This futures contract has become more frequently mentioned lately along with increasing uncertainties around Fed rate hike, and it is quite important for forex traders to know.

At the end of last week, John Kicklighter of DailyFX wrote in his review that Fed Funds Futures are now pricing in the first hike out to July (2016). This is not the first time an analyst or a news source quoted Fed Funds Futures. But do you know what is Fed Funds Futures? This futures contract has become more frequently mentioned lately along with increasing uncertainties around Fed rate hike, and it is quite important for forex traders to know.

Tool For Hedging And Speculation

Fed Futures Contract first introduced by Chicago Board of Trade on October 1988 as an instrument to hedge against Fed rate changes. Its full name is 30-Day Federal Funds Futures Contract.

Since then, Fed Funds Rate contract became an important tool for institutional traders to hedge against or speculate on Federal Reserve's short term interest rate changes. Traders can buy or sell futures contracts based on their expectation of future interest rates. If the trader thinks that the Fed will hike rates in the future, then they will 'sell' the contract. While if they predict the Fed will cut rates, then they will 'buy' the contracts.

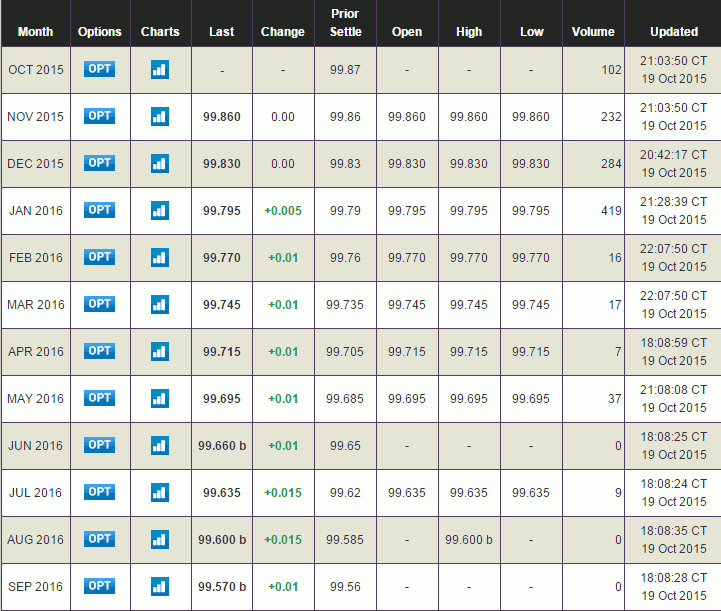

The contracts are made in monthly basis (30 days), so every contract will expire on the last working day in the contracted month. Its prices are calculated based on 100, so contract price is 100 minus Fed rate expectation for that month. Let's say traders expect Fed rate will be 0.4 percent in July 2016, so Fed Futures contract price for July 2016 is (100-0.4) or 99.6. And if traders expect Fed rate will rise to 0.5 percent in September, then contract for September 2016 will change into (100-0.5) or 99.5.

Monitoring Latest Fed Rate Expectation

It's important to note that Fed Funds Futures displays what is expected by institutional traders about future interest rates, and does not imply anything for the current Fed rate. Therefore, although retail forex traders may not have the opportunity to trade the contracts, but we can monitor changes in the asset price to understand how is the latest Fed rate expectation in the market.

Now that we know what is Fed Funds Futures, we can take a look into how John Kicklighter of DailyFX may have concluded that Fed Funds Futures are now pricing in the first hike out to July. See the latest Fed Funds Futures below:

Ignore other figures but those in Month and Last column. In December 2015, there is 99.830. It indicates that institutional traders may expects Fed rate in that period to be at 0.17 percent. Because the current Fed rate is in 0-0.25 percent, it means market players do not expect a rate hike in December 2015.

If we track downward up to July 2016, there will be 99.635 which indicates that traders expects Fed rate to be at 0.365 percent. Thus we can conclude that there is an expectation of 0.115 percent hike from the current Fed rate.

This data is one of the most mentioned benchmark on measuring Fed rate expectations and can be a good monitoring tool. Because of that, major news sources such as Reuters and Bloomberg often quoted it. If you want to take a look by yourself, you can check it out at CME Group website.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance