There are various indicators that can be used to construct a forex trading strategy for beginners who are just getting started. The 20 EMA bounce is one of them.

EMA (Exponential Moving Average) is one of the forex indicators that can be used for better comprehensive analysis by making it easier for beginners to read the prevailing trends. Among the many periods a trader could try out, the 20 EMA provides a simple and smooth look for novice traders.

However, before learning about the 20 EMA, you should first understand the fundamentals of Moving Average (MA) and EMA.

The moving average (MA) is a price action indicator that may be used to determine price changes over time. Traders use MA to spot trends, dynamic support or resistance, and study the market. This approach can also be used to predict when a trend will reverse.

Meanwhile, EMA is one type of MA that gives more weight and significance on the most recent data points. The EMA, in other words, reacts more strongly to recent price fluctuations.

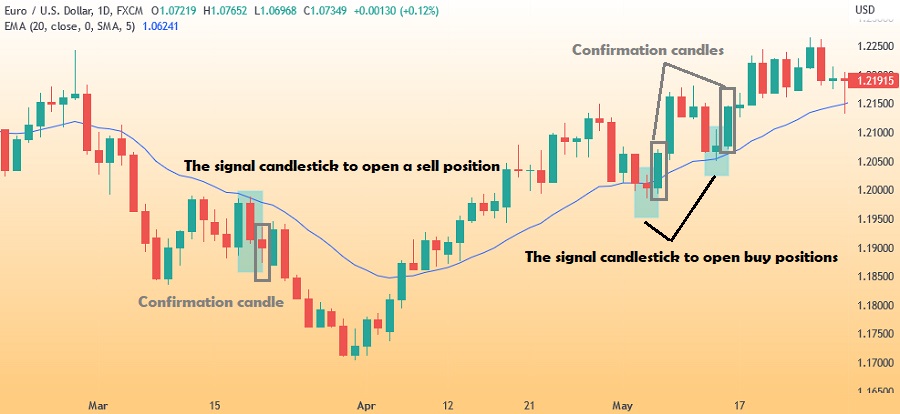

Now, let's discuss what the "20 EMA bounce forex" is all about and what the 20 EMA's purpose is. The 20 EMA functions as a "bounce line" for candlesticks. The process goes like this:

When the price is in an uptrend, it will continue to rise. But at some point, it will fall and challenge the 20 EMA line, especially if the uptrend is strong.

You'll notice that the 20 EMA line continues to drive the price up. This is known as a "retest" or retesting of the 20 EMA line, and it can occur once or a few more times before the retest fails and the 20 EMA line is broken.

As a forex trader, you're looking for a retest to occur, and in this situation, what you should be waiting for is the signal candlestick.

The Trading Rules

Before employing 20 EMA bounce forex trading, there are a few things and guidelines that newcomers in the field of forex trading should be aware of.

- To begin, you should be aware that prices are in an uptrend when they close above the 20 EMA. If prices close below the 20 EMA, the market is in a downtrend.

- The signal candlestick is the one that strikes the 20 EMA first. Because your buy or sell pending orders are based on the high and low of the signal candlestick, it is the only candlestick you should be concerned with.

- Set your buy stop pending order 1-2 pips above the high of the signal candlestick in an uptrend. Keep in mind to cancel your order if it is not confirmed by the following candlestick.

- Place your pending sell stop order 1-2 pips below the low of the signal candlestick in a downtrend. If that pending order is not validated by the following candlestick, you must cancel it.

- For a buy trade, place your stop loss a few pips below the low of the signal candlestick, and for a sell trade, place your stop loss a few pips above the high of the signal candlestick.

The Profit-Taking

After learning some 20 EMA guidelines, there are various profit-taking strategies available. First, you can utilize recent swing highs as a take-profit goal for buy positions, or use previous swing lows as a profit objective for sell trades. You can also apply a 1:3 risk to reward ratio, or make use of trailing stops to better lock in your profit.

Other popular EMA periods worth trying are 50 and 200. How would it be if the two EMA lines are combined to create a complete trading strategy? Learn further in 50 EMA and 200 EMA Simple Trading Strategies.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

1 Comment

Muthiara

May 31 2022

Beginner traders who are unfamiliar with EMA (Exponential Moving Average) will find this article to be extremely helpful EMA.

By reading this post, we may gain knowledge on how to effectively apply the 20 EMA, which can lead to financial success.