Are you one of those who were looking for an easy shortcut to make money with Expert Advisor? If that's so, let's find out how that intelligent software actually performs.

Forex trading is a fast-paced and potentially lucrative activity that attracts people from all walks of life. Expert Advisors (EAs) are automated trading systems that have revolutionized how trades are executed. These systems operate within the MetaTrader platform, allowing traders to execute trades based on pre-defined criteria and algorithms.

This guide will discuss the best tips and practices for using EAs to optimize your profits. Whether you are a seasoned trader or just starting, these insights will give you the knowledge you need to navigate the markets confidently and succeed.

Do These to Make Money With Expert Advisor

There are over a thousand ways to skin a cat, but only some will stick out as the best method. The same applies if you want to make money with Expert Advisor. Here are some methods that I found out in actual practice and you can follow as well:

Set Apart the Good from the Bad Robots

You can research and look for a decent Expert Advisor by their performance reports. You can find them from these sources:

Backtest

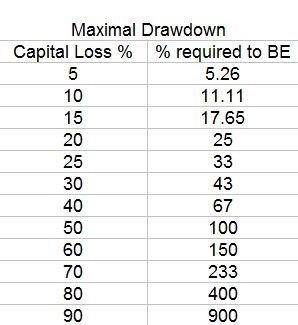

This method recorded EA's performance (past trading sessions). You'll need those records to judge how good your Expert Advisor is. Click the following link to learn how to do backtesting. After backtesting your EA, you should look at its maximal drawdown:

That information is crucial because it informs you how much loss you can risk before pulling off said EA from your trading account.

The table above tells how difficult it is to return to the break-even point if you lost a certain percentage of your starting capital. Remove the EA from your system if it breaches the 25% maximal drawdown threshold to avoid further loss.

Forward Test

Compared to the backtest, the forward test measures your EA's performance on real-time trades. That's why it's more accurate and favorable. In the following example, I use the FXblue widget to showcase the actual performance of an EA.

Be Real, Decent Expert Advisor Doesn't Come Up Cheap

Don't expect a cheap Expert Advisor to make more money than it's worth. As I said, the developer has all the reasons to put a high price tag on his EA if it performs well.

Therefore, investing your money in a decent trading robot that will make money consistently for you rather than trying random cheap/freebies EA is better. You may consider building your own EA if you can't afford one. Fortunately, you don't have to reinvent the wheel from scratch. You can use available frameworks from the EA developers community, like MQL5.

Things You Need to Know Before Using Expert Advisor

It's easy to get misinformed when so many advertisements overwhelm your common sense. To clarify things, you need to know this simple list of facts vs. myths about this automated trading system:

Is Expert Advisor Risk-Free?

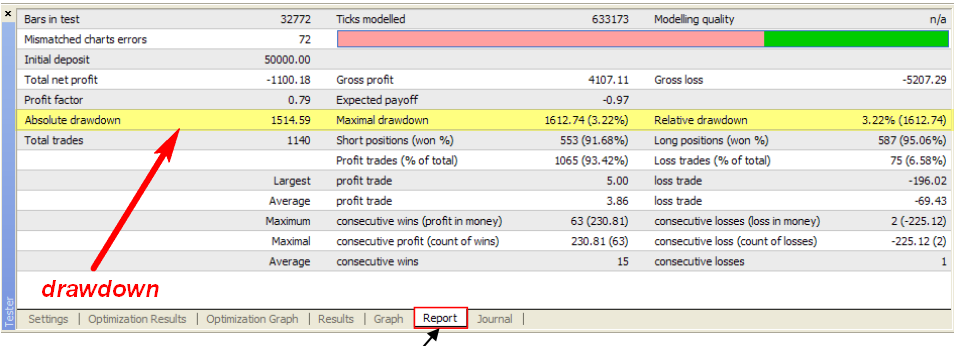

That is total bull crap. No Expert Advisor can guarantee profits from Forex trading without the risk of losing. There's a drawdown factor when you backtest any trading robot. In that case, no matter how good your purchased EA is, there's always a risk of losing whenever they open any position.

As seen above, the report showed maximal drawdown from a backtest of an Expert Advisor, which means the trading robot has accrued losses from a specific period.

Can You Rely on Expert Advisor 100%?

Many EA marketers claimed their trading robot could trade Forex 24/7 without supervision. Yeah, that would only exist in an ideal world. However, in contrast, there's a special condition where you'll have to override Expert Advisors manually. Some of those conditions are;

- News release: trading volumes and market orders peaked only briefly during this period. Subsequently, volatility is very likely and may send all the fake signals your trading robot can't filter, resulting in losing streaks.

- Server hiccup: Expert Advisor needs a VPS as a host. When the host isn't working optimally for specific reasons, your trading robot will also suffer performance loss.

- The market is irrational: let's face it, human decisions still dominate the Forex market. Therefore, the market's inefficiencies can still lead to unexpected price direction.

So, unless all three conditions above are rendered infallible (which is impossible), there's no way you should leave EA to its device for an extended period. In short, you'll still have to check them occasionally to ensure they still perform as advertised.

Can Expert Advisor Make Over 100% Return?

If that's true, everyone should have retired from their job in less than a year while letting that trading bot do its miracle work. Realistically, it's a far cry from the truth. Want some facts?

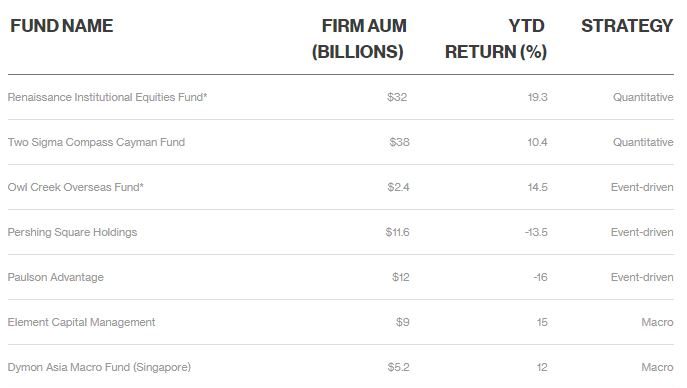

The top two hedge funds above employed the best quantitative researchers to develop state-of-the-art "black boxes". In short, it's a world above any retail Expert Advisor can even dream of competing with.

Did you notice how much return they made over their AUM (Assets Under Management)? They made less than 20% return annually! Now, compare that to claims advertised by your EA's marketer. Over 100% return in less than a month? You don't have to be a rocket scientist to notice something doesn't add up.

Do Experts Develop Expert Advisors?

Surprisingly, most Expert Advisors are not developed by well-endowed researchers. You won't find it at the retail price level, even if it is. People who make money with EAs mostly develop and sell them to other retail traders.

But it doesn't stop there! The one who bought the original EA may also tamper with the source code, creating a "copy" in the process. With that in mind, you'll find many "boot-strapped" EAs that use similar trading strategies and other slight variances. The significant differences between one to other trading robots only boil down to their marketing campaigns.

Are Most Expert Advisors Scams?

This one part is scarily accurate. Most Expert Advisors gleamed over the internet are probably a trap set for unwary beginners. Some of them may offer cheap bargains to attract buyers. First, they can sell their claims for a huge price tag if they are true. So, why would they sell it cheap if they can get more?

Alternatively, if the developers can make decent Expert Advisors, they could have kept the trading bot while charging a hefty commission fee for any wealthy person willing to invest in their automated trading system.

So, with all those odds weighed up, you'll smell funny things about those cheap garbage. For all I can tell, some would even offer free Expert Advisor only to be "hitchhiked" by adware or malware.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance