Exness Premier Program offers a bunch of exclusive benefits for worldwide traders. So, what is it and how to participate in the program?

Exness Premier Level is a specialized loyalty program designed to recognize and reward the most dedicated and active members. As part of this program, valued Exness Premier members enjoy a host of exclusive benefits that progressively increase as they achieve higher and more prestigious membership tiers.

Here are some benefits that you can exclusively receive through the Exness Premier Program:

- Priority customer support

- Access to exclusive educational materials

- Enhanced trading analytics

- Special promotions and rewards

- Dedicated account manager

- Face-to-face meeting with dedicated account manager

- Access to C-suite executive

- Annual premiere Gala Event attending

All the exclusive benefits mentioned above depend on the premier tier you have. There are three tiers: Preferred, Elite, and Signature.

Your eligibility for Exness Premier status is determined by the total lifetime deposit amount and quarterly trading volume of the Exness account.

Where to Find the Information on the Official Broker Site?

- This information is reported per Mar 13 2023.

- We can not ensure if this offering is still available or remain the same in future.

- The broker announcement page may or may not exist anymore, You may explore Exness homepage and try to find "Promotion" section on the menu, footer, etc, to ensure the availability and validity of this promotion.

Unveiling Benefits of the Premier Program

Each tier comes with a different set of benefits that you can enjoy. Naturally, higher tiers will get all the privileges plus some extra benefits. Please note that all of the benefits are only available for the duration of the qualification for a specific tier.

In case you're no longer eligible for any of the Premier tiers, the privileges will also be disabled automatically. In addition, the benefits are not redeemable for cash, refundable, or exchangeable.

Preferred Premier Tier

This is where traders typically start their Premier journey. Being a Preferred Premier member comes with a range of special benefits, such as:

- Priority Customer Support: All your requests and questions will be prioritized by Exness' algorithm systems, and then passed on to the senior customer support team who will deal with your issues in more detail. When the queue is busy, regular clients will be set aside first, and premier clients will be prioritized. This will certainly make the process faster and more convenient for you.

- Exclusive Educational Materials: Get access to various forms of Exness educational content as well as Premier-exclusive webinars and seminars that cover a handful of important topics in trading. This will help you boost your trading skills and eventually improve your trading results.

- Enhanced Trading Analytics: There are many additional Trading Central services that you can enjoy, as well as a free subscription to a series of leading fundamental and technical analysis sources. Every week, there will be a live market briefing guided by market strategists from Exness. The schedule for these sessions depends on each region. For example, the live market briefing in Malaysia is held every Monday morning at 11 (GMT+8). The Malaysian market strategist will provide an overview of which instruments could present trading potential and should be highlighted for the upcoming week.

- Special Promotions and Rewards: Find a bunch of special gifts on your birthday. All premier clients of Exness across various levels will receive a unique birthday gift as a form of appreciation for being valued members of Exness' VIP community.

Elite Premier Tier

Get all the privileges of the Preferred tier, as well as several extra benefits including:

- Dedicated Account Manager: A dedicated account manager will be assigned to each Elite client to personally handle all of their requests at the highest priority, faster than priority Customer Support in the Preferred level. The account manager will also inform them about all of the broker's latest events, program activities, and opportunities. The dedicated account manager can also arrange for a one-on-one call booking with Exness' market strategist if you wish.

- Meet Account Manager: To get maximum service, you can meet face-to-face with your dedicated account manager in your preferred setting, whether it's at a private champagne party or just a simple chat over coffee. You can use this opportunity to receive trading analysis through the account manager. This is unlike Premier Preferred, which only offers consultations via Google Meet or messaging platforms.

Signature Premier Tier

This is the highest tier of the Premier Program and the one that offers the most benefits. Enjoy all of the benefits from the previous tiers, plus the following extra special rewards dedicated to Signature Premier members only:

- Meet Exness Senior Management: Enjoy the privilege to access the broker's c-suite executives at one of the gala dinners or a special meet and greet. Such events can be organized either locally or at specific international destinations.

- Attend Exness Annual Premier Gala: Every year, Exness invites all of the Signature Premier clients to attend a gala dinner and several other exclusive events. Use this opportunity to expand your network with other fellow traders and have a chat with Exness senior management team.

You will also have the opportunity to travel abroad with all expenses covered by Exness. In 2022, trips were organized to South Korea, and participants were allowed to bring their partners along.

Last year, there was also a trip to Qatar to watch one of the World Cup matches. The benefits included round-trip flights, a 5-day stay in a minimum 4-star hotel in Dubai, dining at various enticing restaurants, World Cup tickets, including access to a special VIP entrance. This way, clients wouldn't have to enter the stadium crowded with other spectators.

To sum it all up, here are all the benefits that you can get in each tier:

| Benefit | Preferred | Elite | Signature |

| 📲All requests will be prioritized and escalated to senior customer support team members who will deal with issues promptly | ✔️ | ✔️ | ✔️ |

| Participate in premier webinars and seminars covering a wide range of trading topics, and access educational content prepared exclusively for premier clients | ✔️ | ✔️ | ✔️ |

| Exclusive access to additional trading central services, a complimentary subscription to top fundamental and technical analysis sources | ✔️ | ✔️ | ✔️ |

| 🎁Receive some amazing gifts and cash rewards through exclusive reward schemes and promotional campaigns | ✔️ | ✔️ | ✔️ |

| 👨💻A dedicated account manager will personally handle your requests at the highest priority and keep you informed about all the latest Premier Program activities, events, and opportunities | ❌ | ✔️ | ✔️ |

| ☕Enjoy face-to-face meetings with a dedicated account manager, whether at a private champagne dinner or a friendly chat over brunch | ❌ | ✔️ | ✔️ |

| 🚢Gain direct access to C-suite executives at one of the gala dinners or exclusive meet-and-greet events. These events are organized locally and at exciting international destinations | ❌ | ❌ | ✔️ |

| 🥂Network with fellow Premier Signature clients and mingle with senior management at the Annual Premier Gala Dinner | ❌ | ❌ | ✔️ |

Yes, the higher the tier you have, the more exclusive benefits you can enjoy. The benefits mentioned above can only be obtained through the Exness Premier program.

In other words, you won't be able to access them unless you qualify as a premium client. Therefore, this exclusive program is worth maintaining, considering that all its benefits can be instrumental in advancing your trading career.

The benefits provided by Exness through this Premier tier are not just rewards for those who achieve it, but also a form of commitment and contribution to help you maintain your current Premier tier and elevate it to a higher tier.

For instance, when you reach the Preferred tier, you will receive priority customer support, exclusive additional materials, and analytics. All of these will assist you in maintaining your current tier and support your advancement to the Elite tier.

Similarly, once you have reached the Elite tier, you will be offered a dedicated account manager, whom you can leverage to ascend to the Signature tier, the highest tier. The ultimate goal of the highest benefits you receive at the Signature tier is to enable you to continuously sustain that tier.

See Also:

How to Qualify as Exness Premier Clients

As mentioned before, Premier members will be categorized into three different tiers. The qualification process depends on the following two criteria:

- The lifetime amount of the client's deposit starting from the day of registration of their Personal Area.

- The total sum of the client's trading volume for the previous calendar quarter.

Please note that only external deposits, social trading deposits, and trading volume of open and closed orders qualify are to be calculated in the lifetime deposit criteria. Meanwhile, internal deposits and trading volume from Portfolio Managers and Investors will not be included in the calculation.

Refer to the table below for the full qualifications of each tier.

| Parameters | Preferred | Elite | Signature |

| Total Lifetime Deposits | 20,000 USD | 50,000 USD | 100,000 USD |

| Trading Volume of the Previous Quarter | 50 million USD | 100 million USD | 200 million USD |

Clients can only have one active Premier membership at a time. If the same client qualifies for several tiers based on the qualification from multiple Personal Areas, the broker will only choose the Personal Area with the highest Premier tier.

To qualify for those tiers in all countries Exness operates in, except China, Taiwan, Hong Kong, and Macao, both criteria must be met. By the way, this is a list of countries worldwide where Exness operates. If your country is on the list, you automatically qualify to join the Exness Premier Program.

| Asia | Afghanistan, Bahrain, Bangladesh, Brunei Darussalam, Cambodia, India, Indonesia, Japan, Jordan, South Korea, Kuwait, Laos, Lebanon, Maldives, Nepal, Oman, Pakistan, Philippines, Qatar, Saudi Arabia, Sri Lanka, Turkey, United Arab Emirates, Vietnam, and Thailand. |

| Africa | Algeria, Angola, Benin, Botswana, Burkina Faso, Burundi, Cameroon, Cabo Verde, Central African Republic, Chad, Comoros, Republic of the Congo, Democratic Republic of the Congo, Côte d'Ivoire, Djibouti, Equatorial Guinea, Egypt, Eritrea, Eswatini, Ethiopia, Gabon, The Gambia, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Liberia, Libya, Madagascar, Malawi, Mali, Mauritania, Mayotte, Morocco, Mozambique, Namibia, Niger, Nigeria, Rwanda, Sao Tome and Principe, Senegal, Seychelles, Sierra Leone, Somalia, South Africa, Tanzania, Togo, Tunisia, Uganda, Western Sahara, Zambia, and Zimbabwe. |

| North/Central America | Anguilla, Belize, El Salvador, Panama, Jamaica, Bahamas, Barbados, Costa Rica, Dominica, Dominican Republic, Nicaragua, Guatemala, Haiti, Honduras, Antigua and Barbuda, Bermuda, Cayman Islands, Grenada, Mexico, Montserrat, St. Kitts and Nevis, St. Lucia, St. Martin, St. Vincent and the Grenadines, Turks and Caicos Islands, Virgin Islands, and Saba. |

| South America | Aruba, Brazil, Argentina, Bolivia, Chile, Colombia, Ecuador, French Guiana, Guyana, Paraguay, Peru, Trinidad and Tobago, Venezuela, Suriname, Bonaire, and Sint Eustatius. |

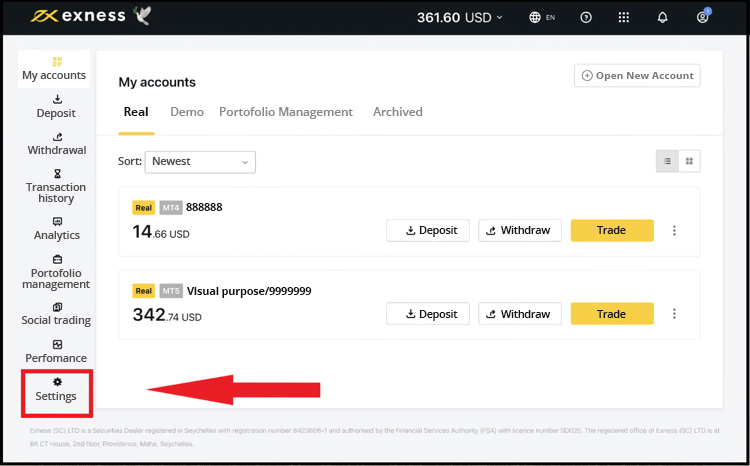

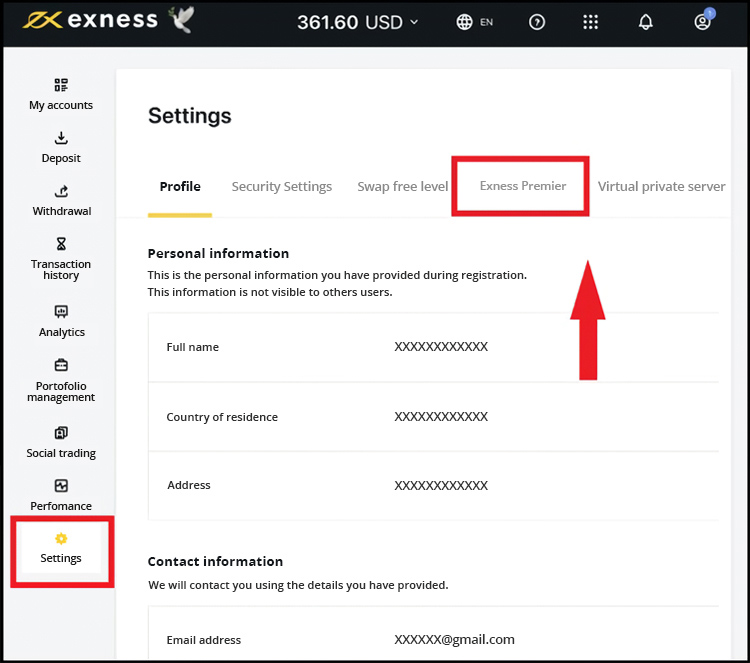

How Do I Check My Exness Premier Status?

You can check your premier membership status in the Profile menu of the Exness Trade app and the Exness Premier tab within the Settings area of your Exness Personal Area.

Your Exness Premier status is also visible in the Social Trading app.

If you don't see your Exness Premier status in the Profile menu or lack the Exness Premier tab in the Settings area, it means you haven't met the minimum requirements to become a potential Premier member.

In order to see your progress towards Exness Premier, you must meet the following requirements:

- Your Personal Area must have been created at least 30 days ago.

- The total amount of your lifetime deposit must exceed 15,000 USD.

- The total amount of your lifetime trading volume must exceed 40 million USD.

For potential Premier members or those close to qualifying, the tab will appear and provide the following information:

- Date of the membership assessment.

- Qualification criteria for each tier.

- The client's membership progress.

For qualified clients, the Exness Premier tab will appear in the Profile menu of the Exness Trade app and the Settings area of your Exness Personal Area. The Exness Premier status will provide useful information, including:

- Current tier

- Date of the beginning of the next quarter

- Link to premier benefits and rewards

- Qualification criteria for achievable tiers

- Link to the Help Centre on how to upgrade to the next tier

- Conversion tool to recalculate trading volume into lots of the most traded instruments

However, if you are qualified but you don't wish to participate in this program, you can simply send an email to [email protected] to cancel your membership.

The Qualification Time

The qualification takes place on the first day of each new quarter. The total lifetime deposit is calculated until the first day of the new quarter and the sum of the previous quarter is used to calculate the client's tier.

This means, at the beginning of a new quarter, clients can either remain on the same tier or move to a different tier.

Exness uses the following calendar quarters for their Premier Program qualification:

- Quarter 1: From the first day of January to the last day of March.

- Quarter 2: From the first day of April to the last day of June.

- Quarter 3: From the first day of July to the last day of September.

- Quarter 4: From the first day of October to the last day of December.

This process is repeated every quarter as outlined above.

Also, there is a cash reward of $200 for clients who are able to maintain their tier. For clients who successfully maintain their tier at the same level, for instance, if they were in the Preferred tier in Quarter 1 and still remain in the Preferred tier in the next quarter, they will automatically receive $200 in cash.

However, if a client moves from the Preferred tier in Quarter 1 to Quarter 2 in April, the prize will be increased to $500 in cash. The same applies if you move from Elite to Signature, the reward will be $500.

Now, what happens if you move down a tier?

For example, if you are currently in the Elite tier and then move down to the Preferred tier in the following quarter, you will still receive $200 because you were still able to maintain your Premier level.

See Also: Exness Review

How to Maintain the Premier Tier?

As stated before, Exness provides a range of benefits through the Premier program, not only as rewards for your accomplishments but also as essential support for your journey to higher tiers.

So, not only can you maintain your tier, but you can also elevate it. Here's how:

Preferred:

- To maintain the Premier Preferred tier, you need to maintain a quarterly trading volume of 50 million USD.

- To upgrade to the Premier Elite tier, the total lifetime value of your deposits must reach 50,000 USD, and your quarterly trading volume must be at least 100 million USD.

Elite:

- To maintain the Premier Elite tier, you need to maintain a quarterly trading volume of 100 million USD.

- To upgrade to the Premier Signature tier, the total lifetime value of your deposits must reach 100,000 USD, and your quarterly trading volume must be at least 200 million USD.

Signature:

To maintain the Premier Signature tier, you need to maintain your quarterly trading volume at 200 million USD.

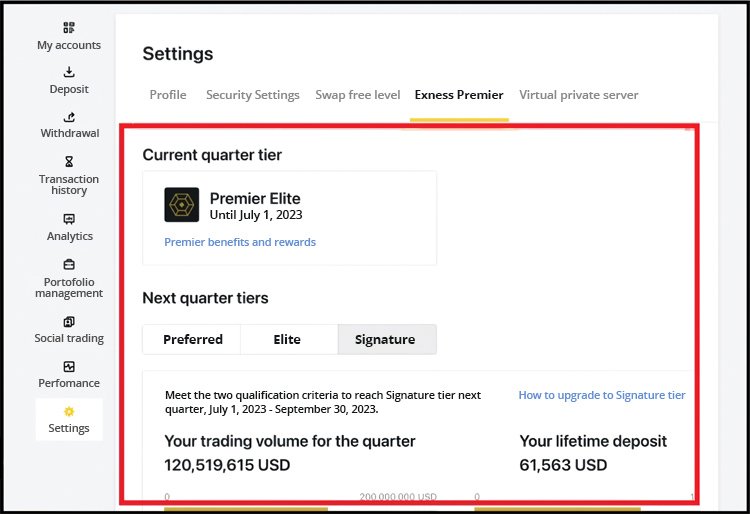

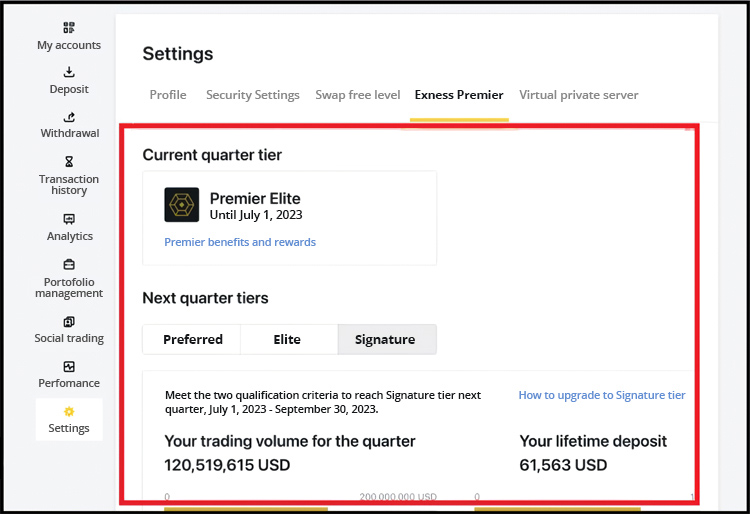

For example, in the image above, it is stated that the trading volume for the current quarter is $120,519,615 and the lifetime deposit reaches $61,563. Therefore, the account is currently in the Elite tier.

To be able to reach the Signature tier, the trading volume needs to be increased to $200 million, and the lifetime deposit needs to be raised to $100,000. So, here are the requirements that you need to fulfill:

- Trading volume deficiency: $200,000,000 - $120,519,615 = $79,480,385

- Lifetime deposit deficiency: $100,000 - $61,563 = $38,437

So, to reach the Signature tier, you need to fulfill the following:

- Increase trading volume by $79,480,385

- Increase lifetime deposit by $38,437

You can optimize your meetings with the dedicated account manager you have right now. Both of you can discuss strategies to elevate your tier by fulfilling those requirements together.

Conclusion

Exness Premier Program is an exciting opportunity to enjoy additional bonuses and special privileges as a high-priority client. All of the benefits are exclusive and incredibly useful for any type of trader. If you are planning to stick with Exness in the long term, this program can be a handy tool to boost your overall portfolio performance. For instance, you can consult with your account manager for free and get the fastest solution to your issues.

Exness is a forex and CFD brokerage that serves clients to trade across multiple markets with the most stable and reliable pricing in the industry. Their features include spreads as low as 0 pips and maximum leverage of 1:unlimited.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

33 Comments

Sebastian

Mar 14 2023

Wow, I'm actually pretty impressed at how detailed the broker provides this information. I mean, it's a good sign right, considering that loads of brokers nowadays offer crazy bonuses and turn out to be a scam? I've known Exness for years now and I'm sure that they're legit. Their client base is big and spread across various countries, so if you guys are interested, this program is definitely worth to check out if you can fulfill the requirements.

Powell

Jun 7 2023

@Sebastian: Hey, that's awesome that you have trust in Exness as a legit broker! It's definitely a good sign when brokers provide detailed information about their bonuses, especially considering all the shady stuff that's out there. It's crucial to be cautious and do your research, so kudos to you for being thorough.

With Exness having a large and diverse client base across different countries, it's a positive indication of their reputation. It's always reassuring to see that they have a solid presence and a loyal following.

The bonus program you mentioned sounds interesting, and it's definitely worth checking out if you meet the requirements. Just remember to read the fine print and understand the conditions associated with the bonus. You want to make sure it aligns with your trading goals and preferences.

At the end of the day, it's all about being informed and making a decision that feels right for you. Take your time to review the details, compare it with other options if you want, and go for it if it ticks all the boxes. Happy trading and best of luck with your endeavors!

Clara

Mar 14 2023

I'm confused, why would anyone refuse to participate in this program considering all the benefits? Is there some sort of risk that the author forgot to mention in this article? I'm a trader myself and I think all of the benefits that this program offers are fairly incredible. Not to mention the fact that the only way to access such benefits is through the Premier Program.

Lana

Mar 15 2023

Well, I think it's important to point out that Premier clients are usually large traders/investors. I mean, just look at the requirements. You need to trade at least 50 million USD in the span of a few months to become a member of the lowest tier! Maybe some of these millionaires prefer to stay anonymous and are not interested in participating in any social events held by the broker. And who knows, they probably already have a personal account manager to help them with their trades and such. Whatever the reason, I believe Exness simply wants to ensure their clients' satisfaction, so the broker allows qualified traders to cancel their membership if they request it.

Holly

Mar 14 2023

Hi

So I did a bit of independent research the other day and I found that there are so many types of loyalty programs offered by different brokers in the market. It was definitely pretty overwhelming, especially if you are new to forex trading. But at the same time, I know that it's crucial to pick the right broker in the beginning of one's journey. Switching from one broker to another can be pretty tiring because you'll need to adapt and learn to trade in a completely new environment.

My question is that in order to to avoid such mistakes, what do you think makes an attractive loyalty program that's mutually profitable for both the broker and the client? Thanks!

Bayu

Mar 16 2023

To answer your question, I personally think there are many factors that traders consider when choosing a broker and its loyalty program. Most of the time, it has to do with the value that the broker offers. Are the benefits useful for the clients? Are the requirements achievable? I think these are some aspects that should be considered first.

We should also note that loyalty programs are mainly designed to encourage traders to stay loyal to the broker, so the benefits should be available in the long-term. Based on my observation, one-time deals may attract a bunch of new clients, but they can easily hop to another broker once they find a more attractive reward.

Brian

Mar 14 2023

Does it seem to you that the Exness Premier Program is similar to a premium membership? You have to pay a certain amount of money every quarter to receive exclusive features that are not available in a basic account. It is similar to an advanced account and is likely to be used by professional traders. Although not many traders may have access to this feature, investors with more funds may use it, as they can consult with an account manager and even meet with them. By the way, have you ever wondered what an account manager does at Exness? What is their role?

Kennedy Williams

Mar 14 2023

Based on the article and the Exness information, an account manager at Exness is a professional who is responsible for assisting clients with their trading accounts. They act as a liaison between the client and the company, providing support and guidance to ensure that the client has a positive trading experience.

The account manager's job is to help clients navigate the various features and tools available on the Exness platform, answer questions, provide educational resources, and offer personalized advice to help clients meet their trading goals.

For clients who have subscribed to the Exness Premier Program, the account manager's role may include additional services such as personalized trading analysis and assistance with developing trading strategies. They can also help clients access special features and benefits that come with the Premier Program membership.

Overall, the account manager at Exness plays a crucial role in providing high-quality customer service and support to clients, and can be an invaluable resource for traders looking to improve their trading skills and achieve their financial goals.

Brian

Mar 14 2023

Wow, really? The job of account manager seems very important and by the way I have seen the account manager as the assistant of the trader. I mean they are there to assist clients in navigating the trading platform and to help them make informed decisions about their trading activities. and also I feel that account managers at Exness are also the professionals with expertise in trading and financial markets, and their guidance and advice should be taken seriously. It mean, if we have lot of money, it is worth it to get the Exness Premier Program!

Jason

Mar 14 2023

Honestly, I'm a bit confused about the Exness Premier Program because there is so much information to digest. Fortunately, the article provides a table that compares the different Premier Program tiers. It appears that the Elite and Signature tiers are the most beneficial as they offer a dedicated account manager to assist with trading. However, the required deposit amount is quite large, ranging from USD 50,000 to USD 100,000, and clients are also required to trade between 100 million to 200 million USD. It seems that this program is geared towards professional traders or companies with large trading capital.

As a trader with a smaller trading account, I am also interested in the Enhanced Trading Analytics offered by the Premier Program. I am curious to know what this entails and how it can benefit my trading strategies.

milestrader699

Mar 14 2023

So, the Enhanced Trading Analytics is basically a tool provided by Exness that gives clients advanced trading data and analysis tools. This helps them make better-informed trading decisions. With this feature, traders can use advanced charting tools, market depth analysis, and real-time market sentiment indicators to identify trends and patterns in the market. This can help them spot potential opportunities and make more accurate trading decisions. One of them is Trading Central that have explained in the article

Moreover, clients subscribed to the Enhanced Trading Analytics feature can access proprietary research and analysis from Exness' team of market experts. This can provide unique insights and perspectives on market trends and events, which can be super useful when developing trading strategies.

Hero

Apr 16 2023

Wow, I am amazed to think about the benefits that traders who put $20,000 into a trade receive that are not available to ordinary traders. The world of trading is filled with opportunities, but it is not always easy to achieve success in this field. Professional traders have the skills, experience, and knowledge to navigate the complexities of the market and turn a profit.

I wonder how professional traders are able to execute trades of such high value and if most of them are swing or position traders due to their ability to hold floating losses.

Herry

Apr 16 2023

@Hero: Yo, pro traders have all the sweet tools and resources to study market trends, watch prices like a hawk, and make smart trades. They're using the most high-tech software, algorithms, and tech indicators to spot sweet opportunities and manage their risk like a boss.

But becoming a pro trader ain't easy, dude. It takes some major dedication, hard work, and a deep understanding of the market. You gotta practice for years, do some heavy research, and build a solid strategy that you won't break under pressure. If you're starting out, just learn the basics, try out different strategies, and get some practice with demo accounts.

In the end, trading is hype, but it's not easy to make it to the top. Pro traders know how to use their skills and knowledge to dominate the market. If you're down to put in the work, have the right mindset and approach, becoming a pro trader is definitely doable. So, let's hustle and get that Preferred status!

Recoba

May 19 2023

When it comes to the Exness Premier Program, it seems like a big deal, especially considering that the traders within this program are professionals who can deposit substantial amounts of money with Exness.

As a novice trader, I'm impressed by Exness's ability to effectively manage the funds of these professional traders. I've heard that Exness offers segregated accounts, which means they create separate bank accounts to keep the traders' funds separate from the broker's operational funds. This helps ensure the safety and integrity of the traders' money.

I'm curious about the requirements or terms that a bank needs to fulfill in order to become a bank that offers segregated accounts for brokers like Exness. What are the key factors that a bank must meet to provide this service? Are there specific regulations or certifications that need to be in place?

Chang

May 19 2023

@Recoba: When it comes to banks offering segregated accounts for brokers like Exness, there are a few things they need to tick off. Now, the specifics might differ depending on the rules and regulations in their area, but here are some key factors:

First up, they gotta play by the rules set by the authorities. Banks need to follow the financial regulations and guidelines that are in place. This is to make sure they're keeping things legit and protecting client funds. Then there's the money stuff. Banks need to show that they've got enough capital and financial stability to handle the segregated accounts properly.

Of course, risk management is a biggie. Banks need to have solid systems and processes in place to tackle any potential risks. They gotta keep unauthorized access, fraud, and all that nasty stuff at bay. Security measures and tight internal controls are a must. And let's not forget about audits. Banks offering segregated accounts usually get regular independent audits to make sure they're playing by the rules.

Hope it can clarify your things!

Udin

Jun 13 2023

Is the Premier Program offered by Exness exclusively for professional traders, or can retail traders also participate? I've been hearing about the benefits and requirements of the Premier Program, but I'm not sure if it's specifically designed for experienced or institutional traders. Can you clarify if retail traders like myself can qualify for the Premier membership? I'm interested in understanding if this program is open to all types of traders or if it's limited to a specific category. Any information you can provide would be greatly appreciated. Thank you

Powell

Jun 14 2023

@Udin: Hey there! The good news is the Premier Program offered by Exness is open to both retail traders and professional traders. It is not exclusively limited to experienced or institutional traders. Retail traders like yourself can qualify for the Premier membership and take advantage of the benefits it offers. The program is designed to provide enhanced trading conditions, personalized support, and exclusive features to traders who meet certain criteria, such as trading volume or account equity. It aims to cater to the needs of various traders, whether they are beginners or more experienced individuals. So, rest assured that as a retail trader, you can participate in the Premier Program and enjoy its perks.

Nabil

Jul 11 2023

As an Elite Premier Tier client, I understand that I'll receive all the privileges of the Preferred tier, along with some additional benefits. One of these extra perks is having a dedicated account manager assigned to me, who will handle all my requests with top priority. I appreciate the personalized attention, but I'm curious about the possibility of meeting my account manager in person. The information mentions the opportunity to meet face-to-face with the account manager in a preferred setting, whether it's a private champagne party or just a casual chat over coffee. Could you provide more details about the process of arranging such meetings? Is it something that can be easily scheduled and facilitated? Additionally, considering the increasing trend of online interactions, does Exness also offer options for virtual meetings with the account manager? It would be great to know if there are convenient online platforms or tools available to connect with the account manager and discuss any questions I may have or gain more insights about Exness products and services.

Powell

Jul 12 2023

@Nabil: As an Elite Premier Tier client with Exness, you'll indeed enjoy all the privileges of the Preferred tier, along with additional benefits, including a dedicated account manager who will prioritize your requests. The opportunity to meet your account manager in person is a unique perk provided by Exness.

Arranging face-to-face meetings with your account manager typically involves a process of coordination and scheduling. Once you qualify for the Elite Premier Tier and express your interest in meeting in person, you can reach out to your account manager or the customer support team to discuss your preference. They will guide you through the necessary steps and help facilitate the arrangements based on your location and availability.

In addition to in-person meetings, Exness recognizes the importance of online interactions and provides options for virtual meetings with your account manager. Virtual meetings allow for convenient and efficient communication, particularly considering the increasing trend of online interactions. Exness may offer various online platforms or tools, such as video conferencing software or secure messaging systems, to facilitate virtual meetings. These platforms ensure that you can connect with your account manager, discuss any questions or concerns you may have, and gain further insights about Exness products and services from the comfort of your own location.

Frederick

Aug 1 2023

Hey, I've heard that Trading Central offers fantastic features for their Preferred Premier members. Could you please provide more details about what's included? I'm particularly interested in understanding how the priority customer support functions and what sets it apart from the standard support. Additionally, I'm eager to enhance my trading skills, so I'd appreciate more information about their exclusive educational materials, webinars, and seminars. Could you also elaborate on the enhanced trading analytics? What additional services and analysis sources are part of their premium package? Lastly, I'm always excited about extra bonuses and rewards. Could you tell me more about the special promotions and rewards they offer to their members? Thanks!

Roger

Aug 2 2023

Based on the article, as a Preferred Premier member with Trading Central, you'll enjoy a range of special benefits. One of the key perks is the priority customer support. All your requests and questions will be prioritized, and the senior customer support team will handle your issues in more detail, making the process faster and more convenient for you compared to standard support.

Moreover, you'll have access to exclusive educational materials, webinars, and seminars that cover essential trading topics. These resources will help you boost your trading skills and improve your overall trading results.

Trading Central also provides enhanced trading analytics with additional services and a free subscription to leading fundamental and technical analysis sources. As a premium member, you'll get early access to all weekly and quarterly reports provided by Exness' expert team, allowing you to stay ahead of the market trends.

Read more: 5 Exness Trading Tools to Trade with Confidence

Foden

Aug 3 2023

In addition to the benefits mentioned earlier, as a Preferred Premier member with Trading Central, you'll have access to some specific and powerful tools and services tailored to help you in your trading journey:

Technical Indicators and Chart Patterns: Trading Central provides a wide range of technical indicators and chart patterns that you can use to analyze market trends and potential entry or exit points for your trades. These tools are designed to assist you in making more informed trading decisions based on technical analysis.

Trading Signals and Alerts: As a premium member, you'll receive real-time trading signals and alerts generated by Trading Central's advanced algorithms. These signals can give you insights into potential trading opportunities, helping you stay on top of the market movements.

Market Commentary and Insights: Trading Central offers regular market commentary and insights from their team of experts. This analysis can help you stay updated with the latest market developments and provide you with valuable context for your trading decisions.

Risk Management Tools: Trading Central understands the importance of risk management in trading. As a premium member, you'll have access to advanced risk management tools and resources to help you manage your trading positions effectively and protect your capital.

Personalized Support: The Preferred Premier membership includes personalized support from Trading Central's team of analysts and experts. You can get assistance with technical analysis, trading strategies, and market insights tailored to your trading preferences and goals.

Robin

Aug 1 2023

I am curious, what are some tips to become a pro trader and achieve the Premier Program in Exness? I've heard that continuous learning and practicing on a demo account are crucial in developing trading skills, but I'd love to know more about their importance. Can you provide some insights on creating an effective trading plan and implementing risk management strategies that can help traders succeed? Moreover, how can traders stay updated with market trends and effectively utilize the trading tools and resources provided by Exness to enhance their trading decisions? Lastly, I've heard that emotional discipline and patience are key traits of successful traders. How do they play a role in the journey to becoming a pro trader and potentially qualifying for the Premier Program? Thanks!

Fidelia

Aug 2 2023

Becoming a pro trader and qualifying for the Premier Program in Exness requires dedication. Continuous learning and practicing on a demo account are crucial to develop trading skills. Creating an effective trading plan with risk management strategies helps protect capital and manage losses. Staying updated with market trends and utilizing Exness' tools enhance trading decisions. Emotional discipline and patience are key traits, avoiding impulsive decisions and sticking to a plan is vital. By following these tips, traders can improve their skills and potentially qualify for the Premier Program. (For example, you can read this article : Attain Success By Applying Seven Virtues In Forex Trading

Remember, trading is a journey of learning, and with dedication, progress is possible. Good luck!

Harry G

Oct 25 2023

I'm really looking forward to achieving Elite Status in Exness someday, and I'm thankful for finding this article early. It gives me a chance to prepare and work towards attaining that status with Exness. There's one aspect that's left me a bit puzzled when it comes to opening a Premier Account with Exness, and that's understanding how the broker's policy works when a client qualifies for multiple tiers from different Personal Areas. Could you please provide an example to illustrate how this policy operates in such situations? Some real-life examples would be greatly appreciated. Thank you.

Aita

Nov 16 2023

It's mentioned that by depositing a higher amount into the Exness Pro Account, known as the Exness Premier Level, you can enjoy the perks of having a dedicated account manager. This manager will prioritize your requests, keep you updated on the latest Premier Program activities, events, and opportunities. I'm curious about the nature of this manager—can we also seek trading advice from them? Additionally, the fact that face-to-face meetings are possible with these managers makes it seem more exclusive compared to other accounts offered by Exness. So, what exactly are these managers? Are they seasoned traders or something else?

Kamun

Nov 18 2023

As I know dude, The dedicated account manager provided with the Exness Premier Level, or Pro Account, is a professional who personally handles your requests with top priority. They keep you in the loop about the latest Premier Program activities, events, and opportunities. While they primarily focus on managing your account and providing updates, the extent to which they offer trading advice may vary.

These managers are not necessarily traders themselves but are typically well-versed in the intricacies of the financial markets and can assist you with account-related inquiries. The option for face-to-face meetings adds an exclusive touch to this account, making it more personalized compared to other account types offered by Exness. So, while they may not be traders per se, they bring a level of expertise to enhance your overall trading experience.

Fernan

Nov 28 2023

Based on what I read in the article, they mentioned that to stick with the Premier Preferred tier, I need to keep a quarterly trading volume of 50 million USD. Now, if I'm aiming for the Premier Elite tier, my total deposits need to reach 50,000 USD over time, and I've got to trade at least 100 million USD every quarter.

So, I'm wondering, how many trades do I need to make to hit that 100 million USD trading volume target?

Yudha

Dec 3 2023

o achieve a quarterly trading volume of 100 million USD, the number of trades required is contingent on the size of each individual trade. Let's break it down: if each lot is valued at 100.000 USD, you'd need to execute 1000 trades within the quarter to meet the 100 million USD target.

However, it's crucial to tailor your trade size to align with your trading strategy, risk management approach, and overall financial goals. Assessing the potential impact of each trade on your portfolio is vital for responsible trading.

Consider factors such as market conditions, asset volatility, and your comfort level with risk. Striking the right balance between trade size and risk management is key to successfully meeting your trading volume targets while safeguarding your overall financial well-being. Always keep in mind the importance of informed and prudent decision-making in the dynamic world of trading.

Amin

Dec 18 2023

From my understanding of the Exness Elite Status, it seems that the broker encourages traders to engage in more frequent trading activities. I'm curious about the underlying motive behind this strategy. While I acknowledge that the Exness Elite Status provides exclusive benefits not available to standard or professional accounts, such as VIP privileges, I'm interested in understanding the broker's rationale for encouraging higher trading volumes.

Consider this: If a trader operates with a capital exceeding $1,000,000 but has restrictions on the number of trades they can execute within a specific timeframe, they might naturally opt for smaller lot sizes to mitigate risk. This approach could lead to an increase in the overall number of trades. Could you shed light on the broker's objectives in promoting such a trading approach, especially when the reduction in lot sizes, despite maintaining the same target, may result in a higher frequency of trades?

Hans

Dec 23 2023

Hey there! Let me explain to you! About Encouraging more trading under the Exness Elite Status probably helps the broker make more money through increased transactions and keeps the trading atmosphere lively. The exclusive VIP features sweeten the deal, and it makes sense for traders with bigger funds to go for smaller trades to manage risks better. This approach not only fosters a responsible trading environment but also boosts trader loyalty by offering special perks. It's a win-win situation where both the broker and traders benefit. Just be sure to check out the program details to make sure it fits your trading goals.

Agha

Dec 23 2023

Hello! I'm interested in learning about the accounts eligible for participating in the Exness Premier program. Specifically, I'm curious about the types of accounts that can help attain Elite status in Exness. The article mentions the Exness Premier Level as a specialized loyalty program for dedicated and active members but doesn't specify the account types. Since achieving this status requires a significant number of trades, I'd like to know which type of trading might be the quickest to reach the required level.

Sammy

Dec 27 2023