Here's the story of why you need a good and fair Forex broker, the middlemen of foreign exchange, the one that makes you come out as a winner.

Have you ever seen a buzzing crowd of businessmen picking up phones and shouting calls on a foreign exchange trading floor? Those men are collective forex brokers actively helping traders to allocate capital and execute market orders. Eventually, with their help, each trader can potentially make profits.

Why Do You Need Forex Brokers?

Traditionally, a trading lot in the foreign exchange market required approximately 100,000 units of base currency to effectively pass a market. For example, a single lot in GBP/USD (Pound sterling/US dollar) is equal to £100,000.

Therefore, only traders with high capital and large investment banks can join in. That is where a forex broker comes into play. Forex brokers can help an average retail trader to enter forex trading with leverage. In its essence, leverage is a system where a forex broker may leash a trading lot for a margin.

This is how leverage works:

Thomas got only $10,000 and he's short $90,000 (out of 100,000 base currency) to pass a single lot in USD/JPY. In short, he needs a forex broker to lend him enough money.

Thomas found a forex broker that offered him 1:50 leverage. Without hesitation, Thomas took that offer. Now, he can trade under 2% margin of the original lot, that's equal to $2,000. Effectively, he's left with the remaining $8,000 to be traded in the forex market until it hits margin call.

TLDR; If you're not rich-blooded like Warren Buffet, you'll need a forex broker to lend you enough money to play the forex YOLO games.

See Also:

Aspects to Consider When Choosing a Broker

You may start online trading with just about any forex broker. However, if you want to actually profit, you have to carefully pick them. In order to do so, you need to check all these things:

A. Check Their Identity and Legitimacy

The first thing to come to mind is the quality of your forex broker. Needless to say, the quality of a forex broker is directly linked to how they are regulated and from where they operate.

By the way, do you know that a shady forex broker can operate on an offshore island without any clear regulations? Yes, it's true and that's the dark truth in forex market reality. Be wary my friends! Shall you be tempted by their overly unrealistic offering, we're here to wake you up!

To avoid those traps, you need to scrutinize the legit-ness of your broker. Go Ahead, find the answers to these questions:

- Where's the headquarter? Is the address written on their website actually refer to an actual place?

Yup, you need to find their actual address. If you can't locate it via the internet global map, most likely it's a fake address. - Who regulates them? Are they under the jurisdiction of a regulatory body?

A good, legit forex broker will be regulated under a legal regulator. Some of these are; NFA and CFTC for the North American region, FCA for the UK, ASIC for Australia, and CySEC for Cyprus. - To whom shall I send my complaints or questions? Can I get a satisfactory answer?

By norms, a brokerage provides customer service or sorts to answer all your question. If the answer is satisfactory to you, it's a good sign to start trading with them.

Other than that, you must look for brokers that implement robust security measures to safeguard your funds and personal information. Check if they utilize encryption protocols and maintain segregated client accounts. Additionally, consider the broker's reputation and reliability, including their trading infrastructure and uptime.

B. Examine the Trading Terms and Conditions

If you want consistent profits from your trading positions, you have to make sure that your forex broker is playing fair. Simply put, check their trading term and conditions before opening a live account.

We know it's not easy to understand the wall of text imposed by your broker to hide their true intention. But fret not, we'll make it simple here!

Step one, check their market model!

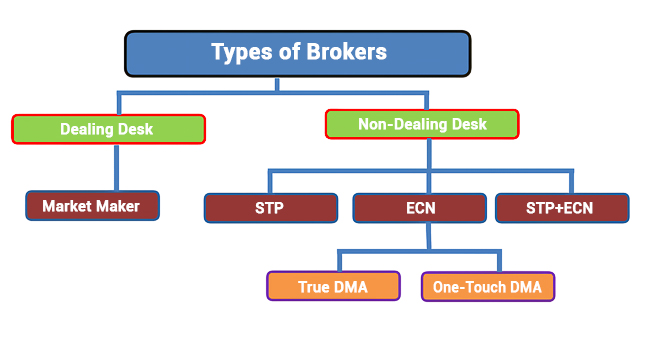

A market model is how a forex broker transmits your trading request to the market. For instance, a good bonafide forex broker will transmit your market order through STP or ECN network without any intervention (i.e., no re-quote).

Step two, check their trading costs! There are multiple ways a forex broker can charge you for their service, such as:

- Spreads: spreads are the difference between the buying (bid) and selling (ask) prices of a financial instrument. Brokers make money by charging a spread on each trade. The spread can be fixed or variable, and it varies depending on market conditions, liquidity, and the broker's pricing model. AvaTrade, easyMarkets, FBS, and FxPro are well-known brokers that offer 1 pip fixed spreads. Meanwhile, lower spreads are generally preferred as they reduce trading costs.

- Commissions: some brokers charge commissions on each trade, especially in certain markets like stocks or futures. Commissions are typically a fixed fee or a percentage of the trade's value. They can vary based on the broker, the type of account, and the volume of trades executed. IC Markets, eToro, Admiral Markets, XM, and Pepperstone are ASIC-regulated brokers that offer low commissions.

- Overnight financing: if you hold positions overnight in the forex or CFD markets, brokers may charge or credit you with overnight financing costs, also known as swap rates. These costs are associated with the interest rate differentials between the currencies being traded. The financing costs depend on the size of the position and the prevailing interest rates. Some brokers that provide swap free accounts are OANDA, ThinkMarkets, and Vantage FX.

- Slippage: slippage occurs when the actual execution price of a trade differs from the expected price. It usually happens during periods of high volatility or low liquidity. Slippage can lead to additional costs if you are unable to execute trades at your desired price. So, you can choose between XTB, FP Markets, eToro, IC Markets, or Roboforex which offer no slippage for your trades.

Inactivity fees: some brokers may charge inactivity fees if your trading account remains inactive for a certain period of time. This fee encourages active trading or serves as a maintenance charge for maintaining an account with the broker.

Deposit and withdrawal fees: brokers may charge fees for depositing or withdrawing funds from your trading account. These fees can vary depending on the payment method used, such as bank transfers, credit cards, or e-wallets. There are several brokers that charge zero fees for depositing or withdrawing, such as: Exness, OctaFX, FXOpen, FBS, XM, and FXOptimax.

Data fees: access to real-time market data and research tools may come with additional costs from the broker. These fees can include exchange data fees, subscription fees for premium research or analysis tools, or access to advanced charting platforms.

It's important to carefully review a broker's fee structure and trading costs before opening an account. Consider your trading strategy, trading volume, and the instruments you plan to trade to assess the impact of these costs on your overall profitability. Therefore, make sure you can get them as low as possible!

Step three, read more info below!

C. What Do They Offer?

Well, of course, it all boils down to what the forex broker offers to you. However, you need to check how sensible and realistic those offers are if you don't want to fall into a trap. As a beginner, it's very common for you to get lured by fantastic offers, such as high leverage above 1:50, commission-free accounts, or even no deposit bonuses!

Think again! CFTC and NFA heavily imposed strict rules on leverage and bonus deposits for a reason! One such reason is the risk of overtrading and trading under a limited margin. In other words, the broker basically lends you a huge amount of money to lure you to trade like blind, hungry rats! And guess what, the rats got depraved and the broker pocketed your loss as profit!

We do understand that you as a retail trader, only possess limited capital. But, don't make it a reason to engage in overtrading with an irresponsible forex broker. Instead, pick a fair and reliable forex broker with realistic offers for their leverage! Remember, trade with a fair forex broker and win like a boss!

Besides, there are several offers that should be considered as well, such as:

Trading platform: make sure it is user-friendly, stable, and offers the features and tools you require. A good platform should provide real-time charts, order types, technical analysis indicators, and a range of order execution options.

Range of instruments: apart from forex, you might be interested in trading other assets like stocks, commodities, or cryptocurrencies. Choose a broker that provides access to a diverse set of markets if you have a broader trading strategy.

Educational resources and research: assess the educational resources, market analysis, and research tools provided by the broker. These can be beneficial, especially for beginner traders, as they offer valuable insights and educational materials to improve trading skills.

D. How Do Forex Brokers Maintain Their Customers?

This is arguably the most important thing to note. A good broker will not rob you blind and leave you like a rag once they are done with you! So, the big question eventually comes down to this, how does a good forex broker maintain a sustainable relationship with their clients aka you?

A good broker should offer responsive and knowledgeable support through various channels, such as phone, email, or live chat. Test their support beforehand if possible. Research and read reviews from other traders about their experiences with the broker. While individual opinions may vary, a broker with a consistently positive reputation is generally a good indication.

Good question really, but too many times we've heard so many scams and bad news about them... Fret not! Good forex brokers actually exist and they do have clients with lasting relationships for years and years to come. You may check one of our reviewed brokers here.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance