Improve your trading proficiency with a written journal. Note down your past mistake, best working strategies, and form a trading system that will lead you to consistent profit.

Do you know that Forex trading journal can do much more than just keeping your trading secrets (or foolish mistakes) hidden from your rivals?

More importantly, it can also improve your trading decision-making and risk management over time by learning and comparing your current to past performances.

3 Reasons Why You Should Make Trading Journal

Writing a trading journal isn't only for nerd's fancy purposes. Here are the following reasons why you should start it:

History Record

Where do you think you'll keep track of all the mistakes you've done? Yes, that's why you need a written note to record it, so you can recall and learn from those past mistakes.

Furthermore, the trading journals can give you a much more personalized touch than a standard terminal trading log.

Faintest pen is still better than the best memories - Chinese proverb

For instance, you can add fundamental notes or specific situations you are in, for each opened position. Not only that, you can also spotlight what pairs perform the best or which time frame gives you the most opportunities.

Secondly, you can track how far you have progressed since your first trades. With that knowledge, you can gauge how much risk you can take to maximize your profit gains.

Planning

A proper trading journal can provide you with information to plan ahead as you open or close the Forex trading position. Specific information such as; position sizing, stop loss and take profit parameters can be gathered from past trading performances.

Simply put, if it works, then you can repeat the same process over and over again. This process can pretty much ease your decision making during familiar market conditions.

Therefore, you won't doubt or second guess your trading setups anymore, as you have understood how it will perform in similar situations.

Evaluation

This is the most important feature of a trading journal as it brings the most benefits. The evaluation process gives the opportunity to mark and compare each aspect of your trading performances.

With that in mind, you can spotlight which trading aspect in needs of most improvement, so you can prioritize it over others.

Also, over time you can value how each trading system, progress, or planning has worked out for you. By that process, you can scratch out the bad apples and keep the good ones.

How to Make Neat Trading Journal

Raise your hand if any of you still make diary entries every day! If that's the case, writing a Forex trading journal will be your second nature in no time. But, don't sweat it, this article will guide anyone willing to learn efficient Forex trading!

The Media

First thing first, use either one of these media to start writing and stick to it:

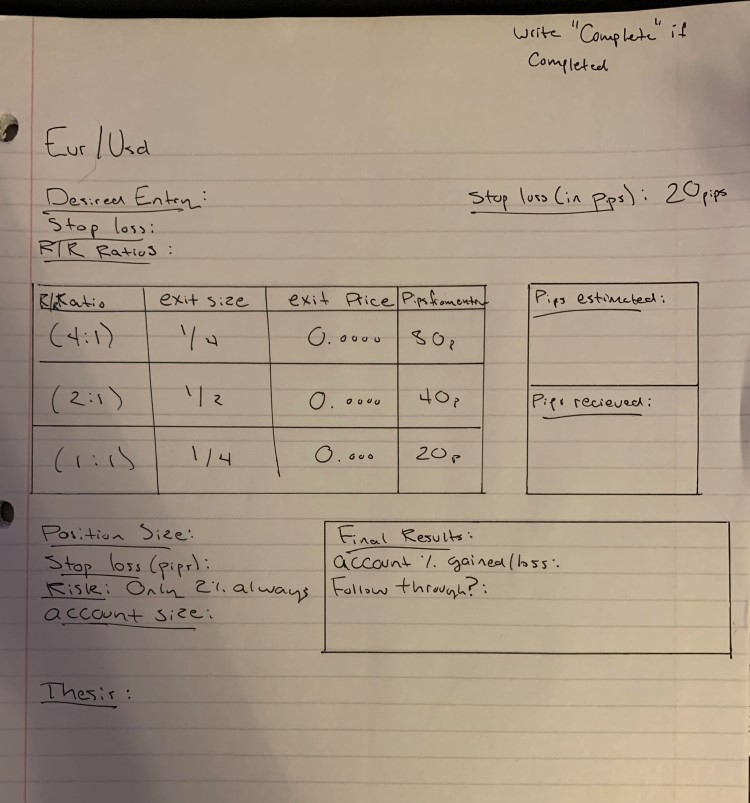

Physical Trading Journal

This traditional method requires traditional media such as; pen, marker, and papers. Yes, I know, it may not be the fanciest setup you can get but it got the job done in many ways.

There's virtually no restriction on the traditional trading journal as your creativity is the only limit

On plus side, you can customize and personalize everything to your heart's content. So, you want a kitty drawing on your checklists, no problem, or crazy big key phrase you quote from your trading idols, why not?

On the negative side, you need to construct everything from scratch. This is a major downside if you're that lazy person who isn't willing to lift a finger on a paper note.

Furthermore, organizing traditional media is way more demanding than its electronic counterpart. In simple words, it's going to be nice for a creative and neat person. On the other hand, it's going to be a mess for laid back and unorganized people.

Electronic Trading Journal

Do you want to consult (or share) your Forex trading plans via social media? Or do you want to make everything easily organized with no more than a single click? No problemo, you can do it all with the help of an electronic trading journal.

An electronic trading journal usually comes in two different accessibility, either offline or online;

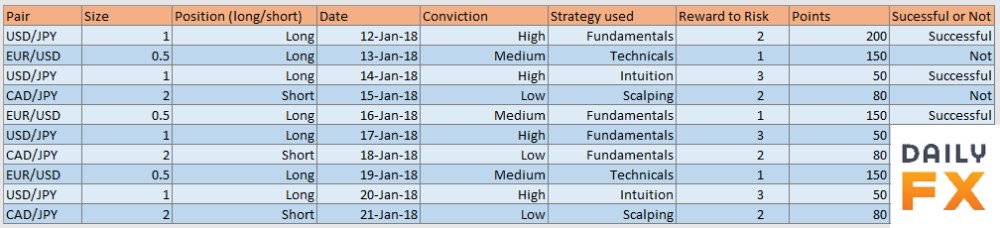

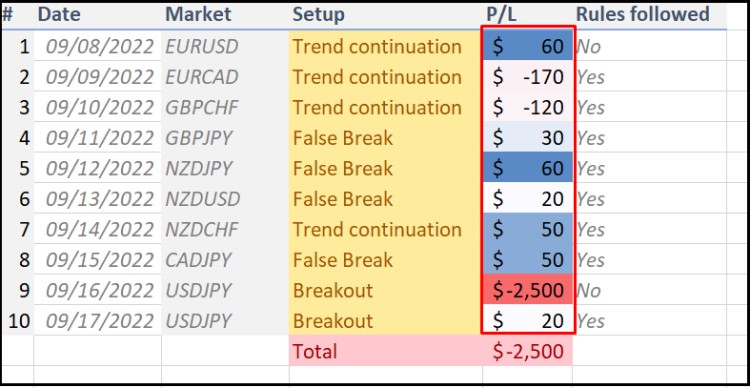

- Offline: you don't need to connect to the internet to maintain this trading journal. However, you cannot update or publicize your work as it is only kept exclusively on your machine (unless told otherwise). Spreadsheets like Ms. Excels or Openoffice.org Calc fall into this category. Below is an example of a trading journal made in Ms. Excel.

- Online/hybrid: some online trading journal requires a constant connection to the internet, or else it won't work. Alternatively, the hybrid one can also switch from offline to online mode to access an online if necessary. Try Tradebench or Google Docs to test it out.

The main advantage of the electronic trading journal is its built-in features, and also it's easy to organize. Everything is already polished so you only need to input simple values to each checkbox, cell, etc.

Most importantly, you can easily search and mark the items you want to sort very quickly, no hassle.

However, there's a slight restriction when you want to add unique functionalities or accessories. So, you can't force spreadsheets to display kitten drawings or big quotes in a fancy configuration without hacking the source code.

Compared to traditional media, this electronic trading journal gives you an edge in its readily available resources and accessibility. Which in hindsight, does all the hard work for you.

So, pick an electronic Forex trading journal if you want sheer practicality in a trade-off for a personal unique touch.

The Methods

There are two main approaches to constructing a Forex trading journal:

Singular Facet

This method focuses solely on either technical analysis or fundamental analysis. This is because some trader pretty much uses the singular method to make Forex trading decisions while ignoring other analytical noises.

Let's say Jamie focuses on technical, so he ignores fundamentals. By then, he can record his chart printouts and make some notations on it, such as; which trade signal got triggered, where the Stop Loss and Take Profit levels were, and whether or not the price was testing either support or resistance level.

This method aims at isolating streams of information so it won't be contaminated with unnecessary noises. However, do mind that the drawback is the risk that you may skip over unnoticed factors.

Multiple Facets

Simple, this is the total opposite of a singular approach. Essentially, you may combine both technical or fundamental analysis as records for each closed position. Additionally, you can even add other aspects such as emotional state or domestic pressures to be weighed in as well.

For example, Clark uses price action and economic news to gauge specific pairs' outlook. He will also record his chart printouts and adding a plethora of notations on it; every single thing that is worth noting.

This Forex trading journal method suits seasoned traders better than beginners. Why? Because without a proper baseline, you can easily mix up too many analytical noises, which later blurs out the clarity of your record.

So, instead of getting worthy information, you end up with messes and confusion. On the bright side, this mixed-method covers every aspect of price-moving factors. This is rather preferable if you want a complete overview of your trading record.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance