Using a trading journal is essential for every trader no matter what strategy they rely on. If you are implementing carry trade strategy, here is an important guide for creating the trading journal.

George Santayana, a novelist, poet, essayist, and philosopher from Spain once wrote:

"Those who cannot remember their past are condemned to repeat it."

In our early days of forex trading, mistakes were inevitably made due to our lack of experience. Sure enough, no one wishes to fall upon the same pit. Therefore, we should remedy said situation simply by taking notes of what we have done. We need to make journal entries every time we enter the market. We take note of when we enter the market, what currency pair we choose, at what price, and some other essential information. At the end of the day or month, we can reflect upon this journal and evaluate our actions.

Some even argue that learning to make a good journal should be in the first few steps to become a successful trader because it can help us avoid mistakes that we had done in the past, especially when moving from a demo account to a live account where the real money is at stake.

The Importance of Trading Journal

It might seem to be a lot of work, but if we look at what it offers, a little scribbling goes a long way. Here is how we might benefit from a forex trading journal:

- Track your performance in trading and scale your goal accordingly.

- See where and how things go south and learn from it for better performance in the future.

- See which strategy works best and which one does not produce the expected result. Thus, we can rework said strategy or discard it altogether for another one that might provide a better profit.

- Take note of which market benefits us the most.

People have taken notes for thousands of years, even the invention of writing itself draws the line between historic and prehistoric times. That shows how important and beneficial a journal is. Traditionally, forex traders pick up a pen and a book to take note of their transactions. Aided by a ruler, they draw some lines to separate the information pertaining to their transaction.

It might be easier if we do not enter and exit the market too often. But if applying high-frequency trading is what works for you, it is recommended to make journal entries on a digital form on Microsoft Excel, Google Sheets, or anything in between.

After choosing the platform, be it a good old book and pen or a sophisticated computer program, we can add this information to each entry:

- Timestamp: The date and time when we make our entry into the market.

- The pair we trade.

- The amount that we invest in: The amount of money, and the lot size.

- The position that we take: Is it a short or long position?

- The price at the moment we enter the market.

- The closing price.

- The risk to reward ratio.

- How much we have gained or lost in pips.

- Our loss or profit measured in the currency of the account.

- The amount of profit we wish to earn out of this position.

- The strategy or indicator that gave the signal to open this position.

- How certain we are of the outcome.

- The swap rates of the currency we trade (in case of overnight position).

What About Carry Traders?

The majority of forex players may have known that there are many strategies to get around in the market. In fact, there are quite a few popular strategies worth trying on, and carry trade is one of them.

It is a particular strategy in which traders use the differences between two currencies' interest rates in a pair as an advantage. They will specifically pay attention to the current interest rates of currencies and the fundamental issues that may push the central banks to change their interest rate policy. Furthermore, carry trade is usually applied in the long term as opposed to other techniques that are carried out in a short duration of time.

See Also:

For carry traders, there are several extra pieces of information to be added in their journals because the data of their position can change over time. Here is the additional information that we need to add to the journal if we practice carry trades:

- The interest rate of the currency traded.

- The interest rate of funding currency.

- Nominal interest rate differential.

- Effective broker commission.

- Daily swap.

- Estimation of the total annual amount of interest-earning.

Of course, not all of the information above is mandatory. We can add or remove any piece of information that we deem to be unnecessary.

The entries must be updated regularly because some of them can change every day. For example, the interest rate can change and affect the estimation of the total annual amount. Even a 0.01% change can affect the estimation of the total annual amount.

Another thing that you need to put into calculation is the difference in interest rate. Some brokers do not pass it to you as a client because they keep it as a commission. In that case, you need to take note of your estimation regarding the effective percentage.

For the task above, brokerage websites usually have a swap calculator so you can calculate the daily interest of a trading position. Next, you multiply that to 365 then divide the result by the position size in question. You should already have a percentage difference between the central bank's interest rate differential and the effective rate of return that your broker will receive a commission.

Trading Journal May Not Be for Everyone

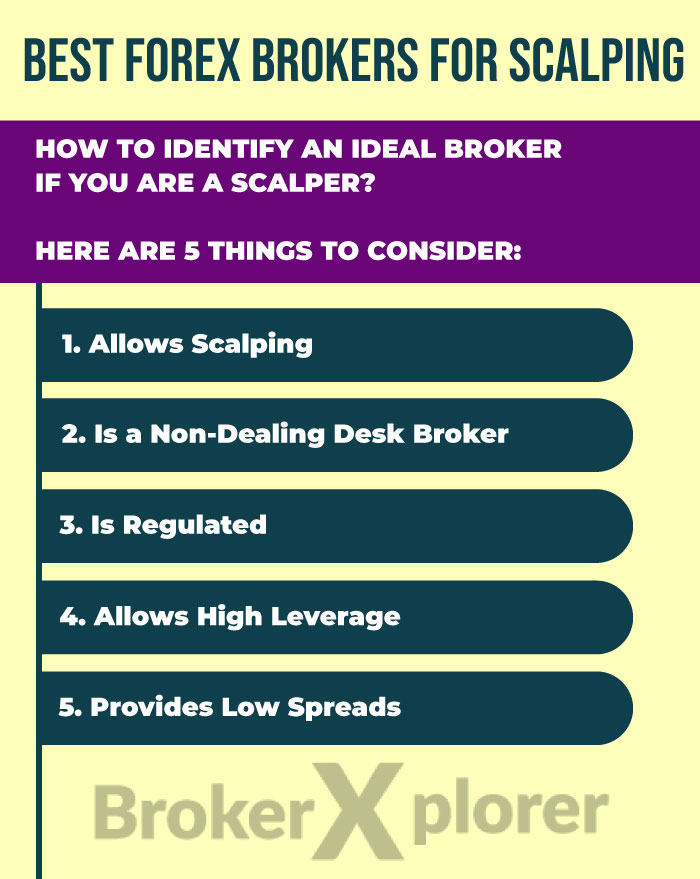

Similar to any other tool in forex trading, this journal also bears some imperfection. For example, traders that employ scalping strategy may not find this whole journal useful as they often trade in a very small time frame and execute a lot of trades in a single day. All the time scalpers have will be spent on trading and there might be no time left to keep a journal as they need to rest after trading.

Such imperfection is also seen by traders who use the forex arbitration strategy, especially the triangular arbitrage. That particular strategy involves 3 pairs of currency of 3 same currency and the price difference between those three. For example, if we have a deposit of $1 million and the exchange rate as follows:

- EUR/USD: 0.8631

- EUR/GBP: 1.4600

- USD/GBP: 1.6939

We can do these in sequence:

- Sell dollars for euros: $1 million x 0.8631 = €863,100

- Sell euros for pounds: €863,100 ÷ 1.4600 = £591,164.40

- Sell pounds for dollars: £591,164.40 x 1.6939 = $1,001,373

From $1,000,000, now we have $1,001,373.

We can see from the example above that triangular arbitrage requires a swift execution before the market corrects itself and there might not be enough time to spare on a journal while you are at it.

Not only spending a lot of time, but this strategy can also make a lot of entries in your journal because a single execution of this strategy only yields several pips and therefore requires several executions if you want to make a decent profit. If you make 10 trades, that means you have 30 entries to write down. Possible, but stressful.

Just like every business, everything comes at a cost, and keeping a journal might cost us more than we can afford. That is because keeping a record of our actions could be exhausting or just not suitable. However, keeping track of what we do, especially in an environment full of unpredictable events like the forex market is essential if we want to be a full-time trader.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance