a result, officials usually take certain measures to stimulate the economy to grow again in such conditions. This is often known as reflation.

Economic cycles can affect everyone with various backgrounds and occupations, including online traders. Different phase of cycle can affect the market in certain ways, so it is important for traders to understand how it works and learn how to take advantage of every phase. This time around, we're going to be focusing on reflation and how to trade it.

Understanding Reflation and Its Example

Reflation refers to a period of economic expansion caused by some fiscal or monetary policies, which are typically enforced in response to an economic recession. In the US, the policies can come in the form of huge direct federal stimulus released by Congress or low interest rate policies and other measures by the Federal Reserve.

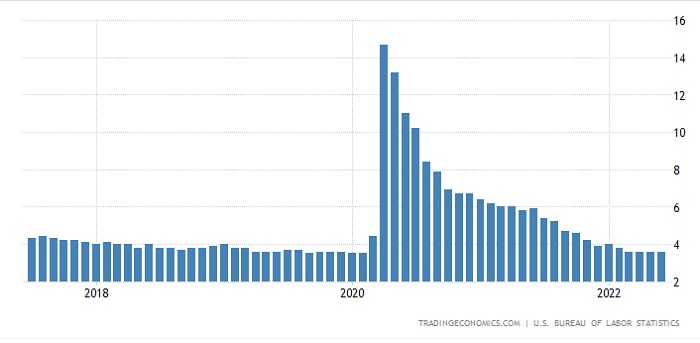

The most recent reflation occurred in 2020 when the US experienced an economic contraction from the global COVID-19 pandemic. All residents were quarantined or urged to stay at home, which resulted in a massive economic downturn. People received lower income and there was a decreasing demand for goods and services. Many businesses fell and suffered losses, so they were forced to lay off employees. As a result, the unemployment rate of the country surged up.

In response to the situation, the authorities implemented several fiscal and monetary policies in order to provide relief for the affected families and get the economy moving again. Some of the fiscal measures include direct stimulus payments to consumers, extended unemployment benefits, loans and aid funds sent to local government, payroll tax deferment for businesses, and advance Child Tax Credit Payments from the IRS. Meanwhile, some of the monetary policies include low interest rates, direct government loans for businesses, and loosened regulatory requirements for banks.

Following the reflation policies, the economy started to experience quite a significant recovery. Most Americans are already vaccinated and the restrictions that kept the economy from growing are slowly lifted. The most obvious impact can be seen in the improvement of unemployment rates. In April 2020, it reached a peak of 14.8% and declined to about 3.8% in less than two years.

The US Unemployment Rate

The US Unemployment Rate

Reflation Vs Inflation

Now you may wonder what reflation has to do with inflation and what makes the two different. Reflation refers to the implementation of policies conducted by the government to stimulate the economy. It is done in a more controlled way to increase consumer buying power and decrease the unemployment rate, so it's often seen as a healthy sign to improve the economy and stop the deflationary spiral.

On the other hand, inflation does not look at unemployment rates or other economic factors. Instead, it only refers to the increase in prices of various goods and services over a certain period of time. It's the opposite of deflation and it can occur after the period of reflation. Like reflation, inflation can be a good thing if it's under control, but most of the time, it imposes a threat to the economy as hyperinflation can reduce consumer buying power and make it more expensive to borrow money.

Reflation Trade and How It Works

The growing economy can be a great sign for investors as well. It is worth pointing out that reflation typically gives high impacts on certain sectors only, depending on the context.

For instance, the post-pandemic reflation causes the hospitality and dining sectors to grow as they were affected the most during the recession, along with other sectors like travel and tourism. Some sectors like energy and materials are also affected, but more indirectly. Such information is what traders and investors must be able to figure out to make a profit.

The act of investing to take advantage of the reflation period is called reflation trade. Investors must be able to spot opportunities from the growing sectors and immediately invest in them while the economy is recovering. They can simply invest in individual stocks of growing companies or diversify their portfolio by investing in sector-specific Exchange-Traded Funds (ETFs) or index funds.

Apart from that, investing in bonds might also be beneficial in a reflationary market. Bonds are basically interest-bearing IOUs. They are issued for a specific period of time called the "term to maturity". This means investors will get paid a fixed amount of interest every six months or years until the bond matures. Meanwhile, the total return rate of the bond is called "yield". Bonds are issued by the government or businesses for various purposes, such as to make capital improvements or to acquire other businesses.

During the reflation period, interest rates typically rise up. When this happens, the yield as well as the price of the older, existing bonds is decreasing. This is because new bonds with higher interest rates are issued by businesses in order to expand, making the older bonds less attractive. In this case, you can take advantage of the situation by selling your older bonds in favor of those newer ones with higher yields.

Such a condition causes the value of currencies to rise up. Meanwhile, financial sectors like the stock market may be experiencing a downturn because traders are more interested in investing in low-risk investments, like bonds. This phenomenon can happen sometimes, but it is only transitory until the economy fully recovers and new inflation rates occur.

Ongoing Uncertainties

Reflation may present huge investment opportunities in many emerging sectors, but it is also a strong period of uncertainty. The case of COVID-19, for instance, is still highly uncertain and the recovering economy still faces many hurdles. As a result, there are mixed opinions about the current situation for reflation trades. While some investors are going full-speed to invest based on reflation, others are more hesitant and assume that instead of reflation, we are actually in a period of inflation, which means that there might be a market correction soon.

That being said, no one knows exactly what the future holds. The next question is whether the central banks will take action to control long-term yields and prevent them from increasing too fast. If that's the case, then the already high stock valuations could be at risk, especially growth-related ones. The economic reopening and the likeliness of economic growth should also be considered in relation to their effectiveness in ensuring positive continuity in the future.

Final Thoughts

All in all, we can see that the reflation period can present considerable investing opportunities if you know how to spot them. This involves making investments in specific sectors of the economy or a specific type of asset in the aftermath of an economic recession.

Nevertheless, keep in mind that reflation is only a transitory period or "normalization" that occurs after a recession. This is why you need to be aware of when the period starts and ends. Apart from that, the reflation period is also considered risky as it can lead to hyperinflation real fast if it's poorly managed. So, before you make any speculation or any investment, make sure to read the situation and do your research thoroughly. Last but not least, remember to only invest what you can afford to lose and weigh all the risks.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance