Looking to make a profit from forex markets but not sure where to start? Exness Social Trading might be the perfect solution for you.

It's pretty obvious that social trading is very popular these days. This type of trading opens new opportunities for many people and is often seen as a great path to earn from the market. The practice dates back to decades ago when people came together to discuss investment opportunities and pool their money to invest in a particular project.

Modern social trading, however, just started in 2010 with the emergence of social trading platforms that can be accessed from anywhere in the world.

The good news is that now many brokers offer social trading platforms with various features to appeal to both rookies and professional traders. As one of the leading brokerage firms in the world, Exness social trading is certainly hard to miss. Not only accessible but the platform is also known to be beginner-friendly.

Exness Social Trading is a platform that allows investors to copy the trades of experienced traders, known as strategy providers. This means that investors can take benefit from the expertise of professional traders without having to do any of the research or analysis themselves. Once investors have found a provider that they want to follow, they can simply click on the "Copy" button and the platform will automatically execute the same trades as the provider.

Exness Social Trading is a great way for investors to get started in the world of trading without having to learn everything from scratch. It is also a great way for investors to diversify their portfolios and reduce their risk.

To find out more details, let's take a closer look at the Exness Social Trading platform.

Exness Social Trading Platform at a Glance

Exness launched its very own social trading platform in 2019. In only 3 months, the number of participants has increased to 30,000. Now, it is known as one of the most reliable social trading platforms out there.

Exness social trading app has a user-friendly interface that makes it easy for traders to navigate around. At this time, The Exness Social Trading app is available on iOS and Android.

This app has been downloaded by more than 100,000 users on the App Store and Play Store. Furthermore, this app also has a good rating of 4.2 (Play Store) and 5.0 (App Store).

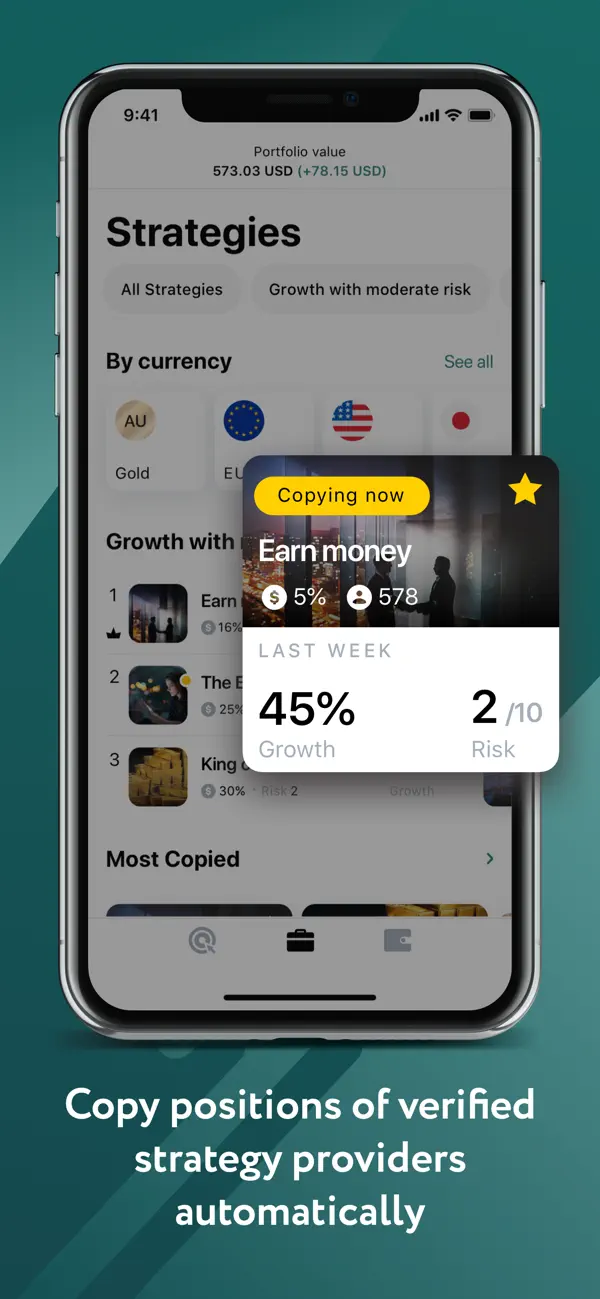

1. Strategies List

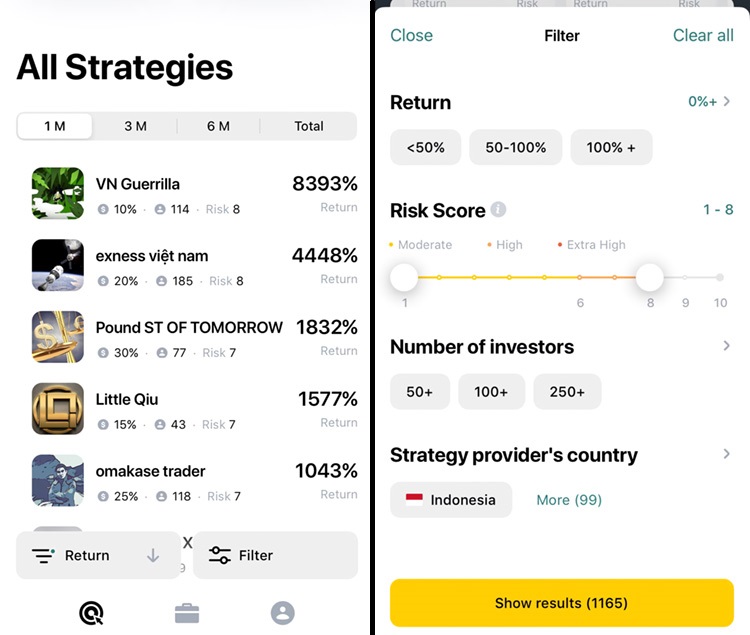

This is where investors can browse through various strategies and sort them based on various criteria, such as Currency, Most Copied, Return, Risk, Commission, and Number of Investors. If you want a more specific answer, you can add additional filters like Time Period, Return, Risk, Number of Investors, and Strategy Provider's Country in the Exness Social Trading app.

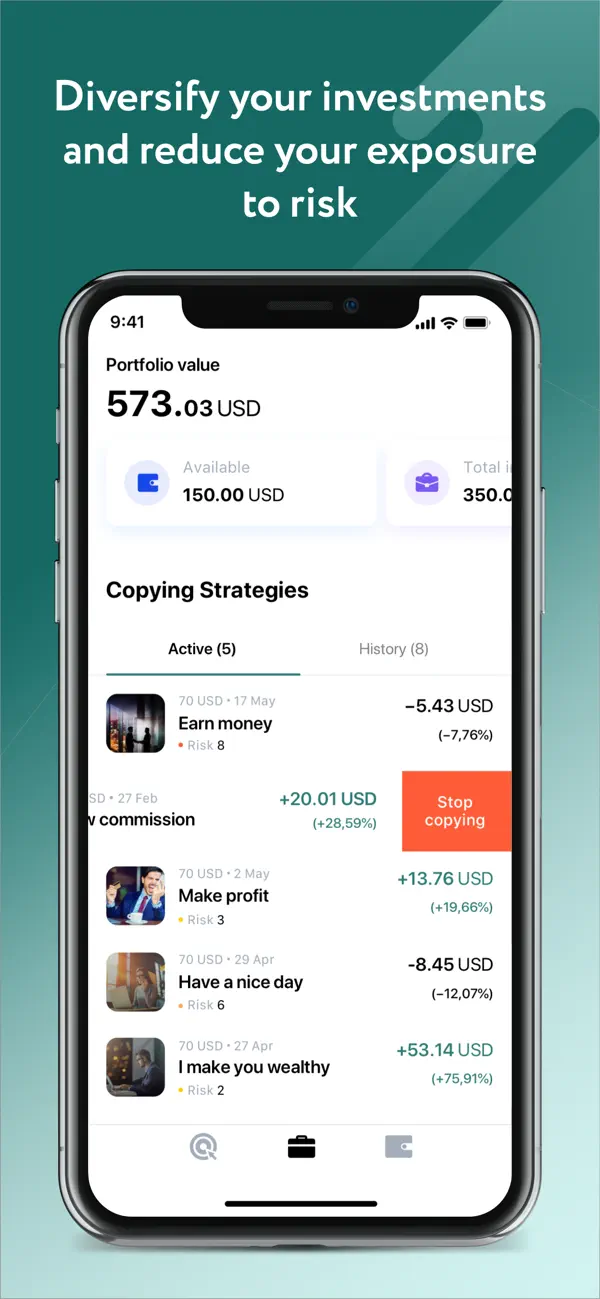

2. Portfolio

This is where you can see all of your active investments as well as your copying history. Aside from that, you can also view your current available balance and manage it.

In this section, the investor can diversify their investments and reduce their risk exposure. You can choose a strategy with low to medium risk but also match the return with your expectations. Furthermore, investors will be able to request a withdrawal by tapping on the wallet icon in the Portfolio section.

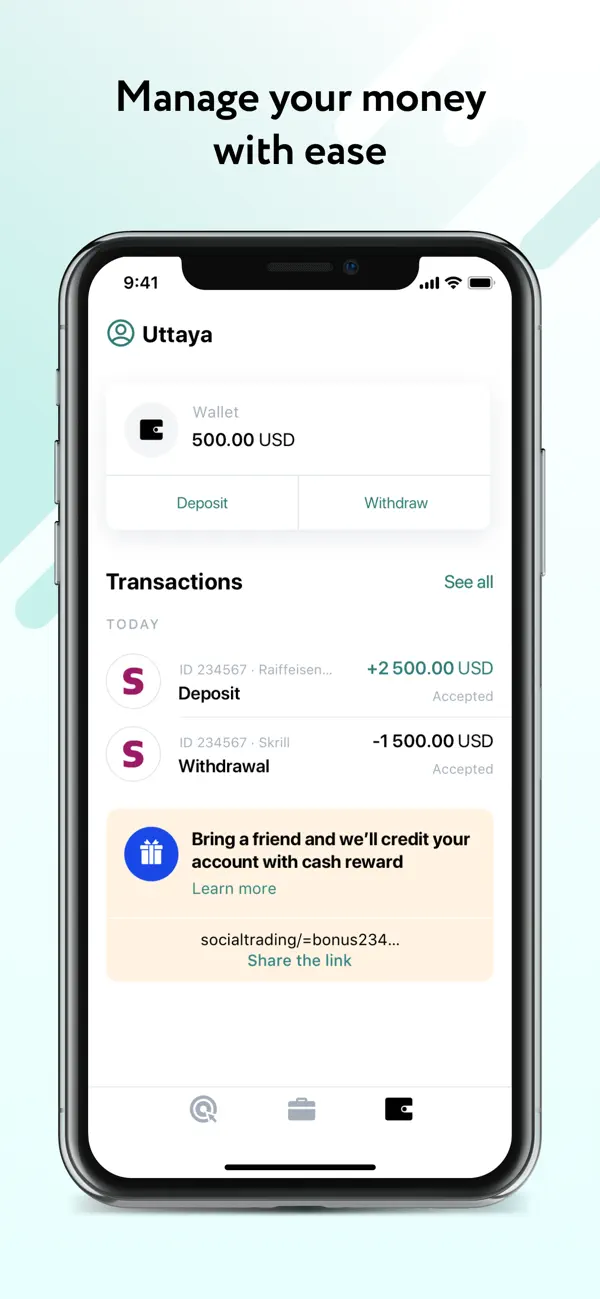

3. Account

The Account section is the central hub where you can access and manage all your personal information. It provides various functionalities to ensure a seamless trading experience. In this section, you can customize your account settings, verify important documents, easily get in touch with customer service, locate your partner link, and conveniently make deposits or withdrawals.

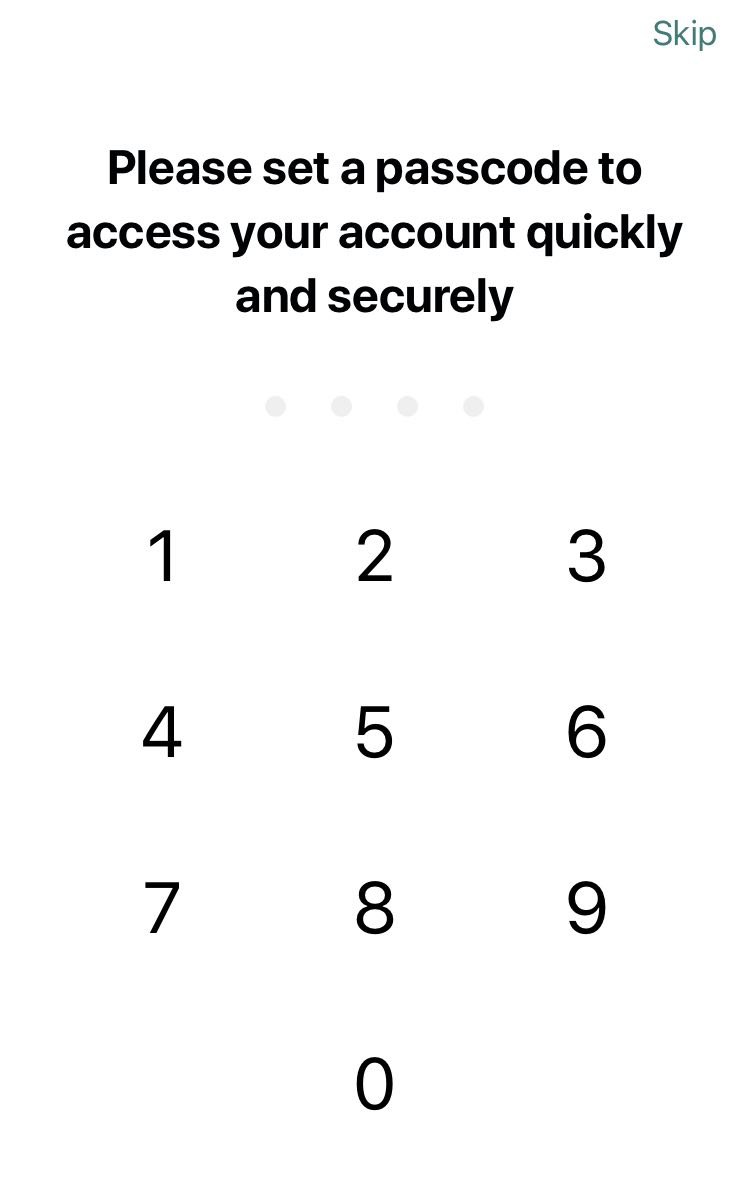

Furthermore, the Account section offers robust security options to safeguard your Exness Social Trading account. You can establish additional layers of security, such as setting up a passcode, moving to a new Exnessaccount, utilizing fingerprint authentication, or leveraging FaceID. These security measures are essential to prevent unauthorized access and protect your account from misuse by unscrupulous individuals.

In addition, within the Account section, you can view the deposited amount in your account and track the complete transaction history. This feature allows you to keep tabs on your financial activity and stay informed about the status of your funds.

In addition, investors would still be protected when the master strategy loses money or eventually reach 0 equity. In such cases, the trade will be automatically closed with a stop-out so the investor is supposed to stop copying the strategy.

Investors only need to pay a commission to the strategy provider if they have made profits in a trading period. If the investment makes losses, they do not pay a commission until the investment's profits of the subsequent trading periods exceed the losses.

How to Be an Investor at Exness Social Trading

1. Open the social trading app and log in to your account. If you already have an Exness account, simply input your data and click "Sign In". If you're a new user, then you need to make a new account. Click "Register" and follow the instructions.

2. For security reasons, you are required to set a passcode to open the app and access your account.

3. Once you've successfully signed in, you can browse a strategy that appeals to you in the Main Strategy Area. You can add filters to customize your search.

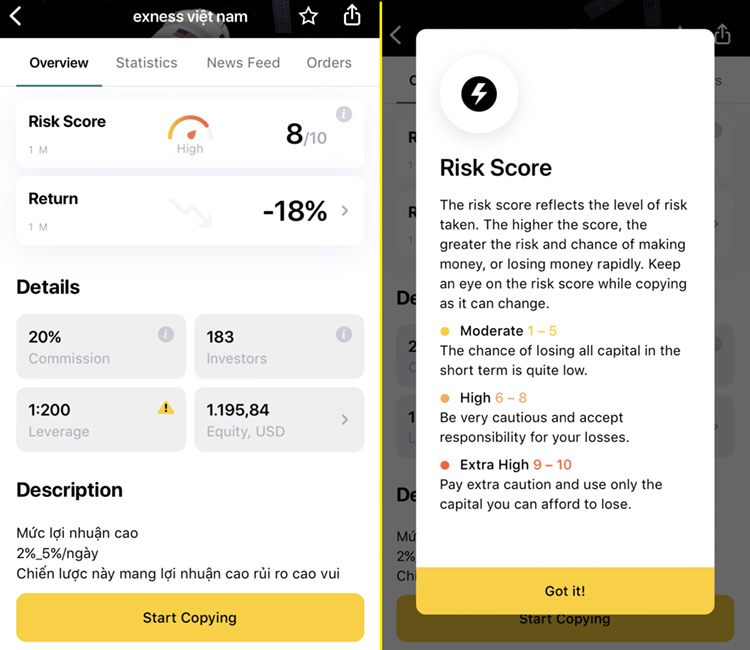

4. Review the information on the strategy. Make sure that it fits your criteria and risk tolerance.

5. To copy the strategy from the Exness Social Trading app, click "Start Copying".

6. Choose an amount that you want to invest in. Make sure that it exceeds the minimum level of investment set by the strategy provider.

7. All done! You can monitor and manage your active investments from the Portfolio tab.

How to Deposit and Withdraw

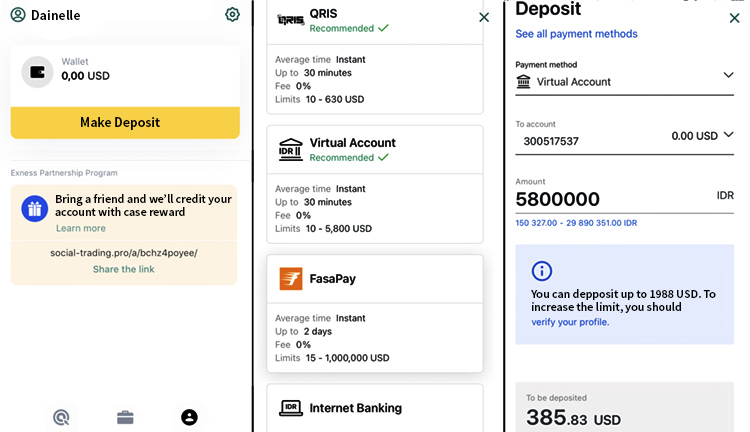

Investors are able to make deposits and request withdrawals through the Exnesss Social Trading platform app and website. As mentioned earlier, deposits and withdrawals can be made through the Portfolio and Account section.

Deposit

To make a deposit into your Exness Social Trading account, please follow these simple steps:

- Log in to your Exness Social Trading account and navigate to the Account section.

- Locate and tap on the wallet icon to access the deposit options.

- Select from the available payment methods provided and carefully follow the on-screen instructions to complete your deposit traer successfully completing the deposit, the funds should reflect in period within a short time.

Once the deposit is credited to your wallet, you can utilize these funds to invest in copying strategies and start benefiting from Exness social trading platform.

Withdrawal

Meanwhile, to withdraw funds from the Portfolio section, follow these steps:

- Log in to your Social Trading app.

- Navigate to the Portfolio tab and tap on your wallet.

- Select Withdraw.

- Choose the payment method (based on which was used for the deposit transaction).

- Set the amount and currency for withdrawal.

- You will be presented with a summary. Tap Confirm to continue.

- Enter the verification code sent to your account's registered email address, or via SMS to the account's registered phone number, depending on your chosen security type.

- Finish with Verify to complete the withdrawal.

Your funds should appear in your wallet shortly. The exact time it takes will depend on the payment method you used. If your funds do not appear after a reasonable amount of time, please contact Exness support for assistance.

Please note that it is not possible to make a withdrawal while your investment is active, ensuring the integrity of the trading process. Additionally, internal transfers are not available for investors. If you have funded any trading account using a credit card in your Personal Area (PA), it is necessary to initiate a credit card deposit refund from your PA before proceeding with any fund withdrawals from your Social Trading wallet. This ensures proper handling of financial transactions and adherence to regulatory requirements.

Tools and Features

Exness offers a variety of tools and features in its social trading app, enabling investors to select strategies, monitor performance, and assess profitability. Here are some key features investors need to know:

1. Trading Realibility Level (TRL)

Trading Reliability Level (TRL) is a measurement tool of how well a strategy provider manages their trading risks. It is calculated by combining two factors: safety score and value at risk (VaR) score. The safety score measures how likely it is that a strategy provider will lose all of their capital, while the VaR score measures how much money a strategy provider could potentially lose in a worst-case scenario.

A trading reliability level (TRL) is a numerical assessment, ranging from 0 to 100, assigned to a strategy provider or portfolio manager (SP/PM) based on their trading performance. A higher TRL indicates a greater level of reliability in the trader's performance.

It is important to note that the calculation of TRL can only be performed 30 days after the initial trade is executed within a strategy or fund.

TRL levels are categorized as below:

- Low score: TRL ranging from 0 to 40.

- Medium score: TRL ranging from 41 to 70.

- High score: TRL ranging from 71 to 100.

Please note that TRL is based on historical data and does not predict future performance. However, investors can still use TRL as a measure of how professional the strategy provider is.

2. News Feed

The News Feed is a section of the social trading platform where strategy providers can share updates with investors. These updates include information about the strategy's performance, upcoming trades, and any other relevant news or information.

Investors in Exness Social Trading App can use the News Feed to stay up-to-date on the strategy's progress and make informed decisions about whether to continue copying the strategy. The News Feed also supports a translator feature that makes it easier for investors to understand updates from strategy providers.

3. Statistics

Statistics is a tool in the Exness social trading app that allows you to view the return and equity of a strategy.

Here is a more detailed explanation of each metric:

- Return: This metric shows how much money the strategy has made or lost over a period of time. These daily stats calculate the user's change in equity from the beginning of the month until the end of the month and offsets any deposits/withdrawals.

- Equity: This metric shows the total amount of money that is currently available in the strategy's account. It is calculated by adding up the strategy's profits and losses, as well as any additional deposits or withdrawals that have been made.

Investors have the flexibility to customize the visual representation of graphs and data in the Statistics tab based on specific timeframes, such as 1 month, 3 months, 6 months, and more.

4. Orders Tab

In the Orders tab, investors can monitor all open orders as well as the order history made by the strategy. Tapping on any item in the list will expand its details.

It is crucial to pay attention to the information presented in the orders tab as it provides insights into the profitability of executed orders by the strategy provider.

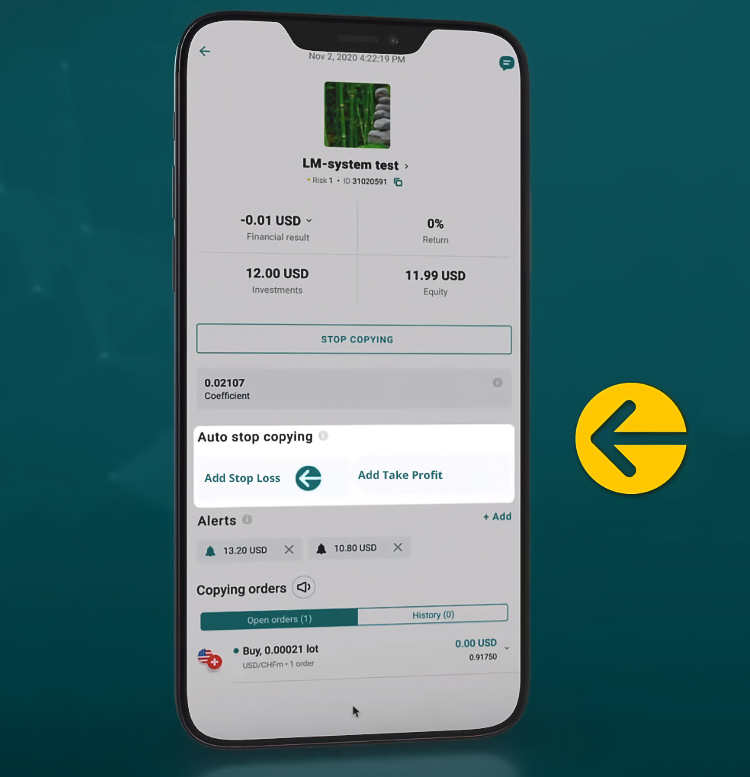

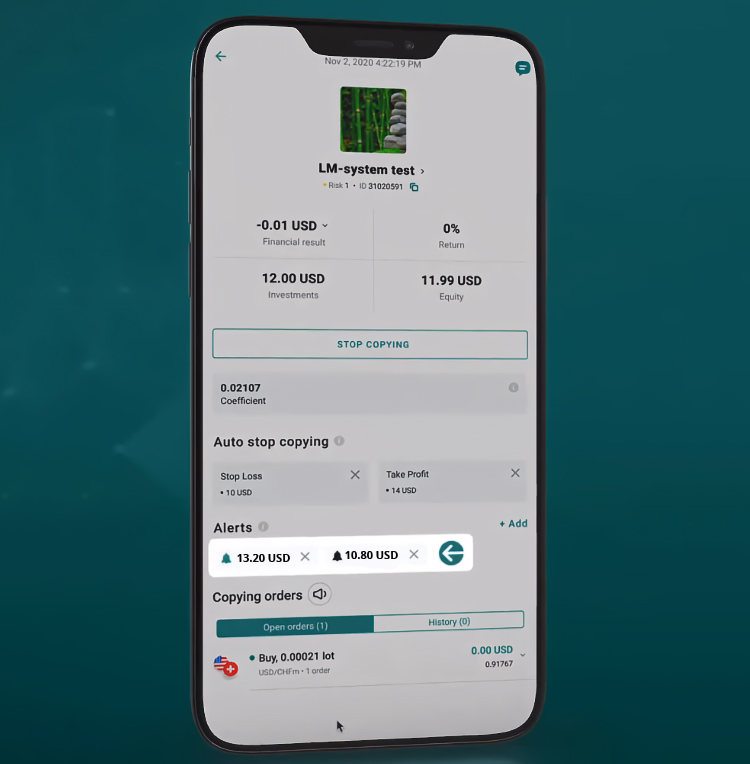

5. Stop Loss and Take Profit

This feature is highly recommended to be installed in the strategy you have chosen. This tool can protect the value of the user's investment from unexpected price movements when the investor is not paying attention.

To set stop loss and take profit, click on the investment strategy and click "Add Stop loss" or "Add Take Profit" located under the caption "Stop Copying Automatically". Enter your desired price limit and click add, then confirm.

After confirming the installation, your investment will be closed automatically when it crosses the price limit. Investors can change the limits that have been applied by clicking the numbers on the stop loss and take profit.

6. Notification

Exness Social Trading for investors has the option to set alerts that will notify you through message notifications on their mobile devices when a specific equity level is reached.

This feature enables you to closely monitor the performance of your investments. By default, there are pre-installed alerts, but you can modify or remove them to suit your preferences.

Finding a Good Strategy for You

Before you start copy trading in Exness, there are some things you should do first. To choose your first strategy to copy, it's important to review the strategy and ensure that it has a high chance to bring you profit.

You can find all of the in-depth information you need on the strategy page. To view it, simply click the strategy from the Strategy Main Area or the Portfolio tab, then click "Overview".

There are several types of information that you can gather such as:

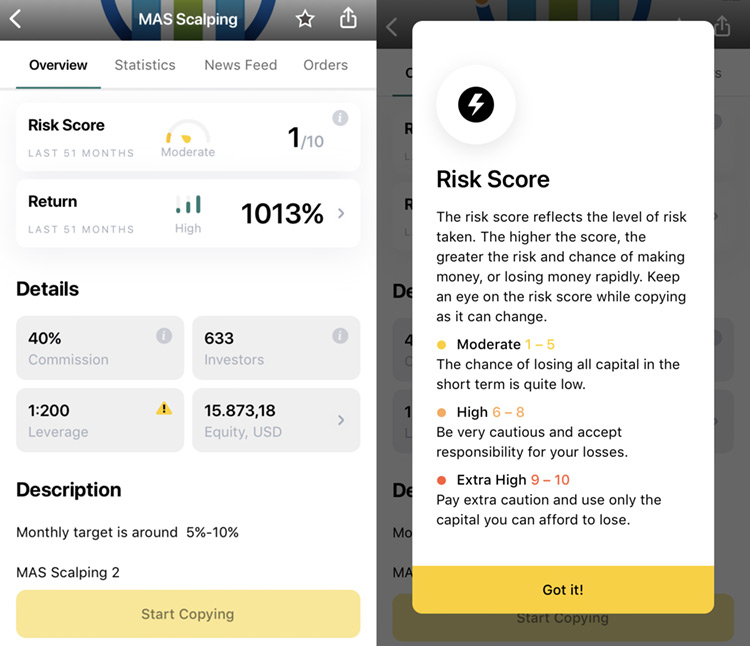

Risk Score

It reflects the level of risk of the strategy. Basically, the higher the score, the greater the risk. Keep in mind that while a high-risk strategy can give you more money, it can also make you lose money more quickly.

The score ranges from 1-10. Let's take a look at the table below for detail about risk score measurement.

| Risk Score | Level | Description |

| 1-5 | Moderate | The risk of losing all of your investment in the short term is low. |

| 6-8 | High | Be very cautious and accept responsibility for your losses. |

| 9-10 | Extra High | Be extra careful and only use money that you can afford to lose. |

The risk score displayed for a strategy represents the highest level of risk attained on that specific day. However, this score is recalculated every 20 minutes and increases only if it surpasses the highest score achieved during the day. Additionally, Strategy Providers can improve the risk score by trading with a smaller portion of the strategy's capital over 30 days.

Whenever a strategy achieves a higher risk score, it is promptly updated. For scores of 9 and above, the strategy is automatically hidden from potential Investors as a default precautionary measure.

If you encounter a risk score of 6, it indicates a high level of risk. The higher the score, the less available free margin the strategy has, making it more susceptible to potential vulnerabilities.

Return

Return in Exness Social Trading displays the growth of a specific strategy and it is updated daily. The statistics are designed to calculate the change in the strategy from the beginning of the month until the end of the month.

The calculation considers different periods determined by specific actions such as account deposits, withdrawals, and internal transfers, collectively referred to as balance operations (BO). The return value is determined by multiplying these periods between balance operations and presenting it as a percentile.

In other words, whenever a strategy provider withdraws or deposits, the return calculation is not influenced at all to prevent artificial results. For more details, here's an example of a return calculation:

- In February, the strategy's equity increased from USD 500 (E1) to USD600 (E2). So, February's return is calculated: (USD600 - USD500) / USD500 = 0.2 or 20%

- Then the strategy provider made a USD 400 deposit, and the strategy's equity is adjusted: USD600 + USD400 = USD1,000. So the return calculation in March will start not from USD600 (E2) but from USD1,000 (E3).

- In March, the strategy's equity increased from USD1,000 (E3) to USD1,500 (E4). We can now calculate March's return: (USD1,500 - USD1,000) / USD1,000 = 0.5 or 50%

- Now we can calculate the overall Return:

K1= February Return + 100%, so K1 = 20% + 100% = 120%

K2 = March Return +100%, so K2 = 50% + 100% = 150%

Rolling Return = (K1 K2) - 100%, or (120% 150%) - 100% = 180% - 100% = 80% So Rolling Return is 80%

Return calculations are specifically performed based on the balance operations, which include deposits, withdrawals, and internal transfers. There is no restriction on the number of balance operations that can be considered. Note that the mention of February and March as time periods is solely for illustrative purposes and not a fixed requirement.

Other than Risk Score and Return, there are other aspects to consider:

- Commission

This shows the amount of commission needed to be paid to the strategy provider. - Leverage

This shows the ratio of the strategy provider's own money to the borrowed funds, which are invested in the strategy. High leverage means higher exposure to the markets due to the increase in contract size. However, this does not impact the risk score. - Investors

This shows the number of investors that are currently copying the strategy. - Equity

The currency of the strategy and the total value of the account if all of the positions are closed. - Description

This area shows the thought process behind a strategy. At the very bottom, you can also see when the strategy was first created. - About Trader

Contains the basic information of the strategy provider, including their name, how long they've been trading with Exness, and their country of origin. If you want to read further, click "More Details". - Trading Period

This is a set amount of time between commission payments and ends on the last Friday of every month.

All of the details above are important to decide whether a strategy is worth copying or not. Remember that aside from the strategy itself, you also need to ensure that the strategy provider is reliable. This is why it's also important to check out the provider's profile.

How Much Should You Invest?

Investors can generate profits through social trading, but it can be challenging for those with limited capital. This is because investors are required to pay a commission to the strategy provider if the chosen strategy proves successful.

Typically, reputable strategy providers charge commissions ranging from 20% to 40%. If your goal is to make quick profits, you will need to risk a significant amount of money.

The minimum investment required by Exness is USD10. But to pay commission and trade with more flexible conditions, the recommended budget could be around USD100-USD200 at the very least.

In addition, some strategy providers on Exness offer advice on minimum investments to ensure the potential profits outweigh the costs. For instance, Jemmy Alwiyandu, the MAS Scalping strategy provider, suggests a minimum investment of USD500 for his investors.

When to Stop Following a Strategy?

After opening an investment with your chosen strategy, it is important to monitor its performance on a regular basis. By monitoring your investment performance, you can help to ensure that your investment is on track to achieve your goals.

Knowing when to stop following a strategy in Exness social trading is a crucial decision that should be based on several key factors. While there is no definitive rule, here are some indicators that may signal it's time to stop following a particular strategy:

- Consistent Loss

If the strategy consistently results in losses over a significant period, it may be a sign that the strategy is not effective or that market conditions have changed. Continuous losses can be identified through the orders tab in the history section. - Check the Drawdown

Another important metric to look at is the drawdown. A drawdown is the maximum amount of money that a strategy has lost in a single period. A high drawdown is a sign that the strategy is risky and could lose a lot of money in a short period of time. To check whether your strategy provider has frequent drawdowns or not, you can look at the provider's statistics section. - Lack of Transparency

Transparent and reliable information about the strategy is vital. If you notice a lack of clarity or transparency from the strategy provider, it may be a red flag. Incomplete or ambiguous information about the strategy's approach, risk management, or historical performance can erode trust and warrant discontinuation. - Significant Changes in Strategy

It is normal to change strategies in trading to adapt to changing market circumstances. However, if the strategy provider makes significant alterations to the approach without clear explanations or justifications, it could signal a lack of stability or a departure from the strategy's original principles. Evaluate whether these changes align with your investment objectives and if they warrant continued following. - Divergence from Personal Goals or Risk Tolerance

Each investor has unique goals and risk tolerance levels. If the strategy does not align with your personal objectives or exceeds your comfort level regarding risk, it might be time to consider discontinuing it. Your financial well-being should always take precedence.

How to Stop Copying Strategy?

To stop copying a strategy, investors can do it on the strategy page that they want to stop. You can follow the steps below:

- Log in to your Exness Social Trading app.

- Find and select the strategy that you want to stop.

- Once opened, you will see an option to Stop Copying at the top of the main area.

- Confirm the action and you will no longer be copying this strategy.

It is important to note that If you are choosing to stop copying when the market is closed (for example, during the weekend), there can be two possible outcomes:

- If there are more than 3 hours until the market reopens, the investment will be stopped at the last market price.

- If there are less than 3 hours until the market reopens, the investment will not be stopped and there will be an error notification. You can stop copying after the market reopens.

Summary

Exness Social Trading is a service that allows investors to copy trades from expert traders, known as strategy providers. This can be a great way for investors to learn from experienced traders and potentially make money without having to do intense research or analysis.

To get started with Exness Social Trading, investors need to create an account and deposit funds. Once they have funded their account, they can browse through the list of strategy providers and select the strategy they wish to copy.

Exness offers a range of effective tools and features in its social trading app, allowing investors to select strategies, monitor performance, and assess profitability. These features empower investors to make informed decisions and closely track their investments within the Exness social trading app.

Exness is a forex and CFD brokerage that serves clients to trade across multiple markets with the most stable and reliable pricing in the industry. Their features include spreads as low as 0 pips and maximum leverage of 1:unlimited.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

61 Comments

Sweety

Jan 31 2023

The explanation of this article states that a social trading account is not just copying trading strategies from copying active traders, who are known as strategy providers. This platform provides many benefits, especially for beginners, from copying more professional traders.

In addition, this account can also provide benefits to professional traders (Strategy Providers). When the providers' strategies generate profits, they also get commissions from investors who copy their trading activities with the value they set. For investors, it is important to download the Social Trading mobile app, while Strategy Providers can manage, monitor and trade as usual with their Exness account.

So, instead of being a trader (investor), I'm more interested in opening a strategy provider account because I think my experience and strategy are capable in that field. What do I need to do to open a strategy provider account? Please, maybe someone can explain.

Kelly

Jan 31 2023

Sweety: Wow, it turns out that you are an experienced trader... I am amazed by you because trading requires patience and thoroughness in my opinion. Even though I'm actually still a beginner, I've been interested in Exness' social trading platform for a long time, because yeah, besides being able to copy trading strategies from pro traders, I can also share and discuss trading issues.

To become a strategy provider, you need to register a Personal Area on the Exness website with an email address and mobile number.

Once you have access to your Personal Area, log in and click on the Social trading tab from the main menu, then follow these steps:

Rachel

Jan 31 2023

Even though I haven't tried real trading yet, I really like brokers that provide copy trading platforms because I feel all beginners really need this platform to trade while learning plus getting profits too. At least with this platform, I can gain trading knowledge from professionals.

It turns out that Exness also provides a platform similar to copy trading but more friendly to novice traders. I'm automatically interested in knowing more about this social trading platform. Usually, if we want to open a social trading platform, we have to open an account first, yes, at Exness.

I think opening an account at Exness is not much different from other brokers, which is quite easy and sophisticated. Apart from opening an account, there is usually a document verification process, right? If I want to join the Social trading platform, do I have to verify my account? please also explain How do traders verify documents?

Yolanda

Jan 31 2023

Rachel: OK, my friend, I'll help explain account verification at Exness. In my opinion, account verification when opening an account at all brokers is very important, to avoid identity fraud and get complete features from the platform offered by the broker.

The security of client funds is a top priority. They have multiple layers of security, two-factor authentication, strong account verification, and round-the-clock support to solve any issues.

And yes, To use Social Trading, investors must verify all documents of Proof of Identity (POI), Proof of Residence (POR), and Economic Profile. The documents that must be uploaded to verify an account at Exness are the same as those of other brokers. That's all I know, if anyone has something to add, feel free...

Zarrel

Jan 31 2023

Yolanda: Okay, I agree with your explanation that account verification is so important for both the trader and the broker himself to avoid fraud and counterfeiting in trading. Especially for social trading platforms that involve interaction between each trader, both for copying trades, sharing sessions, or discussion forums. when encountering obstacles in trading. Now there are several steps if you want to verify your account, namely

Dalton

Jan 31 2023

Rachel: And Wow, as you know, my Social Trading Account is popular among traders, both beginners and pro traders. The only goal is to generate profits from the trading platform. There are some documents needed viz

Proof of Address – Documents of proof of

So this is a more complete explanation of the documents used for account verification.

Jhony Blake

Feb 6 2023

The point that really makes newbies really take note is to . ensure the requirements to copy trades. I mean, in my experience, copy trading actually allows our trade to copy another trader's entry. So it's like an automated robot, and if you don't copy everything, including the minimum deposit, it's very easy to lose your trade.

I mean to note the author writes on the article:

"Make sure it exceeds the minimum investment set by the strategy provider." SO if the minimum requirement is $100 you must deposit at least $150 because if you deposit less than the minimum requirement your margin cannot follow the trader's trading method there.

Thanks to the author for these details on Exness copy trading!

Robert

Mar 5 2023

Lately, Social Trading and Copy Trading have been heard more and more frequently, following in the footsteps of Mirror Trading which was earlier rife. These two types of platforms for sharing trading ideas on forex, indices, etc. are increasingly being presented by various parties. the Exness platform that allows traders, known as investors, to copy active traders, known as strategy providers

Actually, I'm still confused about this social trading concept. but I also can't deny that I really like this service system, which provides a lot of convenience for novice traders, even for experienced traders at the same time.

In my opinion, Social trading is a pretty good technological innovation in trading that makes it easy for novice traders to gain experience and profit. Want to join this social trading, but not sure where to start? please if anyone can give an explanation regarding this...

Grace

Mar 5 2023

Robert: Exness Social Trading provides the opportunity to invest in the successful strategies of other traders from around the world. Choose a strategy, invest funds, and earn from every profitable trade. Social Trading makes it simple because novice traders can copy the trades of experienced traders, and both earn from profitable trades. By using a series of sophisticated tools, you can control your investment directly from your smartphone.

As an investor, you can 'copy' the strategy made by the strategy provider and earn profits together.

The Exness Social Trading app provides an interesting way to copy trades, packed with features. Exness clients can start using the application with an existing account, and can become investors or strategy providers.

If you already have an Exness account, Sign in and enter your registered email address and Personal Area password to log in.

Create a new account: When you sign up for a new account, click Get Started, then choose your country, enter your email, and set a password. Next, set a passcode to open the app and/or set Touch ID with your fingerprint.

You can then complete account verification or skip this step and come back later. The account has been created successfully and you can start exploring strategies in the app.

To complete account verification, click on the Account icon then click Activate deposit method. You will be asked to enter an active mobile number in your country of residence and verify it by entering the 6-digit code sent to the cellphone. You will also have to provide some personal information. After completing this process, you can deposit up to 2,000 USD in 45 days. To remove this limitation, follow the next steps to complete full verification of your account.

The final stage for complete verification is uploading documents as proof of identity (POI) and place of residence (POR), as well as completing your economic profile.

Jonathan

Mar 5 2023

Grace: When you enter the Social Trading app, you will see strategies grouped into categories for your convenience. You can also view all strategies and use filters to find the strategy of your choice. Understanding the information provided on the strategy page can be very useful in making an informed decision about which strategy you should follow.

The strategy page provides some information about strategies and strategy providers. You can find details such as strategy provider name, registration date, strategy description, important indicators of strategy performance, statistics, trading instruments, orders, trading period, and commissions.

Categories shown in the app are: Most Copied, Moderate risk-return, Best Return per month, Best Return for 3 months, Low commission, and New strategy

To start investing in the strategy, just follow these steps.

Gara

Mar 5 2023

I have experience in trading, including in trading social services. I really like this service system, which provides a lot of convenience for novice traders, even for experienced traders at the same time. But keep in mind, nothing is free in this world. strategists also want to benefit from this service. And well, in my opinion, the management fee or you can call it the commission for professional traders at Exness brokerage is quite high, the commission is close to 50%, which is a huge amount.

Moreover, the profit sharing that is charged at the end of each period if the trader makes a profit, that is an unreasonable number. Higher watermark rules apply. Although there are several brokers who also offer the same service, the commission is not that big. Maybe the value is profitable on the side of the strategy provider, but it is quite detrimental for investors.

Lalisa

Mar 5 2023

How to calculate copy ratio for a strategy?

Arthur k

Mar 5 2023

Lalisa: When investors copy trades made by strategy providers, they are usually trading different volumes. So, how can Social Trading figure out how to calculate returns proportionally? That's what the copy ratio was designed for.

The copy ratio is a calculation of the ratio that balances a strategy's equity (provided by the provider of the strategy) against the investment in that strategy (provided by investors). The copying ratio multiplies the assigned lots of copied orders in order to accurately weigh what the strategy provider uses to trade and what the investor invests.

The copying ratio (K) formula used is investment equity / (strategy equity + amount (cost_spread_open_orders)).

If the strategy has no open orders open_spread_order_cost will be set as 0. In the scenario when the copy ratio is recalculated, the maximum copy rate is set at 14.

Victor

Mar 5 2023

Arthur k: Copying is a process in which the strategy provider's trades are copied to the investor's account, after taking into account the copying coefficient. An investor can start copying a strategy even when the market closes (up to 3 hours before the market re-opens). In this case, the order will be copied at the last available market price.

Taimur Rahaman

Mar 26 2023

Lalisa:The copy ratio for a trading strategy is a measure of how much capital should be allocated to each trade based on the strategy's historical performance. To calculate the copy ratio for a strategy, you can follow these steps: Determine the maximum drawdown of the strategy. This is the largest peak-to-trough decline in the strategy's equity curve. Calculate the percentage of the maximum drawdown that you are willing to risk per trade. This is often referred to as the risk per trade or the maximum loss per trade. Calculate the ideal trade size based on the risk per trade and the maximum drawdown. To do this, divide the maximum drawdown by the risk per trade. For example, if the maximum drawdown is $10,000 and the risk per trade is 2%, the ideal trade size would be $500 (i.e., $10,000 x 0.02 = $200; $200 x 2.5 = $500). Adjust the ideal trade size based on the current equity of the trading account. If the account equity is less than the starting equity of the strategy, reduce the ideal trade size proportionally. For example, if the starting equity of the strategy was $50,000 and the current equity of the account is $40,000, reduce the ideal trade size by 20% (i.e., $500 x 0.8 = $400). Calculate the copy ratio by dividing the adjusted ideal trade size by the actual trade size. For example, if the adjusted ideal trade size is $400 and the actual trade size is $200, the copy ratio would be 2 (i.e., $400 / $200 = 2). Keep in mind that the copy ratio is a dynamic calculation that should be updated periodically based on changes in the strategy's performance and the account equity. It is important to regularly review and adjust the copy ratio to ensure that the capital allocation remains optimal.

Kaium Khan

Mar 26 2023

"I'm a beginner trader and I'm interested in using Exness Social Trading as a way to learn and improve my trading skills. However, I'm not sure if this platform is a good fit for someone at my level of experience. Can you provide me with more information on the features and tools available on Exness Social Trading that would be useful for beginners, as well as any potential drawbacks or risks that I should be aware of? Additionally, can you recommend any specific strategies or best practices for using Exness Social Trading as a beginner, such as how to choose which traders to follow and how to manage risk effectively?"

Finlay

Mar 5 2023

As long as I am a trader who tries several brokers in trading. I really liked the service "Social trading". In my opinion, Social trading is a pretty good technological innovation in trading that makes it easy for novice traders to gain experience and profit. Experienced traders can also copy the strategies provided by traders to help their trading.

Starting social trading is not difficult. Use the flexible filters to find the strategy you like to take risks, invest and earn when the strategy pays off.

Even though I just started trading at Exness for about 3 months or so. But yeah... I have experience in the world of trading for almost 1 year. But unfortunately, I only opened a standard account with this broker. yeah, because before that I didn't know that this broker also provides social trading.

I want to ask, Can I change my registered trading account to a strategy account at Social Trading?

Saito

Mar 5 2023

Finlay: An Exness trading account cannot be converted into a Social Trading strategy account. Once a trading account or strategy account has been created, the account type cannot be changed. We recommend that you create a new strategy account, or register as a strategy provider if you haven't already.

But if you want to link the two accounts, you can. If you have an Exness Account registered with the same email address as your Social Trading account, the accounts are automatically linked - you can log into your Exness Personal Area with your Social Trading credentials to confirm.

The Exness Personal Area is exclusively useful for Strategy Providers, as Investors cannot use this region to copy trades and must use the Social Trading app to open investments.

However, if your Social Trading account is registered to a different email address than your Exness account, unfortunately the accounts cannot be linked.

Thomas

Mar 5 2023

Actually, I'm still new to the world of trading and yes, I rarely hear about brokers that provide trading instruments and platforms. You must have known FBS and OctaFx which always appear in several advertisements on social media. As for the Exness broker, I have honestly never heard of this broker.

And yes, I just found out in this article, and yes, what is being discussed here is related to the Social Features of trading. Actually, even after it was explained, I didn't really understand and actually just found out that there is also a broker called Exness. I'm too early to understand this. I'd better learn to trade in real terms, so I can get experience in trading. Joining social trading as an investor is less profitable in my opinion because I have to give commissions to provide strategies. I am interested in this broker, but maybe more prefer real and demo trading.

As already explained, this broker has only been established since 2008, but I cannot say for sure whether this broker is good and safe. I ask friends for an explanation, is the Exness broker safe for trading and my funds? Is my personal data also safe here? If anyone knows, could you please explain...

Sietsa

Mar 5 2023

Thomas: Founded in Russia in 2008, the Exness Group is a relatively new Forex and CFD broker. This broker has grown rapidly since its inception and now has over 145,000 clients worldwide and is regulated by seven national authorities.

In 2012 Exness obtained a license from the Cyprus Securities and Exchange Commission (CySEC) and moved its headquarters to Cyprus. In 2018, Exness closed its retail businesses in the EU and UK in response to tougher restrictions on retail CFD brokers – although Exness has maintained business-to-business (B2B) services in both regions. Here are the regulators that this broker has come across.

Diego

Mar 5 2023

Sietsa: Exness regularly receives industry awards and recently won Best Global Forex Customer Service 2019, Best Global Forex Trading Experience 2019, and Most Trusted Global Forex Broker 2019 at the Global Forex Awards.

Overall, I consider Exness a safe broker to trade with, albeit with some reservations. The broker's withdrawal from the EU/UK market following tighter regulation was certainly a consideration, but the broker remains well-regulated in many areas.

This broker provides all clients with negative balance protection, which means that traders cannot lose more than their initial deposit. Lastly, this broker is regularly audited by Deloitte, one of the most reputable auditing firms in the world.

In addition, Exness is a member of the Financial Commission, an international organization that resolves disputes in the financial services industry for the forex market. The Financial Commission ensures that traders and brokers resolve their disputes more quickly, efficiently, impartially, and in a realistic manner while ensuring that all parties receive fair and thorough answers to their concerns. This committee also provides additional protection for traders using the Compensation Fund.

The Compensation Fund acts as an insurance policy for member clients. These funds are kept in segregated bank accounts and are used only if the member refuses to comply with the decisions of the Financial Commission. The Compensation Fund will only cover decisions made by the Financial Commission up to €20,000 per client.

Luminous

Mar 5 2023

Sharing strategies online with investors is a great way to get investors interested in strategy providers. If you want to do it, how to share the direct link of the strategy?

Marchel

Mar 5 2023

Luminous: Follow these steps to find and share strategies with direct links. Now you can easily share strategy direct links. Visit the Social Trading website, then search for your strategy on this page, then the strategy. The URL shown is the direct link for your strategy.

When you share a strategy direct link with investors, this is what happens: The investor clicks the link, then opens the strategy on the Social Trading website. The strategy provides an option to Start Copy. If ed, one of two things will happen depending on the investor.

If investors do not have the Social Trading App: They will be redirected to the App Store/Google Play, depending on the mobile device used. then they can download and install the app at this stage. When starting the Social Trading app, they will be redirected to the chosen strategy. If the strategy is not displayed, use the direct link again and it will open in the Social Trading app.

If investors already have the Social Trading app installed: They will be redirected to the Social Trading app. If the app doesn't open, look for the setting in your browser "location to open web links", then "Open with Social Trading". If your browser doesn't have this setting, copy the direct link and paste it into the browser's address bar. The strategy will now automatically open in the Social Trading App.

Leonard

Mar 5 2023

I am a student majoring in economics and recently I am interested in the world of trading, I feel that forex trading can add to my experience and skills in the future. Besides that, I can also increase my income in trading. Well... But since this is my first experience, I want a broker that has a "Social trading" service. The Exness broker provides this service with a variety of available manager strategies.

But I'm a bit confused by the policy. When you want to make a deposit, the payment is sent to a separate account. What do you mean by explanation? This is a bit confusing Can anyone explain or not? Because I don't understand... Thanks...

Burke

Mar 5 2023

Leonard: I am an active user of the oExness trading broker and also one of the traders who really likes the social trading features offered by this broker. I use this broker for about 2 years. And I have followed more than 3 strategy managers and yes I am satisfied with that.

As per my knowledge and experience, to be able to copy trades you must first fund your account. Well, we also have to pay attention to the important part here. You are required to create a separate account for each connected manager, it's okay, otherwise, the deposit has to be topped up separately. Therefore, if you wish to connect to other strategy providers, you must create a separate investment account and fund it separately within your personal account. I hope my explanation can help you. and I'm sure exness can be your consideration as a good and trusted social trading broker provider.

Mike

Mar 5 2023

I have been in the world of forex for a long time, more or less 5 years. However, I've been absent from trading for 2 years, due to the Covid 19 virus in 2020. So now I think I want to start over, by the way, Exness broker is one of the choices of brokers I want to use in trading.

I am interested in the features provided by this broker as a social trading service provider. And yes, it is true that there are many strategy managers provided by this broker. there are so many strategy providers that are provided that it makes me even more amazed by this broker. this is so crazy, there are more than 1000 strategy providers on the Exness social trading platform. But yes, because there are many choices of traders, I'm confused about which one to choose. In your opinion, which of these 3 tips is better for choosing a suitable trader?

Apart from that, I also like trading with a swap-free account, because I am a Muslim. Does Social Trading have a swap-free account? Please explain, guys, about this.

Ostland

Mar 5 2023

Mike: After I read this article, ask my friend who has been a user of this EXNESS broker for less than 1 year. Indeed, I am not a trader who uses this broker for trading, but well, because I read this article, I am somewhat interested in this broker, especially with SOCIAL TRADING services.

From the explanation I received, there are several things that should be taken into consideration when choosing an easy strategy manager, namely by looking at the ratings of traders...Surely EXNESS has carefully educated traders who become strategy managers on this platform. So I believe choosing by rating is a good thing.

As far as I know, on the official website of the exness social trading platform, if you open it, you will see a full page with strategy providers ranging from the most popular to strategy providers that offer low commissions. The following is a grouping of strategy providers on the Exness website page.

on the top page is a row of the Most Copied strategies

This is an opportunity for you to analyze which strategy provider you need. I suggest you not only focus on the most favorite strategy at this broker. Also consider according to your needs, both in profit, and commissions offered by strategy providers. That's all I know about this service. Because I'm still following the application too much, if there are any additions, I can object...

Khalid

Mar 5 2023

Ostland: I also totally agree with your explanation. Even though I just started trading at Exness broker about five months or so. But I have been in the world of trading for 3 years. I like the Social trading trading service which makes it easy to learn trading strategies. Well, although not all strategies can provide benefits. But at least

If you have registered to participate in the Social trading service, and you have chosen a strategy provider that you want to copy all trades from, then you will automatically open and close positions according to what the master copy trades did. So that in this case, all your trade executions (open positions, pending orders, SL and TP levels or closed positions) will be in accordance with the execution of the strategy provider. we can more easily find solutions by imitating other traders.

I don't agree with your opinion that to find traders, rating is the main thing. But we as traders must have the mind "alert and careful in choosing". High ranking does not necessarily guarantee profit for you. You have to check the number of followers, the risk level of the trading strategy, what is the proportion of profit sharing, and how many funds are being managed. And those things are very important.

Charlotte

Mar 5 2023

Hello guys, I have basic knowledge about trading, I'm very curious about Exness brokers who supposedly offer good social trading services. Social Trading is an Exness platform that allows traders, known as investors, to copy active traders, known as strategy providers.

And indeed I had an interest in getting into the world of trading before. I really want to be a trader, but I still choose the right and best broker for me to register. From the explanation of the article above, if we want to subscribe to several strategy providers, I must first register with this broker. However, as an investor, I also have to verify documents if I want to use Social Trading.

And yeah, besides that, I also have to make a deposit first. This is a general rule in trading, but there is also something that confuses me, namely How do I track my deposit or withdrawal transactions? and How to make a deposit as an investor.

Xiamore

Mar 5 2023

Charlotte: As an investor, you are strongly advised to fully verify your account. Although initially, you can make a deposit to start using the Social Trading app without having to verify your profile, after a certain period you will need to verify all the information in order to continue trading. To verify account information, you need: Proof of Identity (POI), Proof of Residence (POR), fill-in Economic Profile data.

After downloading the app and verifying your account, you must first make a deposit to start copying strategies.

Enter the Social Trading app and click on the wallet icon at the bottom. Click Make a Deposit

You will now see a list of payment methods to choose from. Choose your preferred method and follow the prompts to complete the deposit. After making a deposit to your wallet, you can use these funds to invest in copying strategies.

if you want to track the funding transactions that you make, you can do it at the Exness broker. the method is also very easy, namely logging in with the Social Trading application. Click the Profile tab. after that Click See All next to the Transaction header. Full transaction history is now displayed with all transaction details, including transactions that have been completed or are still pending.

However, please note that you cannot cancel pending deposits manually. If you need assistance, you need to contact the Support Team of the Exness broker and provide your email and support PIN to expedite the process.

Samuel

Mar 5 2023

As a new digital phenomenon, social trading offers a variety of smart tools to manage risk and perform analysis. One of the most important features provided by several brokers including Exness is Social trading. But I have also read in a broker article, there are also brokers that provide copy trading platforms. and yeah after I observed, these two platforms are almost the same.

I'm actually quite confused about trading questions. is this me with copy trading or is it different? because there are several brokers who offer Copy trading, but almost all of the explanations are almost similar to social trading.

Is it possible that the two have the same system, just a different name, or is there really a difference?

Tylor

Mar 5 2023

Samuel: Social Trading is a system where financial market investors rely on content compiled by Web 2.0 applications as their source of information in making investment decisions. Social trading presents a new way of analyzing financial data by providing a basis for comparing and copying other people's trading techniques or strategies. Social trading is a type of online social network, like Twitter or Facebook, which only contains trading ideas.

Copy Trading is one of the new technologies applied in the context of Social Trading and comes after Mirror Trading. Copy Trading and Mirror Trading both allow forex traders to automatically copy trading positions opened and managed by other traders, but the fund control settings are different. Copy Trading means money management for follower trader funds will be linked to the pro trader funds they follow

Social trading certainly helps new traders to learn by following the actions of more experienced traders. New traders learn quickly in a real-time environment and depending on the information shared, can easily replicate trades through their own account – if they so choose. Copy trading, on the other hand, is a commitment to following the exact trades of other traders. Perhaps you can see now how the two terms are often confused.

Social trading as copy trading combined with social media will bring you closer to an accurate picture of what social trading is. The main purpose of this social trading is to make it easier for traders to share and follow traders who have been successful through forex copy so that later they can find their own trading strategy.

And for the good news, if you study with Exmess's social trading, you will find that the Platform is also combined with copy trading, so you can also copy trades from strategy providers. Of course there are lots of forex strategies that you can choose and use as well as the potential benefits that you will get. However, all choices are still in your own hands.

Antonio

Jun 29 2023

When it comes to copying trades, is it generally recommended to stop copying when the market is closed or to wait until it reopens? Based on the information provided, it seems that stopping the copying process during market closure can have different outcomes depending on the time remaining until the market reopens. Could you please clarify which option is more advisable and why? Understanding the potential implications and error notifications associated with stopping copying during market closure would help me make an informed decision. Thank you!

Leon

Jun 30 2023

@Antonio: In my opinion, when it comes to copying trades, it is generally recommended to stop copying when the market is closed and wait until it reopens. This ensures a smoother copying process and minimizes the risk of errors or inconsistencies.

Stopping the copying process during market closure allows for a clean break in the trade flow. It ensures that you don't copy trades that were opened or closed while the market was inactive, which could lead to unwanted positions or discrepancies.

If you continue copying trades during market closure, it can result in various outcomes depending on the time remaining until the market reopens. In some cases, the copying platform may display error notifications or attempt to execute trades at unfavorable prices once the market resumes, potentially causing losses or unexpected results.

By stopping the copying process during market closure, you maintain alignment with the live trading environment and reduce the chances of encountering errors or undesirable trade outcomes.

Felix

Jun 30 2023

Hey there! Why do we need a good strategy in copy trading? I mean, we're simply copying the trades of the provider, right? So, what's the significance of having a good strategy in this case? Also, I have a few related questions: How important is it to review the performance history of a strategy before deciding to copy trade it? What factors should be considered to ensure that a strategy has effective risk management measures in place? How can one determine if a strategy is compatible with their own trading style and investment goals? Lastly, why is consistency and reliability important when evaluating a strategy for copy trading?

Henderson

Jul 1 2023

@Felix: Hey mate! Good on ya for asking these questions about copy trading! Even though you're copying someone else's trades, having a solid strategy is still bloody important. Here's why:

Consistency and Profitability: A good strategy means the provider knows their stuff and consistently makes profits. You want to follow someone who's got a track record of success and can increase your chances of making money.

Risk Management: A top-notch strategy includes proper risk management. They'll have things like stop-loss orders and smart position sizing to protect your cash and keep losses in check. Without that, even a profitable trader can end up in a world of hurt.

Now, onto your other queries:

Checking Performance History: It's crucial to review a strategy's past performance. Look at their trades, success rates, and how they handle losses. It gives you an idea of their reliability and whether they're worth copying.

Effective Risk Management: To make sure a strategy has solid risk management, check if they use stop-loss orders and diversify their trades. You want someone who's smart about protecting your money while still chasing profits.

Compatibility with Your Style: Think about your trading style, risk tolerance, and goals. A strategy that matches your preferences and helps you reach your targets is the one to go for.

Consistency and Reliability: You want a strategy that consistently performs well and a provider you can trust. Look for someone who's reliable and transparent about their trades.

By considering these factors, you'll increase your chances of finding a strategy that suits your needs and goals. Happy copy trading, mate! If you've got more questions, fire away!

Aguero

Jul 5 2023

How reliable is the Trading Reliability Level (TRL) as a measurement tool for assessing the risk management and performance of strategy providers or portfolio managers? With the TRL being calculated based on factors such as safety score and value at risk (VaR) score, it aims to provide an evaluation of the likelihood of capital loss and the potential financial impact in worst-case scenarios. However, I'm curious to know more about the effectiveness and reliability of the TRL in accurately assessing and quantifying the trading risks and overall performance of strategy providers. How robust and dependable is the TRL as a numerical assessment in determining the level of reliability and competence of traders?

Brian Joshua

Jul 8 2023

@Aguero: The reliability of the TRL depends on how accurate and relevant the factors used in its calculation are. The safety score and VaR score should be based on solid data and calculations. Plus, it's important that the methodology for combining these scores into a single TRL is clear and transparent.

However, it's crucial to remember that the TRL is just one tool in the toolbox. It shouldn't be the sole basis for assessing a trader's reliability and competence. Factors like track record, experience, risk management strategies, and market conditions should also be taken into account.

So, while the TRL gives you a numerical assessment, it's important to consider it alongside other metrics and qualitative analysis. Trading is complex, and no single metric can capture everything. So, do your due diligence, consider multiple factors, and use the TRL as part of a bigger picture when evaluating strategy providers or portfolio managers.

Bernard

Jul 9 2023

Why do they recalculate the risk score every 20 minutes and only increase it if it surpasses the highest score of the day? And here's another thing: how exactly can Strategy Providers boost their risk score by trading with a smaller portion of their strategy's capital over a whole month? It sounds like there's some interesting mechanics at play here, and I'm curious to understand the reasoning behind it. Can you shed some light on these aspects and how they contribute to assessing and improving the risk levels of a strategy?

Mudryk

Jul 13 2023

@Bernard: Let's dive into the fascinating mechanics behind risk score calculation and boosting for Strategy Providers. Brace yourself: the risk score gets recalculated every 20 minutes, but it only increases if it surpasses the highest score of the day. This real-time recalculation keeps a close eye on risk levels for accurate assessments.

Now, here's the kicker: Strategy Providers can boost their risk score by trading with a smaller portion of their strategy's capital over a month. It may sound odd, but it's all about smart risk management. Starting small and gradually increasing capital allocation shows consistency and stability in performance.

Why go through all this? It ensures risk assessments reflect overall performance and risk management. Frequent recalculations capture sudden spikes, promoting necessary adjustments. The goal is transparent and reliable trading, empowering investors to make informed choices. So, keep an eye on that risk score and observe how Strategy Providers handle capital. It's about responsible risk management and finding strategies that match your investment goals.

Sophia

Jul 15 2023

Besides Exness Social Trading, are there any other user-friendly social trading platforms available for investors? I mean, it sounds like a convenient way to learn from experienced traders and potentially profit without doing extensive research. Are there similar platforms where investors can create an account, deposit funds, and browse through a list of strategy providers to copy their trades? And what are some notable tools and features that these platforms offer to help investors monitor performance, assess profitability, and make informed investment decisions? It would be great to explore alternative options for social trading that provide user-friendly interfaces and useful functionalities.

Hocky

Jul 16 2023

@Sophia: Exness Social Trading is one option for social trading, but there are several other user-friendly platforms available for investors who are interested in this approach. Some notable platforms include eToro, ZuluTrade, and NAGA.

Platforms like eToro, for example, allow investors to create an account, deposit funds, and browse through a list of experienced traders to copy their trades. These platforms typically provide a user-friendly interface that makes it easy to navigate and monitor the performance of different strategy providers.

In terms of tools and features, social trading platforms often offer features such as leaderboards, where investors can see the rankings and performance of various traders. They may also provide detailed statistics and performance metrics for strategy providers, allowing investors to assess profitability and risk levels before making their investment decisions.

Additionally, many platforms have interactive community features, where users can engage in discussions, share insights, and learn from one another. This creates a collaborative environment for knowledge sharing and learning from experienced traders.

Hannum

Sep 3 2023

Dude, is it a copy-trading mechanism like this:

we track traders' trades, traders tell us when and where to enter trades and also tell us where to put SL and TP. That's like a trader opening a trading class and we can either follow it or not. And to pay for the services, we paid them some amount of money.

Meanwhile, copy trading on Exness, based on the article, the copy trading means automatic trading. So, just do all the trade with a single click "copy". Because of that, it makes me a bit confused. How does actually copy trading work and what are the main benefits of copy trading?

Thieary

Sep 4 2023

I think you are misunderstanding copy trading. All brokers that offer copy trading, including Exness, have the same mechanism for copy trading.

Basically, you just need to click the copy trade button after following the traders you want and let your account follow the trades automatically. You just sit back and watch your account move.

But some brokers like Exness also have the option to stop copying trades during copy trading. Meanwhile, other brokers simply let the copy trade continue until the trader finishes the trade.

For more explanation, you can read the below article to see what copy trading is:

Is Copy Trading Really Worth It?

Ghuk Tae

Sep 17 2023

I have been interested in cryptocurrencies for a while and coincidentally, I read this article and found that both Exness Markets offer interesting features.

However, both of them are actually forex brokers, right? When talking about brokers, it usually means there are swap fees if I'm not mistaken. The article didn't mention the swap fees that may occur in CFD assets. I mean, I have encountered many CFD assets such as forex, metals, and even indices that have swap fees.

If possible, could you let me know if cryptocurrency CFDs have swap fees too?

Also, can crypto swaps have their own interest rates? Additionally, regarding the charts, do cryptocurrency CFD charts and cryptocurrency exchange charts have the same graphics and chart formats?

Allejandro

Sep 18 2023

When trading cryptocurrencies via brokers like Exness, remember they primarily focus on forex. So, expect swap fees when dealing with crypto CFDs. These fees vary by broker and asset, favoring long or short positions differently.

Swap rates for crypto CFDs are influenced by supply, demand, sentiment, and interest rate differences. Chart designs may differ between crypto CFDs and exchange platforms, though they source data from the same place.

Naalnish

Sep 19 2023

You are correct!

Exness offers crypto trading via CFDs, but swap fees (overnight holding costs) might apply. Check their website or contact support for current rates. Crypto swap rates can vary like traditional currencies due to market factors. Both CFD and exchange charts display similar info for trading decisions.

Guiche

Sep 22 2023

Hey man, I really liked this article so I read it. But yes, I'm still learning about the world of trading, so I don't understand issues like the terminology used in this article. In this article, the author always mentions the terms Stop Loss and Take Profit several times. What does this mean in trading Interpreted manually, it is still confusing. but I must admit, this is very difficult to understand for me personally. The following is an article about applications at the EXness broker. the broker mentions Stop Loss and Take Profit.

Is this a trading app feature? How important is it for a trader? Please explain. Sorry if the question is a little strange, but this is a very necessary question to get a better understanding of trading.

Hiraga Saito

Sep 23 2023

Hello friends, good luck in your efforts to become a successful trader. Ashamed to ask, lost on the road, that's the motto I always adhered to until now. I will help explain regarding take profit and stop loss. When you interpret the manual, it actually approaches the true meaning of trading. In the world of trading, there are several methods and strategies that can be used to achieve profits according to achievement targets. Among them are stop loss and take profit strategies which usually have become trading features in broker applications.

Stop loss usually abbreviated as SL is the action of selling a trading instrument, such as shares and crypto, at a certain price to limit losses. The SL level is set at the beginning of the transaction, to anticipate if the price does not move up as expected, but moves down. Generally, prices fall at a faster rate than they rise. That's why stopping loss is very important.

Where Stop Loss performs the function of automatically closing a losing position, Take Profit performs the opposite function. Take Profit allows you to set a certain level so that profitable trading positions are closed at that level. For example, if you have a EUR/USD buy order at 1.1280, set your take profit at 1.3000 (20 pips above the open price). After that, if the price rises and reaches that level, the buy order will be closed automatically.

The risk & reward ratio in trading is one part of Money Management. The first thing that must be done before setting up a trading strategy is to calculate the risk that is ready to be accepted so that the trading results are realistic. In other words, the first thing that must be done is to determine the stop loss level first and, after that determine the take profit according to the planned risk & reward ratio. Example: the stop loss level that is ready to be accepted is 50 pips, then with a ratio of 1:2, the specified take profit level is 100 pips.

OK, maybe this is all that can help, actually, the explanation is still long. In essence, stop loss and take profit are automatic close order options to help you prevent further losses and secure profits from the risk of changes in price direction. So, if you want to learn these two features to manage trading risk, there is the right choice.

Marcail

Sep 24 2023

Wow, this discussion about stop loss is quite complete and not too long, making it very easy to understand. Even though I'm actually still a beginner regarding stop loss, but after reading this article, it's quite helpful...

Every trader naturally wants to make a profit. However, to achieve profits, we still have to understand that trading in the forex market is a risky activity, which must be planned with good risk management and especially well-placed trading orders.

Stop loss is a common contract trading operation where the trader believes that the price has reached a level where trading can be stopped for a reasonable loss in order to avoid irrecoverable losses in their portfolio. Using a stop loss is one way to deal with risk.

So, to determine stop loss in trading, one of them is based on price volatility. So the question is, what is the normal volatility of the instrument that I will trade? because I know that if the volume is too low or high it is not good and it is easy to get a stop loss.

Venda

Oct 19 2023

Hello there! I just came across an article that piqued my interest. It mentioned that for copy trading on Exness, you can get started with as little as $10, but it's advisable to have a budget of at least $100. So, what's the reasoning behind the recommendation to maintain a minimum trading budget of $100, particularly when Exness only requires an initial investment of $10? Could you shed some light on the factors that underlie this suggested budget and how it enables traders to more effectively handle commissions and enjoy greater flexibility in their trades? Additionally, what are the perks and advantages that come with having a larger budget for traders using the Exness platform, and how does it impact their overall trading experience?

Gordon

Nov 17 2023

Alright, so the Exness Social Trading has really broadened my horizons. It's not just about copying; we can also customize our settings based on our preferences. We can choose from a variety of available traders, assess their professionalism, check the news feed, and even set our own stop-loss and take-profit points.

Now, what's boggling my mind is the whole deal with stop loss and take profits. If we use those features, does it mean we're essentially trading on our own, or is it still following all the traders we've chosen to follow? As users of Exness or Social Trading's copy trading, can we truly rely on the traders, or is it better to stick with the stop loss and take profit features? Thanks!

Jorge Andreas

Nov 19 2023

Hey there! As someone diving into Exness Social Trading, you're not just limited to copying trades. There's room to personalize your experience by picking specific traders, checking out their professionalism, staying in the loop with the news, and even setting your own stop-loss and take-profit points. The article also highlights how Exness stands out because it lets you copy trades with your own risk level, so you're not solely reliant on the traders!

So, using these features doesn't mean you're flying solo in your trading journey. Even with these tools, you're still essentially following the traders you've chosen. It's not a black-and-white situation; you can blend the insights from the traders you follow with the security of setting your own stop-loss and take-profit points. As an Exness or Social Trading user, you can trust the traders you follow while also fine-tuning your strategy with the stop-loss and take-profit features. Remember, trading is always about Risk Management!

Molina

Nov 29 2023

Hey! I stumbled upon this article about copy trading on Exness, and it got me curious. It mentioned kicking off with as little as 10 bucks, but they're suggesting a minimum budget of $100. What's the deal with that? I'm wondering about the logic behind recommending a higher budget when the initial investment is just 10 bucks. Could you dive into the factors driving this suggestion? I'm especially curious about how it plays into handling commissions and giving traders more flexibility. Also, spill the beans on the perks and advantages that roll in with a beefier budget on Exness. How does having more cash to throw around impact the overall trading experience? Thanks a bunch!

Hanif

Nov 30 2023

As I know here, the idea behind suggesting a minimum budget of $100 for copy trading on Exness, even though you can start with $10, is to help traders handle commissions more effectively and enjoy greater flexibility. Copy trading often involves fees from the traders you're following, and having a bit more in your budget ensures you can cover those costs without eating into your investment too much. With $100, you also get more flexibility to copy multiple traders and diversify your strategy, potentially making your trading experience more dynamic and rewarding. It's like making sure you have enough fuel in the tank to navigate the copy trading journey smoothly!

Bella

Dec 19 2023

The article emphasizes the importance of transparent and reliable information when engaging in social trading on a single platform. Clear and trustworthy details about the trading strategy are crucial, and any lack of transparency from the strategy provider could be a potential concern. If there's insufficient or unclear information regarding the strategy's approach, risk management, or historical performance, it could undermine trust and serve as a warning sign, prompting the need to discontinue the social trading activity.

I'm interested in understanding examples of transparency in the context of social trading. In general, what does transparency mean when it comes to social trading, as mentioned in the article?

Chocolate

Dec 21 2023

In the context of social trading, transparency refers to the clarity and openness of information provided by the strategy provider or trader on the platform. This includes making key details about the trading strategy easily accessible and understandable for followers. Examples of transparency in social trading might include:

Hope it can help!

Nunez

Dec 20 2023

The article mentions that drawdown refers to the most significant monetary loss a strategy experiences within a specific timeframe. A substantial drawdown is indicative of a risky strategy that has the potential to incur substantial losses swiftly. To assess the frequency of drawdowns in a strategy provider, you can review the provider's statistics section.

I'm curious to delve into the specifics of what drawdown entails and its significance. How detailed is the concept of drawdown, and just how crucial is it in evaluating a trading strategy?

Gavenberch

Dec 23 2023

Hey there! Let me answer your question!

Drawdown is basically the biggest amount of cash a trading strategy can lose in a set timeframe. If a strategy has a hefty drawdown, it's like a red flag waving – it's risky, and you could be looking at some serious losses in a short period. To suss out how often these drawdowns happen with a particular strategy, just head over to the provider's stats section.

Now, why does drawdown matter so much? Well, it's like your risk-o-meter. Knowing the nitty-gritty of drawdown helps you figure out how resilient a strategy is when things get rough in the market. Traders dig into drawdown details to manage risks smartly and set the right expectations for potential losses.

Think of it as your trading reality check. Understanding drawdown isn't just about numbers; it's about making savvy decisions

Aliyah

Feb 24 2024