Before analyzing price actions, we must first understand what time frames mean in forex trading.

Forex trading platforms like Metatrader and cTrader enable us to analyze price changes through charts. The EUR/USD chart will rise when Euro becomes stronger than USD. The EUR/USD chart will decrease when USD becomes stronger.

It seems simple, but actually, observations of price movements will also be influenced by time frames. Time frames represent the duration or length of each candlestick or bar on a price chart.

What does it mean? Therefore, we must understand what time frames mean in forex trading and their role in analyzing price actions.

Defining Time Frames

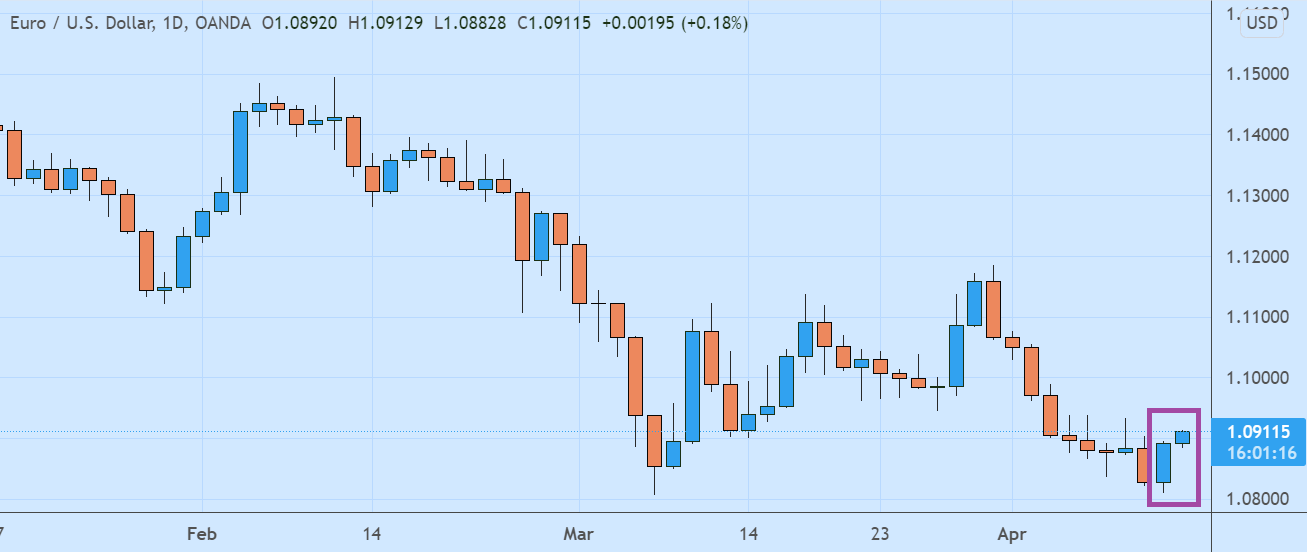

Time frames in forex trading mean certain periods determined as observation periods. At different time frames, the price actions displayed may be interpreted differently. For example, the EUR/USD currency pair strengthened in the last two days (Daily chart) but weakened in the last two months (Monthly chart).

In practical terms, forex charts are generated based on price movement data collected within a certain time frame. Therefore, time frame changes would also lead to changes in the charts. Let's compare the two price charts below to understand it better. The first is EUR/USD in the Daily time frame, while the second is EUR/USD in the Monthly time frame.

In the Daily time frame, each candlestick delineates price movements during one trading day (opening, closing, highest, and lowest prices). In the Monthly time frame, each candlestick depicts monthly price movements. Every time frame represents the period needed to create one candlestick.

The most frequently used time frames in forex are 1 Minute (M1), 5 Minutes (M5), 15 Minutes (M15), 30 Minutes (M30), 1 Hour (H1), 4 Hours (H4), 1 Day (D1 ), 1 Week (W1), and 1 Month (1M/MN). Forex trading platforms usually provide several time frames, and we can easily switch between them to choose the most suitable time frame for our trading strategies.

How to Set Time Frames

- Open your preferred trading platform: start by launching your chosen trading platform, such as Metatrader or cTrader.

- Select a currency pair: choose the currency pair you want to trade. For example, EUR/USD represents the Euro against the US Dollar.

- Open a price chart: locate the charting feature within your trading platform. Usually, you can find it in the toolbar or through a dedicated menu option. Click on it to open a new price chart.

- Choose a time frame: once the price chart is open, you'll typically see a toolbar or menu displaying various time frame options. Click on the desired time frame to select it.

- Adjust the time frame if needed: if you want to change the time frame, simply return to the toolbar or menu and select a different option. This allows you to switch between different time frames and analyze price actions from varying perspectives.

How to Choose the Right Time Frames

Setting time frames in forex trading is crucial for analyzing price movements, identifying trends, and making informed trading decisions. Here are the steps to effectively set time frames in forex trading:

Scalpers

Scalpers open and close transactions quickly, sometimes within a few minutes apart. Therefore, they typically employ time frames under 1 Hour (M1, M5, or M30).

Day Traders

As the name implies, day traders tend to open and close transactions within the same trading day. It could be a few minutes, a few hours, or a few sessions apart.

Therefore, day traders may utilize any time frame between M1 to D1. They may also apply multiple time frame analysis using M30 or H1 time frames to determine entry points and H4 or D1 time frames to identify current and future trend direction.

Swing Traders

Swing traders may maintain each open position for days, weeks, and even months. Therefore, they tend to use higher time frames starting from H4 upward.

Experienced traders generally consider Lower time frames " too noisy, " but they could help scalpers more precisely discover entry and exit points. Higher time frames could show overall trend and price actions but may be too illusory for scalpers. If you don't know which one to choose, remember that you can also freely use multiple time frames.

After setting the most suitable time frames for your strategy, what should we do then? Setting the time frame in forex trading is the first step before technical analysis. Next, you need to identify Support and Resistance levels to understand the current trend and forecast the next price actions.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance