Many people have tried to trade against the trend, expecting higher advantage when they do the thing that is not commonly done. Some of them succeeded, and some of them tragically failed.

Trend following and contrarian trading are two distinct investment strategies with contrasting approaches. While trend following seeks to profit from sustained market trends by aligning with the prevailing direction, contrarian trading takes a counterintuitive stance, aiming to capitalize on market reversals and going against the crowd.

Technically both strategies possessed different merits and drawbacks. Each trading strategy can be good depending on what the trader need:

- Trend Following: Suitable for traders who prefer to align with established market trends.

- Contrarian: Can be appealing to those who believe in taking positions against the prevailing market sentiment.

In this article, you can find out more about trend following strategy and contrarian trading strategy.

Trend Following Strategy

The trend following strategy is an investment approach that aims to profit from the long-term directional movements, or trends, in financial markets. Rather than predicting market reversals or attempting to time entry and exit points, trend followers seek to identify and ride established trends.

There are several key features of trend following strategy

- Identifying trends: Trend followers use various technical indicators, such as moving averages, trendlines, or price patterns, to identify the direction of prevailing trends. They focus on medium- to long-term trends rather than short-term fluctuations.

- Entry and exit signals: When a trend is identified, trend followers typically enter a trade by buying an asset if the trend is upward or selling it short if it is downward. They rely on predefined rules or indicators to determine their trades' optimal entry and exit points.

- Letting profits run: Trend followers aim to capture a significant portion of the trend's movement by staying in the trade as long as the trend persists. Instead of attempting to predict market tops or bottoms, they focus on maximizing profits by letting winning trades run until signs of the trend weakening or reversing.

- Diversification: Trend followers often have a diversified portfolio of assets across different markets. This diversification helps to capture trends in various sectors and reduces the impact of individual market movements on overall performance.

Here is how a trend following strategy looks in the market.

In the picture above, the price can be seen moving upward after a series of downturns. Traders can place a potential entry just before the price start moving up. Then, follow the trend and place an exit just before the trends are over. To do this, traders can use the help of several indicators. The Moving Average, Bollinger Band, RSI, and many more are good indicators for this job.

Benefits of Trend Following

- Profit from major market trends: By aligning with the prevailing market trends, trend following allows traders to profit from significant price movements potentially. Trend followers aim to capture a substantial portion of a trend's upward or downward movement, providing opportunities for substantial gains.

- Reduced reliance on market timing: Trend-following strategies focus on identifying and participating in established trends rather than trying to time market tops or bottoms. This approach reduces the need to make precise predictions about short-term market movements, which can be challenging even for experienced traders. By riding the trend, traders can potentially generate returns without the pressure of pinpointing exact entry and exit points.

- Risk management through stop-loss orders: Trend-following strategies often incorporate the use of stop-loss orders. These predetermined price levels act as safeguards and help manage risk by automatically exiting a trade if the market moves against the anticipated trend. Stop-loss orders help limit potential losses and protect capital in case of trend reversals.

- Potential for consistent returns: Trend following strategies are designed to capture the long-term trends that tend to persist in financial markets. While there may be periods of losses or underperformance, trend followers aim to generate consistent returns over time by focusing on sustained trends and avoiding short-term noise and volatility.

See Also:

Trend Following Risk

- Whipsaw losses: Trend following strategies are vulnerable to whipsaw losses, which occur when the market exhibits frequent and sudden reversals. During choppy or range-bound markets, trends may be short-lived or non-existent, resulting in frequent false signals and potentially generating losses as positions open and close.

- Delayed entry and exit: Trend following strategies may result in entry and exit from trades. As trend followers wait to confirm a trend, they may miss out on the early stages of a trend and enter positions at higher prices. Similarly, when a trend begins to weaken or reverse, trend followers may exit positions later, potentially giving back some of their gains.

- Drawdowns and extended losing periods: Trend following strategies can experience drawdowns, which are periods of losses due to being on the wrong side of a trend or during periods of market volatility. Extended losing periods can be psychologically challenging for traders and may test their discipline and confidence in the strategy.

Contrarian Trading Strategy

Contrarian trading is an investment strategy involving taking positions opposite the prevailing market sentiment. Contrarians believe that when most investors are overly bullish and optimistic, it may indicate an overvalued market and potential for a downturn.

Conversely, when the majority are bearish and pessimistic, it may signal an undervalued market and potential for an upturn. Contrarian traders seek to capitalize on these perceived market inefficiencies by going against the crowd.

There are several things to understand about contrarian trading strategy

- Opposing market sentiment: Contrarian traders actively look for opportunities where market sentiment appears overly optimistic or pessimistic. They take positions that are contrary to the prevailing sentiment.

- Identifying extremes: Contrarians use various indicators and tools to identify extreme sentiment levels. These can include sentiment surveys, put-call ratios, technical indicators, and other market data to gauge investor sentiment and positioning.

- Fundamental analysis: Contrarian traders often conduct in-depth fundamental analysis to assess the underlying value of an asset. They look for instances where the market sentiment appears disconnected from the asset's fundamentals, suggesting potential mispricing.

- Timing and patience: Contrarian trading requires careful timing and patience. Traders may enter positions early, before the sentiment reverses, or wait for signs of a shift in market sentiment. This strategy often requires a longer investment horizon as sentiment reversals may take time to materialize.

- Risk management: Contrarian traders must implement strategies to protect against potential losses. This includes setting stop-loss orders to limit downside risk if the market sentiment proves to be correct and managing position sizes to avoid excessive exposure.

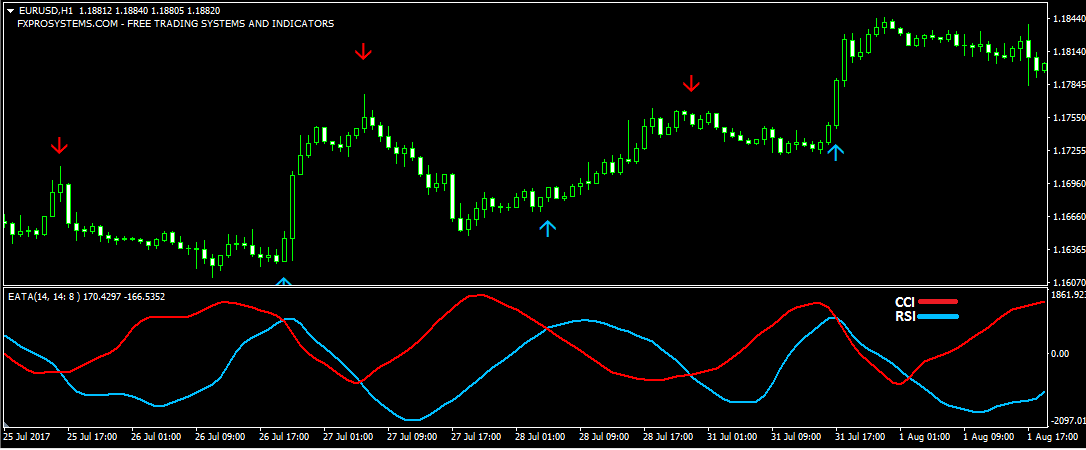

Here is how a contrarian trading strategy looks in the market.

On the example above, it's clear that the price has reached the end of the trend. In this case, the price tends to move sideways slightly, indicating the buyers and sellers are fighting for dominance. Eventually, the buyers win, and the price slowly goes up. Traders can place an entry buy before the price go up again. Use technical indicators for better results.

Benefits of Contrarian Trading

- Profit from market reversals: By taking positions opposite to the prevailing market sentiment, contrarian traders aim to profit from market reversals. If most investors are overly optimistic or pessimistic, contrarians believe there is an opportunity to capitalize on price movements when sentiment shifts, potentially leading to profitable trades.

- Potential for higher returns: Contrarian trading can offer higher returns by identifying mispriced assets. When market sentiment is extreme and deviates from underlying fundamentals, contrarians may find undervalued or overvalued assets that have the potential to revert to their fair value. If their analysis proves correct and the market sentiment reverses, contrarian traders can benefit from capturing the subsequent price movement.

- Reduced herd mentality risk: Following the crowd and relying solely on prevailing market sentiment can expose investors to the risk of herd mentality. Contrarian trading allows traders to step away from the herd and make independent decisions based on their analysis. By taking a contrarian stance, traders can potentially avoid the pitfalls associated with groupthink and emotional decision-making.

- Diversification opportunities: Contrarian trading can provide diversification benefits to a portfolio. By incorporating trend-following and contrarian strategies, traders can be exposed to different market conditions. When trend following strategies perform well during trending markets, contrarian strategies may excel during periods of market reversals, potentially reducing overall portfolio risk.

The Risk of Contrarian Trading

- Losing capital: Counter-trend trading is often debated among traders, with some arguing that buying during a bearish market or selling during a bullish market can lead to advantageous price levels and increased profits. However, this assumption relies on prices changing after executing trades, and if prices continue their current trajectory, traders risk losing their capital.

- Riskier: Counter-trend trading is generally considered riskier than trend following, as a small error can quickly result in significant losses. Nevertheless, certain traders, such as scalpers operating in short timeframes, may be less affected by overall market trends.

Additionally, traders can adopt strategies that trade against immediate trends while aligning with larger timeframe trends, optimizing profit potential by entering appropriately sized positions at the right time. Some specialized strategies, like divergence trading, focus on identifying differences between price movements and indicators to make trading decisions, considering factors such as candlestick patterns, support and resistance.

Which One is Better?

Determining which trading strategy is better, trend following or contrarian trading is subjective and depends on various factors, including an individual's trading style, risk tolerance, and market conditions. Both strategies have their own merits and drawbacks.

Trend following may be more suitable for traders who prefer to align with established market trends and capture sustained price movements. It can potentially lead to significant profits during strong and persistent trends. Trend-following strategies often focus on risk management techniques and systematic approaches to capitalize on favorable trends while managing downside risk.

On the other hand, contrarian trading can appeal to those who believe in taking positions against the prevailing market sentiment. Contrarians aim to identify market extremes and profit from potential reversals or countertrends. Contrarian trading may provide opportunities for early entry into positions and potentially higher returns if market sentiment shifts.

However, it requires the ability to accurately identify market turning points, which can be challenging and carries the risk of entering trades prematurely.

The choice between trend following and contrarian trading ultimately depends on an individual's trading goals, risk appetite, and ability to analyze and interpret market dynamics. Some traders may even incorporate elements of both strategies into their overall trading approach, combining trend following during trending markets and contrarian trading during potential reversal points.

At the root of it, it does not matter whether you trade along with the trend or against it. Trade against the trend may contain more risk than if you trade with the trend, but correct entry and exit strategy and sufficient money management can make such distinction meaningless. If you think trading against the trend is interesting, why not try it out!?

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance