Exponential Moving Average (EMA) is often used to identify trends and trading opportunities. In this article, you will learn how to implement the 3 Bar EMA trading strategy with simple yet significant modifications.

Many technical indicators are provided on trading platforms to help you set up trading strategies. One of them is the exponential moving average, known as the EMA. Countless traders have created EMA-based trading strategies, but the possibility of generating new ones seemingly never ceases, thanks to its versatility and reliability.

A 3-Bar EMA strategy is one of many EMA-based methods that you can try. It is created by combining two short-term EMAs within the same period but with different variables. This unique strategy has been tried and tested, and you can utilize it for your trading success.

The 3 Bar EMA Trading Strategy

The versatility of EMA makes it a great technical indicator to base your trading strategies on, although it should be noted that the perpetual risks of live trading are not eliminated. You can learn the 3 EMA trading strategy which can win you more than 30 consecutive trades if utilized properly.

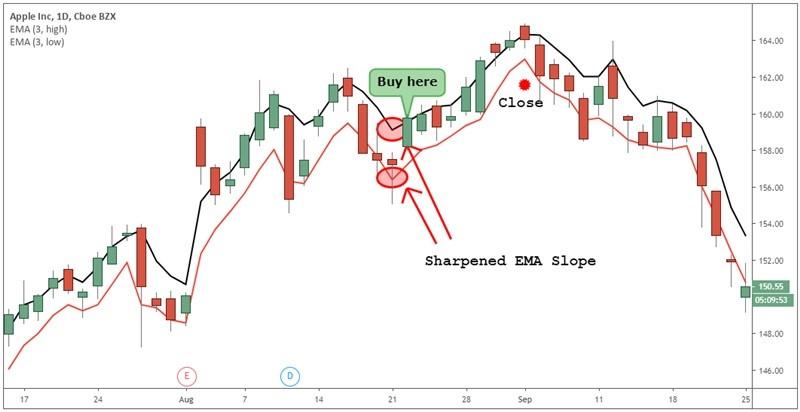

This strategy uses the EMA, but instead of one, we use two EMAs calculated using the bars' lows and highs, respectively. Here is an example of the chart; the blue slope represents the EMA highs, while the EMA lows are the black slope.

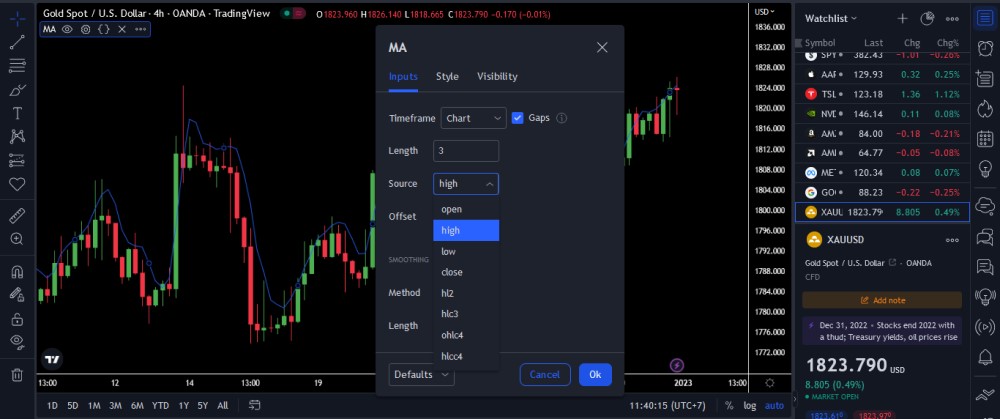

The EMAs above are input as 3-EMA because the data use the 3 most recent bars. In short, we will have two EMAs with the same period, so the only difference is to which component it is applied. Here is how you can set up the calculation of both EMAs. Notice that we don't use closing prices for this strategy.

Using two 3 Bar EMAs can increase the probability of gaining profits as these tools can pinpoint the zones on the chart that potentially signal short-term trend reversals. To have both EMAs calculated within the same period means we can capture the low and high bar prices and prepare a solid strategy based on these interrelated data sets.

Here is how you apply two or 3 EMAs to your trading strategy. For a buy signal, wait until both EMAs move upwards to create a steep angle, as the chart below describes.

Remember, the strategy best works when the two EMAs have sharpened slopes. If you encounter a case where only one EMA has a sharpened slope, it is wise to wait and monitor the price movements. When the conditions are met, you can proceed to buy.

Still using the two 3 EMAs, you can also determine when to close the trade, which is when the price breaks below the EMA-lows. Here is an example to give you an idea.

The two 3 Bar EMAs can filter out the noise from the price fluctuations, which, in turn, reveals the trend direction more comprehensively. During uptrends, the price tends to stay glued to the EMA highs, while during downtrends, the price tends to stay glued to the EMA lows.

You can exploit this price behavior to implement the 3 Bar EMA trading technique combined with the candlestick patterns analysis. For a sell signal, wait for three consecutive candles to have opened and closed near the EMA-lows.

On the other hand, wait until three consecutive candles form near the EMA lows for a sell signal. Look at the chart below to better understand how the strategy works.

Overall, the 3 Bar EMA trading strategy is not difficult to implement, though it needs discipline and practice on your part. If the theory is somewhat difficult to understand, it's better to re-learn until you grasp the idea behind the 3 Bar EMA strategy before trying to test it on a real account.

Pros and Cons of 3 Bar EMA Strategy

| ✔️Pros | ❌Cons |

| If compared to the standard EMA which is usually based on closing prices, the 3 Bar EMA is smoother in movements and doesn't react as swiftly. This provides a much better noise filter especially if you trade in small time frames. | 3 Bar EMA is not as sensitive as other indicators, such as the MACD or the RSI. This means that it may not generate as many trading signals. |

| The 3 Bar EMA presents a unique insight into EMA trading strategy as there are 2 different concepts in waiting for buy and sell signals. | 3 Bar EMA is not suitable for all trading styles, especially the aggressive ones as traders need to wait for a few confirmations before executing a trade. |

| It's favorable for conservative traders since there are steps to confirm signals with a breakout candle (for Long position) and four consecutive candle breakouts (for Short position). | The indicator implementation is not as simple as the usual EMA as traders need to change the setup first. |

See Also:

Trading Tips with 3 Bar EMA

Incorporating the 3 Bar Exponential Moving Average (EMA) into your trading strategy can provide valuable insights and potential trade opportunities. Here are some helpful tips to maximize its effectiveness and enhance your trading decisions.

- Use it in conjunction with other indicators. 3 Bar EMA can be used with other indicators to improve its accuracy. For example, you could use 3 Bar EMA with the MACD or the RSI.

- Set appropriate stop losses. 3 Bar EMA can be susceptible to false signals. This is why it is important to set appropriate stop losses to limit your losses if a trade goes against you.

- Backtest the indicator. Before you use 3 Bar EMA in live trading, it is a good idea to backtest the indicator to see how it would have performed in the past. This will give you an idea of how accurate the indicator is and how it can generate trading signals.

- Trade with the trend. 3 Bar EMA is a trend-following indicator, so it is best to trade with the trend. This means you should only buy when the 3 Bar EMA rises and sell when it falls.

- Use a demo account. Starting with a demo account is a good idea if you are new to trading. This will allow you to practice using 3 Bar EMA without risking any real money.

- Be patient. Trading with 3 Bar EMA can be a waiting game. You will not always get a trade signal, and you may have to wait for the market to develop before you enter a trade.

Final Words

Incorporating the 3 Bar Exponential Moving Average (EMA) into your trading strategy can be a powerful tool to identify trends and potential entry or exit points. Understanding the principles behind the 3 Bar EMA and implementing the tips provided can enhance your trading decisions and potentially increase your profitability.

Remember, the 3 Bar EMA is just one component of a comprehensive trading strategy. Combining it with other indicators, such as support and resistance levels, candlestick patterns, or trend-following indicators, is essential to confirm signals and strengthen your analysis.

Additionally, risk management should always be a priority. Implement appropriate stop-loss orders and adhere to proper risk management techniques to protect your capital and minimize potential losses.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

3 Comments

Purwahyo

Dec 30 2021

Very helpful especially for me as a beginner. Thank you

Hanif Cahyadi

Jan 21 2024

The article specifically discusses a trading strategy centered around utilizing only three EMA bars. According to the article, this strategy is kept simple, relying on EMA crossovers and observing candlestick patterns. Additionally, the article mentions a drawback of this strategy, noting that the 3 Bar EMA is less sensitive compared to other indicators like MACD or RSI, potentially resulting in fewer generated trading signals.

I'm interested in understanding how trading signals can be generated using the 3 EMA Bar strategy. Is there room for incorporating other strategies alongside this, or is it primarily standalone? Thanks!

Eggy

Jan 25 2024

Sure thing! If you want to juice up the signal count with the 3 EMA Bar strategy, try playing around with the EMA periods – maybe shrink the short-term EMA period for more action, but watch out for false signals. Throw in a signal line, like a moving average of EMAs, to smooth things out and add confirmation. Spice it up by tossing in other indicators like MACD or RSI for extra signals and trend strength checks. Take it to the next level by eyeballing multiple time frames for a fuller market view and more signals. But, hey, be careful not to overdo it – too many signals can mean more fakes. Remember, backtesting is your best friend here to find that sweet spot. And, of course, keep risk management on your radar as you tweak your strategy. Happy trading! (ex: Best MACD Setting for Day Trading)