Alexander Edward Kearns, a student at the University of Nebraska in the US, had to kill himself because his trading account at Robinhood went negative by $730,165. What actually happened?

In 2020, because of the COVID-19 pandemic, the U.S. government put a lockdown in place. As a result, Alexander Kearns went to his parent's house in Naperville, Illinois, United States.

Students in the United States, have a lot of free time, so they spend it doing things online. One of the things they do is try their luck at online trading. And Kearns made an account at broker Robinhood.

He was one of three million people who started trading on Robinhood without planning to do so. Because of the chaos on the market caused by the Coronavirus crisis, Kearns decided to try out the options market.

Unfortunately, he didn't realize that the trades were leveraged. He didn't know about the risk, so he was surprised when he saw that the trading account had a balance of -$731,165. As a beginner, Kearns naturally thought he owed close to $1 million.

When Kearns looked at his Robinhood account late at night, it looked like he had $16,000 in it, but it also showed a negative cash balance of $730,165. In his last note, Kearns said he never gave permission to trade on margin, and he was surprised that his small account could rack up such a big loss.

The loss had a big effect on Kearns' mental health and made him unable to think straight, so he had no choice but to end his life not long after. Before he killed himself, Kearns left the following message:

"How was a 20-year-old with no income able to get assigned almost a million dollars' worth of leverage? The puts I bought/sold should have cancelled out, too, but I also have no clue what I was doing now in hindsight... There was no intention to be assigned this much and take this much risk, and I only thought that I was risking the money that I actually owned."

Alexander Kearns's tragic death was actually full of irony. The reason is that the number -$730,165 that made him want to end his life was only temporary.

According to the Forbes article, the trading account balance will be fixed when the underlying assets of the options are credited to the trading account. In other words, Alexander Kearns' losses didn't really make him owe hundreds of thousands of dollars to the broker; it's just technical information that will change automatically after all transactions have been settled.

In this case, Kearns probably didn't know that the negative cash balance on his Robinhood home screen is only temporary. Even if the portfolio is still positive, it is not uncommon for the cash to be negative if the first half of the options are processed while the second half is yet to be exercised.

Is the Sad Story of Alexander Kearns for Nothing?

The answer is no because from this case, new traders can learn what could happen when they start trading without really knowing what they're going to deal with.

Also, many have learned the extent of a tragedy that could transpire from a broker's careless effort in getting new traders. Kearns was indirectly "led" to believe that he owed up to hundreds of thousands of dollars because the Robinhood platform did not tell him that the negative numbers in his account were only temporary.

See Also:

This problem was highlighted by Bill Brewster, Alexander Kearns's cousin and analyst at Sullimar Capital Group.

"The kid threw himself in front of a train over nothing, because a tech company can't figure out they shouldn't show a negative $730,000 cash balance to a 20-year-old kid... Why is there no pop-up window to say this is not an actual obligation? Why is it necessary to show a bunch of millennials that you know are signing up in droves? Why is this OK?" said Bill Brewster to CNN Business.

He stated that this misunderstanding could be cleared up right away if Kearns could get in touch with Robinhood by phone. But the broker only talks to customers through email, which takes about a week to respond to.

How did Robinhood Respond?

Robinhood is one of the US brokers that is trying very hard to get young people to start trading. The broker also has a number of deals, such as trading with no fees, trading easily through the mobile app, and free shares for newcomers.

Alexander Kearns's death gives us a lot to think about. One of them is that the broker doesn't do much to teach new traders.

In response to this incident, Robinhood said it will soon make changes to its platform interface for options trading. These changes will include changes to the buying power display, in-app messages to tell users everything about their transactions, and an in-app history page to help clients understand how options trading works.

Robinhood will also hire options experts who will later teach about the complexities of options trading. The platform mechanism will be added to a new educational section.

Valuable Lessons for Young Traders

Despite Robinhood's way of signing up new traders that took part in Kearns' death, it should be clearly noted that that didn't negate Alexander Kearns' recklessness. As a new trader who was still trying things out, he probably didn't know much about the risks and was too brave to try things out on a real account.

For other young and passionate traders, here are 7 things to learn from Alexander Kearns' so you don't end up in the same situation:

1. Know What You Get Into

The most important thing we can learn from the Kearns case is that we should really understand how trading works before putting real money into it.

Kearns was confused not only because the broker forgot to add information about negative balances, but also because he didn't know how transactions work in the options market.

Also, it's important to know how your broker's platform works. Don't rush to fund your account just so you can trade on a real account if there isn't enough information on the trading platform or if it looks strange by your standard.

2. Use Leverage with Caution

Leverage has been called a "two-edged sword" too many times not for nothing. Leverage has both pros and cons that you should think about.

It can help you get into positions that are bigger than what you have, but when the market is uncertain, the risk of loss can eat your money faster.

So, you have to make sure that the amount of leverage you use is in line with how much you could stand to gain or lose. If you don't, you'll find it hard to keep your cool when you lose money.

3. Pay Close Attention to Negative Balance Protection

Negative Balance Protection is an important form of protection for traders. Stop outs and margin calls are usually built into trading platforms to make sure that a trader's losses don't exceed the amount of money they have. However, when the market is full of surprises, stop outs and margin calls can fail. Choosing a broker with Negative Balance Protection is highly recommended to avoid such risk. This feature can keep your account from going minus unexpectedly.

4. Try to Plan Out Your Risk Management

Stop out, margin call, and Negative Balance Protection should be your last safety net. Before you even get a margin call, it is imperative to manage your own risks. As a matter of fact, risk management can be done in a number of ways, from limiting the amount of risk per position to using a risk/reward ratio to maintain your profitability in the long run.

5. Inspect the Problem

When you trade, it's normal to lose money. There are definitely both gains and losses. But the bigger the profit, the more likely it is that you will lose. So, if you lose money while trading, don't give up too easily.

What if you suddenly experienced a sudden huge loss similar to what Alexander Kearns went through?

- First, try to remember if you have stayed with your plans.

- Only after making sure that everything goes by the plan that you should look into any unusual things happening on the market or the platform. You can ask the broker's rep or go to a forum where other traders who use the same broker as you do share their experiences.

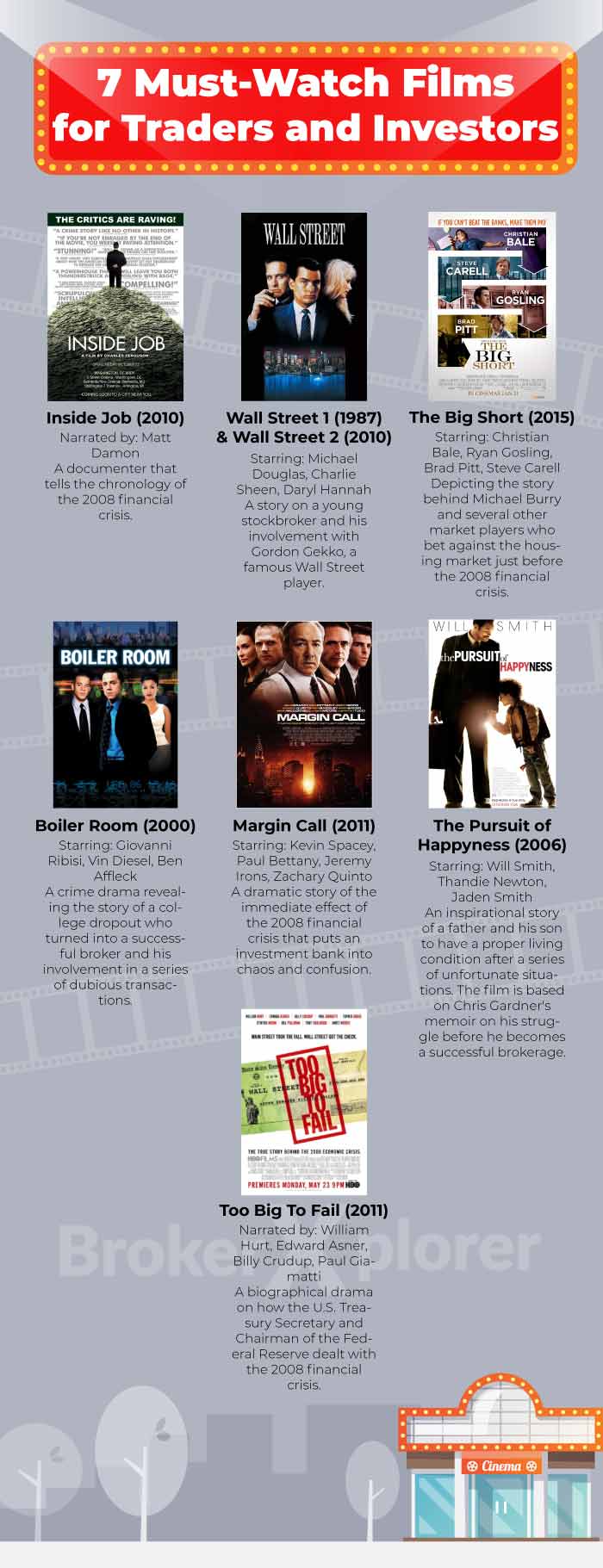

See Also:

6. Don't Trade in High-Risk Situations

Beginners don't have much experience, but those who have learned a lot will know that not all market conditions can be traded. When there is a lot of uncertainty, it is best not to enter the market to avoid unexpected risks.

Retail traders, especially those who are just starting out, are typically by a seemingly huge opportunity when the price moves in big swings. What they don't understand is that it's not always easy to figure out what's going on. In most cases, most good strategies don't even work when the market is "wilding".

7. Take Care of Your Mental Health

You can also take care of your mental health so that sudden changes in the market don't stress you out too much. Do something fun every once in a while to give your mind a break from trading. Traders who take care of their mental health will be more ready to handle anything when things go wrong. They are more capable of assessing the situation and acting in a more sensible way.

Recovering from losses may not be an easy thing to do, but these amazing traders have proven that it's not impossible.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

2 Comments

Nimah

May 31 2022

The events surrounding Alexander Kearns can serve as a teaching tool for all of us, but particularly for younger individuals who are only beginning their careers as traders.

Kearns ought to be able to share his concerns with his friends, parents, and other members of his family, as well as with others who already have experience working in the trading industry.

In order for Kearns to comprehend the gravity of the situation he is in and abstain from making the decision to take his own life,

In addition to this, Robinhood needs to provide beginning resources for new traders. For example, the company should publish articles that provide basic education and information about the trading industry.

John Wick

May 31 2022

Alexander Kearns need to have gotten a better education in the financial markets and trading before he started trading.

When someone has adequate knowledge and enters the world of trading, they will immediately understand that utilizing leverage, particularly for those who are inexperienced, may be highly risky. This is especially true for new traders.

As a direct consequence of this, the Alexander Kearns incident was completely pointless.