In general, raw spread and fixed spread have their own advantages and weaknesses. Which one is the better choice for scalping strategy?

Scalpers typically execute a high volume of trades throughout a trading session. The primary goal of scalping is to make small, quick profits by taking advantage of short-term price movements.

Scalping relies on rapid trade execution, often utilizing advanced technology and direct market access (DMA) to ensure fast order placement and minimal.

Therefore, they need trading conditions that can support all of that. If faced with a choice between a raw spread account and a fixed spread account, which one is most suitable and profitable for scalpers?

If we consider the need for scalping strategies as briefly mentioned above, a raw spread account appears to be more beneficial. Read the following article to understand the reasons.

What is a Raw Spread Account?

A raw spread account is an account that offers low or zero spreads. What this means is that there will be no difference between the market price of a currency pair and the price being offered by the broker.

This type of account is also commonly referred to as an ECN (Electronic Communications Network) account.

To make up for the zero spreads in this account, a broker charges a commission per position per lot in order to earn from your deals. It is popular among professional traders who prefer to trade at exact market rates for more accurate market analysis.

What is a Fixed Spread Account?

A fixed spread account is an account that offers fixed spreads on its markets. What this means is there will be a slight difference of a few pips between the market price of a currency pair and the price being offered by the broker.

However, this type of spread tends to be more stable during extreme price movements, hence the name "fixed", so the risk of spread widening is very small.

Due to already charging a fixed spread on this account type, a broker usually doesn't charge any commission on it. This account type is popular among beginners who are still learning their way around the industry.

Which One is Better?

There are a few parameters we have to look at to determine whether raw spread or fixed spread accounts work better for scalping. Let's dive into them!

Execution Speed

A new trader might not notice this but once you've been trading for a while and you've tried both a raw spread and a fixed spread account, you'll notice that raw spread accounts have a much faster execution speed.

It's because raw spread accounts provide direct market access (DMA) or access to an ECN. This is great for scalping as you'll need to close deals as soon as you get a small amount of profit.

Meanwhile, fixed spread accounts can still offer fast execution speeds, but they may be slightly slower compared to raw spread accounts. The execution speed can depend on the broker's infrastructure and network connectivity.

See Also:

Spread

A raw spread account offers minimal and borderline zero spreads. This is extremely useful for scalping as the closer you are to the actual market price, the higher chance you have at earning good profits.

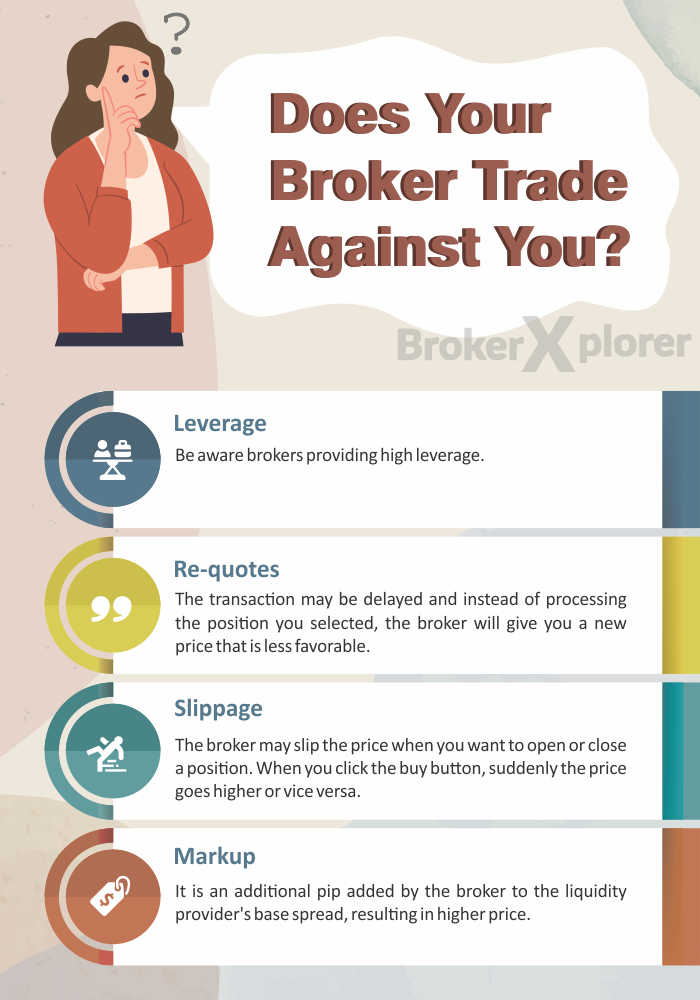

Fixed spread accounts maintain a consistent spread regardless of market conditions. The spread remains fixed, providing traders with certainty about their trading costs. However, fixed spreads may be wider than raw spreads during times of high market volatility.

Commission

A raw spread account charges a fixed amount of commission per position per lot. Even though it provides transparency in pricing and allows traders to see the actual market spread, this can make it harder for a scalper to earn good profits as at the end of the day; all these commissions add up and take away a good portion of the profits.

In fixed spread accounts, the broker's fees and costs are typically included in the fixed spread itself. Traders do not pay a separate commission for each trade, but it may be less transparent compared to raw spread accounts.

Conclusion

After understanding how the scalping strategy works and how each account type differs in using this strategy, it is safe to say that a raw spread account works much better for this strategy.

Although there is a commission charge on raw spread accounts, it is still superior with tighter spreads and faster execution speeds. Most traders, therefore, prefer to use a raw spread account if they're using a scalping strategy.

In addition to raw spread account, you can also try scalping using an ECN account as you will be able to experience the best trading conditions.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance