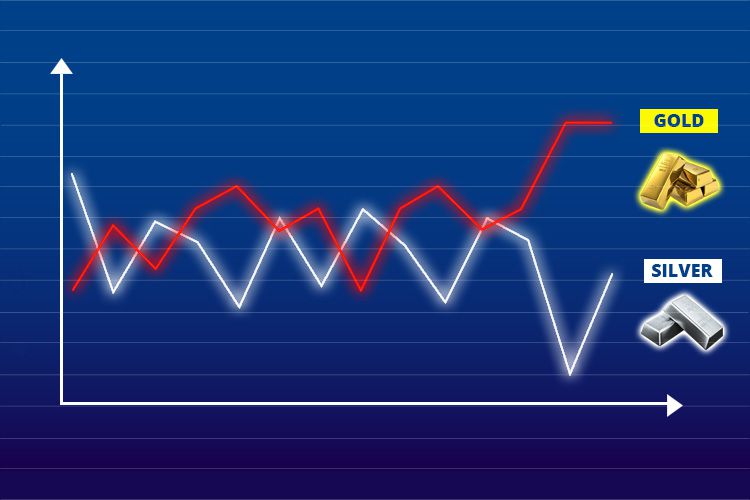

The gold-silver ratio is one way to figure out the dynamic between gold and silver in the commodity market, and you can use it to help your analysis.

Gold and silver have long been recognized as precious metals that have been heavily used as tradable commodities since ancient times. Gold is the most popular precious metal in the world and is often used as a type of "natural insurance" to preserve one's wealth during inflation and other uncertain market conditions. Meanwhile, silver came in a close second by offering a hybrid importance of industrial uses and its value as a precious metal.

Even today, both precious metals still have their place in modern investors' portfolios and are considered two of the most traded commodities in the world. Now, the relationship between gold and silver is apparently useful to predict the market and optimize your analysis in making a strategic investment. How so?

Introducing Gold to Silver Ratio

The gold-silver ratio is actually a very simple concept. It refers to the number of silver ounces you would need to purchase one ounce of gold at the current market price. So, if the gold price is trading at $1,000 per ounce and silver is trading at $0 per ounce, then the gold-silver ratio would be equivalent to 50:1. In other words, you would need 50 ounces of silver to buy a single ounce of gold ($1000 / $20 = 50).

While it's necessary to monitor the prices of each commodity, knowing the ratio between gold and silver is also important as it can somehow add a new layer to your analysis. You can use the ratio to gain new insights into both metals and take advantage of the situation better.

Basically, the gold-silver ratio increases when the value of gold rises faster than the price of silver. On the other hand, it decreases when the value of silver rises faster than the price of gold.

The History of Gold to Silver Ratio

The gold-silver ratio was initially set by governments to serve the purposes of monetary stability, so the number was relatively steady. For instance, the Roman Empire officially set the ratio to 12:1 and it remained at that range for the next hundreds of years. It was not until the discovery of massive amounts of silver in America and the number of successive government attempts to manipulate the prices in the 20th century that the ratio finally saw greater volatility.

Furthermore, the fixed ratio system was no longer relevant after the precious metals are not used as currency. Following the liberalization of gold and silver trading, the gold-silver ratio began to fluctuate more. Here's a short overview of the gold-silver ratio over time:

- The Roman Empire: The ratio was set by the government at 12:1.

- 1792-1834: The US used a bimetallic standard and set the fixed ratio to 15.

- 1834-1862: The Congress changed the ratio to 16.

- The early 1900s: The ratio was mostly in the 20-40 range.

- 1940: Near the start of World War II, gold soared as a safe haven asset and the ratio jumped to 96.71.

- 1980: The price of gold declined, causing a low gold-silver ratio of 15 to 1.

- 1991: When silver hit an all-time low record, the ratio peaked at nearly 100.

- 2020: The ratio soared to 114.77, the highest number since 1915.

- 2021-2022: The ratio fluctuated a lot, ranging from 65 to 95.

How to Plan Your Investment with the Gold to Silver Ratio

There are many ways to use the gold-silver ratio to your advantage. One of the easiest methods is to use extreme ratio levels, which rarely happens but is highly profitable. Most of the time, gold and silver prices move in the same direction, so when the price of gold goes up, the price of silver rises too and vice versa. However, this is not always the case. There are certain times when the two move in the opposite direction, causing the ratio to widen and eventually reach a level that is considered extreme.

An extreme gold-silver ratio is often regarded as an interesting trading opportunity for many investors. Basically, the idea is to sell the "overpriced" commodity and exchange it for the "undervalued" one. Then, when the ratio goes the other way around in a few years, you do the same thing again. Here's an easy example:

- If you have one ounce of gold, and the ratio goes up to an extreme level of, let's say 100, then you can exchange your gold for 100 ounces of silver.

- Once the ratio declines and moves in the opposite direction, you can use it to exchange your silver for a bigger quantity of gold. Let's say the ratio hits 50 after two years, you can then exchange your 100 ounces of silver with 2 ounces of gold, which is higher than your starting point. In other words, you would have doubled your investment in just two trades.

Such a strategy is very simple and quite effective in increasing your wealth without having to put factors like inflation and exchange rate into consideration. However, it should be noted that this investment strategy is not perfect.

First of all, there is no definite rule or benchmark in determining the extreme levels. You might regard 100 as an extreme high and expect the ratio to fall drastically in the next few years, but in reality, the number might go even higher to 120 and more. If this is the case, then you'll need to accept that your accumulated wealth must decline in numbers.

Secondly, gold-silver ratios usually don't fluctuate in short-term periods. Most of the time, it takes years to move from one extreme level to another. Therefore, this investment strategy is definitely not suitable for short-term investors. Instead, it is more appropriate for long-term futures trading or other non-physical assets. Remember that when trading physical assets like gold bars or coins, you should consider additional factors like liquidity, storage cost, and more, which might generally lower your profit.

Trade Precious Metals on HF Markets

Precious metals like gold and silver offer unique investment opportunities and protection against inflation. Based on past prices, precious metals typically have a low or negative correlation to other assets like stocks and bonds, which means that having precious metals in your portfolio might reduce your overall risk and volatility. Therefore, it can be a safe haven investment to build a diversified long-term portfolio.

You can trade derivatives on gold and other precious metals at HF Markets. Precious metal trading is available on all platforms, including MetaTrader 4, MetaTrader 5, and HFM platform. You can even use gold for copy trading on the proprietary HFCopy platform. In addition, you can get maximum leverage of up to 1:1000 for Gold Cent and up to 1:100 for silver trading. If you are interested, just simply open a live trading account, make a deposit, and start trading with the precious metal of your choice.

HF Markets is an award-winning forex and commodities broker. Established since 2010, the company provides trading services and facilities to both retail and institutional clients. For more than 9 years in business, HF Markets has around 1,500,000 live accounts opened and 200 employees globally.

Based on its services, HF Markets can be regarded as middle-class category. Clients do not need to prepare a big deposit for joining to trade with this broker. Also, there are various account types, trading software, and tools to facilitate individuals and institutional customers to trade forex and CFD online.

HF Markets is a registered brand name of HF Markets (Europe). Based on the location, the company is regulated by various financial regulators. Here are the details:

- HF Markets (SV) Ltd, registered in St. Vincent & the Grenadine as an International Business Company with the registration number 22747 IBC 2015.

- HF Markets (Europe), authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with Licence Number 183/12.

- HF Markets SA (PTY), is authorized and regulated as a Financial Service Provider (FSP) by the Financial Sector Conduct Authority (FSCA) in South Africa, under license number 46632.

- HF Markets (Seychelles), incorporated under the laws of the Republic of Seychelles with registration number 8419176-1, regulated by the Seychelles Financial Services Authority (FSA) under Securities Dealer Licence number SD015.

- HF Markets (DIFC) Ltd, authorized and regulated by the Dubai Financial Services Authority (DFSA) under license number F004885.

- HF Markets (UK) Ltd, authorized and regulated by the Financial Conduct Authority (FCA) under firm reference number 801701.

If traders have more experienced, knowledgeable, and sophisticated trading environment, they can join to become Professional Clients, who can manage and assess their own risks. For that reason, these kinds of clients are granted access to more favorable rates but afforded lesser regulatory protections than retail clients.

Trading with HF Markets can enable traders to access a variety of trading instruments like CFDs on Forex, Cryptocurrencies, spot metals (gold, silver, and others), energies (oil and gas), commodities (such as coffee, copper, and sugar), indices, bonds, and popular shares such as Google, Apple, and Facebook.

HF Markets offers some of the tightest spreads in the market, starting from 0 pips in Zero Account. This broker quote major foreign exchange currency pairs to five decimal places. Therefore, traders have the opportunity to get more accurate pricing and the best possible spreads.

HF Markets receives numerous highly prestigious titles, including the huge honor of being ed to join the ranks of the World Finance Top 100 Global Companies. Others are Best Client Funds Security Global by Global Brands Magazine, Best Global Forex Copy Trading Platform by Global Forex Awards 2019, Fastest Growing Forex Broker Mena 2019 by International Business Magazine, and many more.

After opening an account in HF Markets, traders will obtain various forex trading platforms to accommodate all of their trading demands. Whether traders like to trade on desktop or prefer to trade on-the-go, they can use MetaTrader 4 on desktop (terminal, multi-terminal, and web terminal) and phone (iPhone, iPad, and Android).

Clients' funds are held in segregated accounts. Only major banks are used by Markets because they believe that successful traders have to give their full attention to their trading rather than worrying about the safety of their funds.

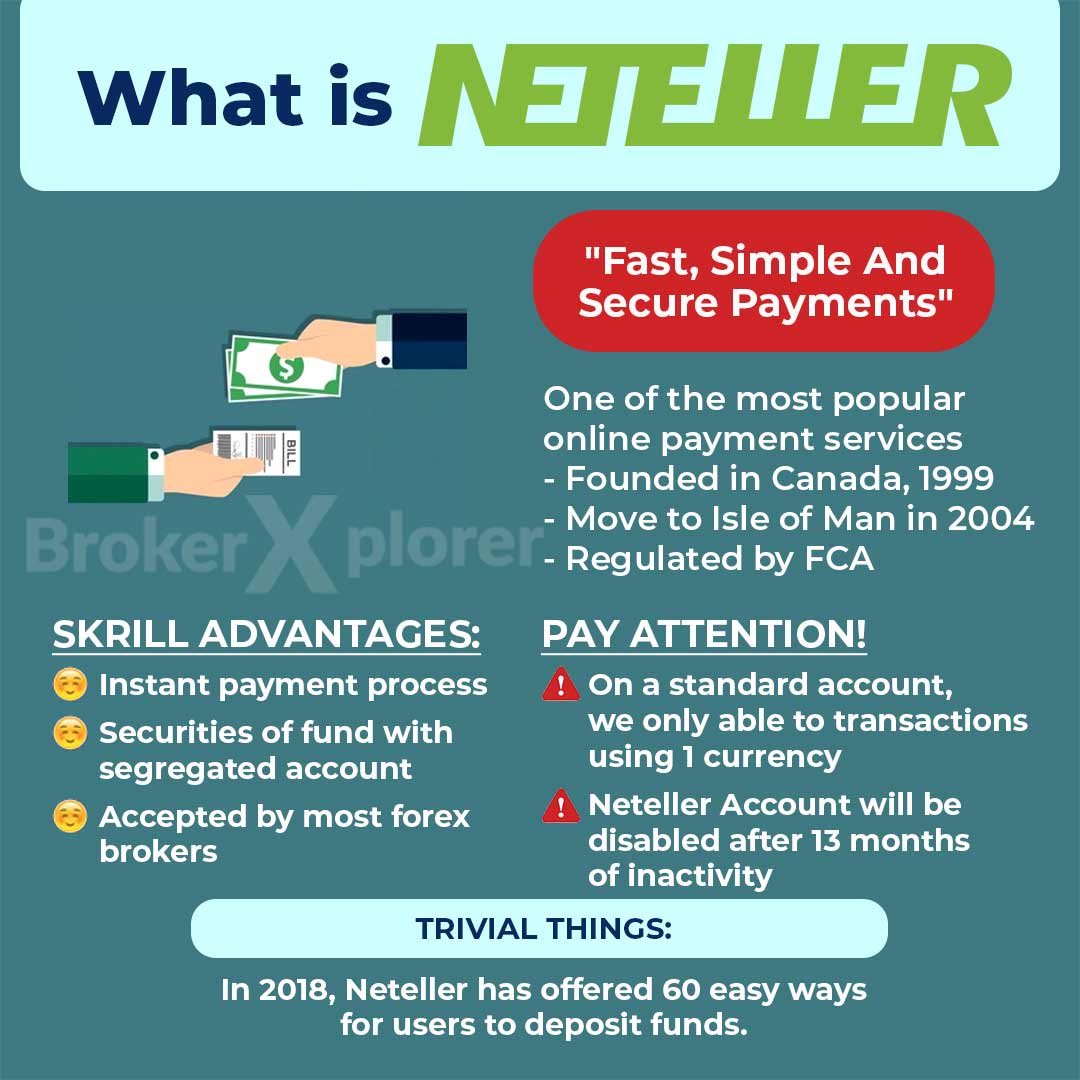

Traders do not need to worry about transaction fees when depositing and withdrawing. Transaction fees are not charged, and diversity of payment methods enable them to choose between Wire Transfer, Bank Card, and online payments (Neteller, iDeal, Sofort Banking, and Skrill). HF Markets ensures that traders make fast transactions 24/5 during the standard hours.

Traders can earn extra income by joining the affiliate program offered by Markets. Clients who join this program will get some advantages, such as 60% of Net Spreads based on the volume traded by sub-clients, up to $15 per a lot of net revenue, and many more. More information about HF Markets can be obtained on their official website which is supported in 27 languages.

From the review above, it can be concluded that HF Markets is one of the award-winning forex and commodities brokers. There are various account types traders can choose in HF Markets, and the broker itself becomes a favorite among traders for its low spreads. This condition is very suitable for traders with limited funds and a desire to get more opportunities to gain maximum profit.

HF Markets is a global Forex and Commodities broker that facilitates both retail and institutional clients. Previously known as HotForex in the brokerage industry, HFM has positioned itself as the forex broker of choice for traders worldwide through their various account types and trading tools. Furthermore, HF Markets allow scalpers and traders use Expert Advisors unrestricted.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance