There are both fundamental and technical trading signals that work for long-term traders. Here are some real market proofs.

Long-term traders may utilize these dynamics as trading signals. We could open a short position when prices pierce the 200 SMA line downward. On the contrary, we could buy the asset when prices break out above the 200 SMA line. The strategy could work in any timeframe, but mainly in higher times such as weekly and monthly.

What are Long-Term Trading Signals?

Long-term trading signals refer to indicators or patterns traders and investors use to decide about buying or selling assets with a long-term investment horizon. These signals are based on analyzing various factors, such as fundamental data, technical analysis, market trends, and economic indicators.

Long-term trading signals are designed to identify investment opportunities that have the potential to generate significant profits over an extended period, usually months to years, rather than seeking short-term gains. Traders and investors who employ long-term strategies often focus on the underlying value of an asset and aim to capture larger market trends or take advantage of significant events or developments.

Some standard long-term trading signals include:

- Fundamental Analysis: Long-term traders often analyze a company's financial statements, industry trends, management quality, and competitive position to identify undervalued or promising stocks.

- Technical Analysis: Traders use technical indicators, such as Moving Averages, trendlines, and chart patterns, to identify long-term trends and potential entry or exit points for trades.

- Economic Indicators: Long-term traders monitor economic indicators, such as GDP growth, inflation rates, interest rates, and employment data, to assess the overall health of the economy and identify sectors or assets that may benefit from the economic conditions.

- Market Sentiment: Traders also consider market sentiment indicators, such as investor sentiment surveys, options data, and the VIX (Volatility Index), to gauge the overall sentiment in the market and identify potential long-term trends.

Benefits of Using Long-Term Trading Signals

Long-term trading signals can be valuable for traders looking to profit from larger market movements. Here are some of the benefits of using long-term trading signals:

- Capitalizing on Major Trends: Long-term signals help identify significant trends in the market that can last for months or even years. By recognizing and acting upon these trends, traders can benefit from substantial price movements and potentially generate significant profits.

- Reduced Transaction Costs: Long-term trading typically involves fewer trades than short-term trading strategies. This can result in lower transaction costs, such as commissions and fees, as traders execute fewer buy and sell orders. Lower transaction costs can contribute to improved overall profitability.

- Minimized Impact of Market Noise: Short-term market fluctuations and noise can often be unpredictable and make it challenging to make accurate trading decisions. Long-term signals focus on larger, more sustained market movements, allowing traders to filter out short-term noise and make informed investment choices based on fundamental analysis and macroeconomic factors.

- Less Time-Intensive: Long-term trading requires less time and active monitoring than short-term trading strategies. Traders can spend less time analyzing charts and executing frequent trades, allowing for a more relaxed approach to investing. This can be advantageous for individuals with other commitments or who prefer a more hands-off approach to trading.

- Potential for Higher Returns: Long-term trading signals are often associated with higher potential returns compared to short-term trading. By identifying and capturing major market trends, traders can ride the wave of price appreciation over an extended period, potentially yielding greater profits.

- Long-Term Fundamentals: Long-term signals often consider fundamental factors such as financial statements, industry analysis, and economic indicators. By focusing on these fundamentals, traders can make investment decisions based on an asset's underlying value and long-term prospects rather than short-term price fluctuations.

- Reduced Emotional Bias: Long-term signals provide a systematic and rules-based approach to trading, which can help mitigate the influence of emotional biases on decision-making. By relying on objective signals and analysis, traders are less likely to be swayed by short-term market sentiment or panic, leading to more disciplined and rational investment decisions.

However, there are also some risks associated with using long-term trading signals:

- The market can change direction quickly, making it difficult to identify long-term trends. This can lead to losses if you enter a trade too early or too late.

- The signals may not be accurate, which could lead to losses. This is why it is essential to use multiple signals and to backtest them before using them in live trading.

- The signals may not be suitable for your trading style. For example, long-term trading signals may not be helpful if you are a day trader.

Overall, long-term trading signals can be valuable for traders looking to profit from larger market movements. However, using them with other factors, such as fundamental analysis, is important to reduce your risk and improve your chances of success.

Long-term Trading Signals Study Case

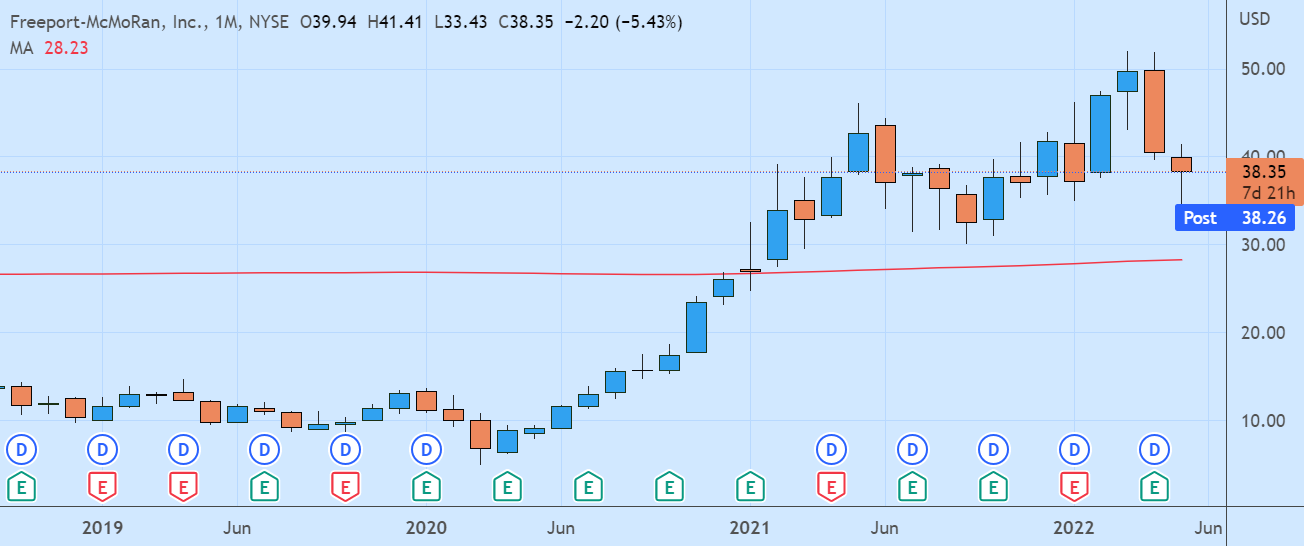

Here are two examples: The first shows the fall of Sea Limited stock prices (NYSE: SE) in the weekly chart, while the second displays the rise of Freeport-McMoran (NYSE: FCX) in the monthly chart.

Trading signals from 200-day Moving Averages also work well for long-term commodities and FX market traders. Below are two other examples from similar setups in the monthly West Texas Crude Oil and weekly EUR/USD charts.

The reliability of 200-day Moving Averages has been substantiated through research instead of mere anecdotal proof. It is one of the best technical trading signals that work for long-term traders, although it yields lower results than fundamental indicators.

An independent trader, Joe Marwood, researched 22 different entry signals on US stocks and compared their average returns over a 10-year holding period. The results were displayed in his blog, Decoding Markets. According to Marwood's research, the best and the worst trading signals for long-term investors were fundamental indicators.

The trading signal that generated the best 10-year returns was an EV/EBITDA score between 0 and 10. It resulted in a 113.18% average return, a 34.72% median return, and the best win rate of 64.61%.

The runner-up was a price-to-sales (P/S) score between 0 and 3, which produced a 106.66% average return, a 27.23% median return, and a 62.67% win rate. In contrast, the worst and second-worst were P/S scores over ten and P/S scores below 0, which resulted in negative returns.

Where are the technical indicators? A closure above the 200-day Moving Average generated the best 10-year return among technical-based trading signals. It gained an 88.14% average return, an 18.07% median return, and a 60.94% win rate.

Are there any other technical signals that work well for long-term traders? Others arguably lead to far worse results. However, such research is limited regarding how many tools it can test. There is also a high possibility that we can find new, more reliable trading indicators in the future. Therefore, keep learning and never stop following the market.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance