Crucial for your success in forex trading, risk management can be made possible byways of diversification, understanding your odds, and calculating risk in each transaction. Here is the complete explanation.

Risk management in forex trading is equally vital as money management. Forex in business sense is an investment. And there is no investment instrument that doesn't contain risk. Remember the jargon, 'High risk, high return'. What does it mean? The higher the investment's potential of profits, the higher its potential of risk. If we want to gain high profit, we have to do these risk management steps:

- Diversification

- Understanding Your Odds

- Controlling Risk

In this article, we are going to talk deeper about the three things you should do to manage your risks before you start trading.

Diversification

The first step in managing your risks is to diversify your investment. You must have heard the saying, 'Don't put all eggs in one basket'. When we put all of our 'eggs' in one basket, it could all collapse when the 'basket' fall. Therefore, it is not good to bet all you've had in forex trading too.

If you are an employee without hefty savings, it is advisable for you to keep your day job while you started forex trading. If you are quite wealthy, its is better if you divide your investment between forex and non financial investment like gold and property, or other financial instruments, like stocks, bonds, etc. A combination of financial and non financial investment is a perfect combo to minimize your risk of losses, because the two usually has contrary relationship. With correct proportion of both in your portfolio, you could produce profits from both in the same time.

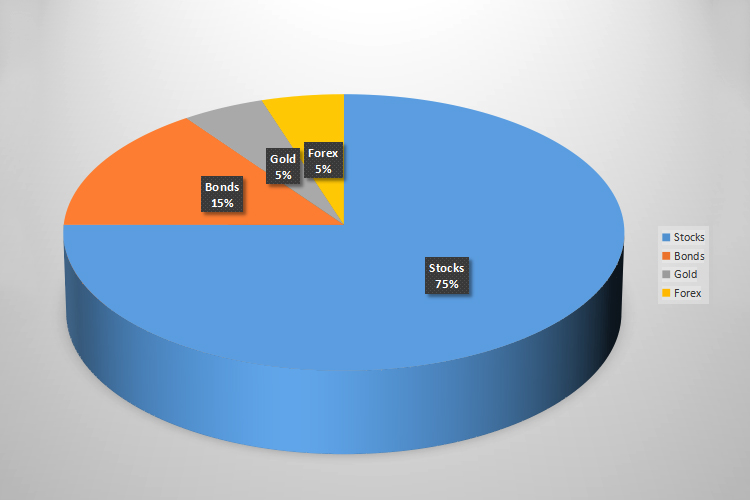

Let's say you are 20 years old stock trader now. Based on the rule of thumb and the adjustments provided, here is what your asset allocation would be:

- Stocks: Subtracting the age (20) from 100 gives us 80%. So, 80% of the assets would be allocated to stocks.

- Bonds: Since we allocated 80% to stocks, the remaining 20% would be allocated to bonds.

- Others: We shave off 5% from both the stock and bond portfolios, resulting in 75% allocated to stocks and 15% allocated to bonds. The 10% obtained from this adjustment is then allocated to others, such as gold, commodity, and other of your liking.

So, the final asset allocation for our hypothetical 20-year-old would be as follows:

- Stocks: 75% of the portfolio

- Bonds: 15% of the portfolio

- Others: 10% of the portfolio

It's important to note that asset allocation should be based on individual goals, risk tolerance, and investment horizon.

Understanding Your Odds

The first thing you'll need to enter this business is start up capital. However, whether you will succeed or not and whether you will be able to avoid unnecessary losses depends on two things: your knowledge on forex and the broker you choose. Understanding forex means you have to recognize the fundamentals, the technicals, as well as market sentiment and trends. While choosing the right broker forex means you have to ensure that your broker has a good reputation and regulated, plus their trading term is suitable for you.Having a good understanding on forex and trading with a good broker will raise your odds in managing risk and attaining success, no matter how much your start up capital amounted to.

Controlling Risk

Just as there is no investment without risk, there is also no transaction without risk. However, so long as you can measure it, you surely will be able to manage it. That's why there are the Two Percent Rule and Five Percent Rule. Ask yourself, how much you are willing to lose, and apply it on your trades.

Another factors that's going to play in increasing your risk in each transaction is leverage. Leverage seems like a great news for traders with small capital, but it is actually a devil in disguise.

Leverage is one advantage of forex trading which enables you to trade in large quantities even when you've only had few available funds. Brokers provides you with various kinds of leverage; 1:1, 1:50, 1:100, even 1:1000. Using 1:1 leverage means you use only the funds in your hand.

1:100 means you will have 1000USD to start trade even though in reality you only have 10USD. Where does the 990USD come from? you 'borrow' it from your broker. Having funds that is not yours to do as you wish may tempt you to behave carelessly. Even more so if you use 1:1000 leverage; you'll get confused figuring out how to manage your risks. What seems like small loss could turn out bigger and unaffordable.

What You Need to Know Before Entering Market

Already applying the abovementioned methods and still losing? Calculate your risk-reward, drawdown, and how much loss you can bear first!

Risk/Reward Ratio

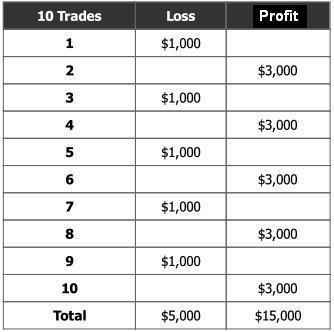

Risk/Reward Ratio is a ratio used by traders and investors to measure the amount of expected profits they are going to gain from a certain trade/investment (reward) compared to the risk of the said trade/investment. In order to make profitable trade, you should ensure that the level of reward is higher than its risks.

The table above shows us a risk/reward ratio of 1:3. Although the trader was only profit in a third of his trade, but overall, he still managed to produce 10,000USD. Not bad, isn't it!?

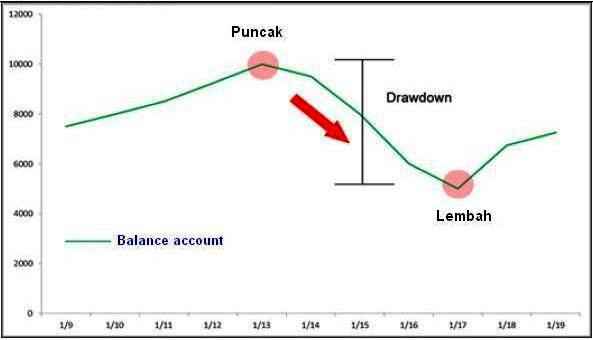

Drawdown

The use of money management will improve your profitability. But to know how effective your money management is, you should know your drawdown percentage. Drawdown refers to balance account shrinks after a series of transactions. There is also maximum drawdown, where the shrinking balance account is counted over a certain period. The picture below illustrates maximum drawdown of an account.

Risk Tolerance

No matter how sophisticated the trading strategy you use, possibility of losses is always present. A strategy with 70 percent profitability means that in 100 transactions, there is 70 wins and 30 losses. But is that meant in 10 transactions, there will be 7 wins and 3 losses? Certainly not. It is possible that in that 100 transactions, the first 30 was losses, and only after such long journey, winnings happened. Money management makes it possible for traders and investors alike to make profits even after such losing streak.

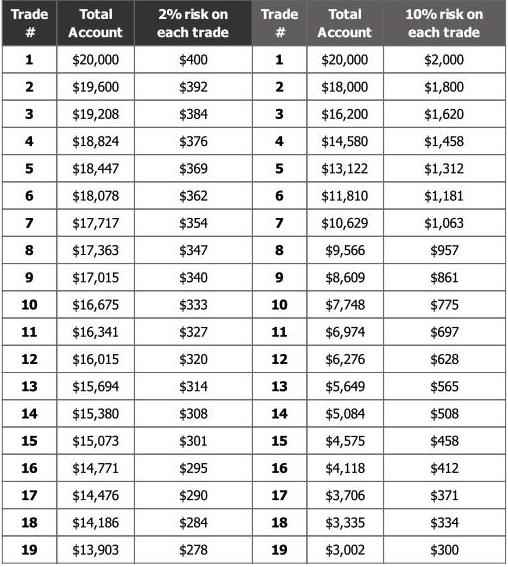

In the picture below, we could see the difference between a trader who uses 2% risk rule and one who puts in 10% risk on each trader.

Although both of them has the same 20,000USD start up and suffers 19 losing streak, there is a difference in how much funds left in the balance. The one who uses 2% risk rule still has 13,903USD, while the other only has 3,002USD left in his account.

To recover from losing streak and reach breakeven point, you have to produce more profits. The more losses you suffered, the more profits you should make. That's why, you have to be really sure in counting how much losses you could bear before you make the trade. To simplify the calculation, you can use the money management calculator that can generate recommended lot sizes, stops, and targets based on your trading rules.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance