The best trading hours are during high volatility and liquidity to get low spreads. ThinkMarkets defines market sessions into Asian and Nylon to determine the best trading time.

With indices, shares, and most other financial products traded on various global exchanges, traders can only trade during exchange business hours. Fortunately for forex traders, currencies don't have these restrictions since the forex market is open 24 hours a day, 5 days a week, allowing you to trade day or night.

But that doesn't mean it has to open around the clock. The best times to trade depend on certain periods due to differences in trading sessions. It is crucial to understand the various forex trading sessions to determine the best trading times and the best forex assets to trade. And this is how ThinkMarkets gives understanding to their traders regarding that matter.

See Also:

Seize Trading Opportunities Anytime

Since the forex market has no physical location or a central exchange, it is considered an Over-the-Counter (OTC) or "interbank" market. It means the entire market operates electronically within a network of banks. Global traders can trade through their broker 24 hours a day as they see fit.

If you are a part-time trader and work during business hours, the best time to trade forex is before and after hours. The same goes for students. Trade whenever you have free time. The best forex trading hours should not overlap with daily trading because trading requires optimal concentration to maximize results.

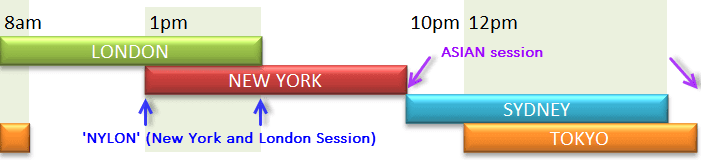

There are 4 main trading sessions, Sydney, Tokyo, London, and New York. The Sydney and Tokyo are generally referred to as the Asian Session, while the London and the New York are classified by ThinkMarkets as the Nylon Session.

As a multi-asset online brokerage, ThinkMarkets present a wide range of trading assets starting from Forex to Precious Metals, Commodities, Indices, Shares, and Cryptocurrencies. The Australian-based broker is established in 2010 and has since opened additional headquarters in London and regional offices throughout Asia-Pacific, Middle East, North Africa, Europe, and South America.

Along with its history operation, ThinkMarkets has been awarded and recognized many times in various aspects. Most recently, they won the Best Value Broker in Asia at the 2020 Global Forex Awards.

Average FX spreads for traders opening an account in ThinkMarkets start from 1.2 pips for the standard account, while ThinkZero provides the best trading experience with 0.1 pips spread. Still, traders may need to consider that ThinkZero applies commission from $3.5 per side for every 1000,000 trading volumes.

As a global online brokerage, ThinkMarkets operates under various financial regulatory institutions. For example, ThinkMarkets Australia is managed by TF Global Markets (Aust) Limited and is licensed by the Australian Financial Services as well as the Australian Securities and Investment Commission (ASIC) with ABN: 69158361561. ThinkMarkets UK is registered under the Financial Conduct Authority (FCA) by the company name of TF Global Markets (UK) Limited (number: 09042646).

ThinkMarkets consistently try to improve their trading environments with various advanced products. Automatic trading fans are provided with free VPS Hosting, while passionate traders who'd like to experience beyond MetaQuote platforms can try ThinkMarkets' proprietary platform called ThinkTrader.

The trading platform is available on 3 different interfaces specifically designed for Web Desktop, Tablet, and Mobile displays. Furthermore, customized tools such as 80+ drawing tools and more than 125 indicators for technical analysis accessible even through Mobile screens would certainly provide a brand new trading on-the-go experience.

As far as market updates go, trading in ThinkMarkets would be accompanied with news from FX Wire Pro that is known for its strict policy toward upholding objective journalism and delivering critical, trusted information in real-time. Information segments covered by FX Wire Pro include Economic Commentary, Technical-level Reports, Currency and Commodities, Central Bank Bulletins, Energies and metals, together with Event-driven Flashes.

For payment methods, ThinkMarkets offer the gateway via bank transfer, credit card (Visa and MasterCard), Skrill, Neteller, POLi internet banking, BPay, and Bitcoin wallet.

All in all, it is safe to say that for a company that started business since 2010, ThinkMarkets is an accomplished broker in terms of legal standing and innovation in trading technology. As an additional safety assurance for traders, this broker underlines its commitment to provide a $1 million insurance protection program which is made possible by ThinkMarkets' insurance policy with Lloyd's of London that protects clients' funds for up to $1 million in the unlikely event of insolvency.

The most trading activity occurs during the London session (also in Europe), while the highest liquidity occurs during the New York session and the London trading session is in progress at the same time. These are called "Nylon" sessions (New York and London), the most liquid forex trading sessions of all market sessions where liquidity and trading volume are maximized.

The New York trading session starts at 08:00 EST (Eastern Time) and ends at 17:00 EST. Meanwhile, the London trading session begins at 03:00 EST and ends at noon EST. Between 08:00 and 12:00 EST, two trading sessions are opened simultaneously or overlapping in the forex market.

These are times of high activity for market participants in various global financial centers. ThinkMarkets regards it as having enough volatility to trade assets with high liquidity and low spreads. The best overlap is London/New York time (13:00 GMT – 16:00 GMT).

This overlap creates very high rates of price action and very high breakout opportunities. The breakout strategy in trading is a common practice carried out by experienced traders where the price penetrates a key level. The general momentum for the breakout is from the beginning of the New York trading session to the end of the London trading session.

During this time, banks in London and New York will end their official trading sessions, while banks in Asia will open for trading. The Asian session begins with the opening of the Sydney market at 22:00 GMT. It's called the 'Sydney Open', but it's really the opening of the New Zealand financial market. The Asian session continues until Tokyo closes at 0800 GMT.

The Asian session is usually followed by low liquidity when most currency pairs trading in a range. Low liquidity also means that currency pairs are generally traded with relatively large spreads. It is because the volume is not as high as that of the Nylon

Most of the activity during the Asian session takes place early in the morning when the relevant economic news is released. The best currencies to trade during the Asian session are the Japanese Yen, Australian Dollar, and New Zealand Dollar. According to ThinkMarkets, forex traders should also pay attention to press releases from the Australian, New Zealand, and Japanese Bureau of Statistics.

24-Liquidity Cycle

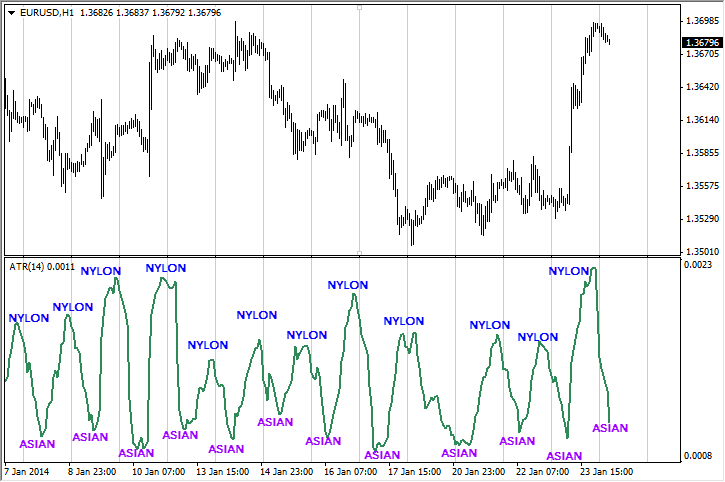

In explaining its points, ThinkMarkets provides a visual representation of changes in liquidity over 24 hours that includes a 14-period ATR (Average True Range) indicator. It is a volume proxy, with each horizontal line representing 24 hours.

Note that volume and liquidity are lowest during the Asian session, increase during the European and London open, and peak during the Nylon session. It's not accurate to hours or minutes, but it shows the daily cycle of increasing and decreasing volume.

In the end, the best time to trade depends on availability, time zone, or trading style. For example, if you only want to target a few in a low-volatility environment, the Asian trading session is enough for you. However, if you want high volatility and huge price movements to win big, trading early in the Nylon session is more suitable.

ThinkMarkets is a multi-awarded broker for online trading. Since 2010, they have become a highly regulated brand with a global presence that keeps striving to empower traders with access to a wide range of financial markets on their sophisticated platform, ThinkTrader.

Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

15 Comments

Leonard

Apr 18 2023

Hey, maybe I'm a bit off, but I think the reason why the forex market is open for 24 hours is because the markets around the world open and close one by one. It starts with the London market, then the New York session, and when the London market closes, the New York market continues until it closes. After that, the Sydney market opens, and when it closes, the Tokyo market opens. This cycle continues until the London market opens again. So, basically, that's how it works, and we need to find the overlapping hours when the markets operate together to get more liquidity

Cory

Apr 18 2023

Yes, you're correct! The forex market is open 24 hours a day, 5 days a week because it's a global market that operates in different time zones. The market opens with the London session, which is the most active session in the forex market. Then the New York session takes over from London and continues trading until it closes. After that, the Sydney market opens, followed by the Tokyo market. The cycle continues until the London market opens again.

Finding the overlapping hours when different markets operate together is important because it provides traders with more liquidity and more opportunities to trade. The overlap between the London and New York sessions is the most active time in the market, with higher trading volumes and volatility, which creates more opportunities for traders to make profits.

Andy

Apr 19 2023

As a beginner trader, I read this article and found out that the Asian market is known for its lower volatility, while the American market tends to be more volatile. Which market would be more suitable for a beginner like me in terms of managing risks and starting out on a safer note?

When comparing the Asian market and the American market, which one generally carries less risk for beginner traders due to its volatility? I want to ensure I choose a market that aligns with my risk tolerance and allows me to navigate the trading landscape more comfortably.

Evan

May 19 2023

In my opinion, as a beginner trader, it might be a good idea to start with the Asian market rather than the American market. The Asian market tends to have lower volatility compared to the American market, which can make it more suitable for beginners. With lower volatility, the price movements are generally smoother and less erratic, allowing beginners to get a grasp of trading without being overwhelmed by intense swings.

In terms of risk, the Asian market is generally considered to be less risky for beginners due to its lower volatility. The stable and predictable price movements in the Asian market provide a more controlled trading environment, giving beginners a chance to learn and gain confidence in their trading strategies. It allows you to focus on building your skills and understanding market dynamics before potentially venturing into the higher volatility of the American market. This is just my opinion, and ultimately, the choice of which market to trade in depends on your personal preferences, risk tolerance, and trading goals.

Timmy

May 24 2023

I have a different viewpoint, my friend! I believe that the American market, especially during its active trading hours, provides excellent opportunities for beginners. It is known for its higher liquidity, which leads to lower spreads. These lower spreads can be advantageous for beginners as they reduce transaction costs and potentially increase profitability. Moreover, the American market is characterized by significant price movements, allowing traders to capitalize on larger price swings.

In addition, many traders, including novices, prefer to trade currency pairs such as EUR/USD in the American market. This currency pair is widely regarded as one of the best for beginners. It offers ample trading opportunities and is well-suited for those starting out in the trading world.

On the other hand, while the Asian market may have lower volatility, it can also suffer from low liquidity. This can create more challenging trading conditions, potentially leading to increased risks.

However, as you rightly mentioned, the choice between the Asian and American markets ultimately depends on the preferences of individual traders. Some may find the lower volatility and more controlled environment of the Asian market appealing, while others may be drawn to the higher liquidity and potential profitability of the American market.

Luis

Apr 19 2023

Thanks for the article. It seems that I now have an idea about the trading sessions that we can follow to maximize our trading, whether it is during the New York session or the Asian session. Both sessions have different time zones, and traders can participate in either session depending on their availability, whether it's during morning or night in their local time.

Regarding trading during these sessions, I'm wondering which one is better for a beginner - the New York session or the Asian session? I have noticed that many currency pairs are involved in forex trading during both sessions, including major pairs. Can someone explain the differences and advantages of each session for a beginner like me? Thank you!

Hendrik

Apr 19 2023

it's actually a good idea to start trading during the Asian session if you're a beginner. That's because the Asian session tends to have a lower volatility compared to the other sessions, like the New York session, which can be quite unpredictable and fast-paced. And since the Asian session overlaps with the European session, there's still a good amount of liquidity to take advantage of. But don't get me wrong, the New York session can also offer some great opportunities, especially if you're looking to trade major currency pairs like EUR/USD or USD/JPY. It's really up to you and your trading style. Just keep in mind that it's important to find the right balance between volatility and liquidity. Happy trading!

Yoga

Apr 20 2023

The New York session is one of the major forex trading sessions and it starts around 8am EST and ends around 5pm EST. During this session, the market is highly active, especially during the overlap with the London session, which happens from 8am EST to 12pm EST. This overlap period is known as the "golden hours" because it is when the highest trading volume and liquidity occur. However, as a beginner trader, it's important to find a session that suits your schedule and trading strategy, so you should also consider the Asian session which overlaps with the European session. I think if you have higher risk tolerance, you can choose this session as well. And if you want to take higher risk, why don't try both of the session? Since you can test the trading in the demo account too!

karen

Apr 25 2023

I'm a trader from Asia and I'm curious about the Asian trading session. I prefer to trade during this time since it's the perfect time for me, but I recently read that the liquidity in the Asian markets is usually low compared to other Forex markets. I'm wondering how this will affect my trading strategies and if I need to be more mindful of it. Are there any tips to reduce the impact of low liquidity in these markets? And why is the Asian session known to have lower liquidity compared to other sessions?

Junior

Apr 26 2023

Certainly! I will answer your question! The lower liquidity during the Asian session can have an impact on trading strategies, as it can result in wider spreads and slippage, which can make it more difficult to enter and exit trades at desired levels. Traders need to be especially mindful of this and adjust their trading approach accordingly, such as by using limit orders instead of market orders or trading on higher timeframes that are less affected by short-term volatility.

To mitigate the impact of low liquidity, traders can also consider trading currency pairs that are more active during the Asian session, such as AUD/USD, NZD/USD, and USD/JPY. Additionally, it's important to be aware of any economic news releases or events that may impact liquidity and volatility during the Asian session, and to adjust trading accordingly.

There are several reasons why the Asian session typically has lower liquidity compared to other sessions. One reason is that many major financial centers, such as London and New York, are closed during the Asian session, which can result in lower trading volumes. Additionally, many Asian countries have capital controls or other restrictions on currency trading, which can limit the flow of capital and reduce liquidity.

Andro

Apr 26 2023

I completely disagree with your answer. I mean, Asia has several major financial centers such as Tokyo, Hong Kong, Singapore, and Shanghai, which are crucial for various financial activities like currency trading, investments, and corporate finance. But compared to the European and American markets, the Asian markets have lower trading volumes and liquidity during the Asian trading session. This is because of several factors, including less participation from major players, different trading hours, and cultural differences. Hence, traders must be aware of the potential impact of lower liquidity on their trading strategies and should take necessary steps to manage the associated risks.

Michael

Apr 25 2023

Hey there! I'm curious about the New York and London Sessions in forex trading. I've heard that these sessions have higher liquidity and trading volume compared to other sessions. I'm wondering what factors contribute to this and why the American forex market in particular has such high trading volume. How does this impact the overall trading experience for traders in this market and what strategies can be used to take advantage of it? Additionally, is it easy for beginners to start trading during these sessions? I appreciate your insights, thanks!

George

Apr 27 2023

Well, these sessions are known for having a ton of trading activity and high liquidity. The American forex market, in particular, is pretty popular because it's home to some of the world's largest financial institutions and corporations, and there's a lot of money being moved around there. Plus, the New York session overlaps with the London session, which means even more trading activity and volatility. As for beginners, it's definitely possible to start trading in these sessions, but it's important to have a solid understanding of the market and some risk management strategies in place. Overall, it can be an exciting and potentially profitable market to trade in, but as with any type of trading, it's important to do your research and proceed with caution.

Adong

May 17 2023

The article mentions that the best time to trade ultimately depends on factors such as availability, time zone, and trading style. It suggests that for traders who prefer targeting a few trades in a low-volatility environment, the Asian trading session may be sufficient. Can you provide further insight into this?

I'm interested to know if trading during low-volatility periods, such as the Asian trading session, offers profitable opportunities compared to trading during high-volatility periods. Are there specific strategies or advantages associated with low-volatility trading that traders can capitalize on? Additionally, how does the potential for profit differ between low-volatility and high-volatility trading environments?

Sebastian

May 19 2023

I agree with the article! During low-volatility periods, the price movements are usually steadier and more predictable. It's like a calm ocean instead of a stormy sea. This can be great if you prefer a more stable and less risky approach.

During these times, it's often easier to spot trends and set up support and resistance levels. This can help you with your technical analysis and make more informed trading decisions. One popular strategy in low-volatility markets is called range trading. It's all about identifying price ranges or consolidation patterns where the price bounces between certain levels. You can buy at the bottom (support) and sell at the top (resistance) of the range. It's like playing ping pong with the price!