Not all candlestick patterns are as accurate and reliable as they used to. Here are the five most powerful candlestick patterns to trade with.

Candlestick patterns are top-rated and essential tools in forex trading. Understanding them allows traders to interpret the changes in the market and take action from that information.

Simply put, a candlestick is a single bar showing the price movement in a certain period. These candlesticks display an asset's open, high, low, and close price over a specific period. Candlestick patterns use one or more candlesticks to form a certain pattern to help traders analyze the market. The main goal is to predict the direction of price movements in the future based on the chart. There are many kinds of candlestick patterns that forex traders often use.

Of the many pattern choices, there are known to be the most powerful candlestick, including:

- Evening star

- Two black gapping

- Three line strike

- Abandoned baby

- Three black crows

Please refer to the following for a more detailed explanation of why these five candlesticks are the most powerful patterns.

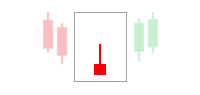

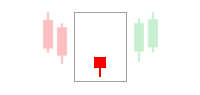

1. Evening Star

The evening star shows a bearish pattern that tends to indicate a reversal. It starts with a long bullish bar carrying an uptrend to a new high. The market's gap is higher on the next bar, but it is suddenly short of fresh buyers, resulting in a small candlestick. The pattern completes with the third bar that changes direction (reverse). The third candlestick is very important as it confirms the turnaround of the price trend. After the completion of the pattern, the price will continue to create lower lows, potentially triggering a broader-scale downtrend. According to Bulkowski, this pattern has a 72% accuracy rate.

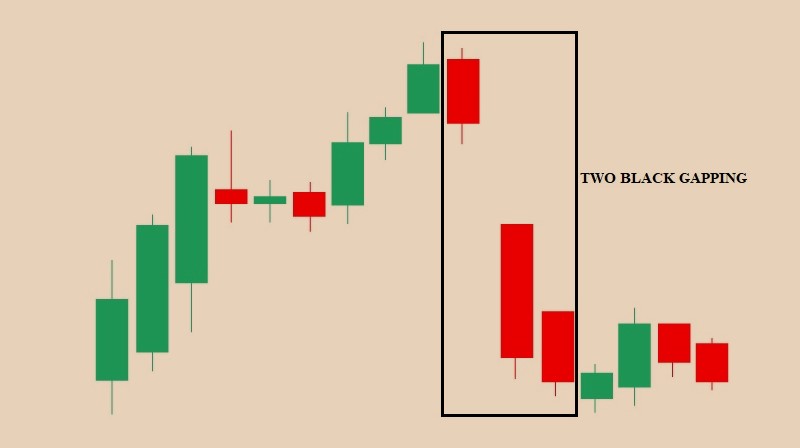

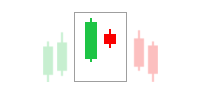

2. Two Black Gapping

As the name suggests, the two black gapping patterns are characterized by a wide enough gap between the first and second candles. The pattern usually appears in an uptrend before a gap is formed and followed by two bearish bars posting lower lows. The bearish pattern then indicates that the price will continue even to lower lows and potentially trigger a downtrend continuation. Bulkowski stated that the pattern has an accuracy rate of 68%.

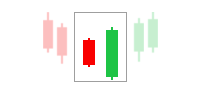

3. Three-Line Strike

Three line strike tends to indicate a bullish reversal characterized by the formation of three bearish candles within a downtrend. Because it indicates an impending uptrend, the pattern usually starts after a series of slopes. The first three bars go to a lower low and closes near each other's low. The fourth bar then opens even lower but starts the reversal by changing direction in a wide-range outside bar that closes above the first candle's high at the beginning of the pattern. Although this pattern is considered quite rare in the forex market, according to Bulkowski, the accuracy rate is pretty high, 83%.

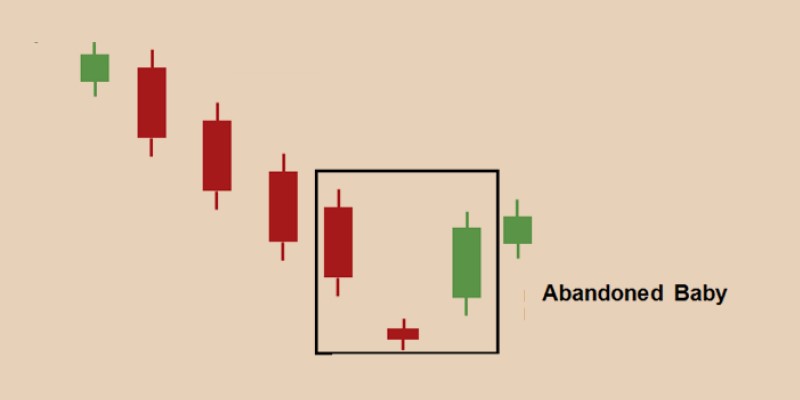

4. Abandoned Baby

The next pattern we're talking about is the abandoned baby pattern. This pattern can indicate a bullish or bearish reversal, depending on the position of the candlesticks. This pattern's distinctive feature is the second Doji candle in the middle of the other two candles.

In the bullish abandoned baby, a reversal pattern appears at the low of a downtrend after a couple of bearish candles. A gap starts to form, but fresh sellers fail to appear and cause a Doji candlestick followed by a gap and the third bullish bar to complete the pattern. It means that the buyers finally outperform the sellers, making the price move in an uptrend. This condition indicates that the bullish movement will continue, potentially triggering a strong uptrend. According to Bulkowski, the pattern has a 49.73% reliability.

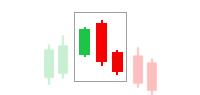

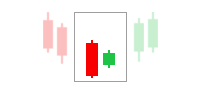

5. Three Black Crows

Following the previous patterns, the three black crows are also categorized in the reversal candlestick patterns, which means that the pattern could lead to the change of the price direction from the previous trend. In the typical appearance of the bearish three black crows, it starts with an uptrend that closes near high or when the price is at the overbought level, so traders began selling to take profit and prevent the price from going higher.

The pattern was then ideally completed by three long bearish candlesticks with very short or no shadows. The pattern indicates that the price will go even lower, potentially triggering a significant downtrend. Bulkowski claimed that this pattern has a 78% accuracy rate.

Are Candlestick Patterns Accurate?

To use candlestick patterns effectively in trading, traders must understand their time sensitivity within specific time frames (intraday, daily, weekly, monthly). Patterns lose reliability shortly after completion. Candlestick patterns can indicate either a price reversal or continuation, as described by Thomas Bulkowski's book.

There are 42 types of patterns, categorized as single, double, or triple candlestick patterns. Not all patterns remain accurate due to hedge funds and algorithms analyzing charts. However, some patterns still provide reliable trading.

Final Conclusion

Candlestick patterns are useful to help traders analyze the market and predict the next price direction in the future. Although many believe the patterns are starting to lose their accuracy in the modern forex market, several patterns are still reliable in predicting price movements, as stated in Thomas Bulkowski's statistics.

That is why understanding candlestick patterns is still important for forex traders. For a start, you can reference the candlestick patterns explained in this article. Those patterns' high accuracy rate will help you reduce the risk of trading from false opportunities and poor decisions.

Though it may not be easy to spot the patterns on the chart initially, it is important to remember that the more you practice, the easier it will get. It is also highly recommended to spend the majority of your practice time in a forex demo account as it will eliminate the risk of losing real money.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

4 Comments

Angelia

Nov 24 2023

I've got a few questions here aboot the evening star pattern. The article says it's a bearish reversal pattern. It starts with a long bullish bar, which means the uptrend is reachin' a new high. The next bar opens higher, but there's not enough buyer interest, so it ends up bein' a small candlestick. The pattern's reported accuracy is around 73%, which is pretty high. So, the big question is, how does this candlestick pattern work in swing trading? Is it a good tool to use, and what timeframe should I use it on?

Billy

Nov 28 2023

Hello, As you know, the evening star pattern is commonly used in swing trading strategies. Swing traders aim to capture short to medium-term price movements, and reversal patterns like the evening star can be valuable for identifying potential trend changes.

The choice of timeframe depends on your trading style and preferences. The evening star pattern can be applied to various timeframes, but its effectiveness may vary. Some traders prefer shorter timeframes (e.g., 15 minutes or 1 hour) for more frequent opportunities, while others may use longer timeframes (e.g., daily or weekly) for a broader market perspective. Regardless of the pattern used, effective risk management is crucial. Set clear entry and exit points, along with stop-loss orders, to protect your capital in case the trade doesn't go as expected.

Also, I suggest before fully relying on the evening star pattern, consider backtesting it on historical data and practicing with a demo account. This helps you gain confidence in recognizing the pattern and understanding its limitations. Hope this answer can help you!

Andre

Jan 23 2024

Regarding the three black crows, the pattern is described as commencing with an uptrend that closes near the high or when the price reaches the overbought level. Traders then initiate selling to secure profits and curb further upward movement. Does the occurrence of three black crows consistently indicate a strong signal for a bearish market? Also, based on the visuals shared, it appears that the black crows may not always manifest as complete bearish candlesticks. Is there a distinction in signal strength whether the three black crows form as full bearish candlesticks or display elements like heads and tails as depicted in the images?

Memphis

Jan 26 2024

Hey there! When you spot those three black crows hanging around, it's like the market flashing a neon sign that says, "brace yourself for a bearish ride!" They typically show up after a bullish trend, hinting that traders are locking in gains and putting the brakes on the upward momentum.

Now, onto the real deal – do these three black crows always mean a hardcore bearish market is coming? The short answer is yes, it's generally seen as a strong signal for a bearish shift.

And about the visuals – you've noticed, right? Those crows aren't always sticking to the script with full-on bearish candlesticks. Sometimes they've got heads and tails, a bit of flair. Does it make a difference in the strength of the signal? Well, some traders might prefer the classic all-bearish look, but even when they've got a touch of style with heads and tails, the three black crows can still pack a punch in signaling that bearish turnaround. It's like they're saying, "Yeah, we're bearish, and we've got a bit of swagger too!