Have you ever heard of the OCO Order? As an advanced type of order that can make your trading easier, there is a simple trading method that incorporates it well. What is it?

Forex trading would be particularly convenient if a trader can leave two orders with two different conditions, where one can be automatically canceled if the other is executed. This strategy can help strengthen one's trading discipline as well as lessen the effort required to monitor the market. That kind of help does exist, and it is called the One-Canceling-the-Other (OCO) Order.

As the name implies, the OCO Order enables a position to be automatically canceled by an opening position from the opposite order. This is not a simple stop or limit order, because those kinds of orders will not automatically cancel positions from the opposition side. Not only used as a tool to help traders with the mechanism of opening and canceling orders, but the OCO Order can also be utilized as a strategic weapon. How so?

OCO Orders in the Trading Platform

By default, there is no OCO Order installed on MetaTrader 4. To allow a trader to make use of this strategy, one must download the OCO Order's plug-in and install it on the platform. The plug-in will allow the trader to place an OCO Order.

Many experienced traders pick up said add-on from a trustworthy source such as forex brokers' extra trading facilities. One example is Admiral Markets who equips its MT4 offering with a special feature called the MetaTrader Supreme Edition (MTSE). MTSE gives the traders a variety of options on trading plug-ins and indicators which were made specifically for advanced trading strategies.

OCO Orders on the MTSE

The MTSE provides two types of OCO Orders which are OCO Breakouts and OCO Reversions.

OCO Breakout can be used when you think that the price is going to break either upward or downward. It works as two stop orders placed at the same time. One of them is placed above the current price which will trigger a buy if that threshold is reached. The other one is placed below the current price where it will automatically trigger a sell position if the market trend is confirmed going down. One situation where it might be useful is when there is an important news release or any other situation where a big movement is about to happen.

On the other side, OCO Reversion places a pair of limit orders instead of stops like OCO Breakout. This strategy is applied when you want to profit from bounce movements. Normally, the price is expected to move back after reaching certain levels like support, resistance, psychological key levels, pivot points, and many others.

Practical Usage of an OCO Order Strategy

One of the most known trading strategies is Price Action. You can base your analysis on the price movement to predict where the price may head next. In this discourse, we will delve into the use of a candlestick pattern commonly used in Price Action strategies, namely the Inside Bar. How can it support the use of an OCO Order?

Inside Bar Trading is often carried out for its practicality and simplicity, especially by daily traders and scalpers. This method of trading can be applied to all time frames. Inside Bar shows a consolidation when a market is taking a break after moving on a strong trend.

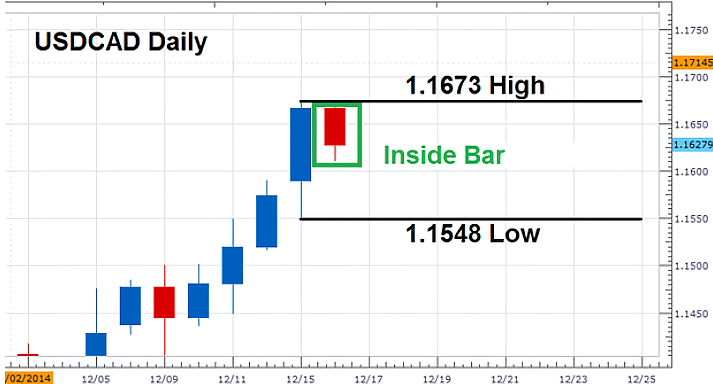

Inside Bar is a candlestick where the body and the wicks are fully enclosed within the previous candlestick range (the Mother Bar). Thus, the Inside Bar generally forms a higher low and lower high against the Mother Bar. Another term for this candlestick pattern is called Harami.

To start using Inside Bar as an OCO Order strategy, pay attention when the candlestick pattern has been formed. A trend continuation often takes place, but sometimes there is a retracement or even a reversal if the price fails to break the support or resistance level. The following image depicts an inside bar that is formed after an uptrend:

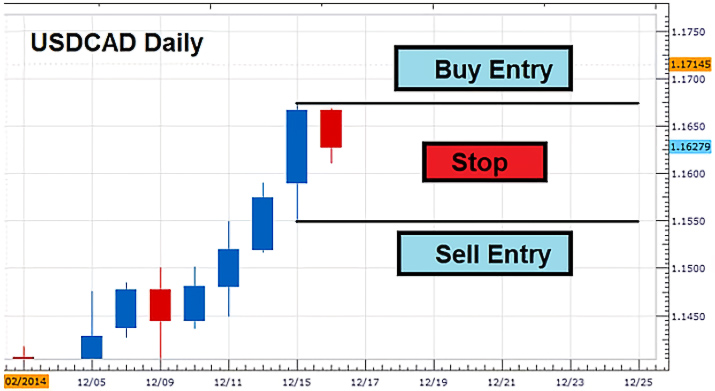

In this case, the ideal OCO Order is the breakout type, since the price is expected to either break the high of the Mother Bar or cross the low of the Mother Bar. In the example above, the buy stop order is set at 1.1673 and the sell stop is set at 101548, so the difference between the two positions is 125 pips. The Stop loss level is recommended to be placed at half the distance. For the take profit, it is best to use a risk to reward ratio that follows your own money management rule.

High volatility often ensues after a breakout, and that is why the OCO Order is extremely needed in this kind of strategy. As previously explained, OCO Orders will cancel out the unexecuted order right after the other one is executed. Imagine if your sell stop position is still running while your buy position has been executed. The price volatility can touch the intended sell stop entry and leave it open while the price moves in the opposite direction. Consequently, the safest option is to immediately cancel the other position should an order is triggered.

Save from Admiral Markets, there are other brokers offering the OCO Order as an additional plug-in. If you want some alternatives, don't hesitate to take a look at the list of Forex Brokers offering OCO Orders.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance