The popular yet unregulated market of Bitcoin has attracted many scammers to take action. Here's the list of top Bitcoin scams and how to avoid them.

Cryptocurrency trading is often seen as a safer way to trade compared to fiat currency. Bitcoin, currently the largest cryptocurrency in the world, introduced the new technology called "Blockchain" back in 2009, which claims to be able to provide a new layer of security in trading transactions.

It uses a decentralized system of linked yet independent computers. As the market keeps growing and more new transactions take place, various types of scams also emerge.

Contrary to popular belief, these scams are actually quite necessary to identify the flaws and vulnerabilities in the system. Considering that the number of investors keeps increasing each day, the Bitcoin system also needs to be updated and make a safer environment. But needless to say, scams are bad news for traders.

For this particular reason, we have written down the top Bitcoin scams that you should be aware of:

- Fake exchanges and wallet

- The Ponzi schemes

- Old school scams

- Fake cryptocurrencies

- Social media scams

- Malware

- Social engineering scams

- Pump-and-dump scams

- ICO scams

- DeFi rug pulls

Why should we be cautious with the cases above? And how can we avoid them? Let's discuss each one in the following article.

Exchange and Wallet Breaches

Cryptocurrency exchanges are basically sites where traders can buy, sell, and exchange cryptocurrencies. Despite having security measures and policies, hackers can still spot vulnerabilities.

For example, in 2017, the criminals found a way to hack the system and took people's money from the largest trading platform located in South Korea, BitKRX.

At the end of 2019, the crypto exchange Poloniex also has gone through a similar breach and had to ask their customers to reset their passwords immediately.

Another case comes from the Kucoin exchange that was hacked on 25 September 2002. The trading platform lost millions of dollars worth of cryptocurrency because of it.

Apart from exchanges, hackers also targeted crypto wallets. One of the biggest cases occurred in June 2020, when hackers stole no less than 1 million customers' email addresses by breaking through the email and marketing for Ledger, a French-based crypto wallet provider.

The Ponzi Schemes

Ponzi scheme is quite a common fraud in the trading world and has been around for many years, but only recently has it reached the decentralized and volatile cryptocurrency market. The scam basically follows the pyramid scheme, where you use the money gained from new investors to pay earlier investors. In other words, these people aren't really earning profits from the investment.

In 2019, a $277 million Ponzi scheme practice was found, which resulted in the arresting of three men who have been operating in the BitClub Network for years.

The scheme collected money from investors in exchange for shares of cryptocurrency mining profits. Investors should've also earned money by recruiting new investors. Sadly, these people never get any returns from their investments.

To identify this type of scam, there are a few things that you can do, namely avoiding investments that are too good to be true, unregulated businesses, unlicensed individuals, and issues with payments.

Old School Scams

While the technology keeps developing, old school scams actually still exist and should not be overlooked. Imagine receiving an email or a call from someone claiming from a legitimate entity and asking you to pay some taxes or deposit some money (in this case, Bitcoin). Would you send the money then?

Well, unfortunately, many people do. The reason why this scam type is still around is that many people still fall for it in one way or another.

To avoid these old school scams, the simplest way is to be skeptical of phone calls or emails that say they're from a government department or other legal companies. Always double-check the authenticity before you decide to do anything that they ask.

After all, legitimate entities won't contact you in that manner and in addition, won't ask for Bitcoin.

Fake Cryptocurrencies

Fake crypto is a common scam that is exclusive to the crypto trading world. The scam basically starts off by presenting itself as a new alternative to Bitcoin. The idea is to make traders believe that it's too late to start trading with Bitcoin as the price already soars high. Instead, it would be better to invest in one of these up-and-coming cryptocurrencies.

Currently, there are thousands of crypto to choose from, so it may be hard to recognize every single one and each alternative may look convincing to invest in. Some of them may be fake and the name only exists to lure people into investing in it.

My Big Coin is one of the examples. The scammers behind My Big Coin managed to take at least $6 million from customers and then transferred the funds into their personal bank accounts.

That's why, you should know which Bitcoin alternative is real and which one that is fake.

Social Media Scams

Apart from emails and phone calls, social media platforms are also flooded with scams and fraud practices. These days, every person must have at least one active social media, enabling hackers to use the wide network to find their targets. They usually make fake accounts to solicit Bitcoin from followers or directly hack popular Twitter accounts.

In July 2020, several accounts belonging to famous individuals and companies were hacked altogether, including the tech experts Elon Musk and Bill Gates, investor Warren Buffett, and companies like Apple and Uber.

By taking control of these accounts, hackers posted tweets that were asking people to send money to a specified Blockchain address and promising to double the fortune as a charitable gesture. According to the reports, there were 320 transactions made within minutes of the tweets being posted.

Not only Twitter, but the giant video-sharing platform Youtube is also risky. In July 2020, Apple co-founder Steve Wozniak filed a lawsuit against Google because his private conversations about Bitcoin were being exposed in giveaway scam videos on Youtube.

The video also involved asking people to send money and promising to double the amounts. As a result, seventeen other individuals also filed a lawsuit against Youtube because of this fraud.

Malware

Malware (malicious software) has always been one of the most common ways for hackers to access one's computer and gain vital information such as passwords or bank account numbers. Because all crypto transactions are processed online, it is possible to meet this type of scam, especially if your personal Bitcoin wallet is connected to the internet.

There are various types of malware that can pose a threat to computer systems and users. Here are some examples of common types of malware:

- Viruses

- Worms

- Trojans

- Ransomware

- Spyware

- Adware

- Keyloggers

- Botnets

Hackers can use malware to get access to your account and drain all your funds if you're not careful. Malwares are able to get into your devices if you click certain links in your email. They can also be downloaded from websites and social media. Therefore, make sure to protect your device and don't even try to click suspicious links.

Social Engineering Scams

In this type of scam, hackers typically use psychological manipulation to gain control of vital information relating to user accounts. One of the common ways to do it is by phishing, which involves hackers sending an email to targets that attach fraudulent links specifically designed to ask users to enter private key information.

One notable real case of phishing in the cryptocurrency industry is the attack on the popular cryptocurrency exchange, Binance, in 2019. In this incident, hackers used a sophisticated phishing campaign to steal users' login credentials and gain unauthorized access to their accounts. Here's the scheme:

- The attackers created a fake website that closely resembled the legitimate Binance website.

- They sent out phishing emails to users, luring them to click on a link that directed them to the fake website. The emails were designed to create a sense of urgency, claiming that there was an issue with the users' accounts or that they needed to verify their information.

- Once users clicked on the link and entered their login credentials on the fake website, the attackers captured their information.

- With the stolen credentials, the hackers gained access to the victims' Binance accounts and initiated unauthorized transactions, withdrawing funds from the compromised accounts.

Typically, hackers are interested in crypto wallet private keys which can be used to access funds within the wallet. Once the hacker obtains this key information, they can freely access the account and steal the Bitcoins. You can protect yourself by avoiding clicking links on such emails or verifying whether the email really belongs to a certain legal company or not.

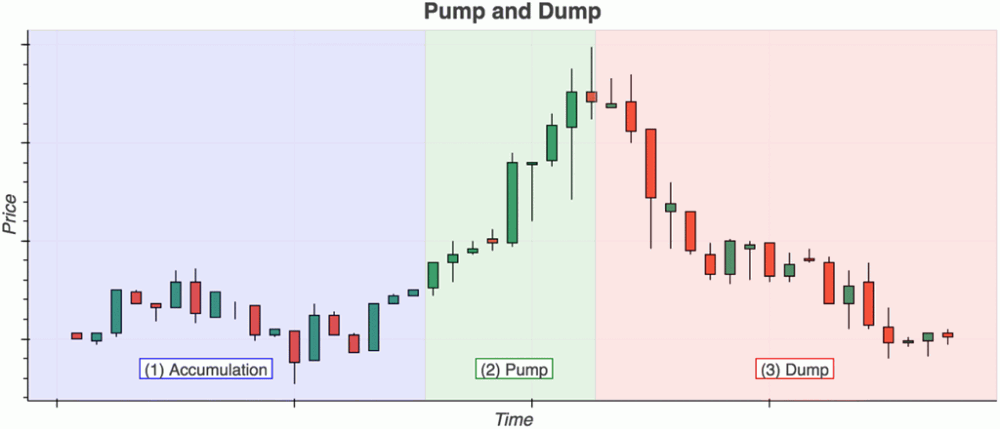

Pump-and-Dump Scams

Pump-and-dump scams have existed since the early times of stock trading. This scheme works when a group of scams get together and buy a bunch of penny stocks, which leads to the price going higher.

At the same time, they get outsiders to invest in the stock by promising them easy money. In light of cryptocurrencies, these scams are also present, usually promoted with fake news stories and fake celebrity endorsements.

To be fair, digital technology has matured so much that it may be hard to identify the real and fake ones. If you're caught in one of their actions, you may experience financial ruin, which can be very damaging.

You can do a few things to avoid this type of scam, such as avoiding single-tip purchasing and knowing when some promises sound unrealistic. Also, avoid groups that do pump-and-dump trades and people who tell you there's no risk.

See Also:

ICO Scams

ICO scams were particularly popular back in 2017 and 2018. Although it died down a while after, it began to emerge again in 2019. One popular method to separate investors from their Bitcoin through ICO is to create fake websites that show initial coin offerings and instruct users to deposit coins into a certain wallet.

The most famous case is that of Centra Tech. To make it look convincing, the program was backed by several celebrities including boxer Floyd Mayweather and musician DJ Khaled. Once the fraud was revealed, the promoters and founders were penalized, some even got into jail.

DeFi Rug Pulls

DeFi Rug Pulls is one of the newest scams in the cryptocurrency markets. The purpose of Decentralized Finance or DeFi is to decentralize finance by removing gatekeepers for financial transactions. While it can bring various advantages to the market, it also comes with its own issues.

Some people would make use of this system and steal the investor funds at such venues. The practice is commonly known as rug pulling, which has become prevalent as DeFi protocols have become popular with investors trying to double their profits by hunting down yield-bearing crypto instruments.

A smart contract that locks in funds for a specific period is a common way for scammers to steal money. Once the contract expires, developers can use their programming functions to steal Bitcoin from it.

One prominent real case of a DeFi rug pull in the cryptocurrency industry is the incident involving the project called "SushiSwap" in 2020. SushiSwap was a decentralized exchange (DEX) built on the Ethereum blockchain that aimed to provide a decentralized alternative to centralized exchanges.

The creator of SushiSwap, known by the pseudonymous name "Chef Nomi," gained significant attention and trust from the community. However, in a surprising turn of events, Chef Nomi performed a rug pull, which refers to the act of the project's creator or team abruptly pulling out funds from the project and leaving investors with worthless or significantly devalued tokens.

In this case, Chef Nomi transferred a large portion of the project's funds (around $14 million) to his personal account. This action caused panic among SushiSwap token holders and led to a significant drop in the value of the SUSHI token.

Conclusion

Though it claims to have a safe and protected environment, Bitcoin trading is not free of scams, hackers, and criminals. Being a crowded, volatile, and unregulated market makes it an easy target for scammers to steal money from investors. While the Blockchain itself is relatively safe so far, hackers always find their way to get into people's accounts through various methods as explained above.

Therefore, always stay alert to any possible scam scenarios and stay updated. New types of scams emerge every once in a while, so you have to be prepared and trust your instincts. If something is too good to be true, then it most likely is.

One type of scam that is quite rampant in the crypto space is the Telegram scam. If you're an avid user of the platform, better be careful and learn how to spot telegram crypto scams.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano