Many US traders might find it difficult to choose a crypto broker due to the strict regulations and limited options. Here is the list of the best US-based crypto brokers you should know.

As the largest economy in the world, it is unsurprising that the United States also embraces cryptocurrency and even plays a role as one of the most important trading zones for crypto traders. However, due to some regulations imposed by the state's government, finding a licensed US broker that accepts cryptocurrency can be quite a hassle.

Contents

Why are Some Crypto Brokers Not Available in the US?

First and foremost, crypto trading in the US is completely legal. But that doesn't mean it is free of regulations. If we go back to the early days of Bitcoin, we would find that the crypto trading ecosystem was highly unregulated.

Practically anybody with some money in their pockets and a stable internet connection could buy and sell cryptocurrency without providing any information about their identities. But if we look at it now, the US is probably one of the places with the strictest regulations when it comes to crypto trading.

All crypto brokers that operate in the US are subject to regulation by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

CFTC is the authority that basically approves and classifies cryptocurrency, which is considered a type of commodity. Meanwhile, the SEC views cryptocurrency as a form of digital currency, so they impose regulations that aim to protect investors from criminal activities and monitor tax evasions. As a result, crypto exchanges must comply with various requirements and anti-money laundering programs in order to accept US clients.

The high fee is another issue that crypto exchanges must face in the US. In some cases, fees charged by the individual US states are simply too high for them, so it is not financially worthwhile to offer their service there, especially considering the fact that they're not allowed to offer high leveraged trading.

As a result, only a small number of companies stay in the US. Most crypto exchanges just simply choose to ban US traders and decide to take their business somewhere else. Some brokers create a branch that operates specifically for US traders, but usually, the services are limited. This is what makes it difficult for US traders to find the right crypto broker.

The good news is that US brokers are usually reputable and safe to use because they're under the government's watch. However, keep in mind that determining which broker to use is a crucial step in crypto trading, so you need to choose the one that suits you the best. Here are some of the best crypto brokers to check out.

The Best US-based Crypto Brokers

Even though you already know the list of the best brokers in the US, among them, which ones are the most reliable and crypto-friendly?

1. Coinbase

Coinbase is certainly one of the most popular results that come up if you search for a crypto broker in the US. Coinbase was established in 2012 and it is now the largest US-based crypto exchange with over 20 million clients worldwide.

The exchange's crypto trading platform is mostly known to be user-friendly and easy to use. It can be accessed either from desktop or mobile phones. They also offer the Coinbase Pro platform that offers more complex and advanced trading requirements. For crypto trading, Coinbase supports 14 cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin to name a few.

Currently, Coinbase is available in 23 states of the US, including Arizona, Arkansas, Carolina, Colorado, Connecticut, Florida, Georgia, Illinois, Kansas, Maine, Massachusetts, Nebraska, New Hampshire, New Jersey, North Carolina, Oklahoma, Oregon, Texas, Utah, Virginia, West Virginia, Wisconsin, and Wyoming.

In terms of trading cost, Coinbase offers a trading commission of as low as 1% for crypto trading. There are also a wide range of deposit and withdrawal options, including bank transfer, credit card, PayPal, and more.

Another great point is that Coinbase has never encountered a major crypto hack and provides a high-security system. In order to protect their clients, Coinbase prevents users from sending cryptocurrencies to scam addresses. The users' funds are also FDIC insured, which means that the funds are insured up to a maximum of $250,000.

2. eToro

eToro is another notable crypto exchange that accepts US traders. The exchange is a pioneer in social copy trading and becomes increasingly popular because of the excellent service for copy traders.

Therefore, eToro is perfect for beginners who want to learn crypto trading while also making money in the process. As for now, eToro has successfully attracted over 9 million clients from at least 170 countries after operating for more than a decade. It continues to expand its reach and provide various innovative products.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

In eToro, US traders can easily buy and sell cryptocurrency on a sophisticated platform. You can also choose to store the coins in the eToro exclusive in-house wallet or send the coins to an external wallet of their choice. eToro supports quite a wide option of cryptocurrencies, including BTC, ETH, LTC, EOS, BCH, XRP, DASH, NEO, ADA, ZEC, ETC, XLM, BNB, TRX, and MIOTA.

When it comes to trading fees, eToro doesn't charge any fee for making transactions. However, there's a conversion fee of 0.1% set to market rates. Users can deposit and withdraw using several methods, such as wire transfer or ACH.

The minimum withdrawal amount and fees depend on the cryptocurrency that the user uses. Keep in mind that eToro doesn't offer the 1:2 leverage trading in the US as they do in other countries because of the US regulations.

3. Kraken

Kraken is a trustworthy exchange that was founded in 2011. The exchange has expanded its business to over 150 countries in the world including the US. Their service is available in almost all US states, but they don't operate in New York and Washington. There are at least 18 different cryptocurrencies supported by Kraken, including Ripple (XRP), Monero (XMR), and Dash (DASH). Their trading platform is currently available for desktop and webtraders.

In terms of trading fees, Kraken uses a unique system that is quite competitive compared to other platforms. Basically, they use the maker-taker fee schedule with price incentives that are based on the client's trading volume over the past 30 days.

So for example, if a client trades less than $50,000 in a month, they'll be charged with $2.60 fees for every $1,000 they spent in trading. The fees for market makers range from 0-16% whereas for market takers the fees range from 0.10-0.26%.

4. TradeStation

TradeStation is one of the top options when it comes to crypto trading and technology. The exchange has been around since 1982, formerly known as the Omega Research.

They rebranded as TradeStation back in 1991 under the company NASDAQ and later acquired by the Monex Group in 2011.TradeStation is known to offer great platforms, namely the web-based platform for casual traders and the sophisticated desktop platform for active traders. Both of them support $0 stock and ETF trading. As for crypto traders, you can buy, sell, and trade various cryptocurrencies such as BTC, LTC, ETH, BCH, and XRP.

The pricing system is pretty simple. If your account balance is lower than $100,000, you need to pay a 0.50% maker fee and a 0.50% taker fee. But if your account balance is higher than $100,000, you won't have to pay a maker fee; you only need to pay either a 0.25% or 0.125% fee depending on your account size.

See Also: List of Crypto Exchanges with Low Fees

5. Gemini

Gemini is one of the few crypto brokers that operate in New York and is fully compliant with the NY rules. Launched by the Winklevoss twins back in 2014, Gemini is known as a highly regulated crypto exchange where users can easily buy, sell, and store cryptocurrencies. The exchange supports an impressive number of 26 cryptocurrencies, including some of the popular ones like BTC, ETH, LTC, BCH, and ZEC. The exchange also has its own native coin called Gemini Dollar.

However, it's worth noting that the high compliance somehow makes the verification process rather complicated. Other than that, the pricing is quite expensive compared to other exchanges. Gemini charges around 0.99-2.99% on transactions under $200 and 1.49% on those over $200.

6. CEX.io

Unlike the previous exchanges, CEX.io is still relatively new to the crypto industry in the US. Although the exchange was first founded in 2013, they just got their money transmitter licenses in 2019. Now, CEX.io is available in 31 different states across the US, including Arkansas, Arizona, Alaska, Colorado, California, District of Columbia, Delaware, Iowa, Indiana, Kentucky, Kansas, Maryland, Michigan, Massachusetts, Mississippi, Minnesota, Montana, Missouri, Nevada, New Mexico, New Hampshire, Pennsylvania, Oklahoma, South Dakota, Rhode Island, Utah, Wyoming, Wisconsin, and West Virginia.

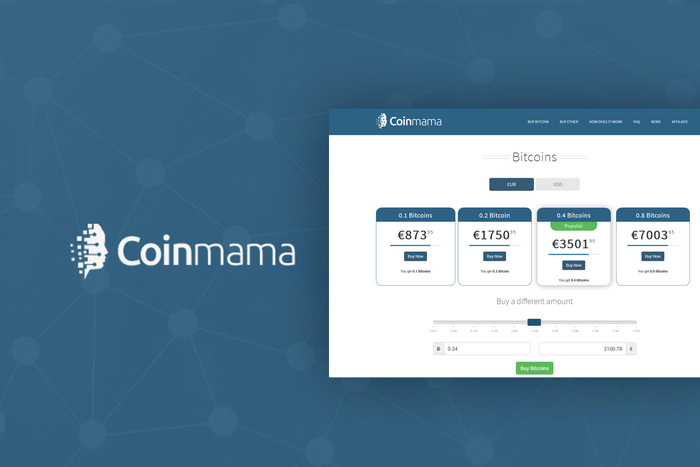

7. Coinmama

Last but not least, we have Coinmama, a trusted broker that has been around since 2013. Coinmama is quite popular among crypto traders but sadly, the exchange only operates in a small number of states, which are Alaska, Dakota, Delaware, Georgia, North Dakota, Ohio, Oklahoma, Rhode Island, and Wyoming.

In Coinmama, you can buy and sell at least 10 different cryptocurrencies including BTC, ETH, BCH, ADA, LTC, QTUM, XRP, XTZ, and EOS. Just like other US-based exchanges, Coinmama doesn't offer margin trading. Also, keep in mind that the fees are relatively high.

The Bottom Line

The evolving cryptocurrency regulation in the US has brought several benefits as well as drawbacks for US traders. On one hand, the strict regulations make the crypto trading environment much safer than before and minimize the chance of being scammed by unregulated brokers. However, some of the rules can be quite burdensome for traders due to the limited choices of brokers and the additional requirements for identity verification. Nevertheless, those are the rules that you need to comply with as a US resident.

In searching for the best exchange, it's recommended to also look at its trading volume to get a better crypto trading experience, as sufficient volume will ensure liquidity and support you to easily trade your coins.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Toncoin

Toncoin Dogecoin

Dogecoin Cardano

Cardano