A managed account could prove to be a worthwhile investment for your needs. This is ideal if you want to get into the world of forex trading but you clearly don't have the time.

A managed account could prove to be a worthwhile investment for your needs. This is ideal if you want to get into the world of forex trading but you clearly don't have the time or effort available on hand to actually get trades done on your own.

This is an interesting concept: It involves a professional trader being hired to make forex currency trades and investments on your behalf. The trading is done in exchange for a percentage of whatever profits you are getting.

This can be an interesting investment to look out for but this is also a risky endeavor. That's because you are essentially telling a total stranger to take care of the trading process for you. Therefore, it is an intriguing option that you must be careful about. There are times when different managed accounts might do things that you are not going to be all that comfortable with.

What Is A Managed Account?

A managed account in forex trading is when an individual or a professional money manager handles the trading activities on behalf of the account holder. The account owner grants permission to the money manager to trade and make investment decisions in the forex market on their behalf.

Under this arrangement, the money manager is authorized to execute trades based on their expertise and an agreed-upon investment strategy. They analyze the market, identify trading opportunities, and carry out trades with the aim of generating profits for the account owner. The money manager may have access to various tools and research resources to assist them in making informed decisions.

Managed accounts are commonly used by investors who wish to participate in the forex market but lack the time, knowledge, or inclination to actively trade themselves. By entrusting the trading activities to a professional, they seek to benefit from the manager's expertise and potentially achieve better returns.

It's important to acknowledge that managed accounts involve a certain level of risk, and it is crucial for the account owner to carefully select a reputable and experienced money manager. It is recommended to conduct thorough research, review the manager's track record, and understand the fees and terms associated with the managed account arrangement before proceeding.

Managed Accounts Provide Signal Services For You

Managed accounts can include many setups that entail the use of signals. Signal services work by creating signals and analyzing trends to make trades work automatically. This could be added in some cases to help you get something worthwhile.

Signals can be created by some of these managed account providers. These signals are often designed by some providers to their own benefit. They might even try and change spreads around to make them harder to attain or at least more profitable on their own end.

This is something that should be avoided if possible. You need to actually get in touch with a managed account provider that will offer full control over your account without forcing you into spending more than what you can afford.

Managed Accounts May Be Operated by Robot

Some managed accounts can be run by professionals at a variety of agencies. However, others may be run by forex robots.

A forex robot is a program that uses technical signals to analyze particular actions in the forex market. It uses signals to target when investments are to be made.

A robot sounds great but that does not mean it will always work. You have to avoid these robot programs as they can possibly cause some serious risks with regards to whether or not they can actually identify the trades you are trying to handle.

Scams

There are often times when managed accounts can be scams. Not all managed accounts are scams but you have to be cautious.

There are many signs of a scam to watch for:

- A group may guarantee profits on everything you do.

- The group may also not have much information available about it online.

- Some groups may also have the ability to cover up information on what they are doing by not reporting to regulators.

- Look at how long a group has been around for as well and see if there are any news stories or legitimate reviews of it; a group without all these legal things added to it might be a scam.

Protecting Yourself From Scams

As difficult as scams can be, you don't have to fall victim to them. There are many things that can be done to protect yourself from these scams:

- Do plenty of research on any managed account provider you might come across. See that any entity you come across is legitimate and understands what it is doing.

- Avoid any group that uses automatic triggers including robots. These programs, while they sound appealing, are hard to trust.

- Check on the total amount of money you might have to spend in order to use any of these services. Some groups might ask for at least a quarter of your trade's value; this could be a sign of a service simply using poor management plans while focusing more on grabbing your money.

Who Regulates These Accounts?

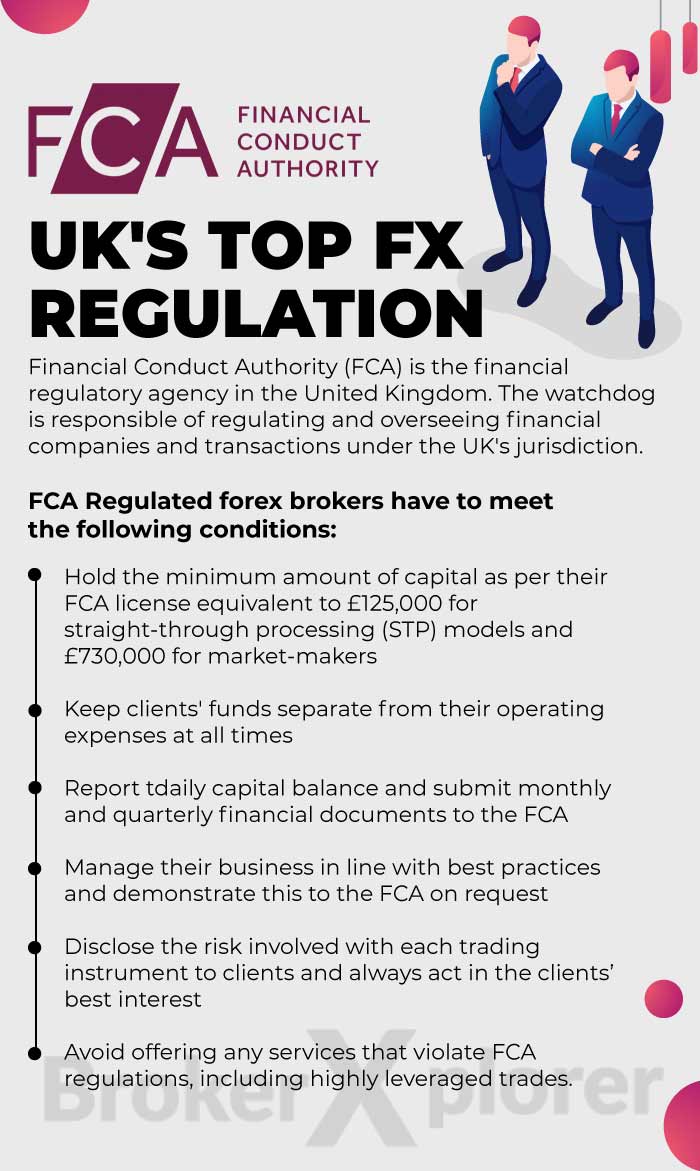

Managed accounts are regulated as a means of ensuring that only the right ones that operate legally can be used. In the United States, the Commodities Futures Trade Commission helps to analyze accounts and protect investors from fraud. Meanwhile, the National Futures Association registers legitimate accounts that entail legal functions for trading purposes.

There are even a few foreign entities that regulate these accounts. The Financial Conduct Authority and Prudential Regulation Authority both monitor accounts in the UK while the Australian Securities and Investments Commission does the same in Australia. Be sure to pick the right Forex broker for your managed account trading.

This article is contributed by Forex Bonus Lab, a website dedicated to the most recent Forex bonus offers and the reviews of the leading brokers.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance