Forex PAMM is when your invested capital is bound to be allocated by a fund manager who runs his own capital and his investors' capital. Nevertheless, is it really profitable for investors?

There you go, you are an investor, and you want to be rich without learning Forex 101 simply because you don't have the time to do so. Then someone offered you to join forex PAMM. He said, yes, you can enter the Forex industry without the know-how (well, probably a little bit). But the biggest question is... Is forex PAMM profitable for investors?

Forex PAMM stands for Percentage Allocation Management Module. As written on the tin, your invested capital is bound to be allocated by a fund manager who runs his own capital and his investors' capital.

Forex PAMM accounts can potentially be profitable for investors, but it is important to note that profitability is subject to various factors and individual circumstances.

You know, it's like handing over your faith to a reverend, except that this faith is pretty much tradeable and thus profitable.

Benefits of Using Forex PAMM

Using a Forex PAMM account can offer several benefits for investors. Here are some potential advantages:

- Professional money management

It allows you to delegate trading activities to professional money managers. These managers have experience and expertise in the forex market, potentially increasing the chances of making profitable trades. - Diversification

Investing in a Forex PAMM account provides an opportunity to diversify your investment portfolio. By allocating funds to multiple PAMM accounts with different money managers, you can spread your risk across various trading strategies, currency pairs, and market conditions. - Accessibility

It also offers accessibility to the forex market for you who may not have the time, knowledge, or... I don't know what to say, expertise to actively trade yourself perhaps. It allows you to participate in the forex market without requiring in-depth market analysis or continuous monitoring though. - Potential for passive income

Profits generated from successful trades made by the money manager are proportionately allocated to you based on their investment size. This can provide an additional source of income without active involvement in the trading process. - Transparency

Many Forex PAMM platforms provide transparency by offering detailed reporting and performance metrics. You can monitor the performance of the money manager, review trading history, and assess risk management practices. This transparency helps investors make informed decisions and evaluate the effectiveness of the money manager. - Flexibility

Forex PAMM accounts often offer flexibility in terms of investment amounts. You can choose the desired investment size based on your risk tolerance and financial goals. This flexibility allows for scalability, as you can increase or decrease your investment in the PAMM account as per your preferences.

See Also:

How It Works

Forex PAMM service would always converge several parties to partake, they are:

- Forex broker

- Investors

- Traders (or in this case, fund managers)

Let's say an expert trader, named after Soros, agreed upon terms and conditions imposed by ABCFX (fictional firm) broker and thus registered as one of their Forex PAMM fund managers. Soros then advertised his current trading portfolio to attract investors, and boy! It worked!

Two investors signed an agreement with ABCFX to invest under a certain term which enabled them to join the same program. They dumped their sizeable funds for Soros to kickstart his trading wonder.

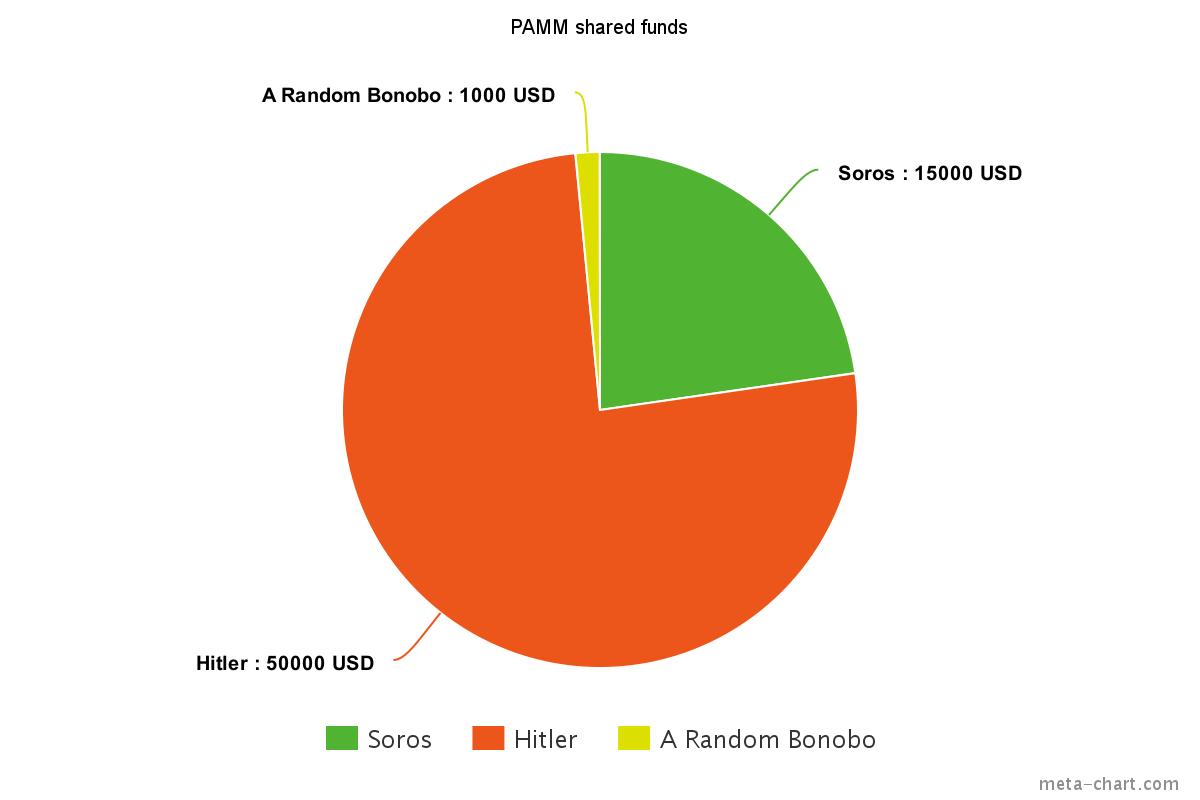

Notice that these two investors came about with substantially different budget allowances. One such investor, namely Hitler, invested USD50,000 compared to a random Bonobo that could only afford USD1,000. On top of that, Soros ran his own USD15,000.

Now, let's do the math (I promise, I'll keep it as stupidly simple as humanly possible)

The first thing investors need to know is the total amount of invested funds.

Total invested fund = Soros capital + Hitler capital + A random Bonobo capital = 15,000 + 50,000 + 1,000 = USD66,000

Please note that the percentage of each fund to total invested fund does play a huge part in this role as each profit or loss will be accounted for according to it. After all, that's why P in Forex PAMM stands for percentage.

Soros' percentage = Soros own fund/total invested fund = USD15,000/USD 66,000 = 22.7 percent

Hitler's percentage = USD50,000/USD 66,000 = 75.8 percent

A Random Bonobo's percentage = 1.5 percent

Let's say, Soros actually lived up to his trading wonder, he made 25 percent profit in his first trading term (can be monthly or weekly, up to parties' agreement) which netted him USD16,500, tallied up the total invested pool to USD82,500 (66,000 + 16,500)

And let's not forget that Forex PAMM fund manager would actually charge investors with a fee that's completely up to them to set. So, let's say Soros was rather charitable and set his fee to 5 percent of the profit gained within a trading term.

Soros' Fee = 16,500 x 5 percent = USD825

The remaining profit which was USD15,675 (16,500-825) would then be shared according to each investor's percentage, like so:

Hitler's profit = USD15,675 x 75.8 percent = USD11,882

A random Bonobo's profit = USD15,675 x 1.5 percent = USD235

Soros' profit = USD15,675 x 22.7 percent = USD3,558 (wait, what? He got profit on top of his fee? Yes, in Forex PAMM each registered trader is also counted as a single entity of investor)

As you can see, Hitler as the top investor also got the most share out of it (quantitatively speaking), while that random Bonobo...well, he only deserved to get the breadcrumbs. In other words, if you want to be a rich investor, consider dumping more money to your faith-bound reverend, ehm, a Forex PAMM fund manager.

What Happens If Your Fund Manager Loss the Trades?

That would anger Hitler for sure as he would suffer the most loss as well.

No question asked, Soros didn't get his trading fee after his loss (he's lucky enough to escape alive, though).

The impact of losing trade savagely cut the total invested fund. So, if Soros made a 30 percent loss, it would also drain the previous collective funds (including total profit made on previous trading terms) by 30 percent as well.

Speaking about number crunching, it's like Hitler would send a load of army to terminate Soros. So, uhm, yeah, here's the number anyway:

Total current pool = Total invested pool + profit/loss on previous trading term = USD66,000 + USD15,675 = USD81,675

Total loss = Total current poolSoros' Loss on a trading term = USD81,675 x 30 percent = whooping USD24,503

That total loss would be spread according to each investor's accumulated fund (initial capital plus previous profit or loss) minus the loss percentage. Again, that's why P in forex PAMM stands for.

Hitler's loss = accumulated fundloss percentage = 66,882 x 30 percent = USD20,065.

Soros' loss = 18,558 x 30 percent = USD5,567

Bonobo's loss = USD371

As you can see, Forex PAMM can actually provide humongous profit if you invest on a titanic level (just like Hitler). However, it also carries out potential huge risks every single investor should be aware of.

At the end of the day, you may not need to learn the intricacies of Forex trading, thanks to Forex PAMM. But hey! Now you need to scrutinize one and each of the available fund managers and made a leap of faith with them!

Oh, by the way, Hitler made the decision to desert his failed fund manager and switch to a spanking brand new one, his name is Mr. Belfort (aye, that one man).

Here Comes the Broker

Up to this moment, there are several lines of major retail forex brokers providing PAMM services, their basic features generally include:

- Security: fund managers can not withdraw other investor funds. It's safe and locked.

- Access: investors can assess fund managers' trading portfolios and track records. Each broker may come up with different interface and statistic view.

- Risk Diversification: there goes a saying, don't put all your eggs in a basket, it also applies to Forex PAMM fund managers. Investors are recommended to split their investment funds with some of the top traders.

Instaforex is one of the most popular Forex PAMM providers, along with FXTM, RoboForex, FXOpen, Forex4you, and so on.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

6 Comments

Kazuki

Feb 25 2023

It's like a stock investment for me and PAMM. This means that you can deposit into the trading pool and those who deposit more will get a bigger profit. It is also based on percentages. So if your profit from PAMM is say $500, let's say your total pool is $10,000 and you deposit 20% of your trading pool share. $500 x 20% = $100 profit.

Another advantage is that you don't have to actually trade at all. Just put your money in and let your money manager take care of your money. But this is a scenario where PAMM makes a profit, can PAMM also suffer losses? that's the question

Theo

Feb 25 2023

Kazuki: Yes, PAMM (Percentage Allocation Management Module) accounts can suffer losses just like any other type of investment. The purpose of a PAMM account is to make a profit, but there is always the risk of loss when trading on the Forex market!!

In PAMM accounts, professional money managers make trading decisions on behalf of investors and use part of their funds to trade Forex or other instrument trading. When a manager successfully completes a trade, profits are distributed to investors in proportion to their original investment, just like the article said but however, if the manager makes a losing trade, the investor may also suffer a loss. The details of what is PAMM, you can read this article : What are the difference between MAM, PAMM, and LAM?

Anthony

Feb 25 2023

In my opinion, there are two popular options for Forex beginners. Trade yourself with a standard forex trading account or invest in a PAMM (Percentage Allocation Management Module) account. Regular forex trading accounts allow traders to buy and sell currencies themselves, using their own strategies and analytics. This option gives you more control over your trading decisions, but it also requires a higher level of knowledge and experience. And gaining knowledge and experience requires really a lot of time to study and is not always successful!

On the other hand, PAMM accounts allow investors to pool their funds with other investors and have professional traders manage their funds. This option offers a passive income potential.

As a beginner in forex trading, should I choose between trading alone with a standard account or investing in a PAMM account? What are the pros and cons of each?

Jerry

Feb 25 2023

Anthony: Choosing between trading alone with a standard forex account or investing in a PAMM (Percentage Allocation Management Module) account depends on an your decision about therisk tolerance, and level of experience in the forex market. Based on my experience, I can tell the pros and cons of trading with myself, which are :

Pros:

Cons:

Meanwhile, PAMM, which is I dont experience at all, so, I cant give my opinion in there. But one cons that may you can get is too rely on the money manager, not all the investment you get will always geet prfit. Based on the article, when you depostiit more portion, you will also get more portion of loss beside profit. Because, money manager actually can be other traders that have experience so they chosen by broker to become money manager

so it is back to you, , the decision to trade with your own or rely into invest in a PAMM account. It is important to observe, learn and carefully consider the risks and benefits of each option before trading.

Jansen

Feb 25 2023

Austin

Feb 25 2023

Jansen: Money managers in PAMM basically is other traders, or the traders that sign up to become moeny manager. Usually, the brokers will check their performance and will give the permision of the terms and conditinos such as the performance of the trading as the terms.

So, they will just use a variety of strategies and techniques to generate returns just like common forex trader. Some strategies that you may usual hear include technical analysis, fundamental analysis, and a mix of both also used by money managers. And also, they even use automated trading too. Money managers may also specialize in certain currency pairs or market sectors, or use a more diversified approach.

If you PAMM Money Manager, you can also check performance and reports in Profile. And we recommend using a more transparent money manager and a more experienced trader to check the trading period.