No matter how rich you are, there is no guarantee you're going to stay that way forever. These interesting stories provide priceless lessons that might be useful for your trading journey.

Every investor has a single goal in mind which is to become successful in their career someday. Many of them have officially achieved the goal and shared their success stories of what they did to become billionaires. Unfortunately, being at the top of the field and gaining millions of dollars a year doesn't guarantee that they're going to stay in that position forever.

Even the wealthiest figures aren't immune to sudden collapses and failures in their careers. A series of poor decision-making, mishandled finances, bad luck, and other factors can turn their lives upside down and make them drastically lose everything. In a blink of an eye, these 0.001% people suddenly became the 99%.

It is definitely quite tragic how billionaires with their private jets, yachts, and mansions could end up in bankruptcies and lose the entire fortune that they had worked hard for. Here are the 8 biggest downfall stories from billionaires who have lost their wealth. See what happened and what you can learn from the stories.

1. Yasumitzu Shigeta

Yasumitzu Shigeta is one of the youngest self-made billionaires from Japan. Not only that, he was the youngest CEO of a publicly traded company when it later registered its shares with JASDAQ. In his early days, Shigeta dropped out of college in 1988 to build a mobile phone distributing company named Hikari Tsushin. He continued developing the company until it came on top in Japan and was pretty popular in China. He made his first billion in 1999, but due to the market volatility, his fortune could fluctuate rather quickly (up to $5 billion in 24 hours).

In 2000, shares of Hikari Tsushin traded at $2,300 and Shigeta was worth $42 billion on paper. But the tide was turning fast. He lost $40 billion in only a matter of months. In 2009, his stock's worth is left to $600 million. Since then, Shigeta has been working hard to gain his money back. In 2005, he re-emerged as a billionaire and managed to rise up his company's stock price up to 88% in 2013.

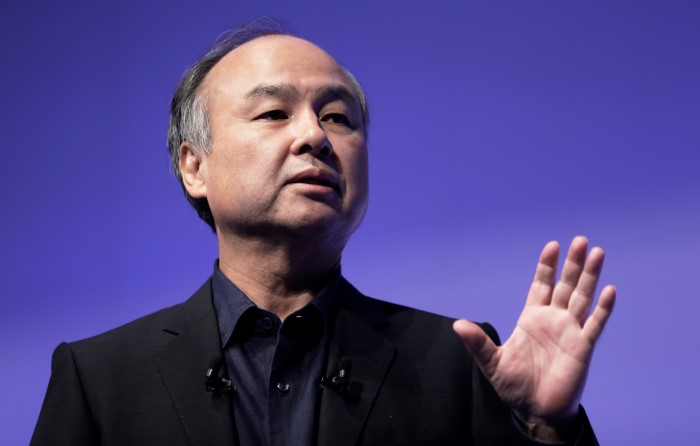

2. Masayoshi Son

Masayoshi Son is a Japanese billionaire who is mostly known as the founder of Softbank. He is also the CEO of Softbank Mobile and chairman of the UK-based Arm Holdings. He launched Softbank in the 1980s, whose core business is telecommunications and technology. Softbank has signed a lot of investments, including buying stocks in Yahoo! and Alibaba.

At the height of the dot-com bubble in the late 1990s, Masayoshi Son's worth was surging by $10 billion per week, making him one of the richest people alive at that time. However, it didn't take long until the dot-com bubble burst. As a result, Softbank's shares plunged 75% in only a span of two months and were 93% lower by the end of 2000. It made Son lost $70 billion of his wealth, the highest ever recorded financial loss for a person in history.

But even so, Son didn't stop there. He decided to focus on the mobile industry and managed to acquire Vodafone Japan in 2006, which was a revolutionary deal for Softbank. The company has been thriving since then. Son returned as a billionaire in 2013 and due to Alibaba's CEO, he's still the wealthiest man in Japan with a net worth of $16.6 billion in 2014.

3. Björgólfur Thor Björgólfsson

Iceland is not a home to many billionaires, so the story of Björgólfur Thor Björgólfsson really stands out. He was the first Icelander to join Forbes magazine's list of the world's wealthiest people in 2005, declared as the "Iceland's First Billionaire", and was ranked as the 249th richest person in the world by Forbes magazine in 2007 with a net worth of $3.5 billion.

After graduating in the US at UC San Diego, Björgólfur moved to Russia and started a soft drink and beer business. In 2002, he sold his company to Heineken for $352 million and moved back to Iceland. Not long after, he and his father bought a 45% controlling share of Landsbanki, Iceland's second-largest bank.

However, his business went sour following the Icelandic financial crisis in 2008. The Icelandic government ended up seizing the top banks in the country, including Landsbanki. Not only did he lose his entire fortune, but he was also stuck with no less than $750 million of debt. His story is now widely known as the biggest personal bankruptcy in Iceland's history.

4. Allen Stanford

Allen Stanford was one of the richest men in the US who owned banks and mansions around the world. At his peak, his fortune was estimated to be worth about $2 billion. His success started from speculating in real estate in Houston after the Texas oil bubble burst in the early 1980s. Allen and his father made a vast fortune by buying up depressed real estate and selling it years later as the market recovered. After his father's retirement, Stanford took control of the company named Stanford Financial Group, which is now defunct.

After moving to the Caribbean nation of Antigua, Stanford began taking interest in cricket matches and sponsored several lucrative tournaments. At one point he staged a cricket match between his own team and England with a $20 million prize, making him the nation's largest private employer. He also made history as the first American ever knighted in Antigua, adopting the moniker "Sir Allen". At that time, his wealth even exceeded Antigua's GDP by roughly $1 billion.

However, in early 2009, Stanford and his company became the subject of several fraud investigations and was soon charged by the US Securities and Exchange Commission (SEC) for several fraud charges. In early 2012, Stanford was officially arrested with a 110-year federal prison sentence for allegedly orchestrating a $7 billion Ponzi scheme, which is one of the biggest in history.

5. Seán Quinn

Seán Quinn was one of the richest people in Ireland. In 2008, Forbes magazine listed him as the 164th wealthiest individual in the world and estimated that his net worth at that time reached $6 billion.

Seán's started his career by launching his own company, the Quinn Group. He and his family started off with minor operations in Derrylin and expanded into a large organization with more than 8,000 employees in various locations throughout Europe. The group has ventured into many kinds of products including cement and concrete products, radiators, hotels and real estate, container glass, general insurance, and plastic manufacturing plants.

Even with such success and wealth, the Quinn Group couldn't escape Ireland's property collapse in 2008, which crippled the country's economy in general. The nationalization of Anglo Irish Bank in 2009 also made the situation worse as it wiped out the family's investment. At that time, Quinn and his family owned at least a quarter of stakes in the bank. The series of unfortunate incidents eventually led him to bankruptcy in 2012 with over $3 billion in debt. After the bankruptcy filing, Quinn and his family were only left with $15,000.

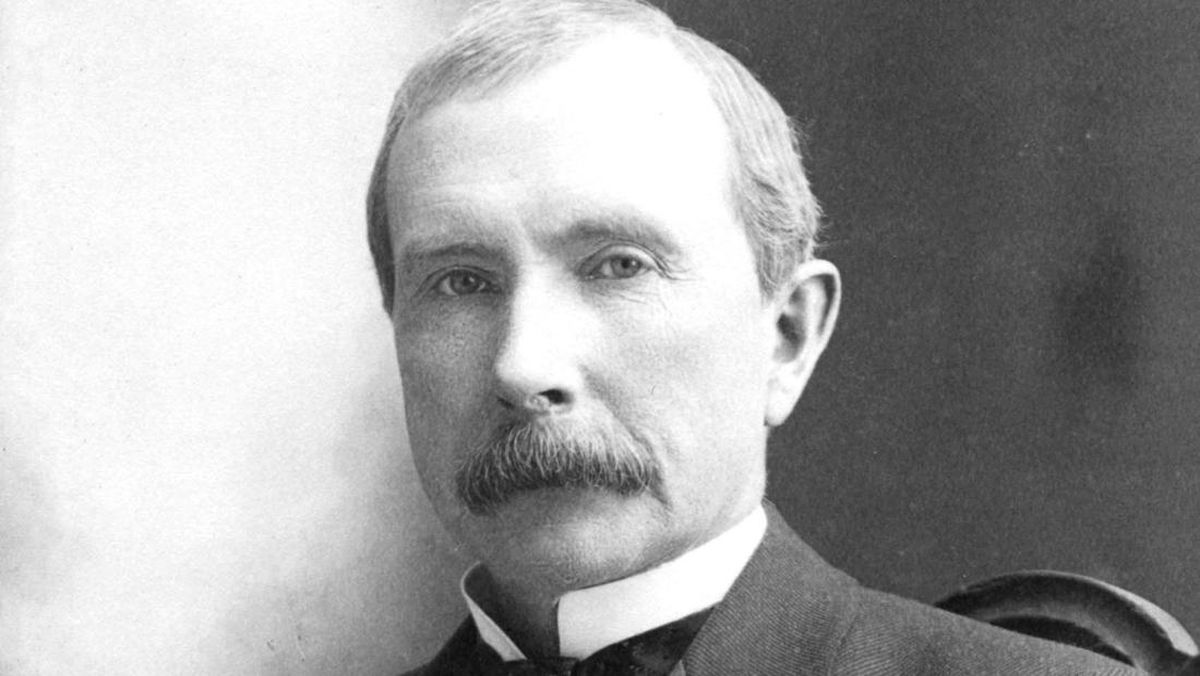

6. John D Rockefeller

John D. Rockefeller was one of the richest people in history. At the age of 24, he formed an oil company to make extra money. Nobody could have guessed how essential oil was to become as the price fluctuations were pretty high at that time. Every time a new oil well was tapped, prices hit rock bottom. New refineries showed up everywhere and many of them are at loss because of incredibly low prices.

In the midst of the crisis, Rockefeller saw an opportunity and took it. He negotiated with leading railroad companies, who granted him discounts for transporting oil all across the country, giving him a massive advantage over his competitors. He also bought many of his rivals' companies at low prices and thus, created the country's first monopoly act.

Nonetheless, he soon was confronted with accusations and lawsuits that charged him for violating antitrust regulations and building a monopoly. Apart from that, the situation in the market was not great as everyone was suffering due to the Great Depression. Following the market collapse, Rockefeller had to lose at least $709 million back in 1929.

See also: Oil Price Today

7. Eike Batista

Eike Batista was one of the wealthiest people in Brazil. In 2012, Eike's net worth was estimated at around $34.5 billion, which according to Bloomberg, making him the 8th wealthiest person in the world and the richest man in Brazil.

As the son of Brazil's minister of mines and energy at that time, it's no surprise that Eike was taking a huge interest in making a fortune from commodities. He started trading gold and diamonds in the early 1980s and launched his own gold mining company not long after. In 2000, the company was worth $20 billion in value by operating eight gold mines in Brazil and Canada, along with one silver mine in Chile.

Of the five leading operating companies that Batista controlled, OGX, the oil and gas business was the most successful. The company was believed to have nearly $19.9 billion of value at its peak. However, the oil production from the exploration areas was ultimately much less than expected, so the company simply couldn't keep up with debt payments and oversold the commodity. In the end, Eike filed for his company's bankruptcy in 2013. In September 2014, he reported that his net worth is negative $5.1 billion.

See Also:

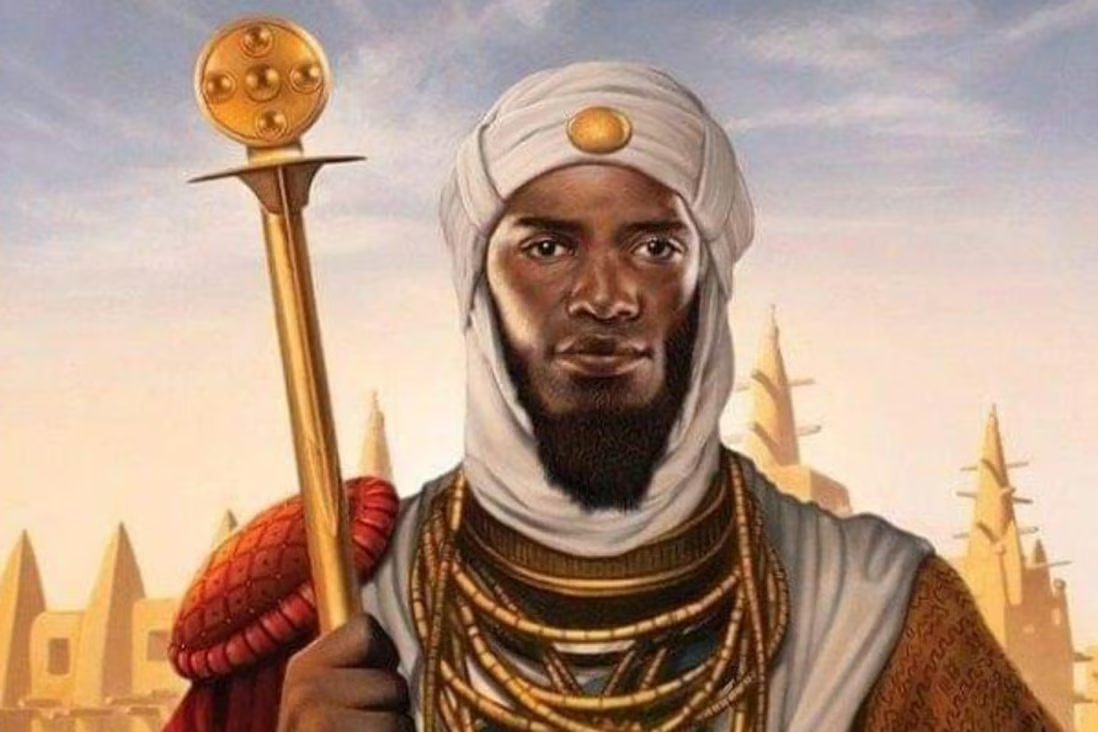

8. Mansa Musa I

Mansa Musa I was the ruler of the Mali Empire from 1321-1337. He was the richest man in history, whose wealth was too vast to be imagined right now. In the 1300s, the Mali Empire was the biggest producer of kola nuts, ivory, gold, and salt.

As a devout Muslim, he set off a journey to Mecca for the Hajj pilgrimage. He brought a big party of 60,000 men, caravans, and a huge amount of gold with him. When arriving in Cairo, he showed his generosity by buying goods and handing out gold to poor people. However, it did more damage than good as the value of metals in Egypt began to depreciate and the economy in general took a significant hit. It took decades to recover.

Also, he was heavily criticized for spending too much gold on his journey instead of spending it for his people. After his death, the throne was passed down to his son who could not hold it together. The empire began to crumble down since then. Within two generations following Musa's death, his vast wealth almost disappeared entirely.

See Also:

The Bottom Line

Being a billionaire is everyone's dream, but once you become one, there is never a guarantee that you're going to stay that way until the end of the day. We can see that even billionaires can go bankrupt due to various reasons such as poor decisions, economic downturn, or even bad luck. But even after losing a tremendous amount of fortune, some of them did manage to climb back up again and recover.

The point is learning from past mistakes, looking for a chance in potential areas, and do your best. After all, Masayoshi Son managed to recover by entering a new industry with high potential in the future. With various stories shared above, hopefully, you can have a better insight to plan your trades in the long term.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance