Using a trading platform with DOM (Depth of Market) has plenty of benefits, especially for scalpers and day traders, Which platform offers the best DOM?

Trading platforms come with different features to maximize traders' experience in the market. For example, they may provide their users with analytical tools or built-in economic calendars. Another popular feature in the trading platforms is the Depth of the Market.

Depth of the Market shows the liquidity of a particular instrument being traded at different prices. From DOM, traders can know about the asset's supply, demand, and liquidity at each price point. A good market depth means good liquidity, while low liquidity means the market depth is low or poor.

It also means that a big transaction size has a bigger potential to affect the price. DOM will be displayed in most trading platforms as a list of buy and sell orders. The list is organized according to the price level and updated in real-time to reflect the current situation.

Here are trading platforms with the DOM feature:

- MT5: Provides sophisticated and comfortable trading experience.

- cTrader: Allows users to search strategies directly.

- Trading Station: Exclusive platform that is closely associated with FXCM.

- OANDA: Belongs to OANDA, offers a tight spread across different kinds of CFD instruments.

- TWS (Trader Workstation): Belongs to Interactive Brokers and is equipped with abundant advanced features.

- LP Dealer: Belongs to IG, enabling traders to access the complete order book.

Each platform above will be explained further below.

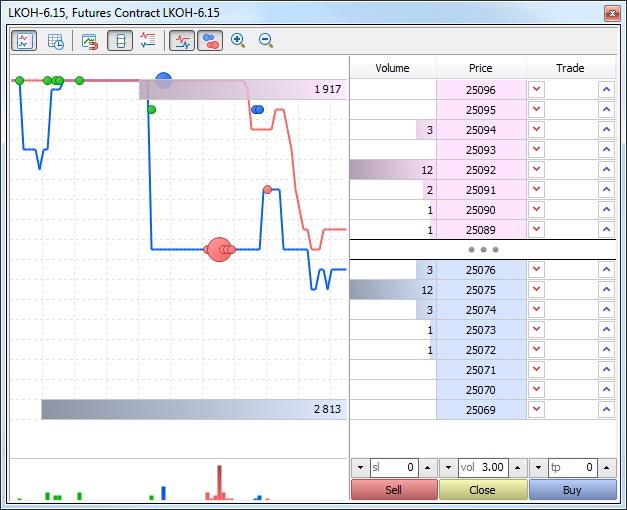

MT5

MetaTrader5 or commonly known as MT5 is a very popular trading platform as well as one of the best trading platforms with DOM. MetaQuotes Inc., the same company that launched MT4, developed this software.

MetaTrader5 was created as an upgrade from its predecessor and was aimed to provide a more sophisticated and comfortable trading experience. There are interesting features traders can enjoy from this platform, including Depth of Market.

MT5 Depth of Market has a user-friendly interface, so traders can easily understand what is happening. Traders can find this feature under the Market Watch menu. MT5 provides two operations:

- Market operations consist of buying/selling instruments at the best price.

- Meanwhile, a trade request allows traders to create a pending order to buy or sell an asset at a specified price.

Considering the scale of MetaTrader adoption, it doesn't surprise that MT5 has been widely offered in this industry. Thus, brokers like Admirals, Exness, and OctaFX are also considered as DOM providers due to their status as MT5 brokers.

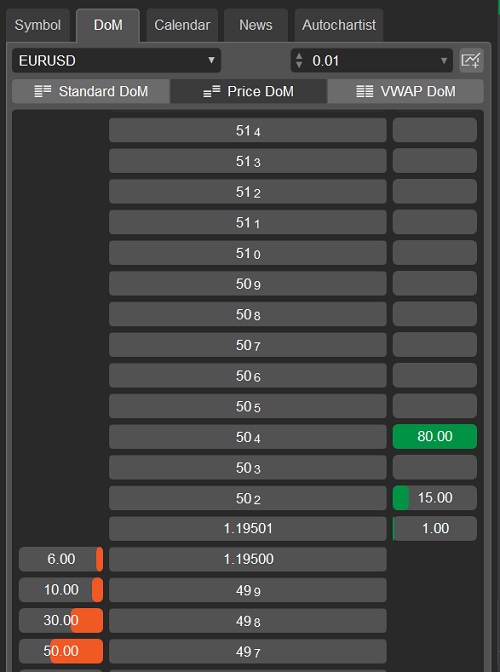

cTrader

Another popular trading platform with DOM is cTrader, a technology developed by Spotware System. This trading platform is known for its no-dealing-desk feature, rich charting tools, advanced order types, and level II pricing. Copy traders can benefit from this platform because cTrader allows users to search strategies directly.

cTrader Depth of Market allows real-time tracking of a certain instrument and placing orders using particular settings. There are three types of DOM in cTrader.

- The first one being the standard DOM, which is a type of viewing of the current market depth that doesn't allow trading.

- The second type is Price DOM; it allows traders to enter the market with stop and limit orders and manage open positions.

- The last type is VWAP DOM which is very useful since it shows the volume weight of each price.

Because of its functionality, cTraders started gaining as much popularity as MetaTrader. Nowadays, plenty of brokers provide cTrader as an alternative to MetaTrader. Some of them are Pepperstone, IC Markets, and Roboforex.

Trading Station

An exclusive platform that is closely associated with FXCM, Trading Station provides market-depth functionality for Active Traders. Multiple liquidity levels are visible on each price, perfect for short-term traders.

Apart from that, plenty of unique features such as the cloud to store user profile and chart settings, trading analytics, calendar, and many more. The platform provider, FXCM, has been around for 20 years, so their experience is not to be underestimated.

FXCM exclusively offers the market depth functionality to its Active Traders on the Trading Station forex and CFD platform. This feature allows traders to access and view multiple levels of liquidity at each price point.

It provides valuable information, particularly beneficial for short-term and high-frequency traders who rely on detailed market insights to make informed trading decisions.

FXCM (Forex Capital Markets) is a brand name of a retail broker for trading on the financial market, especially the foreign exchange market. The broker was founded in 1999 and was originally headquartered in the United States. After a series of lawsuits from customers and case settlements by the US regulator (CFTC), FXCM moved from the US and became a UK-based broker, authorized and regulated by the Financial Conduct Authority (registration number 217689).

Trading with FXCM is supported by enhanced execution with the Liquidity providers' stream pricing through the FastMatch Electronic Communication Network.

FXCM works with several global banks, financial institutions, and other market makers as their Liquidity providers including Barclays Bank, Citadel Securities, Citibank, Deutsche Bank, FASTMATCH, XTX Markets Limited, UBS, Morgan Stanley, Commerzbank, and Jefferies Financial Services.

This, in turn, enables FXCM to present its clients with fast trade execution, competitive spreads, low negative slippage, no re-quotes, no stop/limit restrictions, and up to 89% of orders are executed at the requested price or better.

For the trading platform, FXCM is remarkably known for its proprietary product called Trading Station. The latest version of this platform's web display is claimed to be built in Mac Friendly HTML5. It features a range of trading appliances such as integrated news, economic calendar, FXCM's top trading tools, social trading functionalities through FXCM Cloud, customized trading analytics, automated strategies, and advanced charting for better analysis. For flexible traders who prefer trading on-the-go, FXCM has also provided Trading Station in mobile version, both for iOS and Android users.

However, the company's in-house platform is not the only option presented for clients. FXCM also gives the choice to use MetaTrader 4 for clients who are more familiar with MetaQuote's product. Also, ZuluTrade access is enabled for clients with keen interests in copy trading schemes that transcend across brokers.

Instead of classifying account types based on minimum deposits, FXCM chooses to offer trading accounts based on the instruments traded. For FX traders, this broker provides Active Trader and Institutional accounts.

Active Trader is the ultimate account type for retail traders with two-tier pricing. Tier 1 applies a minimum deposit of $25,000 with a $30 commission for 1 million volumes traded, while Tier 2 has no detail on deposit requirement but gives better fee conditions. Spreads in both tiers start from 0.2 pips.

Institutional account, also known as FXCM Pro, is marketed as a wholesale execution and liquidity solution for retail brokers, hedge funds, and emerging market banks. The account presents trading spreads from 0.1 pips and other competitive benefits like API solutions as well as prime brokerage services.

For non-FX traders, FXCM provides a CFD trading account with low spread costs from 0.37 pips (in XAU/USD) and a wide range of class assets from precious metals, soft commodities, and indices.

Last but not least, a collection of in-depth articles is provided to help traders' knowledge and insights on the forex market. Trading tools like FXCM Plus, Market Scanner, Trading Signals, and Technical Levels are also developed to support traders who open accounts in FXCM .

In conclusion, FXCM is an experienced retail broker with a lot of "ammunition" to help traders with its best version of execution, pricing, and tools. It is a well-regulated broker backed with a long history in the financial market, even though it has a dark history in the United States' brokerage industry.

Still, the relatively high standard on minimum deposit ($25,000) puts FXCM as a broker suitable for experienced traders with good money management. It is not recommended for new traders with limited capital.

OANDA

OANDA's trading platform is known to offer a tight spread across different kinds of CFD instruments. Additionally, traders can access the Depth of Market on web traders.

The feature allows traders to use spreads starting from just 0.6 pips for typical EUR/USD order sizes. OANDA Trade web and mobile platforms and the MT4 add-on provide access to the Depth of Market feature.

This feature lets traders see the available sizes and prices within the market depth on order tickets in the OANDA web platform and mobile app.

When traders input the desired number of units, the sell and buy prices on the ticket will dynamically update, showing the entry price and spread for the specified units.

If the requested units exceed the first level of depth, the system considers subsequent levels to calculate the entry price. To access the depth of market information, traders can click on "market depth" (or tap "DOM" on mobile) within the order ticket.

Traders looking for brokers with accurate precision, OANDA can be an option. That is because OANDA is a broker that provides quotes with 5-digit accuracy and active price movements that follow market developments. Order execution speed is also faster in this broker.

It provides benefits for novice traders, as they can trade with smaller volumes using the calculation system based on currency value, unlike other brokers adopting the lot system.

Founded in 1996, OANDA was built by Dr. Michael Stumm who is a lecturer in Computer Engineering at the University of Toronto, Canada, along with his colleague, Dr. Richard Olsen of The Olsen Ltd., which is one of the leading econometric research institutes. They have a head office in San Francisco, United States.

OANDA branch offices can be found everywhere. Some of these offices are located in the United Kingdom, Singapore, Japan, and Canada. With this number of offices spread, OANDA has increasingly attracted the attention of clients worldwide.

OANDA's company is registered under several well-known jurisdictions in financial trading. They are regulated by CFTC and NFA in the US, FCA in the UK, ASIC in Australia, and many others. Traders do not need to worry anymore about security when trading in OANDA. However, these advantages make trading rules at OANDA more stringent compared to other brokers.

For example, OANDA only allows maximum leverage of 1:20, because the rules in the US and Japan do not allow leverage above that. Besides, the registration procedure is more complex due to various additional requirements that are not submitted by other forex brokers. On top of that, hedging is not allowed in one trading account as the client must open an additional account to hedge.

Nevertheless, OANDA is known for being a leading broker with many advantages offered. OANDA faces increased market risk during periods of price volatility, such as economic and political news announcements. When market spreads increase or decrease, their pricing engine widens or narrows spreads accordingly. That way, traders can get the latest conditions from price movements in the market more quickly.

Prices move very fast in the market. Especially when news releases have a large impact on market volatility. This condition is often exploited by brokers to take advantage of clients with Requotes. However, traders do not need to worry about additional costs when trading with OANDA.

The company never withdraws Requotes so traders can get maximum profit. When traders are unavailable to monitor open positions, they can set take profit orders to lock in profits and Stop Loss orders to help protect against further losses.

As an experienced and well-known online forex broker, OANDA is committed to maintain an efficient trading environment that reduces latency and provid tools to help clients manage the degree of acceptable slippage.

With a fast & reliable trading platform by OANDA, clients' trades are executed in 0.012 seconds. This suits traders who choose brokers based on execution speed.

Because of this exceptional execution service, it is not surprising that OANDA won many awards, including the winner of the world's Best Retail FX Platform at the prestigious e-FX awards. The broker is also voted number 1 for Consistency of filling trades at quoted prices, Execution speed, and Reliability of platforms.

There is no minimum deposit or minimum balance required to open an OANDA account. Deposit and withdrawal can be done easily. OANDA provides a variety of payment method facilities, including Paypal, Wire Transfer, Credit Card, and Debit. Traders can adjust it to the region where they live.

OANDA provides more than 100 trading instruments, including 71 currency pairs, 16 indices, 8 commodities (Brent Crude Oil, Copper, Corn, Natural Gas, Soybeans, Sugar, etc.), 6 Bonds, and 23 Metals.

The fxTrade and MetaTrader platform are available at OANDA. These platforms can be used for Desktop and Mobile. Another plus is they have an OANDA Technical Analysis that exists in collaboration with a technical analysis provider called Autochartist.

With these platforms, clients can monitor price movements easier and automatically recognize patterns created on charts, as well as receive alerts when the awaited patterns appear. Access to this technology can be enjoyed free of charge.

In conclusion, OANDA is an ideal broker for traders in need of fast execution backed by many years of experience. The company is also a good alternative for those looking for a well-regulated broker with flexible trading and deposit conditions.

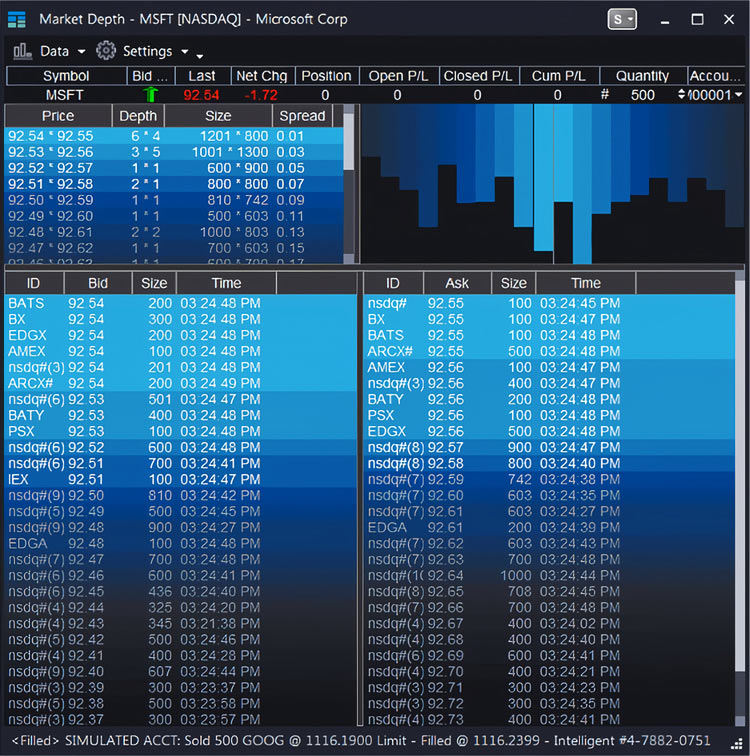

Interactive Brokers

Thomas Peterffy founded Interactive Brokers and has been around for 43 years. Right now, they claim to have more than one million client accounts. Interactive Broker offers different kinds of trading platforms. Among all of them, TWS (Trader Workstation) stands out the most. This trading platform features DOM and other advanced features.

The Market Depth window provides a consolidated view of alternative bids and offers beyond the inside quote, allowing traders to assess market liquidity more effectively. An integrated TWS (Trader Workstation) component facilitates large volume trades by displaying cumulative quantities and average execution prices available at specific prices or better.

The benefits of TWS Market Depth include:

- Instant recognition through color-coding

- Access to Level II data via subscription

- Displaying Level I data from exchanges that don't offer deep data

- The ability to quickly create, modify, and transmit orders.

Additionally, traders can create opposite side orders to reverse their positions, automatically generate closing orders, and customize the Market Depth window according to their preferences.

Interactive Brokers is a direct market access broker that provides execution, clearance, settlement, and prime brokerage for customers. Since it was found 41 years ago by Thomas Peterffy, the company has grown internally to become one of the premier securities firms with over $7 billion in equity capital.

First acknowledged as a popular broker for advanced traders, Interactive Brokers launched a second tier of service called IBKR Lite for more casual investors in 2019.

The IBKR Lite provides services on over 125 market destinations worldwide and gives direct access (online) trade execution and clearing services, both to institutional and professional traders for a wide variety of traded products including stocks, options, futures, forex, fixed income, and funds worldwide. Interactive Brokers Group and its affiliates execute over 859,000 trades per day.

Headquartered in Greenwich, Connecticut, Interactive Brokers has over 1,400 employees in the USA, Switzerland, Canada, Hong Kong, UK, Australia, Hungary, Russia, Japan, India, China, and Estonia companies. IBKR is regulated by the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), the Financial Conduct Authority (FCA), and is registered in the New York Stoch Exchange (NYSE).

Interactive Brokers offers a wide range of product-centered tools like the OptionTrader and Probability Lab for simplified single and complex multi-leg option trading; FXTrader for forex trading, Mutual Fund/ETF Replicator for helping traders find a lower cost on ETF alternatives, also fixed-income screeners for corporate and agency bonds. Overall, trading with Interactive Brokers would be provided with the most useful and updated tools to maximize trading and investing goals.

As a popular and regulated broker in the US, Interactive Brokers has won some awards. Recently, they were awarded by the Barrons as the 2019 Best Online Broker, which is categorized as the best broker for mobile, international, and frequent traders. Besides, they also won an award as Top Performing Broker by the Preqin Service Providers, and Best Overall Broker by Investopedia (Best for Low Costs, Best for International Trading, Best for Options Trading, Best for Day Trading, and Best for Penny Stocks). The awards are not only achieved during 2019. Since 2005, Interactive Brokers has won lots of awards regarding its best services for clients.

To optimize clients' trading speed and efficiency, Interactive Brokers provides some powerful suites of trading platforms. Below is the list:

- Client Portal

A one-stop destination to check quotes and place trades, see account balances, Profit and Loss, as well as key performance metrics, funding, and reporting. - Desktop TWS

A flagship platform designed for active traders and investors who trade multiple products and require power and flexibility. Opening an account in Interactive Brokers and using this platform allows traders to utilize the most advanced algorithms and trading tools, as well as a library of tools and asset-based trading layouts for optimum customization. - IBKR TWS for Mobile

The IBKR TWS for Mobile is made for traders who want to easily trade and monitor their IBKR account on-the-go from either iOS or Android device (tablet or smartphone). - IBoT

IBoT is a robot for finding information and placing orders using clients' own words. IBot is available on TWS for Desktop, IBKR Mobile, and Client Portal. - IBKR WebTrader

IBKR WebTrader is made for traders and investors who prefer a simplified interface. - IBKR APIs or IBKR Pro

This trading platform is provided especially for traders and investors who want to write their trading software or automated trading programs; third-party software users.

Overall, Interactive Brokers has always been a great choice for those who want to find out a credible and regulated broker for trading. Offering lots of trading platforms, Interactive Brokers has committed to provide their best services for both novices and professionals, since it is suited to every clients' needs.

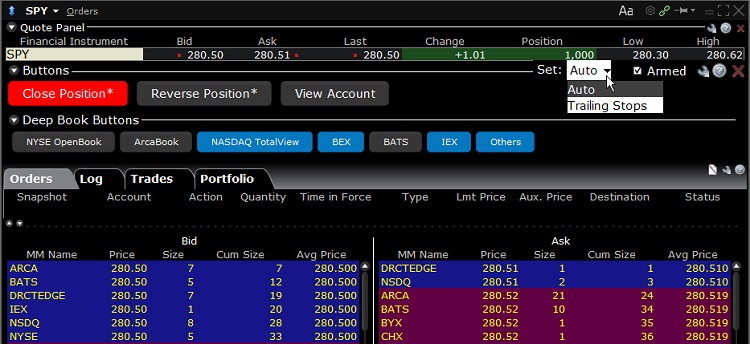

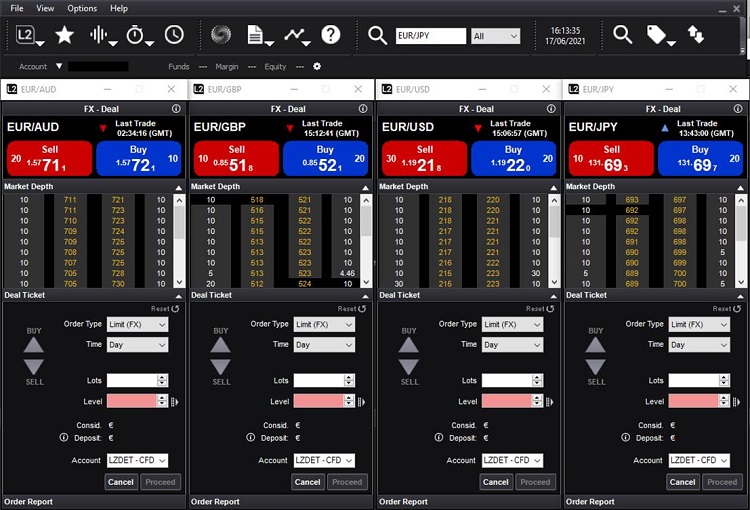

L2 Dealer

Presented by IG, L2 Dealer is one of the most reputable platforms with access to Depth of Market. The platform was created to give clients more control over their CFDs assets, which is perfect for those who wish to participate directly in the market. They offer market depth from a range of exchanges.

The Market Depth feature allows you to access the complete order book, giving visibility into every bid and offer made in a market. This enables you to assess market sentiment by determining whether other participants are bullish or bearish before making your own trading decision. Additionally, you can use volume metrics to time your entry based on the underlying market's liquidity.

IG Markets is an online trading provider with decades of experience in the financial market. Founded in 1974, the world-leading company has gathered more than 178,000 clients worldwide with over 16,000 markets reached as of 2019. IG Markets is authorized and regulated by the Australian Securities and Investment Commission (ASIC). It is also important to note that being established in 1974 makes IG Markets one of the forefront online CFD brokers. Their service has expanded to 15 countries across five continents.

Aside from famous for its reliable experience, IG Markets is also known for its truly broad range of trading instruments. In fact, the broker has long been regarded as one of the most accomplished companies in offering the most trading assets to clients. The wide choice of instruments includes forex pairs, 26 indices, over 12,000 shares, hard and soft commodities, cryptocurrencies, as well as other markets such as bonds, rates, and options.

Forex trading in IG Markets is provided in two ways: CFD and DMA (Direct). Here are the conditions for each type of trading:

Forex CFD

- Minimum spread: 0.6 pips

- Commission: None

- Platforms: Web, mobile apps, MT4, ProRealTime, L2 Dealer, terminals and APIs

- Trading size: Contracts

- Demo account: Yes

Forex DMA

- Minimum spread: No details

- Commission: from $10 per $1 million traded

- Platforms: Web, mobiles apps, L2 Dealer, terminals, and APIs

- Trading size: Lots

- Demo account: No

Both ways of trading are available for all clients. However, DMA does not enable trading in MetaTrader 4. Clients are also not allowed to trade in a demo account for virtual trading. It is essentially a type of trading reserved for experienced traders with high necessity for the best pricing in the market, as DMA offers market depth from a range of exchanges (including full market depth from the LSE).

Trading platforms in IG Markets are accessible via web, mobile app, and desktop. They are offered with 2 main varieties: Core Platforms and Specialist Platforms. The core platform is meant for all types of trading with the add-ons of DMA, ProRealTime access, and Forex Direct. Meanwhile, Specialist Platforms consist of L2 Dealer, ProRealTime, and MetaTrader 4.

The first two platforms charge fees that include minimum $2000 balance and monthly fees for shares data and level 2 prices (for L2 Dealer), as well as platform fees amounting to $40 per month and monthly fee for shares data (for ProRealTime).

IG Markets does not require a minimum balance to open an account. It also provides a swap-free account that frees clients for any interest, rollover, or swap charges on overnight positions. Yet, All costs and charges are built into the spread. This account suits well with long-term traders who need to keep their positions open for days or even weeks.

For beginners, IG Markets builds an IG Academy that gives interactive education and online trading courses. This way, clients can get a grip on the financial markets with the essentials of trading provided in infographics, video explainers, and end-of-course quizzes. Even better, the IG Academy is already integrated into its mobile app so clients can always learn about financial markets in much more efficient ways.

In conclusion, IG Markets is a client-friendly broker with more than 40 years of experience to back up its credibility. Their efforts and commitments to provide the best varieties of trading platforms are proven in the unique Core and Specialist Platforms.

Traders with little experience can apply to Forex CFD account in either Core Platforms or MetaTrader 4, while professionals can achieve the best experience in the financial market with IG Market's DMA trading and L2 Dealer or ProRealTime platforms.

How to Use DOM Data?

Depth of Market provides information for traders, allowing them to see where the price may be headed soon. Another purpose is to help traders understand the bid-ask spread of an instrument as well as the current volume. This information is useful for traders who wish to exploit market volatility. This is why DOM is popular among scalpers and day traders.

For example, a trader is looking to open a position in ABC.

Currently, ABC is being traded at $5.00. The Depth of Market shows an offer at $5.05, but there are also 50 other offers at $ 4.90. Seeing this trend, traders might determine that ABC will go higher, giving more insights on whether they should execute a trade or wait for better timing.

Why Does It Matter?

DOM provides information that can be useful to determine whether to place an order. It also helps traders to understand which order the market is weighted on. Usually, when the price increases, the market is more inclined towards buy orders and vice versa.

That being said, market depth is a very efficient way to check the activity of a certain trading instrument. From this feature, traders can determine whether the instruments have enough depth and volume to support their trading plans. This can determine their success as well as failure in the market.

A trading platform with DOM can be very useful for traders, especially scalpers and day traders. Depth of Market provides information regarding the liquidity of a certain trading instrument. This data help traders to time their trades in line with the current liquidity. If you want to use this data for trading, consider trading with MT5 or cTrader brokers. Other than that, proprietary platforms like ThinkTrader and Trading Station may be suitable too.

A trading platform is an important aspect of trading. However, some platforms can be too complex for new traders. Which trading platform is perfect to start your forex trading with?

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Peter

Aug 10 2023

Have to laugh at DOM on FX @ 10 sitting on each level

Denny

Jan 11 2024

I believe I'm familiar with approximately six trading platforms that provide a Depth of Market (DoM) feature. However, before delving into the selection of a trading platform, I must first grasp the concept of DoM. According to the article, market depth serves as a highly effective means to assess the activity of a particular trading instrument. Through this feature, traders can ascertain whether the instruments exhibit sufficient depth and volume.

I am curious about how the platform gathers information. In other words, how does the DoM function? Additionally, can the data displayed be considered reliable? Thank you!

Fury

Jan 15 2024

Hey! Great question you've got there. Let me share my knowledge on that! Essentially, the app pulls in its information from real-time data provided by various players in the market, such as brokers and exchanges. They collect all this data and give you a quick overview of what's happening with the market depth. However, the reliability of this info depends on how accurate and fast these sources are.

Traders use the DoM to see how easy it is to buy or sell something and make savvy moves based on the insights from the order book. Just a heads up, it's crucial to use a reliable and well-known trading app to get accurate DoM data. Keep an eye out for any info on data accuracy and understand where the information is coming from to make better decisions in your trades. You can also read this article : DOM Trading Strategy for Beginners if you are beginner in DoM! Hope it can help!

Sonny

Feb 25 2024

According to the article, it mentions that through the DOM (Depth of Market), traders can gather information about the supply, demand, and liquidity of an asset at various price levels. A high market depth indicates good liquidity, whereas a low market depth suggests poor liquidity.

What I'm curious about is the concept of liquidity, particularly the difference between good and low liquidity. Could you provide examples of each and explain how liquidity affects traders like myself? Thanks!

Ternier

Feb 28 2024

Sure thing! Liquidity refers to how easily and quickly an asset can be bought or sold in the market without significantly impacting its price. Good liquidity means there are plenty of buyers and sellers actively trading the asset, leading to tight bid-ask spreads and minimal price slippage. For example, a highly liquid asset like a major currency pair in the forex market typically has numerous participants trading it, ensuring smooth execution of trades at desired prices.

On the other hand, low liquidity indicates fewer participants trading the asset, resulting in wider bid-ask spreads and greater price volatility. An example of low liquidity might be a thinly traded stock with limited trading volume or a niche cryptocurrency with a small market cap.

As a trader, liquidity has significant implications for your trading experience. In markets with good liquidity, you can enter and exit positions quickly and at competitive prices, minimizing trading costs and slippage. However, in markets with low liquidity, executing trades may be more challenging, with higher transaction costs and a greater risk of price fluctuations.